(Source: John De Bord/Shutterstock.com)

Following in the footsteps of their bigger brothers, most notably the Marcellus-Utica and Haynesville, the Niobrara and Denver-Julesburg (D-J) basins continue their climb to record production. However, unlike most other plays that saw substantial production declines post-2014, the Niobrara and D-J never saw their production levels dip below 113 MMcm/d (4 Bcf/d), according to the U.S. Energy Information Administration (EIA). In its November “Drilling Productivity Report,” the EIA reported the Niobrara Basin reached record production in October with 144.4 MMcm/d (5.1 Bcf/d) of natural gas, up 1.4 MMcm/d (50 MMcf/d) over September production.

Although a predominantly gas-heavy play, the Niobrara’s oil production has seen exponential gains during the course of the market recovery. According to the EIA, oil production in the Niobrara also has reached record levels, with 620,000 bbl/d through October.

The Niobrara’s rig count bottomed out in 2016 when less than 20 rigs were in operation, but according to the EIA, that number has steadily rebounded with nearly 60 rigs in operation through August.

Permitting activity is also on the uptick, according to Drillinginfo. In an exclusive report provided to E&P, Drillinginfo reports that the number of permit filings in the D-J Basin has grown from just over 600 during the first quarter of the year to more than 800 in the third quarter. Since late 2015, the core areas of interest for developers have been northeast Weld County, Colo., and southern Laramie County, Wyo.

Some of the most recent top wells in the play have IPs of 1,800 boe/d or more. According to UGcenter.com, WPX Energy’s 701-4 HN1 Williams well saw an IP of 2,666 boe/d and Chesapeake Energy’s 6H Feller Unit NW well produced 1,859 boe/d.

Crude oil volume type curves in the D-J Basin steadily increased between 2013 and 2016, with current IP rates hovering around 280 bbl/d. (Source: Drillinginfo)

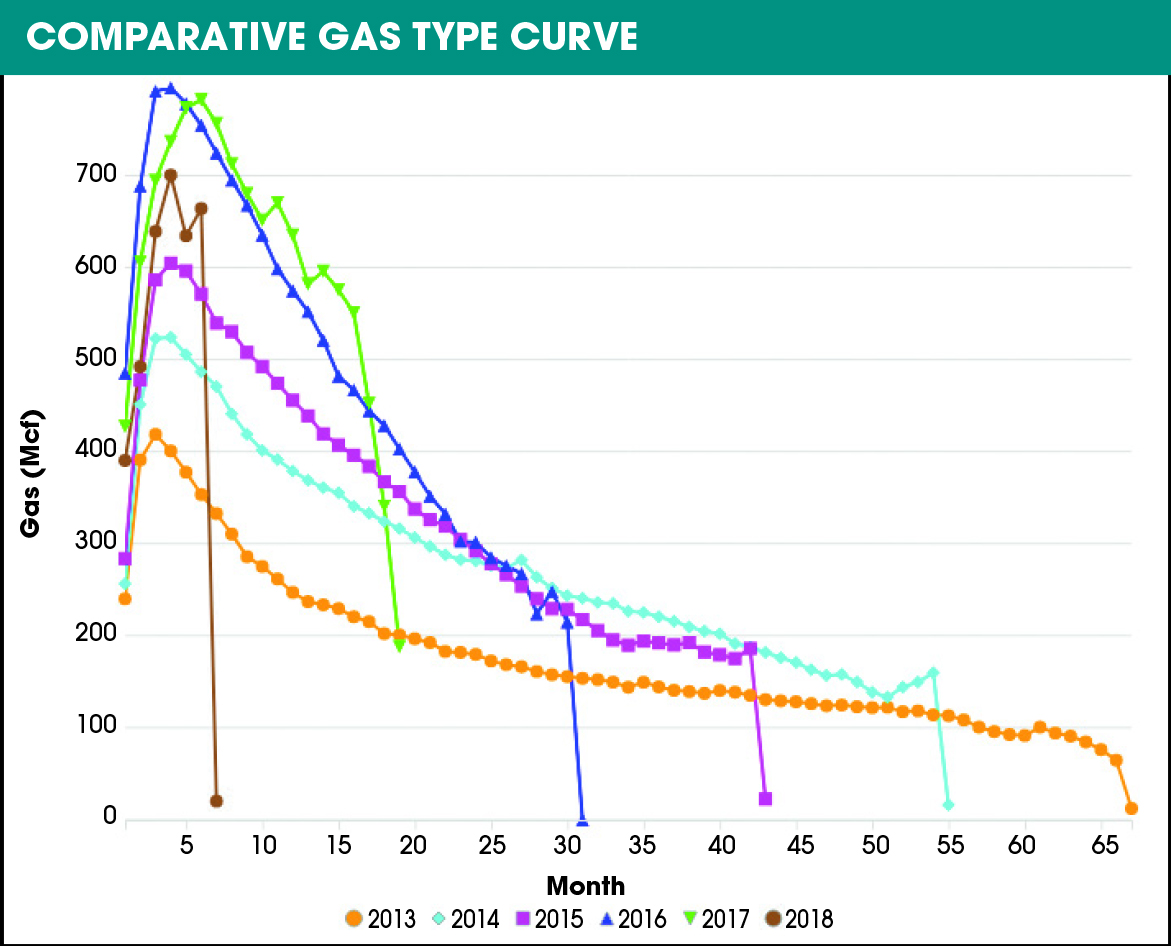

The D-J Basin saw steady increases in natural gas production volumes between 2013 and 2016, although 2018 production date-to-date has dipped slightly. In addition, overall gas volumes are not as high as wells in gas-directed plays that often see up to 283 cu. m/d (10,000 cf/d), according to Drillinginfo. (Source: Drillinginfo)

Laramie County type curves have the highest IP rates for crude oil. The Weld County curve reflects a larger sample size, however, and has IP rates of about 265 bbl/d. (Source: Drillinginfo)

Laramie County wells feature the highest IP rates overall in the D-J Basin, but the volatility in the curve is a result of a relatively low sample size compared to Weld County, which features the second highest IP. (Source: Drillinginfo)

Recommended Reading

Commentary: Are Renewable Incentives Degrading Powergen Reliability?

2024-02-01 - A Vistra Corp. chief, ERCOT’s vice chairman and a private investor talk about what’s really happening on the U.S. grid, and it’s not just a Texas thing.

Rystad Sees Little Support for Henry Hub in Coming Weeks

2024-01-26 - Rystad Energy sees little support for Henry Hub prices in the U.S. as dry gas production rises after the Jan. 17 Arctic freeze that impacted all of the Lower 48 states.

Turning Down the Volumes: EQT Latest E&P to Retreat from Painful NatGas Prices

2024-03-05 - Despite moves by EQT, Chesapeake and other gassy E&Ps, natural gas prices will likely remain in a funk for at least the next quarter, analysts said.

CNX Joins Crowd of Companies Cutting Back NatGas Production

2024-03-12 - Appalachian gas producer CNX Resources is reducing natural gas production in 2024 and announced delays for well completions on three shale pads.

US Natgas Prices Hit 5-week High on Rising Feedgas to Freeport LNG, Output Drop

2024-04-10 - U.S. natural gas futures climbed to a five-week high on April 10 on an increase in feedgas to the Freeport LNG export plant and a drop in output as pipeline maintenance trapped gas in Texas.