The E&P industry enters 2018 disciplined, equipped to address the price fluctuations inherent in the energy sector and poised to improve its economics in a meaningful way.

In the fall 2017 Grant Thornton LLP/Hart Energy Survey, operators reported that they are focusing on core assets, making incremental improvements and using new technologies on existing properties. Interest in acquisitions is increasing, but both buyers and sellers are carefully weighing the risks of investments or divestitures against their ability to build a sustainable business. On the technology front, the industry appears to have made steady improvements in its systems to access valuable data and run businesses more efficiently.

Kevin Schroeder, leader of Grant Thornton’s national energy practice, commented, “We’re seeing operators living within their cash flows, working in the basins they know and rightsizing their resources. We’re seeing more transactions that exchange acreage to build on strengths of the overall portfolio for both parties.”

While a smarter industry creates a more favorable environment for sustained, profitable growth, there are still opportunities for improvement. Access to data has improved, but the industry is still reporting challenges in turning data into insights. The answer lies in attracting a new generation of talent to an industry that is willing to disrupt itself to reinvent the role of energy.

Focus on core assets

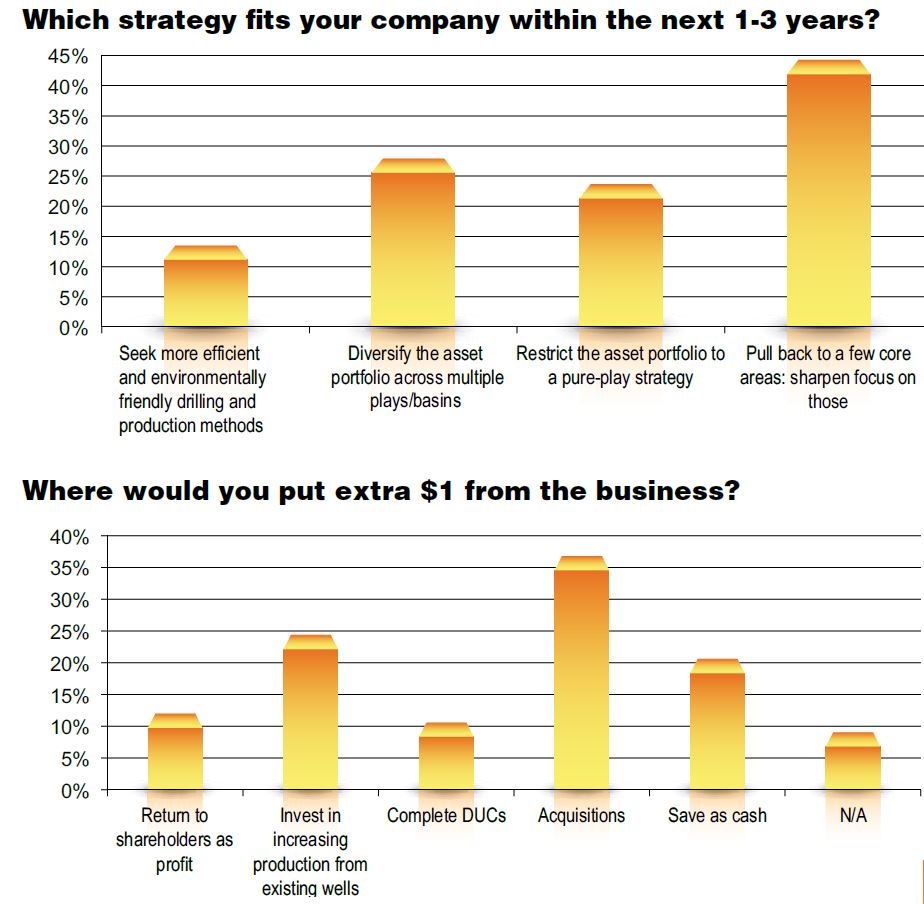

Producers are concentrating on holdings in the fields they know best. When asked, “Which strategy fits your company within the next one to three years?” the top response was to pull back to a few core areas and sharpen focus on those.

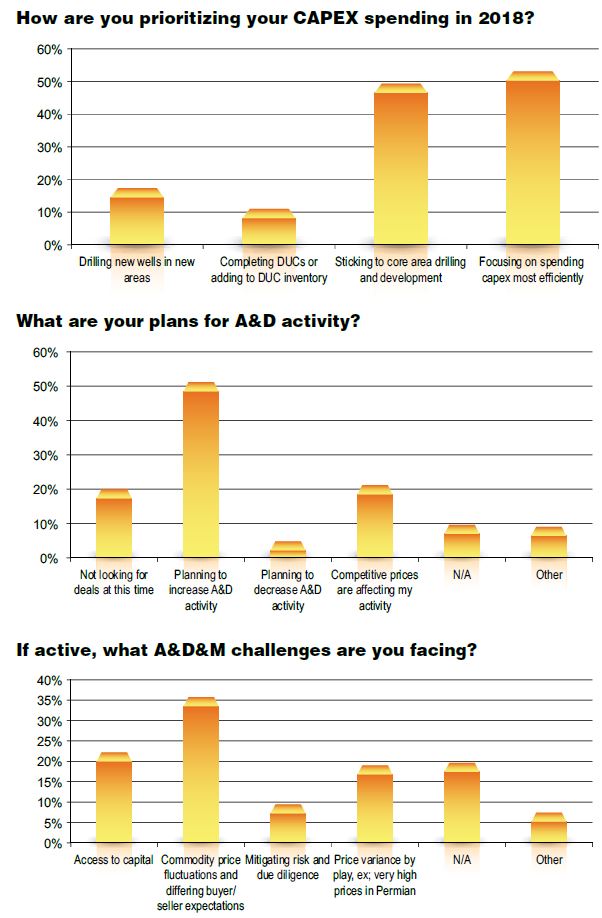

They are spending capex more efficiently. One respondent commented that it was applying emerging technologies in conventional play areas, which illustrates that drilling technologies are gaining in sophistication and cost effectiveness.

A key development in the survey findings highlights an improvement in managing the economics of the energy sector. When asked if operators are able to keep production flat, a majority said yes. This was the first time that more than 50% responded yes since the question was first asked and reflects the spirit to operate with discipline for sustainable growth.

Cautious increase in acquisitions

What would operators do with $1 extra from their business? The top response was acquisitions. Nearly one-half of the survey respondents indicated they are increasing M&A activity, while only 2% indicated they were decreasing activity.

But while interest in acquisitions is increasing, the industry is also demonstrating discipline and caution around investment strategy. There is a growing disconnect between buyer and seller expectations on prices, with more than one-third indicating that a difference in buyer and seller expectations on price was the biggest challenge, a significant jump from when Grant Thornton asked the same question earlier this year, when only one-quarter indicated that challenge. One respondent commented, “There is a lack of trust in what’s presented. Too many sellers don’t have jewels for sale, just polished glass.”

The differing expectations on price may be related to the fact that there are fewer distressed sellers. In 2015, 60% of respondents indicated that they wanted to sell or merge; in late 2017, that percentage dropped to 33%. While the drop indicates a stronger industry operating in a greatly improved economic environment, the drop also indicates that the buyers’ market of two years ago has dissipated.

Better access to data

The industry appears to have made steady progress in information technology. Just two years ago, respondents indicated that they had deferred critical technology investments, and nearly a third of respondents commented that they did not have access to relevant data for decision making. Today, only one-sixth of respondents felt that data access was still a challenge.

But turning data into actionable insights remains a challenge. One respondent commented that “the tools have improved, but not the skill in applying the analysis.”

In some ways, gleaning insights from the data has gotten more challenging. When asked, “What information are you looking for, but have difficulty getting?”, 44% indicated play and basin analytics, up from 31% when the same question was asked a year ago.

Data is the foundation for strong analytics, and it is very encouraging that the industry has made strides in improving its access to data. But analytics based on the data provides answers to fundamental questions:

- What happened?

- Why did it happen?

- What will happen?

- What should I do to improve the business?

While the E&P industry has started this journey, there is more to be done.

Leading E&P companies use integrated technology platforms to quickly view rich seams of information and production data on wellhead operations. These platforms allow for multiuser viewing at multiple sites, which means, for example, that an onsite superintendent could view a well’s current production and pressure, while an engineer at headquarters looks at the same information in real time. As a result, they can optimize day-to-day operations, respond more quickly and effectively to emergency situations and undertake the data analysis that gives them a more macro level view of how to improve the business.

The next generation of talent

The industry is growing, and that includes talent. When asked about plans for hiring, nearly one-half of the respondents indicated that they were hiring or planning for selective hiring in 2018. That is a significant increase from when we asked the same question in 2016, when less than a third indicated they were hiring.

The challenge is that the baby boomer generation is retiring, and many individuals permanently left the industry after rounds of layoffs during the past 10 years. At the same time, skill requirements are changing—becoming more technical, with improved analytics and insights. What can the industry do to attract a new generation of talent that at present appears to be more drawn to industries like health care and technology?

“We are a highly technical business that has not done a great job at communicating the innovative nature of the industry,” Schroeder said. “To attract a new generation of talent that is excited by change, it’s time to be willing to disrupt the industry from within and develop a culture that fosters new thinking.”

It’s a fine line, to be sure. Operators will need to maintain discipline and focus on their core business, while finding the courage to disrupt and makes changes to spark critical innovations and renewed interest in a career in the energy industry. Entering 2018, the best companies will position themselves to meet both challenges.

The survey is based on answers from more than 500 respondents collected in October 2017. Respondents were C-suite and senior executives from U.S. independent producers, midstream operators, oilfield service companies and financial companies. Participant titles included CEO, COO, CFO, CIO, senior vice presidents, board members, general counsels and tax and finance professionals. Trending references are based on the survey done in March of 2017 and surveys in 2016 and 2015, all drawn from more than 500 respondents with a similar profile.

For more than 40 years, Hart Energy editors and experts have delivered market-leading insights to investors and energy industry professionals. The Houston-based company produces magazines (such as Oil and Gas Investor, E&P and Midstream Business), online news and data services, and geographic information system data sets and mapping solutions; hosts industry conferences (such as the DUG™ series); and provides a range of research and consulting services. Visit hartenergy.com for more information.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.