Equinor has significantly reduced its carbon emissions at its U.S. unconventional operations through improved flaring practices, such as this one in the Eagle Ford Basin. (Source: Equinor)

Energy companies are faced with myriad challenges when working to produce oil and gas. The costs to do so are in the millions of dollars, the environments in which they work are often harsh and unforgiving, and hydrocarbon reservoirs are complex and difficult to navigate and understand. Additionally, companies must do all of these things safely and go to lengths to ensure their workers, as is commonly explained, go home in the same shape they went to work.

Although each of those issues is critically important to an oil company’s operations, so too are their efforts to operate in an environmentally responsible way. As the shale revolution matures, along with it has emerged a better understanding of the environmental issues associated with unconventional oil and gas production. A wide variety of scientific studies during the past decade have revealed that unconventional oil and gas production is responsible for poor air quality in places like the Bakken and earthquakes in Oklahoma—a result of injecting wastewater into disposal wells. Most recently, the U.S. Occupational Safety and Health Administration (OSHA) has enacted new mandates instructing oil companies to better control respirable silica dust at fracturing pads.

Addressing these issues has become a priority for many oil and gas companies as they work to overcome adverse perceptions of their own industry.

As oil companies work to find the best solutions for cutting down on greenhouse-gas (GHG) emissions and avoiding seismicity issues, federal and state regulators continue to work to find the right balance between environmentally responsible operations and overly onerous and costly restrictions.

The U.S. Environmental Protection Agency (EPA) is studying current wastewater disposal restrictions, announcing in October a plan to work with industry stakeholders and communities to reevaluate details of the Clean Water Act that deal with produced water management. The EPA is looking to potentially loosen restrictions on the discharge of produced water.

In addition to wastewater management regulations, the EPA also is considering easing fugitive emissions monitoring. The EPA announced in October that it is proposing changing monitoring requirements for “non-low production well sites” to once per year, for “low production well sites” to once every other year and to eliminate the requirement for monitoring “all major production and processing equipment” once it is removed from a well site “such that it becomes a wellhead-only site.”

The EPA disclosed that such actions between 2019 and 2025 would result in an increase of 100,000 short tons of methane emissions, 24,000 more tons of volatile organic compounds emissions and 890 more tons of hazardous air pollutant emissions than under current monitoring guidelines. The EPA also reported that the new mandates would result in industry cost savings during the same period of $43 million.

Emissions management

Following a series of recent studies that have identified elevated levels of GHG emissions in regions of unconventional oil and gas production, both operators and service companies are adopting practices that are proving to reduce emissions while also saving on expenses.

One of those practices is carbon capture, utilization and storage (CCUS) in which operators capture and store CO2 to eventually sell to other industries or oil and gas companies or use themselves for EOR methods. Occidental Petroleum utilizes CCUS in its Permian Basin EOR operations and has developed two EPA-approved monitoring, reporting and verification (MRV) plans for its CO2 EOR fields in the Permian Basin at the Denver Unit in Texas and in Hobbs, N.M. According to Occidental, the plans provide a framework for quantifying the amount of CO2 permanently sequestered in the geology of the reservoir.

The company reported that during the first year of the MRV plans, Occidental sequestered more than 59 Bcf of CO2.

Equinor also has made strides to lessen its CO2 emissions in its North American unconventional operations. Max Medina, subsurface manager for global unconventionals at Equinor, said the company reduced its CO2 emissions by 65% from 2014 to 2017 by improving its flaring operations.

“Our mission as a company is to go down to 8 kilos of CO2 emissions per barrel, and we’re certainly on a trend to get there in our U.S. operations,” he said.

Medina added that Equinor is in the early stages of implementing carbon capture practices for its unconventional operations, and field tests could take place in 2019. He said Equinor is utilizing best practices the company has learned from similar carbon capture operations in Norway and is working to scale those practices for onshore U.S.

“Here, the challenge is we don’t have the scale or the single place to install a facility that we have in Norway,” he said. “We find we need more modular capture facilities. How we make that work on a modular basis where we can spread carbon capture around our basins is our challenge.”

Operators venturing into CCUS operations will find a regulatory environment encouraging them to do so. In February Congress approved legislation that increases the tax credit for carbon capture and storage projects. The 45Q tax credit, introduced in 2017 as the FUTURE Act, is a performance-based tax credit on eligible carbon capture projects.

According to the Great Plains Institute, the requirements for the credit include safely storing CO2 in geologic formations or putting it to beneficial use in products then claiming the credit, such as EOR. The value of the tax credit depends on the type of CO2 storage. Companies storing CO2 for EOR receive a credit of $35/ton, while $50/ton is available to companies storing CO2 in geologic formations.

Speaking at the Society of Petroleum Engineers Annual Technical Conference and Exhibition in September, Wayne Rowe, Schlumberger’s carbon services project manager, said previous tax credit levels were not enough to encourage many companies to implement CCUS operations. The previous iteration of the 45Q tax credit allotted $10/ton for EOR operations.

“There really wasn’t much of a driving force for an oil company to take advantage of this,” he said. Rowe said the credit increase, however, will likely spur interest and investment in CCUS operations in the U.S. The Great Plains Institute also reported that the changes to the credit would provide certainty for investors knowing that the credit will be available once a project begins operations.

“This increased financial certainty should catalyze investment in projects by helping to close the remaining cost barrier to deployment of carbon capture technology, reducing the commercial risk for early adopters and driving down costs over time through innovation as more and more experience is gained through the development, financing, construction and operation of carbon capture projects,” reported the Great Plains Institute in March.

Modern frack fleet

In addition to CCUS projects, electric fracturing fleets are emerging as an option for operators to both cut down on emissions at the well site and save on costs. In June CNX Resources announced a three-year agreement with Evolution Well Services for a 56,000-hp, 100% electric fracturing fleet. According to CNX Resources, adopting an electric fracturing fleet will save the company 95% on fuel costs while allowing the company to operate “well below” the EPA’s Tier 4 emission standard.

Andrea Passman, senior vice president for engineering and operations at CNX Resources, said that in addition to the improved cost savings and emissions Evolution Well Services’ electric fracturing fleet offers, CNX Resources discovered such operations result in a much smaller machinery and worker footprint at the well site.

“The footprint of the Evolution frack crew is about one-third of that of a normal crew because the skids they bring the pumps in, there are fewer of them,” she said. “Normally, a regular job to get the horsepower that we would need would take 20-plus trucks. Now we’re talking about eight.”

Passman added that while a conventional fracturing crew would likely amount to 15 to 20 workers, Evolution Well Services’ electric fracturing crew totals 10 to 12 people.

“And most of them are actually not on the equipment on site because it is all run from a single location,” she said. “It is very modern.”

Carrie Murtland, vice president of technology and marketing at Evolution Well Services, explained that the company’s technology utilizes a turbine generator package to power pumping activities where electricity is distributed from the turbine generator to the process equipment, including the pump trailers, which contain more than twice the horsepower of conventional fracturing pump trailers.

Murtland said Evolution Well Services’ power packages emit roughly 1% of the carbon emitted by conventional diesel engines. In addition, many of the dangers inherent with traditional diesel fueling operations at the well site are eliminated by the system.

“Eliminating diesel engines from pumping operations prevents the need for ‘hot fueling’ during pumping operations, which is a well-known hazard linked to many wellsite location fires during conventional fracturing operations,” she said.

Murtland added that based on an operation pumping an approximate 300 hours per month, operators could save between $1 million and $1.5 million per month in fuel savings by reducing diesel fuel consumption by up to 95%.

“Additionally, this technology fits very well with pressure pumping activities in sensitive areas due to the reduced noise level—85 dB versus 115 dB—and requires a much smaller operational footprint,” she said.

Evolution Well Services’ fleets have so far been deployed in the Utica/Marcellus, Permian, Eagle Ford and Scoop/Stack. Murtland said operators in the Permian Basin have shown increased interest in electric fracturing fleets as a result of takeaway constraints leaving operators looking for a productive use for their natural gas. Basins in the Northeast feature infield gas that is relatively high pressure, which Murtland said eliminates the need for compression and often is sufficiently dry as to be burned without necessitating the extra step of stripping out liquids.

“Our fleet is less than half the size of our conventional peers and works well on hillside pads of the region,” she said. “We have completed some wells on pads where conventional fleets simply would not fit; oftentimes we hear of pads being made to fit drilling rigs, but not necessarily frack fleets. This technology fixes that.”

Green innovations

Meanwhile, in an effort to provide the industry with cheaper and cleaner fuel, Frac Shack International Inc. has developed a combined diesel and natural gas distribution unit for bifuel hydraulic fracturing spreads. Frac Shack’s bifuel unit has 14 natural gas lines and 14 diesel lines and is compatible with CNG, LNG pipeline gas or field gas.

“Distributing both diesel and cleaner-burning natural gas to the pumpers helps [operators] offset their diesel consumption, which saves them money and also helps reduce the environmental impact in regard to diesel emissions,” said Dave Lamberton, sales and marketing manager for Frac Shack. “So the frack spread is burning cleaner-burning fuels, it’s running more efficiently, operators are saving fuel costs and they’re helping reduce emissions in the environment.”

Across a variety of fronts, money is being invested and studies continue to be conducted to assuage any negative effects hydraulic fracturing has on the environment. Among those efforts is the Oil and Gas Climate Initiative (OGCI), a voluntary CEOled consortium comprised of BP, Chevron, Eni, Equinor, Exxon Mobil, Shell, Occidental and more.

The OGCI has established a $1 billion investment fund for technologies that help lower the carbon footprint of the energy and industrial sectors. Portions of those funds are provided to companies selected by the OGCI to develop systems and tools to meet the OGCI’s goals. Among those to receive funding has been Clarke Valve, which designs and manufactures control valves.

According to the company, Clarke valves are the only valves in the world to achieve American Petroleum Institute (API) 641 certification for low fugitive emission performance. API 641 applies to stem seal materials and requires allowable leakage of 100 ppm by volume. In June 2017 Clarke Valve delivered its first shipment of its Shutter Valves, a valve system that virtually eliminates fugitive methane emissions, to an operator in the Denver-Julesburg Basin.

In other efforts, the Independent Energy Standards Corp. (IES) developed its TrustWell Responsible Gas Program. The TrustWell program offers a rating, similar to LEED ratings for buildings, for natural gas wells based on a variety of factors, including emissions, leaks and spills, well integrity, water sourcing and more. The program is designed to connect potential buyers of natural gas to sellers whose product earns the TrustWell certification.

In September the IES announced the first transaction of a “responsible natural gas product” in the history of the oil and gas industry using the Trust- Well Ratings certification system. According to the IES, New Jersey Natural Gas has contracted with Southwestern Energy to secure certified natural gas for commercial use.

Managing wastewater

In the wake of the unconventional revolution, operators have been charged with managing the sheer volumes of wastewater that are produced along with oil and natural gas. According to the Colorado School of Mines, about 21 Bbbl of produced water—more than twice the amount of water that flows over Niagara Falls every day—is generated each year in the U.S. from the country’s approximately 900,000 wells. To manage that much water is costly. According to an Approach Resources report, as much as $5/bbl, or up to $1.5 million per well, is attributed to water sourcing and disposal in the Midland Basin.

In addition to the financial burden vast amounts of wastewater places on operators, produced water management also brings with it inherit environmental challenges. Wastewater injection practices, particularly in Oklahoma, have resulted in elevated occurrences of earthquakes. The Oklahoma Geological Survey reports that between 2013 and 2017 there were 2,519 earthquakes with measured magnitudes of 3.0 and above.

However, during that time, researchers and state officials said they mostly identified the causes of induced seismicity and put into place measures and restrictions on wastewater injection practices, which have drastically reduced the number and severity of earthquakes in Oklahoma.

“Research has pointed us toward injection volumes, specifically in the Arbuckle Formation,” said Michael Teague, secretary of Oklahoma’s Energy and Environment Department. “The high volumes [of injected produced water] in that formation were essentially the root cause for the bulk of the induced seismicity that we were seeing.”

In response, the Oklahoma Corporation Commission (OCC) enacted restrictions on injection volumes, and the restrictions have mostly worked. Teague said from 2015, when the number of earthquakes in Oklahoma reached a peak of 903, through 2018, there has been more than an 86% reduction in seismic events measured at 3.0 and above.

With a better understanding of what caused induced seismicity in Oklahoma, the OCC is now looking to limit growth in future disposal rates in the Arbuckle Formation. In February the OCC issued a directive to evaluate those disposal rates.

“The continued drop in earthquakes, as well as new data and input from the Oklahoma Geological Survey, have caused a change in our orientation from focusing on current disposal volumes within the AOI [areas of interest] to looking ahead to try to ensure there isn’t a sudden, surprise jump in those disposal volumes,” Tim Baker, director of the Oklahoma Oil and Gas Conservation Division (OGCD), stated in a press release issued earlier this year.

According to the OGCD, the directive includes not only those Arbuckle disposal wells within the AOI already restricted in volume, but also the few potentially high-volume disposal wells that previously were not under a volume reduction directive because there has been no seismicity in their area.

While the problem behind induced seismicity has so far been attributed to high-volume injection rates, there are some indicators that longer-term injection and even production from older formations have caused regional earthquakes. A report recently issued by EnergyMakers Advisory Group included a holistic assessment of 15 risk factors and mitigation strategies for disposal and EOR wells.

“Our understanding of seismicity is continuing to increase, and the field is probably more complicated than meets the eye,” said Laura Capper, president and CEO of EnergyMakers Advisory Group. “While we’re continuing to understand why it’s happening, we’re also finding out understanding of contributing causes is more complicated than we thought. The long-term effects of cumulative injection can play a role in some areas, and in others, the long-term effects of production, which might result in gradual settling, or subsidence, have also been associated with seismicity.”

During the course of a recent study, Capper and her team evaluated every disposal well in the U.S. along with the corresponding publicly available datasets with the goal of identifying any general trends in seismicity issues. Those findings revealed that a key factor correlating with induced seismic activity in Oklahoma is reservoir pressure.

“Our research indicates that while high volumes of water can be a significant contributing factor, it’s not always a high-pressure problem,” Capper said. “I believe it is as much of an underpressure problem that can occur when you’re injecting produced water at high rates in more shallow aquifers, if that shallow (or moderate) aquifer has a lot of low-pressure formations beneath it. The existence of those low-pressure intervals beneath it can facilitate the pressure transfer down to the basement. That can cause a seismic event. That’s a very simplistic explanation of why Oklahoma has so much seismicity—because it’s got this monster underpressured formation going beneath practically the whole state.”

Capper reasoned that dynamic is why the Permian Basin, which is notoriously overpressured, experiences fewer seismic events.

“In at least some regions, there’s a lot more correlation between seismicity and relatively underpressured areas than overpressured areas,” she said.

Permian Basin seismicity trends

Meanwhile, in the Permian Basin, water management is becoming a growing issue, primarily from a production and cost perspective. As production rises in North America’s most prolific basin, so too does the amount of produced water. While some operators such as Apache Corp. and Approach Resources have implemented produced water recycling systems, many still are using legacy injection wells to dispose of record amounts of wastewater.

Capper explained such operators may soon need to consider other options, including recycling.

“Because [disposal wells] in some areas show signs of diminished capacity, operators are going to have to work harder to find places to dispose of their water,” she said. “They might not be able to inject it back into that same well they’ve been using for 20 years. They may need to find a disposal well with a more receptive formation.”

If operators do look for new locations to dispose of produced water, they’ll have more resources available to them to inject that water safely as to avoid any seismicity issues in the Permian. Earlier this year Jens-Erik Lund Snee and Mark Zoback, geophysics professors at Stanford University, developed a detailed stress map of the Permian Basin. The study, published in February in the journal “The Leading Edge,” featured a map of the entire Permian Basin region and identified areas of the basin that could be susceptible to earthquakes from wastewater injection. As the study reported, seismicity issues in the Permian have been concentrated near Pecos, Texas, around the Dagger Draw Field in New Mexico and near the Cogdell Field in Snyder, Texas.

The map developed by Snee and Zoback identified faults striking east-west in the northern Delaware Basin and much of the Central Basin Platform that would be most likely to slip as a result of injection. In the southern portion of the Delaware Basin, faults striking northwest-southwest are most likely to slip, according to the study.

“Knowing the orientations of faults that are unlikely to slip at any given fluid-pressure perturbation can be of great value because it provides operators with practical options for injection sites,” the report stated.

Reducing produced water hazards

Not only are companies increasingly aware of how much produced water they inject and where they inject it, but also of the chemical makeup of what is being injected into underground reservoirs. According to the EPA, radioactivity levels in produced water from unconventional drilling “can be significant and the volumes large.”

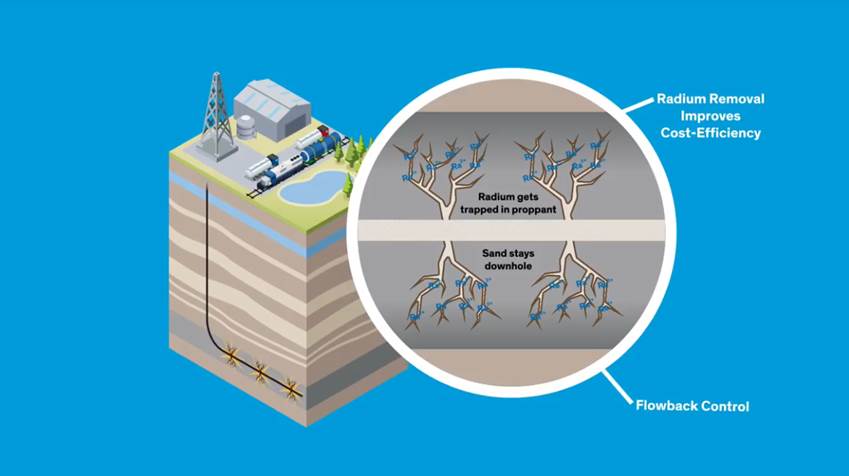

Among the wide array of systems designed to improve the quality of produced water is Dow Chemical Co.’s VORARAD downhole radium sequestration technology.

According to Dow, radium is problematic because it is soluble in water and can travel to the surface in flowback and produced water. Radium decays further into radon gas, which can cause inhalation hazards if exposed. According to the company, because dissolved radium can become concentrated in scale, suspended and precipitated solids when the wastewater is stored, transported or treated, high levels of radioactivity can result.

VORARAD fuses proppant particles together, preventing them from traveling to the surface, which can cause pipe and pump blockage and decrease near-wellbore productivity. The technology works to sequester downhole radioactive isotopes from rising to the surface in produced water.

“As operators continue to develop more sustainable water usage practices for hydraulic fracturing, VORARAD helps alleviate current environmental concerns, fundamentally reducing radium levels in produced water with all of the consequent benefits,” said Juan Carlos Medina, marketing manager for Dow. “These include a reduced radioactive footprint throughout the entire water recycling process and reducing transportation of hazardous materials through towns and cities as they are moved from wells to authorized disposal facilities.”

RCS regulations

Addressing concerns over air and water environmental issues is only part of the challenge for operators and service providers in maintaining their social license to operate. Ensuring the health and safety of oilfield workers is the priority, and modern hydraulic fracturing operations pose new challenges. One of those challenges is associated with the vast amounts of fine-grained sand used to fracture wells. Recent studies by the U.S. National Institute for Occupational Safety and Health (NIOSH) and OSHA have shown that wellsite workers might be exposed to dust with high levels of respirable crystalline silica (RCS) during hydraulic fracturing.

According to OSHA, RCS is the portion of crystalline silica that is small enough to enter the gas-exchange regions of the lungs if inhaled. During the course of the research, NIOSH found that sand mover and blender operations and workers downwind of these operations, especially hot loading, had the highest silica exposure.

In response, in June OSHA enacted a new standard for permissible exposure limits (PEL) for industry workers. The new PEL limits worker exposures to 50 micrograms of RCS per cubic meter of air averaged over an eight-hour day.

“Unlike something like a fire or smoke where you can easily see the hazard, RCS is the size of human hair; you can’t see it,” said Rob Heiberger, operations manager for AIRIS Wellsite Services. “The guys on location don’t realize something that small can be hazardous to their health.”

AIRIS Wellsite Services provides silica dust control consulting services and custom engineering controls as well as its Dust Vacuum 4 dust collection system. Heiberger said AIRIS Wellsite Services helps companies ensure they are compliant with the new OSHA standards on allowable PEL.

“Everyone seems to know that they have to do something at this point,” he said. “Some don’t know what to do, some know what to do and are actually doing it, and then there are some who don’t know what they are supposed to be doing. They know they are supposed to be doing something but are completely unsure of what.”

In a recent white paper issued by Hi-Crush, Jeffery Johnson, the company’s environmental compliance director, wrote that it may no longer be feasible for companies to continue to rely on pneumatic operations for handling sand at well sites.

“New work practice and engineering controls are likely necessary to reduce the dust and silica generated to safe and compliant levels,” Johnson wrote. “Implementation of controls will be required, and providers and operators may struggle with the increased cost and efficiencies potentially lost by implementing such controls.”

Hi-Crush’s PropStream last-mile system integrates a variety of aspects in frack sand supply management. The system also reduces dust generation and decreases worker exposure to dust and RCS. Johnson wrote that the system is self-contained and delivers sand to the blender hopper with a minimal release of dust as the sand enters the hopper.

“Use of pneumatics for material handling and transfer is completely eliminated, as sand is contained in transportable containers, gravity fed onto an enclosed conveyor and conveyed into the hopper,” he wrote.

Companies like Occidental Petroleum, Equinor and CNX Resources are rapidly taking steps to meet evolving regulatory requirements and be good stewards of the industry by retaining their social license to operate. Meanwhile, service providers like AIRIS Wellsite Services, Evolution Well Services, Frac Shack and Hi-Crush continue to innovate and stay ahead of the curve by offering modern solutions to modern challenges.

As Equinor’s Medina said, for companies to remain at the forefront of environmental awareness and worker safety, the work must go beyond simply being aware of the issues.

“It’s not just monitoring,” he said. “You need to be committed to act and spend the money to solve the problems.”

Recommended Reading

Viper Energy Announces Pricing of Diamondback’s Secondary Common Stock Offering

2024-03-06 - Viper Energy will not receive any of the gross proceeds from Diamondback’s secondary offering of its Class A common stock.

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

2024-01-25 - The Permian’s Tier 1 acreage opportunities for startup E&Ps are dwindling. Investors are beginning to look elsewhere.

Why Endeavor Energy's Founder Sold His Company After Years of Rebuffing Offers

2024-02-13 - Autry Stephens', the 85-year-old wildcatter, decision to sell came after he was diagnosed with cancer, according to three people who discussed his health with him.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.