Analysts forecast oil demand will rise by 6 million barrels per day this year. (Source: Shutterstock.com)

Global oil demand is forecast to recover all that was lost when the coronavirus pandemic raged amid an oversupply, fully recouping by year-end 2022, say analysts with Evercore ISI.

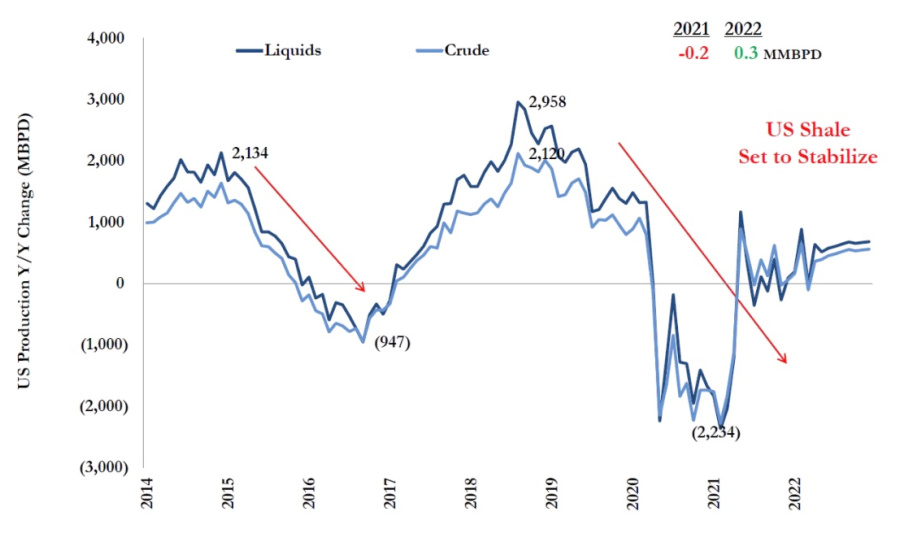

However, North American output is expected to stabilize, leaving the Evercore analysts looking to other non-OPEC suppliers to meet the world’s growing oil needs in the near term.

“Demand really did decline almost 9 million barrels a day in 2020, but we expect about a 6 million barrels per day increase in 2021 and then almost 2 million barrels per day increase in global oil demand in 2022,” Evercore’s Doug Terreson said this week during the company’s Global Energy Outlook webinar.

“We’re going to recoup almost all the demand that we lost, we think, by the end of next year,” added Terreson, who serves as senior managing director and head of energy research for Evercore but retires in April.

Looking further ahead, the rate of change in oil demand growth is expected to fall, he warned, slowing from about 5 MMbbl/d on average for the past five years to nearly zero by 2025 and turning negative by 2030.

One might think that “if the rate of change in oil demand growth falls this amount, it has to be negative for the price, but I would say that it may not be,” Terreson said. That’s because there would likely be a substantial supply response from OPEC, which has consistently removed supply to help improve market conditions.

He, however, noted that just about all of the CEOs participating in Evercore’s conference last week suggested they believed demand would continue to rise through the end of the decade and into the next decade. “We’ll have to see on that,” he said.

The forecasted slowdown—based on outlooks from majors and organizations like the International Energy Agency—would unfold during the energy transition toward low-carbon and renewables-based energy systems in parts of the world.

Many major oil companies have adjusted portfolios—some planning to focus more on natural gas, others adding renewable energy projects and some doing both while reducing carbon footprints—in response to growing pressure from investors and others to lower emissions and produce energy more responsibly.

Prevailing thoughts are that oil is and will still be needed, especially for petroleum products.

Speaking to non-OPEC supply today, Terreson said “expectations for non-OPEC supply have been fairly stable at around a million barrels per day of growth in 2021.” North American output will likely stabilize to current levels in 2021 and 2022, he added.

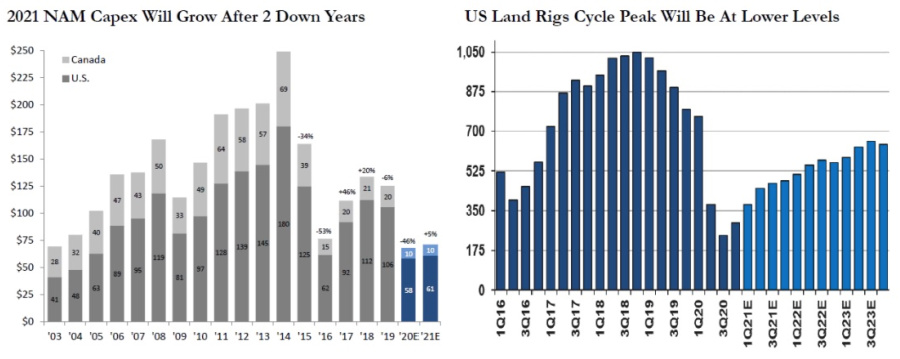

North America is settling into a new normal that is smaller, according to James West, senior managing director and partner, oilfield services, for Evercore. A consolidation wave across the U.S., with Frank’s International union with Expro being among the latest, has resulted in a slimmed down OFS space.

“I can definitively now say the much-needed oil service industry restructuring is almost complete. Certainly, the worst is over and the industry has now reinvented itself and the industry is now investable again,” West said.

He highlighted the sector’s massive equipment retirement, dramatically reduced cost structures, exits from certain basins and underperforming product line as well as quick digitalization uptake, oilfields of the future and embrace of the energy transition.

Though North American spending is forecast to rise by 5% in 2021 after two straight years of declines, it is still below the 2014 peak, the firm’s data show.

RELATED: Oilfield Service Companies Embrace Energy Transition

As for rigs, analysts see the U.S. land rig count crossing the 400 mark within weeks, eventually hitting 500 in early 2022.

“As we’re sitting here in March relative to where we thought things would be in January, we’re about 10% higher on the rig count in some of the most productive areas of the Lower 48,” said Stephen Richardson, senior managing director, oil and gas E&P, for Evercore. “Our 2021 forecast still stands just shy of 9 million barrels below the EIA, and we have about 100,000 barrels of growth in our model between the second quarter and the fourth quarter.”

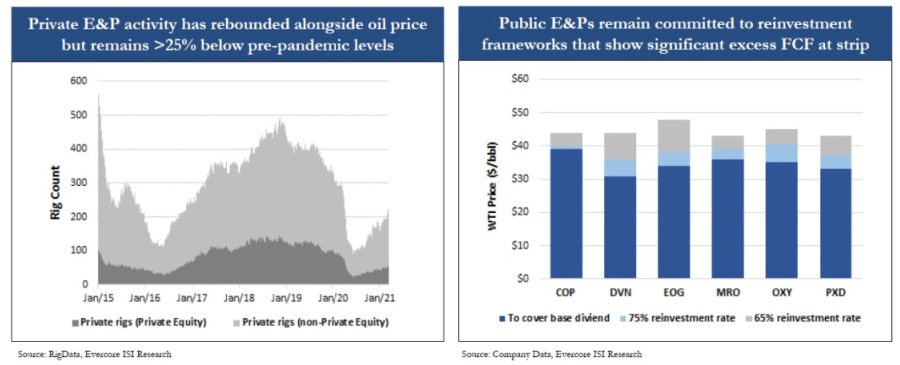

Rising oil prices, which have climbed from about $42/bbl WTI in November to more than $60/bbl today, have given some companies motivation to pump more.

“Privates are ramping up in North America as a result,” West said, “although public companies and the majors are sticking to disciplined spending strategy.”

Despite the rebound, private E&P activity is more than 25% below pre-pandemic levels based on Evercore’s data.

While non-OPEC producers, excluding the U.S., may be filling oil demand needs in the short term, U.S. tight oil could reemerge in the medium term around 2022-2023 considering global underinvestment, according to Richardson.

Future growth depends on a company’s investor base, Richardson said in his presentation, noting a one-size-fits-all reinvestment approach doesn’t exist.

“Industry behavior has radically shifted to value over volume,” according to Richardson. “Most have disabused the view of growth providing either deleveraging or sustainable shareholder returns. Cohesion on these points has been high despite the rise in crude prices more rapidly and significantly than most expected at YE20.”

Participants in Evercore’s Energy Summit were asked what’s driving stock price performance, according to Richardson, who said “oil price is not surprisingly No. 1.” Volume, cash flow growth and returns were also among the top drivers.

Survey results also showed about 50% of investors expect second-half 2021 Brent prices above $65/bbl, and two-thirds see traditional energy outperforming alternative energy through the end of the year, favoring E&Ps above integrated oils and oilfield service companies.

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.