DALLAS—Asset deals have become more challenging in areas like the Permian Basin of West Texas given the fluctuations in valuations as well as the cash available to make them happen, but some smaller, private equity funded groups are still looking for the right acquisitions.

Speaking at Hart Energy’s recently-held A&D Strategies and Opportunities conference in Dallas, Polidoros Trejos, CFO of independent Fortuna Resources Development LLC, confirmed the launch of its third, cash-backed venture Fortuna III with a $100 million commitment from North Hudson Resource Partners LP.

“Fortuna III is targeting the Northern Delaware basin and it is a non-operated opportunity as well focused on near-term developments,” Trejos told attendees at the conference. “Fortuna I was followed the build-and-flip model. That model doesn’t exist today. We will concentrate on buying wellbore-only AFEs (authorized for expenditure). Fortuna III is open for business, and we want your nonop deals.”

With two rigs running currently in the Permian Basin, Chisholm Energy Holdings LLC believes that the right deals in the area are become harder to find due, at least in part, to late-shifting mindsets of the current asset holders

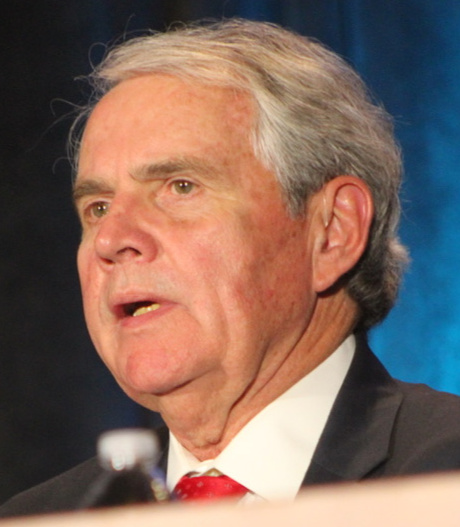

“The market has been reset with one exception and that is the expectations of mineral owners who think it is all still $20,000 an acre,” said the company’s CEO, Mark Whitley. “I’ve got bad news for them. No one is going to pay that.”

He added: “The private equity model that we all assumed was going to work in May 2016 is not functional today. That doesn’t mean it won’t come back. Our backers are a patient group. We will have the opportunity to continue to grow through small acquisition both from a PDP (proved developed producing) standpoint and a leasehold standpoint. Sellers are going to have to change their desires as to what kind of multiple they might take going forward. I think that is underway. There are many teams that are still looking though for assets.”

The tone has definitely shifted from just a few years ago when private money was free flowing into the region, looking for a 24- to 36-month exit window—or the ‘pump-and-dump’ tactic, as it was labeled. Now, private-equity-backed companies have to root down and set up for a longer stay, create free cash flow and postpone their historic quick-flip strategy.

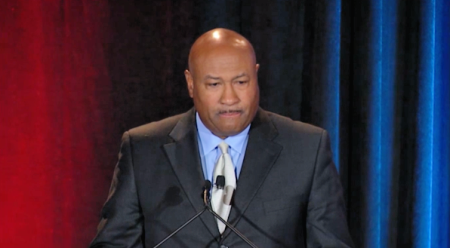

“Private equity portfolio companies, we compete with them more now because they have that [longer-term] strategy,” said Eric Mullins, co-CEO at Lime Rock Resources. “I would still say that the organizations that have capital today are fewer. The public companies are very focused on what they have and trying to live within cash flow. It is very difficult for them to make an announcement on an acquisition and have their stock go up. There’s a 50/50 probability it goes down, so they are not competing as much.”

Over the last two years, Lime Rock has reviewed over 450 transactions. They have completed four.

See full presentations from the deal makers panel at Hart Energy’s 2019 A&D Strategies and Opportunities conference featuring: Eric Mullins, co-CEO at Lime Rock Resources (shown); Mark Whitley, CEO of Chisholm Energy Holdings LLC; and Polidoros Trejos, CFO of independent Fortuna Resources Development LLC.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.