Presented by:

It may be that the swan song for reserve-based lending (RBL)—the seemingly indefatigable financial legs of the oil and gas industry—will play out with a slightly befuddled shrug.

RBL financing helped create the shale run that fueled U.S. oil production growth of more than 960% in the past decade, according to Federal Deposit Insurance Corp. (FDIC) data.

Yet after years of solid support, banks are finally edging toward the door, their RBL loans in tatters after years of bad prices, bad luck and bankruptcies.

An Opportune LLP headline seemed to lament the ugly breakup of the E&P companies and their banks: “Reserve-based lending: What went wrong?”

Clearly, part of the reckoning rests at the feet of the pandemic and simultaneous price war that took WTI prices on a bewildering dive into negative prices last year. More uncertainty was sown by mixed well results, inventory downspacing, well interference and so much spending for so little return.

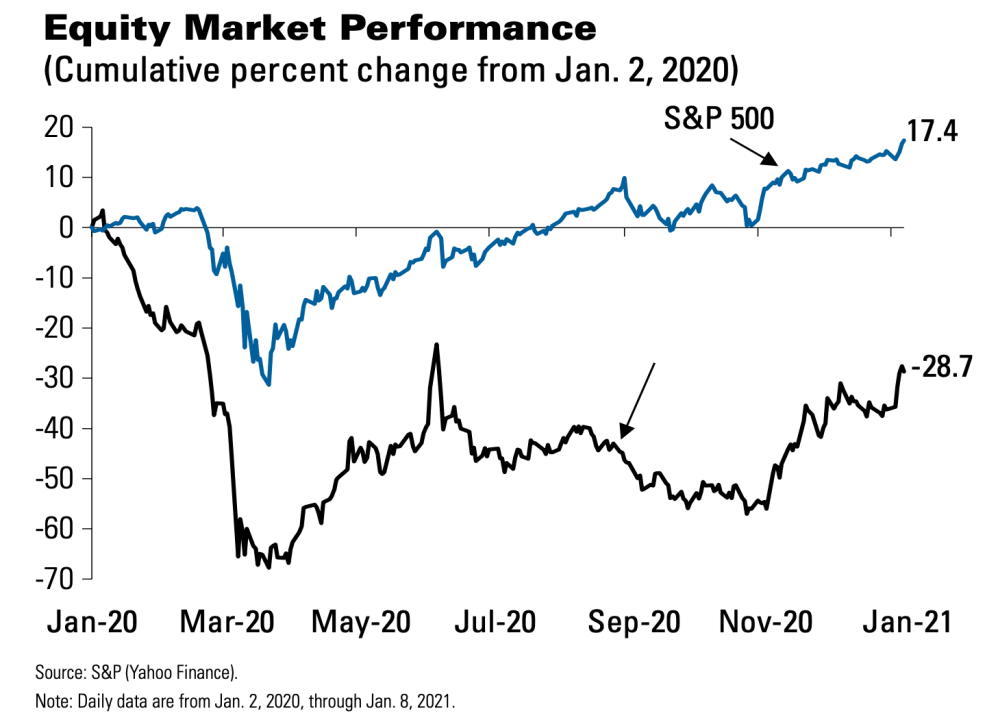

In 2020, out of the S&P 500 Index’s 11 sectors, energy came in dead last again, frozen below the equity market’s X-axis and watching the rest of the S&P 500 manage a 17.4% gain.

But as banks either part with RBL portfolios or tighten the screws on covenants, new capital providers see the twilight of RBL financing as a potential sweet spot with an eye toward providing relief or replacements for RBL instruments.

Most if not all lenders have seen shale’s bad days.

Damon Putman, managing director of energy at Angelo Gordon, said that most lenders are well acquainted with the ways in which down cycles have eroded their confidence, whether in 2015 to 2016 or in the past 12 to 18 months. Those cycles have left a lot of alternative providers uninterested in providing second lien debt.

“A lot of second liens are now called equity,” Putman said. “It is the reality of the situation, and those are very fresh memories for us. So, the further you are down in the capital structure, the more risk you take in.

“Today, there’s not a lot of interest from alternative providers to really do a second lien.”

Capital providers are instead looking at areas where capital can assist companies that may have difficulties with a bank group, such as a maturity that is coming due.

“Where we’re looking to put capital is really to help companies that … have an issue with a bank group, such as an upcoming maturity,” he said. “Truthfully, I think that’s going to be a big part of the next two to three years for where we find opportunity.”

Putman noted that many RBL loans are set to mature. In 2022 and 2023, about $175 billion of oil and gas industry debt is set to mature after a flurry of refinancing in first-half 2020, according to S&P Global Ratings.

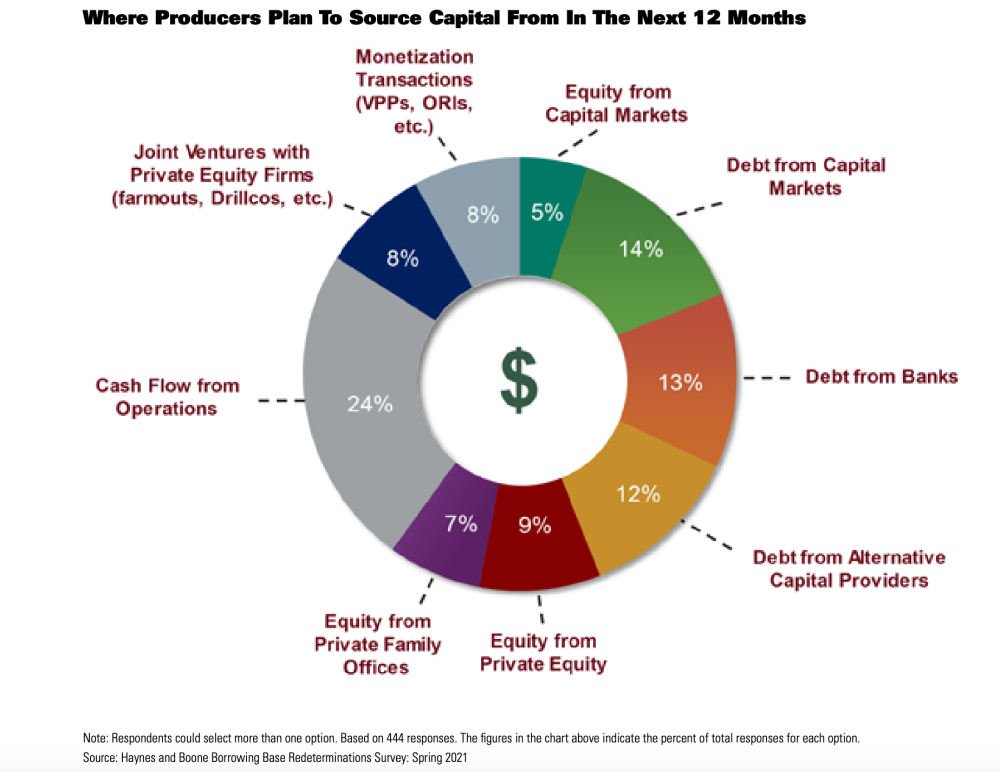

Oil and gas operators are already eyeing different funding sources as borrowing base redeterminations appear likely to trail commodity price improvements. An April survey by Haynes and Boone LLP found that executives largely expected banks to keep borrowing bases flat or increase them moderately.

Producers said they are looking at various sources of funding, including debt from capital markets, banks, alternative capital providers and private equity, according to the Haynes and Boone survey.

Other operators have already suffered through tough redeterminations last year, according to Haynes and Boone. In 2020, companies were rattled as banks hastily withdrew support. In a matter of months, E&Ps saw borrowing base redeterminations sap billions from their borrowing power capacity.

In one striking revision last year, Antero Resources Corp. saw its credit facility slashed to $2.85 billion from $4.5 billion. In May, Centennial Resource Production LLC’s borrowing base was reduced to $700 million from $1.2 billion. Extraction Oil and Gas Inc.’s borrowing base was reduced to $650 million from $950 million. Chaparral Energy Inc.’s borrowing base slid to $175 million from $325 million, creating a borrowing base deficiency.

Vying to fill the void, alternative capital providers say they have a variety of ways to step up to meet producers’ needs, albeit at a higher price point.

Christina Kitchens, managing partner at 3P Energy Capital, said socalled rescue capital is meant to bridge senior debt and larger debt issuances. Such debt would offer funding with a coupon rate of between 7% and 10%.

That alternative capital could then “take the place of what you would call rescue capital, where senior debt perhaps could be restructured, and you’re not stepping too far out from the cost of capital,” she said.

Such funding would give operators more flexibility—if it’s available.

“From a capital perspective, there will be more than that,” she said. “And it’s certainly coming, and then I see that with the funds that I work with and family offices, especially, looking to place that type of capital.”

But Kitchens cautioned that there’s still a gap between funding needs and availability.

“There’s a lot more demands I hear frequently and looking for the type of capital, and there’s just not enough of it yet.”

The new RBL?

As traditional funding sources rethink their strategy for E&Ps—or abandon the space altogether—some capital providers envision staking out a role for their firms that is larger than mere stopgap lenders.

In part, that’s because the reliance on RBL financing may be coming to an end as banks either try to reduce their exposure.

“The certainty of an RBL type of capital no longer truly exists, especially through a cycle and having to think through every six months whether your borrowing base is actually going to be redetermined flat or down,” Putnam said. “That’s the case even in a currently appreciating commodity price environment.”

Don Dimitrievich, managing director, HPS Investment Partners, said the phrase rescue capital is probably a misnomer, and even alternative capital no longer applies to the needs of the industry.

“Limited access to capital markets and high borrowing costs will continue to strain E&P credit quality and liquidity, especially as banks try to limit their exposures to the energy sector by curtailed lending to E&P companies.” —Federal Deposit Insurance Corp.

The aftermath of the pandemic and other downturns has taken its toll. The number of traditional sources of capital that historically funded businesses, such as the bank RBL market, is dwindling. Capital markets have been, if nothing else, volatile, he said.

“At the times we’ve needed the capital the most, that’s when they’ve actually been completely shut,” Dimitrievich said.

Even private equity, which has seen some resurgence, has not been able to raise a significant amount of new capital to invest, he said. What capital providers are offering, however, is less rescue capital or even alternative capital, according to Dimitrievich.

“Ultimately the capital that we’re providing here, you can call it alternative capital. I think it’s more mainstream capital that you’re going to see over time where lenders or capital providers such as us can provide creative capital.”

Lenders would provide developmental capital so that producers can convert their inventory into producing assets, or solutions could include a unitranche hybrid loan structure that combines senior and subordinated debt.

“You’re effectively taking a bank group to either provide incremental capital or address a problem or a challenging commercial lender that’s looking to exit the credit,” Dimitrievich said. “Direct lending is a combination of all those things where you’re in a senior position in the capital structure [and] you provide a customized solution that allows the company to develop their asset base.”

Two realities are now facing oil and gas producers and other sectors of the industry: the amount of capital committed to the space, especially through RBLs, and a coinciding drop among the ranks of lenders willing to risk capital.

“It’s not that capital is going to shrink,” Putnam said. “It is shrinking and will continue to shrink. And, therefore, our dollars, our cost of capital is going to have to go up commensurately.

“It’s notable that a lot of borrowing bases are remaining flat, even though we’ve seen a significant improvement in the underlying commodity of the past 12 months,” Putnam said.

Operators will now have to find more flexible capital that allows them to potentially develop assets and create value, “even though our cost of capital is more expensive,” he said.

Dimitrievich said that expense is typically an area of resistance for borrowers that HPS Investment Partners tries to address.

“We always hear that it’s so much more expensive than traditional RBL capital,” he said. “But when you take a step back and sort of factor in all the different considerations, it can actually be more accretive to the equity the longer term relative to the historic RBL model.”

Ideally, lenders and borrowers will begin to look at their relationships as something more akin to a marriage, Kitchens said.

“You have to look at compatibility for the long haul,” she said. “It’s more important than ever just to be sensitive and look out for the structure and be purposeful.”

Bank drain

What appears to be clearer to borrowers is that the RBL lifeline for oil gas companies has finally snapped.

RBLs were on the minds of E&P executives in December and June as they were surveyed by the Dallas Federal Reserve. More than 70% of surveyed executives anticipated late last year that borrowing base redeterminations would hinge on changes in price deck valuations, while 46% anticipated changes in advance rates on proved developed producing (PDP) and other producing and undeveloped reserves.

In June, an E&P executive told the Dallas Fed the “inability to access credit from reserve-based lending” was affecting the business.

RBL banks continued to retrench during the initial wave of the pandemic while public lenders and public markets have been far more selective on the size of what they will invest in.

As those sources of capital have backed off from oil and gas, or at least been pickier about funding, capital allocation to companies has moved more toward private capital’s wheelhouse.

Mukul Hariharan, director at Houlihan Lokey, said that the two traditional sources of capital for operators have continued to pull back for roughly a decade.

“The way we think of it, private capital is an asset class, and it’s an asset class on the investor side,” Hariharan said. “Again, it’s been growing for the past 10 years. It’s not something that’s only available to certain companies at certain times. It’s available to all companies at all times.”

The landscape of upstream companies has changed such that producers are better suited to take advantage of shorter bursts of interim capital.

Hariharan said operators need to rethink capital availability and the “idea that there’s no other alternative.

“The reality is that there are other alternatives, and in many cases, private capital is the best alternative … in terms of flexibility, stick-to-itiveness of the capital.”

And the equity markets will continue to play a factor as well, he said.

No confidence vote

The news for operators remains mixed.

Despite intensified uncertainty after last year’s pandemic and price war, traditional energy stocks have made headway and recovered and, in some cases, pulled ahead of their peers in the S&P 500. Public and private markets are “still around and aren’t going anywhere,” Putnam said. “Public capital remains available, and it appears ready to be accessed.”

But last year still played havoc with financial performance, and operators dealt with high leverage and low oil prices. In 2020, roughly $53.8 billion of energy debt was taken into bankruptcy in the 11 months through November 2020, the highest amount since 2016, according to the FDIC.

“Limited access to capital markets and high borrowing costs will continue to strain E&P credit quality and liquidity, especially as banks try to limit their exposures to the energy sector by curtailed lending to E&P companies,” the agency reported in its 2021 risk report.

Spring 2020 borrowing base redeterminations were particularly focused on limiting the risks and losses from energy portfolios, which potentially limits their willingness to continue lending to the industry, the FDIC said.

“For a number of E&P companies, this reluctance will mean curtailed access to capital and reduced liquidity as borrowing bases are redetermined,” the report said.

More recently, Haynes and Boone’s April borrowing base redeterminations survey of producers, oilfield service companies, financial institutions, private equity firms and other industry participants found modest optimism for redeterminations in the spring of 2021.

Price improvements in recent months have motivated both producers and their lenders to protect against the downside, while the upstream oil and gas industry has settled into a new normal as it raises capital, the survey reported.

While expectations regarding capital sources stayed consistent, respondents said they expected a significant increase in debt from capital markets.

Those surveyed also said they expect the Permian Basin, Eagle Ford Shale/Austin Chalk and Haynesville Shale to attract the most capital during the next two years.

Buddy Clark, co-chair of Haynes and Boone LLP, noted that the consensus among energy bankers is they are no longer giving any value to anything other than PDP. “The days of booking 20% of PUD [proved undeveloped] reserves to juice the borrowing base are gone,” at least for now, he said.

The FDIC said that banks could reduce their risk to the energy sector by reducing their energy loan books, using more conservative price assumptions in the redetermination process and ascribing less value to PUDs.

Putnam noted that many European banks are also no longer interested in “being in the space, basically selling out their portfolios to other alternative capital providers.”

That trend has been noted by reports looking at lending for traditional energy lending. An October 2020 report by the Institute for Energy Economics and Financial Analysis (IEEFA) said that financial institutions, particularly those based in Europe, are limiting their involvement in certain aspects of the oil and gas space.

IEEFA reported tracking 50 significant global financial institutions that announced oil and gas investment restrictions, specifically on oil-sands exploration as well as Arctic drilling.

An April report by CNBC, relying on data from the Banking on Climate Chaos 2021 report, found that 27 of the 60 largest banks had reduced funding to fossil fuel companies. Overall, funding fell in 2020 by 9% compared to the previous year, the reports said.

Even alternative provider numbers are thinning, Putnam said.

“It’s not dissimilar from our market as well,” he said. “There could have been 30 to 35 institutions like ours seven or eight years ago. Then there were probably 15. And now there’s maybe five or 10.”

Clark noted that several lenders were exiting the space. Whitney Bank sold most of its $500 million energy portfolio last year to Oaktree Capital Management at a 50% discount. Huntington Bancshares and Texas Capital Bancshares have reportedly actively marketed their energy loan portfolios. Cadence Bank and Prosperity Bank have also re-evaluated their energy loan portfolios.

The Bank of Montreal, one of the foreign energy banks with the longest presence in Houston since 1962, announced last November it was exiting the U.S. oil and gas space to concentrate on Canadian producers, Clark said. European exits are partly motivated by recent losses but also due to regulatory, political and investor concerns over funding hydrocarbon projects.

But Kitchens said she expects new entrants into the capital space as the segment shows it the ability to make returns.

“One of the things I saw was how bespoke the capital is today,” she said. “I think it will become more customized. And there’s a little bit of a wait and see in the marketplace right now and across the board from a capital perspective.”

How upstream performs, and whether it remains within its cash flow generation parameters, is something capital providers are “patiently watching, waiting and wanting to see, when’s the right time to really expand.”

Recommended Reading

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.