Even U.S.-headquartered Chevron Corp.—a relative laggard on climate commitments—spent $3.15 billion in February on the sustainable fuel-focused Renewable Energy Group. (Source: Tada Images / Shutterstock.com)

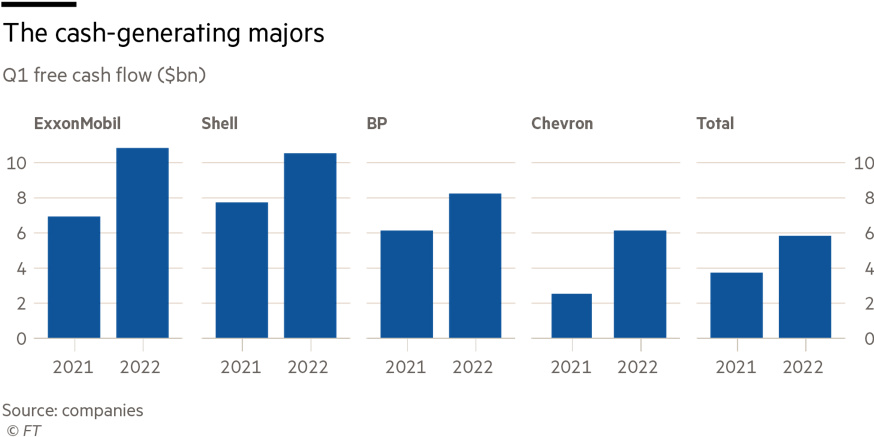

The world’s biggest oil and gas companies are generating more money than ever while spending relatively little of it.

European supermajors BP Plc, Shell Plc and TotalEnergies SE have each pledged to become green businesses over the next three decades but are still investing only a fraction of their capital on renewable energy.

With each expected to report another set of bumper profits over the next week, bankers are asking whether they might be tempted to turbocharge their transition strategies with a big acquisition.

The companies have not stopped buying. In April, Shell acquired Indian renewable power group Sprng Energy from Actis for $1.55 billion; in May, TotalEnergies took 50% of a U.S. wind and solar farm developer for $2.4 billion; and in June, BP said it had gained a 40% stake in a vast Australian renewables project for an undisclosed sum.

Even U.S. rival Chevron Corp.—a relative laggard on climate commitments—spent $3.15 billion in February on the sustainable fuel-focused Renewable Energy Group.

But the deals are tiny compared with the tens of billions that would be needed to strike a transformative deal for a “green energy major” such as Germany’s RWE or Denmark’s Ørsted.

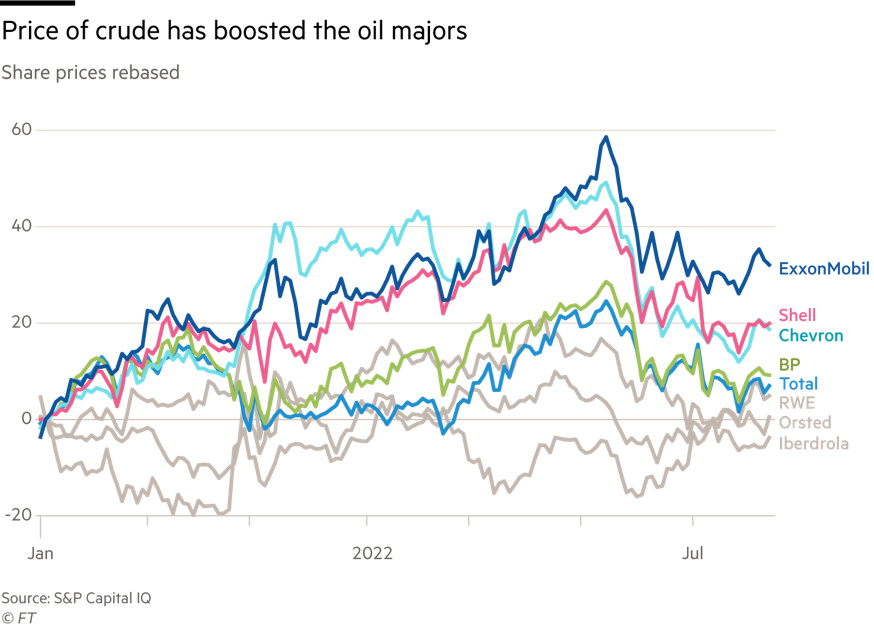

In the first year of the COVID-19 pandemic, as oil prices crashed and the value of renewables companies soared, such a deal looked near impossible. In October 2020 Ørsted’s market cap surpassed $70 billion, as Shell’s fell below $90 billion and BP’s dropped to $51 billion, its lowest since 1997.

This year, the rally in oil and gas prices has helped Shell’s shares jump 30%, pushing its valuation back to over $185 billion. Ørsted’s market cap, in contrast, is down to $46 billion, its shares having dropped about 3% since January.

However, Jim Peterkin, head of oil and gas at investment bank Credit Suisse, said that while the time for such deals would come, it was still some way off.

“I do think there’s going to be a consolidation over time but that may be 10 years away, not one year away,” he said.

Despite the shift in relative valuations, higher investor support for those companies more heavily weighted towards renewables meant the likes of Ørsted and RWE continued to trade at much higher multiples than the old oil and gas majors, Peterkin added.

“The multiples have not changed,” he said, so large-scale acquisitions of renewable companies were “still dilutive.”

Shell CEO Ben van Beurden told the Financial Times he had been holding back from big deals to give Shell more time to better understand the renewables sector.

“At some point in time, I would expect there to be a time for large, inorganic [growth], but you don’t want to start if you are a relative newcomer on the block,” he said. “We’ve been looking at a lot of large things before that didn’t work out, or that we didn’t decide to do . . . and today I’m congratulating myself for not having done it.”

If Shell were to make a big move, he added, the number of power customers the target company had would be more important than the number of power assets.

Others in the industry point to a lack of viable targets for a blockbuster acquisition.

“Yes it makes sense but there’s no obvious deal to done,” said one senior investment banker. “There are not that many targets that would be really transformative and the bigger ones, like RWE or Ørsted, aren’t really executable.”

Ørstedis majority-owned by the Danish government, the banker added, while successful acquisitions of listed German companies such as RWE are rare.

TotalEnergies has been the most active of the supermajors in striking deals. The French group made roughly $6 billion in low-carbon investments between 2010 and 2020, the same as BP and Shell combined, according to Bernstein analysts. Investment bank RBC Capital Markets values TotalEnergies’s low-carbon business at $35 billion, compared with $24 billion for Shell’s and only $12 billion for BP’s.

Bankers say TotalEnergies has been more willing than its competitors to pursue partnerships with renewables companies rather than outright acquisitions. Last year it bought a 20% stake in Adani Green Energy for $2.5 billion at an almost 40% discount to the Indian group’s market cap.

In May, TotalEnergies acquired 50% of U.S. group Clearway Energy Group from Global Infrastructure Partners (GIP). With Clearway owning 42% of its listed subsidiary Clearway Energy Inc, the deal gives Total access to a pipeline of 25 gigawatts of wind, solar and storage projects across the U.S.

TotalEnergies limited the amount of cash it was required to pay to $1.6 billion by investing in the parent company rather than the listed entity and selling GIP a stake in its SunPower business in the same deal.

“That to me is what smart M&A looks like for an energy major going forward,” Peterkin said.

TotalEnergies CEO Patrick Pouyanné, who tends to shun bankers, preferring to negotiate deals such as that with Clearway directly, told the Financial Times that the challenge for the old oil and gas majors was how to make renewables sufficiently profitable.

“Our DNA is that we love the volatility of raw materials of petrol, of gas . . . we know there can be low points but there are high points too,” he said. “A utility isn’t that, these are people that accept a return level that is regulated and controlled.”

As a result, companies such as TotalEnergies will need to acquire or develop renewable energy businesses where at least some portion of the power produced is not subject to regulated tariffs. “If I have, say, 70% of my park under regulated tariffs, I have 30% to 40% of production outside it, I can make a lot of money,” Pouyanné said.

For now, the supermajors are yet to show whether they can run renewables businesses profitably—let alone, for the purposes of successful M&A, more profitability than their current owners.

To approve a deal, shareholders in an oil and gas company would need to be convinced that it could run a company such as RWE’s assets better than they are being run currently, said the head of one renewables-focused private equity group.

Many industry insiders remain skeptical of the ability of oil and gas companies to make the leap.

One suggestion is that by bringing their trading experience to the power market, the European supermajors could increase the returns at renewables projects under their management.

BP, Shell and TotalEnergies’s trading capability stands out, even in the oil industry, and all three have built large power trading businesses. Access to TotalEnergies’s power trading capabilities was pitched as a component of the recent Clearway deal.

If the European supermajors can use this advantage to deliver “double-digit returns” from developing and owning renewables assets, it would go a long way to convincing shareholders to back a bigger acquisition in future, said Peterkin.

Until then, most in the sector expect the biggest deals to remain in the $1 billion-$5 billion range, meaning billions of dollars a quarter will continue to flow back to shareholders in the form of buybacks and dividends.

Shell has completed $8.5 billion of share buybacks already this year and van Beurden has said shareholders should expect more.

Analysts believe the U.K.-headquartered group will report another record quarterly profit figure on July 28 of $11 billion. RBC predicts a further $7 billion in share buybacks in the second half of the year. [Editor’s note: Shell reported a record $11.5 billion profit.]

“Maybe in a year’s time after more buybacks and more dividends, there will be a more serious discussion about what else to do with the money,” said Peterkin.

Additional reporting by Sarah White in Paris.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.