Presented by:

[Editor's note: A version of this story appears in Capital Formation 2021, a supplement to Oil and Gas Investor magazine. Subscribe to the magazine here.]

The energy private equity secondary market’s transaction standstill is estimated to be $2 billion to $3 billion annually, and several challenging steps from all secondary market participants will be required to eliminate the impasse. Underpinning any progress is an accelerating fossil fuel divestment trend. A small liberation of the market could cause a wave of transactions, enabling the quicker achievement investment goals and objectives for sellers and a potential rewarding gain for patient, long-term buyers.

Energy and the private equity market

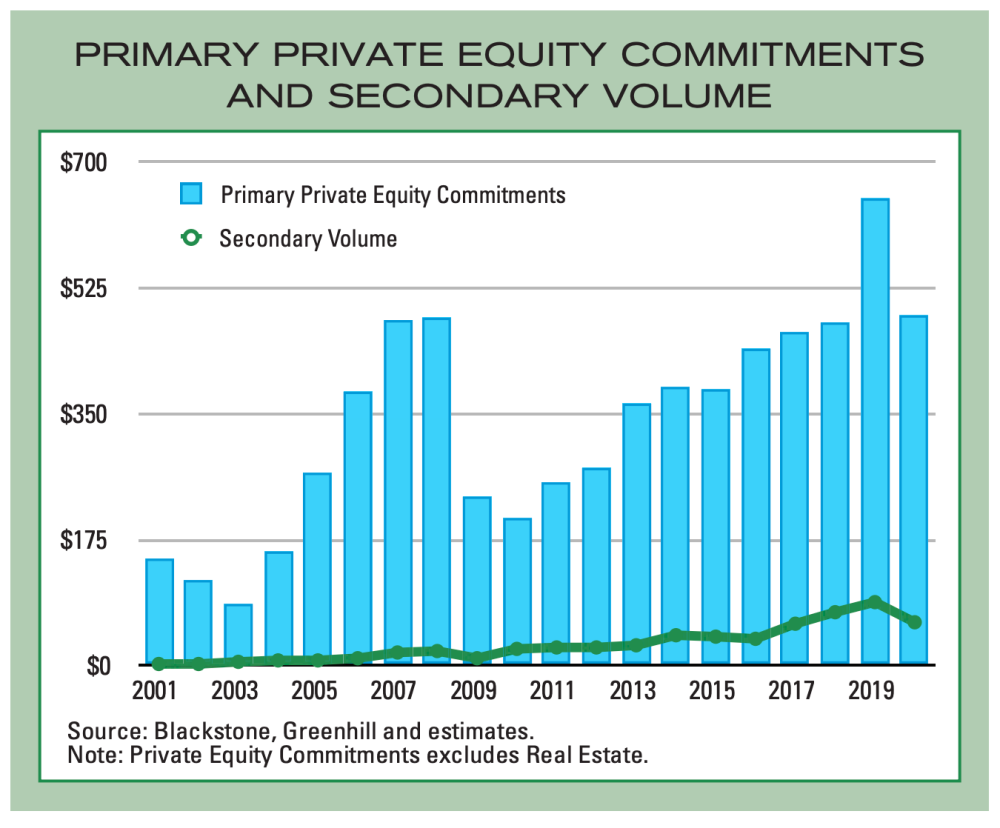

During the past decade, investor annual allocations to private equity have more than tripled and peaked at nearly $650 billion in 2019 before declining approximately 25% last year. The global pandemic pushed investors to the sidelines waiting for market and asset valuation clarity.

Private equity’s massive $7 trillion capital stockpile owes to institutional investors shifting their portfolios toward typically higher returning private equity from lower returning public equity and bonds in a sustained depressed interest rate environment. For institutions with underfunded obligations, such as pensions, the move helps clear required return hurdles.

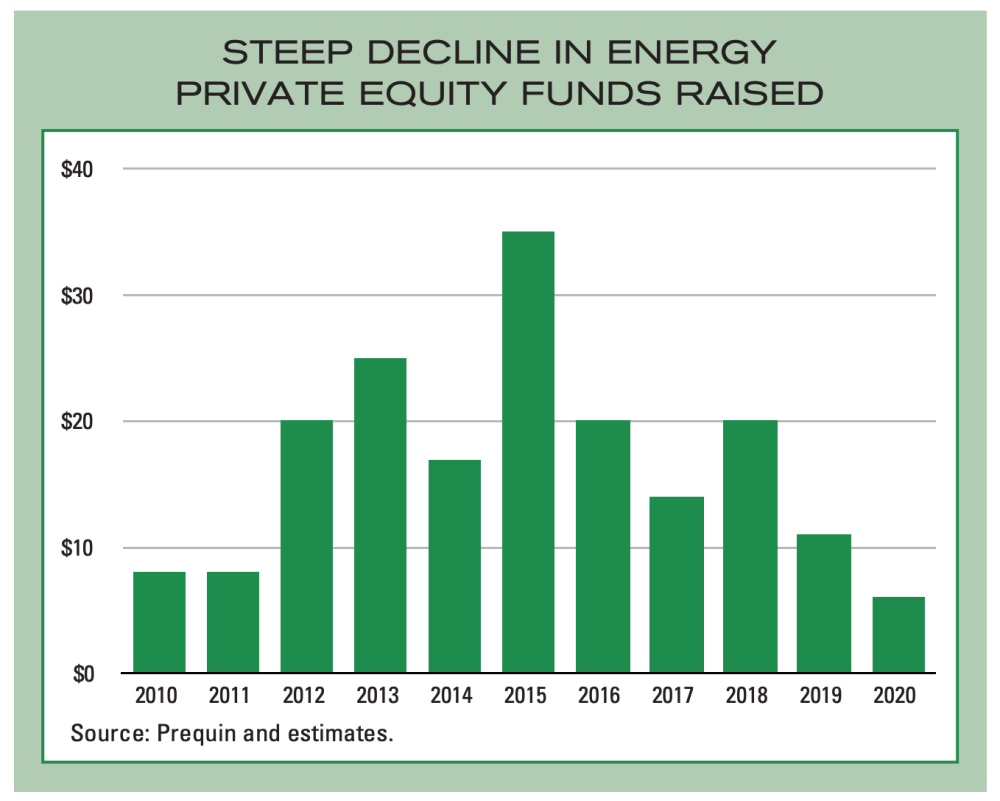

Nearly $200 billion of private funds were amassed since 2010 targeting the capital-intensive energy sector. The energy sector’s remarkable growth and change during the period offered impressive potential investment returns.

Energy funds were raised by both large, diversified private equity firms such as, Apollo Global Management, Blackstone, The Carlyle Group and Warburg Pincus LLC, and smaller, specialist firms such as EnCap Investments LP, Riverstone Holdings LLP and Quantum Energy Partners.

These and other firms raised $35 billion, or 9% of the year’s total private equity, at the 2015 apex. Energy fund raising since has nosedived to a little more than 1% of total funds due to poor investment performance mainly a result of volatile oil and natural gas prices. In addition, the decreasing liquidity of energy investments in the secondary market may have a possible role in reducing primary energy fundraising.

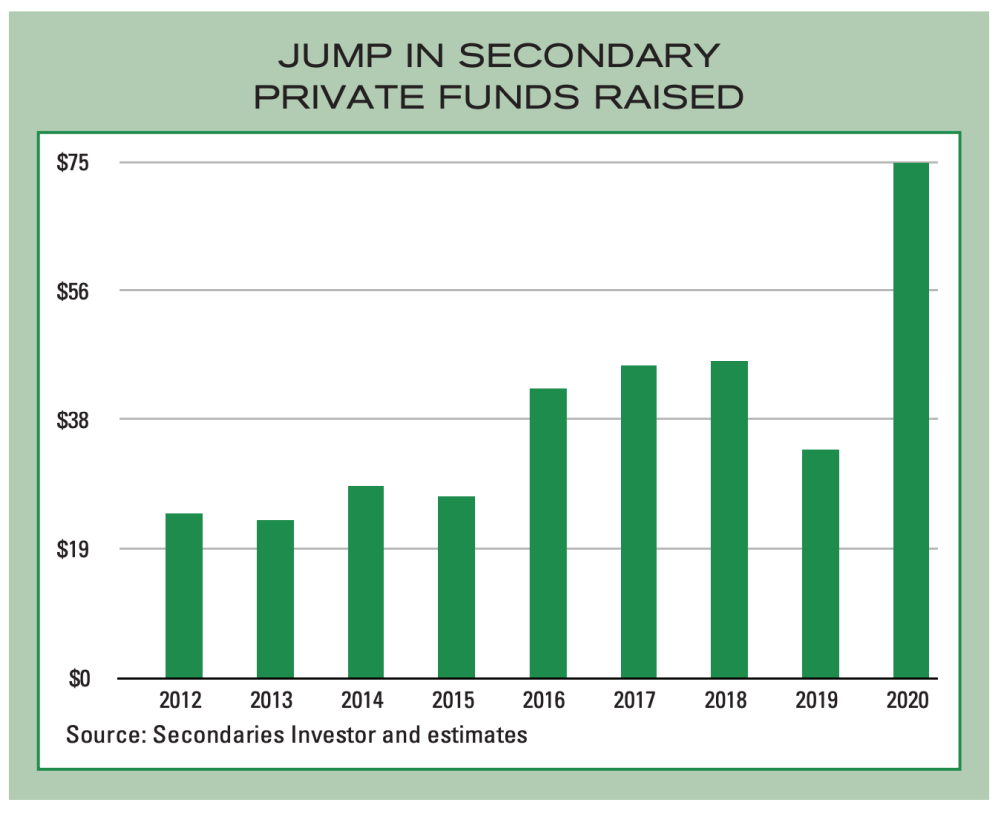

While private equity’s proliferation has been impressive during the past decade, the secondary market for the illiquid investments has grown on a similar trajectory.

Emerging in the early 1980s, the marketplace allows for the exchange of private holdings through a negotiated purchase and sale. Its development has been useful for sellers to proactively manage and rebalance portfolios, as well as reduce capital commitments.

For buyers, the market offers the prospect for low double-digit returns from buying at a discount to asset valuations while limiting risk and volatility through diversification. In addition, a faster return of capital compared with traditional private equity provides appeal.

At its peak in 2019, the secondary market reached nearly $90 billion before falling by one-third last year, much like the private equity market. Both markets are expected to sharply rebound this year.

Increasing volumes and attractive returns have facilitated the secondary market’s phenomenal growth and maturity. Yet it remains in early development, with annual volume less than 5% of the total private equity funds managed.

Not surprisingly, capital and new entrants have been attracted. In 2020, secondary fundraising surprisingly reached $95 billion, nearly three times the prior year’s $35 billion, as investors sought to capitalize on expected market disruption caused by the pandemic. Growth is expected to continue as large alternative asset management firms such as TPG Capital and Brookfield have launched secondary strategies with multibillion-dollar fundraising targets, and more institutions are embracing the strategy.

Private equity investment and secondary markets

Private equity investment is accomplished by the collection capital through a close-end, limited partnership to directly invest in private companies. The partnership “fund” is managed by a general partner (GP) for the benefit of the limited partners (LPs).

LPs aren’t required to immediately provide their committed capital to the fund. Rather the GP makes “capital calls” from the LPs as it makes investments, typically during the first five years of the partnership’s expected 10-year life. During the next five years, the fund’s investments are sold, or “realized.” Sale proceeds and any profits are distributed to LPs, completing the fund’s life cycle.

Prior to the end of a fund’s life, an LP’s priorities and strategies often change. An LP might wish to exit its financial commitment and interest in a fund for a number of reasons, including simply as a tool for portfolio rebalancing and diversification.

That intent spawned a new market, known as the “secondary” private equity market, to provide an exit for an illiquid asset class through a negotiated purchase and sale to a third party.

Sellers achieve liquidity for their investment and are no longer obligated for the unfunded portion of their capital commitment. Buyers pay an agreed price, often at a discount to the investment’s value, in exchange for future proceeds from the investment. By purchasing the interest, buyers can achieve a better risk/reward profile and accelerated cash flows compared with primary private equity investing.

The transaction ‘logjam’

Despite the energy sector being such an important part of private equity investing, secondary trading’s evolution and available capital, energy transactions are curiously underrepresented in today’s secondary market.

The value of energy transactions hasn’t grown commensurately with the secondary private equity market. While the sector represents about 4% of private equity funds raised since 2010, it only accounts for about 3% of annual secondary transactions on average, or $1 billion to $2 billion, in recent years. Not surprisingly, energy deals nosedived last year to about $250 million, a minuscule part of last year’s slowed $60 billion secondary market.

Secondary transactions typically occur in year five to seven of a fund’s life after most capital calls have just passed. Energy funds raised in 2015, the sector’s pinnacle year, newly entered this “sweet spot” for deals, implying that secondary transaction volume should be climbing, not collapsing.

Assuming a current private equity portfolio turnover rate of just 2%, approximately $4 billion of annual energy secondary transactions would be expected. Accordingly, the value of the believed activity shortfall is estimated at $2 billion to $3 billion annually.

To “unjam” the secondary market for energy private equity investments, all industry participants—investors, fund managers and their portfolio companies— must meaningfully adapt and adjust to the new sector investment environment. Like all financial markets, a more active and developed secondary private equity exchange would benefit all participants by allowing them to more quickly and easily achieve their respective investment goals and objectives.

Factors for energy’s shortfall

Energy’s shortfall in the secondary market can be traced to a number of factors affecting both buyers and sellers, including:

Poor prices—With recent commodity price volatility, energy fund interests have traded at steep discount to their book value. Market participants are generally unwilling to transact at current prices, so the outlook for increased activity isn’t expected to greatly improve in the near term. Any sale at prevailing prices would likely generate an investment loss for holders.

“Loss aversion”—Private equity investors are apparently no different from individuals when facing investments that don’t perform as expected. Both exhibit, what behavioral economists term, “loss aversion,” which refers to the pain felt from incurring a loss. According to scholarly research, individuals feel twice as much pain when incurring a loss as they feel when making a profit.

Poor returns—The late 2014 oil price decline sparked a rise in secondary energy transactions as optimistic value investors sought to take advantage of a believed short-term market price dip. Such hopefulness hasn’t always yet been rewarded primarily due to sustained oil and gas price volatility and some energy fund portfolio company financial distress.

Lack of specialization—A nascent market allowed secondary investors to be generalists that primarily purchased large, diversified private equity portfolios rather than interests in specific funds. Like any market that evolves, secondary investors are slowly recognizing that specialization is becoming a requirement. Yet most secondary funds today aren’t organized by industry and staffed by specialists. Just like biotech, real estate and other sectors, energy investment requires specialized skills. Limited energy investing knowledge and skill inhibits sector secondary transactions.

ESG concerns—Institutional investor concern for ESG issues increasing takes priority in their portfolio decisions. Forty percent of the $14 trillion assets dedicated to alternative investments like private equity is managed by ESG-committed firms. The accelerating momentum on climate change profoundly affects fossil fuel investment and secondary transactions.

Despite the energy sector being such an important part of private equity investing, secondary trading’s evolution and available capital, energy transactions are curiously underrepresented in today’s secondary market.

Huge potential on the horizon

Despite current logjam, the outlook for increased energy secondary private equity market activity looks to be robust. The encouragement stems from the aging of existing energy funds as they approach their sale “sweet spot” and the accelerating fossil fuel divestment wave.

To date, more than 1,300 institutions worldwide, representing nearly $15 trillion, have agreed to full or partial fossil fuel divestment. In December 2020, New York State’s pension fund, the nation’s third largest with $226 billion in assets, announced a planned divestment during the next five years. The news could spark similar announcements and a wave of secondary private equity energy transactions.

Potential energy transactions resulting only from New York State’s divestment from its $58 billion private equity allocation could total nearly $3 billion, or three years total volume based on historic average activity, assuming a typical 5% portfolio allocation. Current ESG-motivated energy secondary transactions are thought to be a small part of the overall market at present.

Riding the wave

For the secondary market to become more active, sellers, buyers and portfolio companies would need adapt and change to the current market and outlook. Those changes include:

Investor capitulation—The first obvious step to unjam the secondary market would have investors overcome their loss aversion and take the required strategic steps to reshape their portfolios. While investors may incur a loss on their original commitment from a sale, they would also eliminate or reduce associated future capital outlays. They could redeploy the proceeds and budgeted capex to better performing investments and reduce risk. Those investors with divestment directives could achieve their objective sooner.

Sidecar funds—Secondary investors could form dedicated “sidecar funds” for those investors willing to invest in energy, such as distressed contrarian and opportunistic ones. However, these vehicles would need to be staffed with specialists that have broad knowledge and deep experience as sector investors.

Fund Manager-led secondaries—A newer and rapidly growing part of the secondary market is restructured funds organized and facilitated by the private equity fund manager. Accounting for about one-third of the overall secondaries market in 2019 and up substantially in last year’s distorted market, these transactions alter the investment terms to secure additional time for the fund’s unrealized portfolio. While providing liquidity options to existing investors, the transactions also benefit the manager by narrowing their focus to better manage their investments and investor base. The deals also provide fresh capital from committed secondary investors, some with new money mandates. These secondaries are complex and present several challenges, especially aligning the interests of both the new and remaining investors with those of the sponsoring manager. Many investors typically do not have the agility required to appropriately to participate and are often unwilling or unable to do so. Several manager-led energy secondaries attempted in recent years have not been particularly well-received or believed to yet be successful.

For those comfortable with investing in an industry that engages in “elephant hunting”—seeking to make large oil and gas exploration discoveries—tackling the many challenges facing the energy private equity secondary market shouldn’t seem insurmountable if taken in small, prudent steps.

Create a “good bank/bad bank”—Many energy fund portfolios have holdings with widely mixed performance and outlooks, making them unappealing as a whole to secondary investors. One potential solution is to use a “good bank/bad bank” structure has been widely adopted as a remedy for banks with troubled assets. The successful strategy segments better performing portfolio companies from their weaker brethren into separate legal entities. Each entity has an appeal to a distinct set of secondary investors and provides increased liquidity opportunity for investors. While the concept is simple, the practice can be complicated. Organizational, structural, and financial trade-offs issues require thoughtful consideration.

Portfolio company strategy shifts—Energy fund portfolio companies also need to adapt to make themselves more valuable and compelling investments. Today investors demand energy companies demonstrate disciplined capital spending that creates value and generates free cash flow. Gone are the days of excessive outlays to grow scale and revenue as quickly as possible.

Companies should also seek combinations to achieve greater financial and operational efficiencies and to become more attractive consolidation candidates. In addition, they can pivot and repurpose their assets and attributes to the new energy economy, such as reclaiming drilling acreage for solar power development.

By improving their performance, portfolio companies would not only boost their own value, but also their private equity provider’s fund returns. The effort could, in turn, boost the sale potential of those fund interests in the secondary market, thus helping to reduce that market’s current “logjam.”

Size of the prize is immense

The estimated $2 billion to $3 billion energy secondary private equity market gridlock and potential for future activity clearly are immense. While the proposed measures, even collectively, would not completely remove the logjam, they each could serve as important steps toward a more vibrant, healthy and better functioning energy secondary private equity market.

Still the key question remains, “Who provides the funds for secondary purchases?” Most secondary capital is sourced from institutional investors that are often under increasing ESG mandates, making their participation in the potential coming energy secondary wave somewhat restricted.

Besides sidecar funds, long duration investors such as sovereign wealth funds, family offices, deep value investors or entities that are skilled at evaluating and pricing risks, such as insurance companies could increase their market presence. Given this collective’s smaller investment size capabilities relative to overall institutional investors, utilizing their capital at scale would likely seem to be unachievable. Further, some of largest sovereign funds are already linked to oil revenues and view energy companies funded by private equity as unwelcome competitors, so their participation might be limited.

Ultimately only institutional investors can fully “unjam” the energy market by being both buyers and sellers, as they already are in most cases, in the overall secondary market. They simply need to recognize the benefits of taking action.

A new elephant to hunt

As Nobel Prize winner Desmond Tutu wisely once said, “There is only one way to eat an elephant: A bite at a time.” The quote teaches that what might seem daunting, overwhelming and impossible can be accomplished with gradual steady actions.

For those comfortable with investing in an industry that engages in “elephant hunting”—seeking to make large oil and gas exploration discoveries— tackling the many challenges facing the energy private equity secondary market shouldn’t seem insurmountable if taken in small, prudent steps.

Although understandably concerned and apprehensive, sellers must be willing to dispose their investments at prevailing prices, even at a loss, to benefit from redeploying the proceeds to potentially higher returning investments. And if under an ESG mandate, they can achieve their divestment goal sooner.

By definition, secondary buyers are contrarian and patient, like many successful energy investors. Prudent purchasers would surely be willing accommodate motivated sellers knowing that current energy sources, such as oil and gas, are forecast to remain dominant for the next several decades. Under that scenario, energy investments, including secondary ones, could likely increase in value over time, and more so if purchased at discount in today’s market.

Supporting potential secondary energy private equity investment gains are portfolio company self-help valuation improvement actions and potential capital infusions resulting from manager-led fund restructuring previously mentioned.

For secondary buyers and sellers prepared to act, a robust transaction market could be very rewarding, regardless for their respective energy sector investment mandates and outlooks. While private equity fund managers and their portfolio companies could likely benefit, too.

Mark S. Bononi is a global energy investor and analyst in New York City.

Recommended Reading

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.

US Threatens to Not Renew Venezuelan Energy Sector License

2024-01-31 - The U.S. Department of State alerted Venezuela that it could decide not to renew General License No. 44 amid what Washington has labeled “anti-democratic actions.”

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

US Decision on Venezuelan License to Dictate Production Flow

2024-04-05 - The outlook for Venezuela’s oil industry appears uncertain, Rystad Energy said April 4 in a research report, as a license issued by the U.S. Office of Assets Control (OFAC) is set to expire on April 18.