Presented by:

The city of Pittsburgh, especially in the winter, seems perpetually locked in a slate hue, either of color or mood, brought into clear distinction by the yellow bridges, one named for Andy Warhol, that span the murky Allegheny River.

Though not a clear division, the river serves to bifurcate part of downtown’s business sector from shopping, museums and PNC Park, the ballpark guarded by the statues of Roberto Clemente, Bill Mazeroski and other Pittsburgh Pirates legends.

Downtown, the buildings are a mix of healthcare, banks, hotels and, in more recent years, the natural gas companies that have taken over vertical slots in the skyline. EQT Corp.’s building is seemingly most prominent among them, perhaps because it has lately become one of the leading E&P kingdoms here.

It has not always been so. Pittsburgh has had a rocky and explosive history with methane. Before that, it was known as the Smoky City, choked and darkened by massive coal-burning to power homes and industry.

Natural gas was fleetingly the city’s savior but sputtered by the early 20th century. Only in the past couple of decades has natural gas been restored to its former glory and, beyond that, made the city burn brighter than ever.

Pittsburgh is perhaps the easternmost outpost of the shale universe, and the leaders of some of its largest natural gas companies have plenty to say about what they offer not just the nation but the world.

Increasingly, CEOs of Pittsburgh companies have felt spurned, not merely by liberal politicians but by their northeastern neighbors in Massachusetts (who instead accept Russian LNG shipments at Boston Harbor from time to time) and gas-dependent but ideologically adverse New York.

Naturally, this rubs Toby Rice, CEO of EQT, the wrong way.

“I’m from Boston. My mom still burns oil in her basement to heat her home like it’s the 1800s,” Rice said during Hart Energy’s DUG East Conference and in a subsequent interview. “To use oil is about six times more expensive than using clean burning natural gas.”

Calling it a step above burning “whale oil” for home heating, Rice said it’s one of his life goals to get his mother’s home powered by natural gas.

An ESG mindset

The most relentless obstacle is a group of environmental activists who don’t see natural gas, as Rice does, as a way in which to cut emissions but a false choice between all hydrocarbons and renewable sources. However, even Europe is pro-renewable.

Activists have made it difficult to construct pipelines that would allow it.

“They’ve basically put a wall up, cutting Appalachia and the Marcellus Shale off from serving more gas to New England,” he said. “That’s been about 6 Bcf/d of pipeline projects that have been canceled or delayed.”

Pittsburgh has previously been at the forefront of pro-environmental leanings in the past, based on the use of natural gas. An ESG mindset, both for the general health and for more economical reasons, has long been on the brains of city’s natural gas producers.

As a 1927 natural gas handbook noted, “gas leaking into the atmosphere means a continual loss in money,” according to “Boom and Bust in Pittsburgh Natural Gas History: Development, Policy, and Environmental Effects, 1878–1920” by historians Joel A. Tarr and Karen Clay.

Rice sees U.S. LNG powered by the Marcellus as the biggest green initiative on the planet.

“We shouldn’t be thinking about cutting down LNG exports; we should be thinking about doing more,” he said.

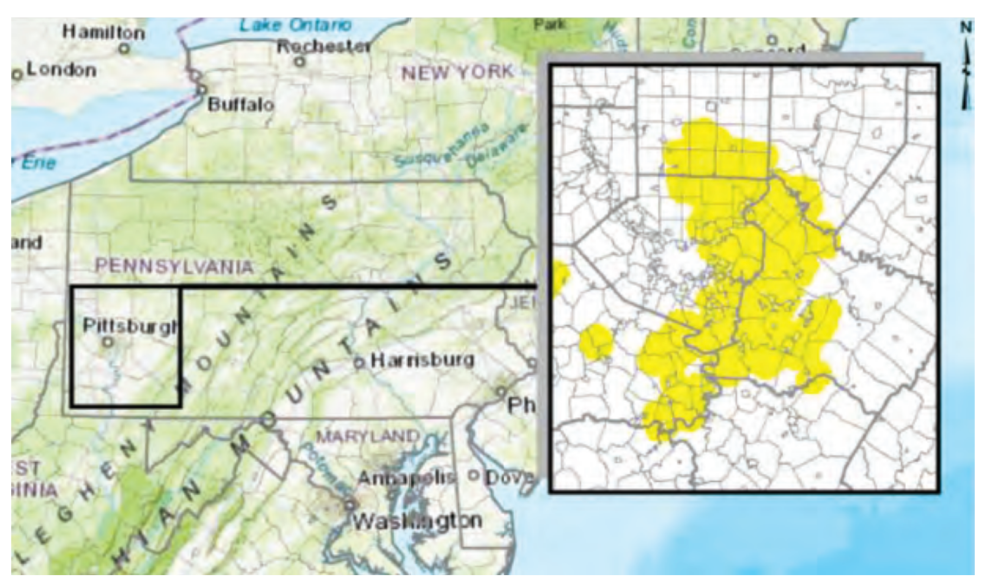

To that end, EQT said in May it would be expanding its operating position in Pennsylvania through the acquisition of Alta Resources LLC in a $2.9 billion deal.

EQT acquired Alta’s upstream and midstream subsidiaries in the core of the northeast Marcellus Shale to add to its footprint in southwest Marcellus in Ohio, Pennsylvania and West Virginia. Alta’s acreage position added roughly 300,000 acres in the northeastern part of the play.

But Rice remains convinced that the environmental movement represents a “very vocal minority.”

“I think most Americans would agree we care about cheap, reliable, clean [energy].”

But opponents of natural gas, however, have lured politicians into more dangerous territory in which clean energy, not just reliable or affordable, is the priority, CEOs say.

The moderate firebrand

Baltimore was the first American city to use natural gas as a lighting system, and Pittsburgh followed in 1837, according to Tarr and Clay.

But national publications such as Harper’s Weekly said the city’s natural gas had taken over coal in a peaceful revolution.

But supplies waned. In 1892, a speaker at the Engineer’s Society of Western Pennsylvania warned, “We are going back into the smoke. We had four or five years of wonderful cleanliness for Pittsburg, and we have all had a taste of knowing what it is to be clean.

“But we are back into the smoke. It is growing worse day by day.”

At DUG East in December, Nicholas J. Deluliis, CEO of CNX Resources Corp., spoke of a similar dread as he called for a halt of the encroachment of left-wing policies that could effectively plunge the city and the national back into darkness.

Deluliis, who hosts a podcast called “The Far Middle,” sees politics inextricably linked to the energy powering small, mid-sized and large businesses. He sees the country’s middle class in particular being eroded by a “hard left environmental movement, by the administrative state and by elite academia, at times.”

“The current situation this region and industry finds itself in evolved under a campaign where the reality is shrouded purposely by those looking to replace it with a mirage.”

He sees strident attacks against natural gas, domestic oil pipelines, petrochemicals and home gas hookups as a justification to create new rules and regulations and mandate subsidies and tax credits to build “wind farms to nowhere.”

The cost isn’t just to C-suites in offices in Pittsburgh, Houston or New York, but to anyone who he says doesn’t subscribe to the “zero-carbon mythology” of renewables.

Deluliis wants a new social contract in which the industry gives more and gets more.

Impact and severance tax paid more than $2 billion to the commonwealth of Pennsylvania cumulatively in summer 2021.

“Do you know of any other industry that’s paid more of a fair share than we have in the past 10 years? Because I don’t.”

Deluliis said the fee structure, now a decade old, should be updated so that the industry, region and state get more out of the fees.

He also wants environmental reporting to include more rigor into regulatory importing for environmental metrics.

He’s also proposed that employees and contract service providers are targeted exclusively through local and regional hiring.

“What if we also target without our local and regional spending individuals and companies from the socioeconomically underserved communities?” he said. “We talk a lot in this industry and across all of business, rightfully so, about diversity, but I’m being geographically non-diverse by hiring and spending exclusively in the regions that we operate within.”

Deluliis also wants the industry to proactively plug abandoned wells under his new social contract.

In exchange, Deluliis proposes a simple recognition that every economic endeavor in Pittsburgh, the region, the nation and the world has a carbon footprint, including wind and solar.

Deluliis also wants leaders to support pipeline construction, natural gas and combined-cycle power generation, which he argues are good for the climate and for jobs.

“They should be completely aligned with us on this,” he said.

And he also sees Pennsylvania being hurt by left-leaning ideology, including from President Joe Biden, state governors and local mayors.

Leaders need to “defend this region and industry’s interests when we’re threatened by nonsensical, ideological, regulatory or financial attack from others,” he said.

And Deluliis wants to eliminate protective markets and subsidies for “expensive, unreliable foreign wind and solar.”

“They make the budget gaps of municipalities and school districts and states and nations worse,” he said. “The middle class and working poor bear the brunt of those costs, both direct and indirect.”

Deluliis said the country is now headed toward outsourcing its energy independence to foreign rivals with the hope they “don’t use it against us time and time again.”

CNX’s approach to ESG has taken an empirical bent as it has worked to strengthen its environmental politics through what Deluliis called a “tangible, impactful, local” approach.

The company has chosen to look at reasonable actions in a reasonable period of time that “move the needle” on societal and quality of life fronts.

“There’s a good, a bad and an ugly with respect to ESG,” he said. “Obviously embracing and running toward the good is what we try to do.”

Community approach

When CEO Tim Dugan first met the team of nearly 50 employees in 2020, he quickly realized why Olympus Energy LLC had been successful.

Like other E&Ps, the goal was to drill high-quality wells, generate significant revenue and provide healthy returns to owners and investors.

But the team also had invested every project with integrity, excellence and stewardship.

The company works in an area other E&Ps might be reluctant to work in because its operations are in close proximity to neighborhoods.

“But our mission is, and always has been, to develop our assets, not just responsibly, but in a way that truly makes a positive difference in the lives of our stakeholders, communities, employees and the entire region that we all call home,” Dugan said. “We don’t plan to be perfect, but we do promise that doing things the right way, and the way will always be a top priority.”

Most of the company’s wells, he said, are in the top quartile of all Marcellus wells with several in the top 2% of all producing wells.

“But what we’re most proud of is that the longer laterals from our Midas pad minimized the impact of the community and created additional values for our owners,” he said. “Since we started drilling in 2017, we haven’t scaled quickly. We’ve been focused on doing it properly because we understand what responsible development looks like in the communities in which we operate at Olympus.”

The company also supports community initiatives that provide benefits for all, especially the most vulnerable. Dugan said that didn’t just mean writing a check. “We also invest our time,” he said, noting that in December “we had eight employees that spent their time packing boxes of food for low income families and individuals who face food insecurity and rely on the Westmoreland County Food Bank for help.”

In 2021, every Olympus employee contributed time to volunteer activities.

Olympus works closer to more populated areas than most companies, including new subdivisions in suburban neighborhoods.

“We have to have a thoughtful approach to development that enables us to minimize our impact and maintain strong relationships with our neighbors.”

Diversity remains a challenge. Dugan said that about 70% of the company’s employees look like him: white males.

To branch out to a more diverse group of potential talent, the company has started to engage in conversations with students across the region and launched four scholarships that will provide up to $10,000 per student.

“As an industry, we have always found ways to get better and overcome challenges,” he said. “We’ve had a tremendous impact on improving air quality and reducing emissions, probably more so than any other industry in the world. We did it because we knew it was important, and we knew it needed to be addressed. We may not get credit for it, but we’re doing it.”

The industry needs to tackle diversity with the same focus, he said.

On ESG, Olympus has also leaped toward making water use and transports to its sites a priority as it seeks to reduce truck traffic and benefit residents.

“We’ve partnered with local municipal authorities and built infrastructure that will allow them to provide freshwater access to more residents in the community and also serve Olympus operational needs to date,” Dugan said. “Even at the early stages of our development, we’ve invested over $20 million in water infrastructure and just go one step further. Our goal is always to reuse 100% of our produced water.”

Late last year, the company also announced it would be the first integrated E&P company to seek independent Project Canary certification of its upstream producing and midstream infrastructure assets.

“We probably get more pushback on every permit we apply for than any other company,” Dugan said.

That’s why the company is pursuing Project Canary certification, using an electric fleet and why its approach to ESG has become “critical to our success.”

“We made the decision early on that we can’t fly under the radar and get a few wells under our belt. We need to do it right from the start.”

Man on a mission

Rice sits in a break room near the DUG East Conference stage where he’s just come off stage delivering a blistering critique of Massachusetts Sen. Elizabeth Warren’s charge that LNG was hurting American consumers.

Part of his response is what he hopes will be a reframing of natural gas not as the enemy of combating climate change, but one of its best chances at beating it.

“I believe in climate change. I believe it’s caused by humans. But I do not believe it’s an apocalypse,” he said, “because I believe in human ingenuity.”

Rice’s bet is that innovation and the ability to adapt and solve problems will lead to an obvious conclusion: shut off the largest source of emissions in the world, foreign coal.

Despite his disagreements with Warren and other activists, “that’s why I think we’ll be arm in arm, side by side on this initiative to unleash U.S. shale and promote U.S. LNG initiative as the biggest green initiative on the planet.”

Opposition to pipelines continues to hurt the Marcellus Shale’s ability to produce.

“The community where we operate at EQT, we are embraced. Because people love the fact that we’re coming out to operate in their backyards. Because they know that’s going to mean jobs, it’s going to mean meals at their local restaurants. It’s going to be people buying properties,” he said

But Rice has no illusions about the struggle to get cheap, reliable energy to Americans.

The stark reality is that environmentalism has become a far more sophisticated movement in which vocal minorities are giving the wrong signal to politicians.

The basin produces 35 Bcf/d of local demand takeaway that, when the Mountain Valley Pipeline comes online, will increase to 37 Bcf/d.

“The reality is the price signal is there,” Rice said. “The actual pipe signal is not. And unfortunately, that’s not something that we can control. Certainly, industry’s proposed billions of dollars of projects that have been canceled, for lack of better terms, environmental activists.”

Rice fears that could lead down a road Americans don’t want to go down.

With plenty of natural gas in the Marcellus, Rice wonders whether continual blocking of infrastructure will send the U.S. into energy poverty.

“Is that going to make natural gas prices spike to $5 when it should be $3? Because we have different concerns than people in … a developing country [are] just trying to get energy any way they can,” he said.

And he points to Europe, which has seen a meteoric increase in natural gas prices.

“You can have developed nations that suddenly find themselves in energy poverty because of a lack of investment,” he said. “And that could easily come back over here.”

That doesn’t mean that EQT shies away from operating in strict regulatory environments. It already faces stringent rules in Pennsylvania, Ohio and West Virginia.

“Is it difficult to operate up here in Appalachia? Absolutely. But we deal with it. We just need more time for planning.”

Rice said as long as the rules of the game are clearly defined, EQT and the industry will do what it’s always done: “meet those demands.”

Recommended Reading

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.