Presented by:

[Editor's note: A version of this story appears in the July 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

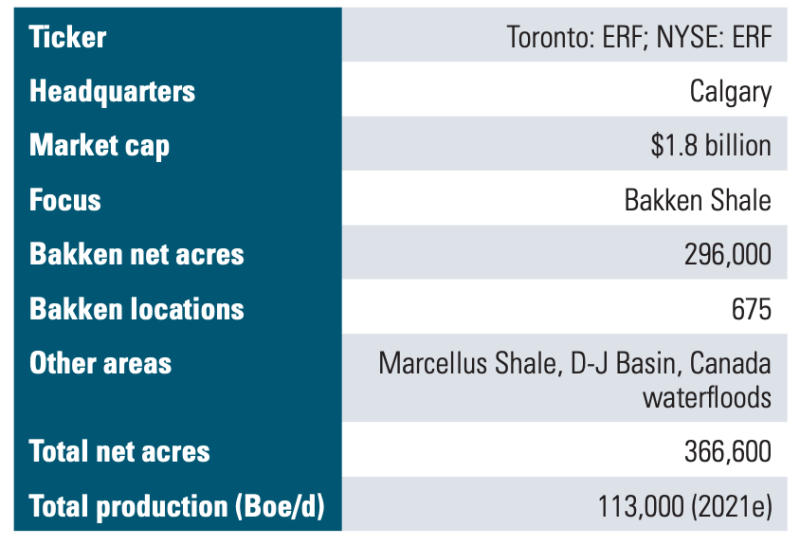

Lying unobtrusively in the shadows of the Bakken Shale for the past half-decade, Calgary-based Enerplus Corp. struck earlier this year with two transformative back-to-back acquisitions for almost $800 million to bolster its portfolio. The combined deals quadruple its acreage footprint in the play and nearly doubles its cash flow—without adding any G&A costs.

“I would have loved to have bought something multiple times over the past five years,” said Enerplus president and CEO Ian Dundas, “but there are times when you can buy sensibly and times when you can’t.”

The first deal added 151,000 net acres—with some 30,000 identified as core—from Bruin E&P Partners LLC for $465 million. Enerplus, which had sold Bruin its first package as a startup, was in conversations with Bruin regarding selling before the pandemic, but “they carried a little too much debt for our liking, and we couldn’t see eye to eye on value,” Dundas said. That debt sunk Bruin when prices tanked in 2020, and Enerplus was able to acquire the assets from Bruin’s new bank owners post-bankruptcy.

The second deal tacked on an additional 79,000 net operated and nonoperated acres characterized as Tier 1 carved out of Hess Corp.’s portfolio for $312 million. Together, the deals immediately double identified drilling inventory in the Bakken, even before upside is considered.

Enerplus’ history is long and storied, first forming in 1986 as Canada’s first royalty trust before converting to a standard corporation in 2011 prompted by Canada’s change in tax laws. It is also one of the Bakken Shale originators, buying into the Williston Basin before the technology for extracting oil from tight rock was fully understood.

Almost but not quite a pure play, Enerplus also holds a nonoperated and free cash flowing joint venture with Chief Oil & Gas in the Marcellus Shale, a small but emerging opportunity in the Denver-Julesburg Basin in Colorado and Canadian waterfloods.

Dundas joined Enerplus in 2002 in the business development role, ultimately ascending to the CEO seat in 2013. He spoke with Oil and Gas Investor in May shortly after closing the Hess acquisition.

Investor: What inspired you to go on a Bakken buying spree to start the year?

Dundas: It was the market. We had positioned ourselves as being a company that could do more in the Bakken. Over time we built the core of the company around our Bakken footprint and it was a pretty good footprint, but we knew we could do more. We felt there was an opportunity to build scale, but until recently the value wasn’t there.

We’ve been in many conversations with investors for quite a few years around, “When are you going to build out in the Bakken?” And we just couldn’t see a line of sight to making a dollar there through acquisitions, so we made a decision that we’d keep our powder dry. We would build one of the biggest strategic assets we had, which was maintain the balance sheet. We didn’t think we’d have a pandemic, but we thought we would have a moment.

When the pandemic hit, Bruin couldn’t get through. They became insolvent and had to restructure. With the balance sheet where it was and our familiarity with the asset, we were able to move a little more quickly than others might have been able to and offer some deal certainty to the seller. We didn’t buy quite when oil was on the bottom, so there was a little bit of recovery which got them to a level where their new shareholders were at a place that made sense for them. And it made sense for us.

The Hess deal was a bit of a different asset than Bruin in that there was a bit more upside that we had to pay for. But, you know, it worked for us, it worked for Hess. We bought at a level where we were really comfortable that we could generate attractive full-cycle returns. And we haven’t seen that opportunity in the Bakken for a long time, certainly not for core assets.

It’s been easier to buy fringier assets, but those assets required $60 oil prices or higher to even come close to printing full-cycle returns. And that’s not what these deals look like.

Investor: The Bruin acquisition included a large portion of acreage north and south of the Bakken core play. What opportunity do you see in these positions, and what are your plans for these areas going forward?

Dundas: If you go up to the Williams County acreage, it clearly screens as noncore if you just look at the average across the entire swath, but if you get more specific to the southeastern corner, there are some great wells there. So we highlighted those wells for about a third of the Williams acreage as being core, and they will fit nicely into our plans.

On the remaining two-thirds of the Williams acreage, the northwest portion, there’s oil there and you can make a well, but we don’t see it competing economically at the same level as the core. We’ve got some ideas as to how we might advance on that, such as a different approach to completions, which could unlock additional upside.

“There’s a lot of optionality that sits in the portfolio from an inventory perspective that we didn’t have before. It’s significant.”

Then for the land far to the south [in southern Dunn County], we haven’t said much about it. If you look at well results all around that area, you’d conclude it’s another step down in terms of being removed from the core. So we wouldn’t have any near-term plans to spend capital there.

Investor: Is that a divestiture target?

Dundas: Maybe. We’ve talked about anything outside of the core of the Bakken as being something we’d entertain selling. For us, it’s about the best way to unlock value in those assets. But this market feels like one where it’s better to be buying than selling. We will have to see where the market goes.

Investor: The Hess package added both operated and nonoperated inventory in Dunn County. What in particular attracted you to these assets?

Dundas: We think this is a special opportunity actually. It’s a unique package. It’s high-quality acreage. The Bakken has been worked for some time now, and core inventory is harder to pry out of owners’ hands, although with today’s costs and $55, $60 oil, more parts of the play look attractive.

This (acreage) just didn’t have the focus of Hess’ near-term capital plans. In fact, they hadn’t drilled a well there since 2015. Even in the absence of any additional activity, we had confidence that with modern completions you can drill some pretty exciting wells there. We actually had the luxury of watching their nonop partners—call it 80% operated, 20% net nonop—continue to move forward on the acreage to help validate our view.

We haven’t seen an opportunity like that come along in a while, and Hess was able to get value for some of the upside. Our balance sheet was made to be used at certain times, and this is one of those times.

Investor: What do you see as the upside?

Dundas: We’re going to find things to do there, for sure. In Fort Berthold, we’ve got spectacular Three Forks development, and it’s homogeneous, classic resource stuff. If you move outside of Fort Berthold into Dunn County, you’ve got some great Three Forks wells as well, but it’s not as broad brushed; it’s a bit more compartmentalized. So we see Three Forks opportunities there as well but effectively almost none of those are in our base numbers.

There’s a lot of optionality that sits in the portfolio from an inventory perspective that we didn’t have before. It’s significant.

Investor: How will these two deals shape Enerplus going forward?

Dundas: It’s meaningful. We’ve added close to a billion dollars to our scale, which is nice to have but, far more importantly, we effectively doubled the inventory at an attractive cost and believe we will see operational synergies. Financially, the deals are highly accretive which doubled our near-term free cash flow profile.

Following the deals, we rolled out our updated five-year plan. We said in a $50 to $55 world we see generating C$1.2 billion to C$1.8 billion in cumulative free cash flow through 2025—almost the entire market cap of the company, and higher if today’s prices hold. That plan also allows us to grow our oil 3% to 5%. We now have meaningful inventory to be able to do that; it’s a 10-year-plus inventory.

It’s a really significant change. And that’s just anchored on core inventory.

Investor: Is this enough to say grace over, or would you consider further acquisitions in the Bakken?

Dundas: I think we’ve demonstrated that we are open to consolidation. We’re still a bit of a small company. The balance sheet is still really good, and we’ve put ourselves in a position that we clearly could do more.

The question is going to be is there value still? We’ve now seen four Bakken deals. We’ll have to see where the market goes, but if the market maintains some discipline and there are opportunities to make money on an accretive basis, I think we’re in a great position to continue to build out. And if we don’t, we’ve got this five-year outlook that’s compelling. So we won’t chase it.

Investor: What role do your Marcellus-nonoperated holdings play in your plans?

Dundas: It’s evolved. We’re 10 years into that project. We started as a way to learn about operating in Pennsylvania with a view to parlay the experience into an operated position. Although we changed our plans to build out a meaningful operated project, the play has worked out much better than we ever dreamed.

Well performance is really off the charts. We participate in these wells and they come on at rates where at one time we would have thought you’ve added an extra zero, like 50 million [cubic feet] a day IP with reasonable declines. Instead of talking about 3 to 5 Bcf wells we talk about 2, 3 or 4 Bcf per thousand ft of lateral—and these are often over 9,000-ft lateral sections. They’re enormous numbers.

But the strategic role of the asset is different than it once was. We largely view it as an ATM. It’s a free cash flowing business with a very stable profile so we view it more as capital than anything else. It’s nice to have a bit of exposure to gas, and we have really a strong relationship with our largest operator, Chief Oil & Gas.

Over the years we have said that we would consider selling but recently it has felt like it hasn’t been a seller’s market. You’ve got buyers out there buying at PDP valuations and wanting double-digit rates of return, so it doesn’t sound like great business to me to be selling into that if you don’t have to. We’ll consider selling if we could it get paid a fair price, but I’m not sure it’s where the market is today.

Investor: What about acquiring an operated position?

Dundas: Pennsylvania’s pretty interesting on a lot of levels. I mean, they’re some of the best wells the world’s ever seen, and you don’t need to build an offshore platform for them. The play really changed the Lower 48 gas market. But you’ve got a group of incumbents there; you’ve got 30 rigs and 30 operators and three or four that really matter. And those that really matter have incredible footprints and infrastructure, so it’s hard to compete with them.

It’s not like Enerplus can go in and can create this incredible position. We’d have to spend billions and billions of dollars to be able to compete out there. When I think about our company, we are a Bakken company. The Marcellus is high quality, but strategically noncore.

“I think we’ve demonstrated that we are open to consolidation. … We’ve put ourselves in a position that we clearly could do more.”

Investor: Do you feel like you have enough running room in the Bakken to be a Bakken-only company, or might you seek to expand your portfolio beyond that?

Dundas: Today we have a comprehensive multiyear plan that we think can make people a lot of money. I don’t think people are going to be talking about inventory being an issue for us. It’s 10 years-plus, and I’ll take the over on the plus. It’s very, very different at these lower growth rates. It’s an attractive place we are in right now.

We’re starting from a real position of strength and quality. The ability to manage these businesses with a less frenetic pace at these single-digit growth levels, it just helps on so many levels. So we plan to remain nimble, and we expect there will be more deal activity in the Bakken, but if we don’t do something for a while, that’s fine.

Investor: Any motivation to build scale to attract more investor interest?

Dundas: There’s no question that if Enerplus was three times Enerplus, we would open ourselves up to a broader suite of investors. But we’ve got a good suite of investors, and there’s no reason to think that our company can’t continue to rerate at our current size. We’ve transitioned our business from one that seven or eight years ago was largely retail to a pretty strong group of institutions on both sides of the border. So we’re in a good place for our shareholder base.

If we were larger, we would broaden our investor base, but I don’t think we need to do that to deliver outsized returns. In fact, if you deteriorate the quality of your business chasing scale I think you are likely to lose support. We have always felt that chasing scale for scale’s sake is reckless, so we have focused on value and quality as we are building out the company.

One of the things that is interesting right now is capital is more discerning, more disciplined and more educated. Not every single deal is being treated the same. I think there’s more sophistication coming into the market.

Investor: How did Enerplus weather the events of 2020?

Dundas: Like a lot of companies, we laid down all the equipment we could. We effectively stopped everything that we could do and fortunately were in a position to make that happen. We didn’t see a reason to spend a penny at that moment.

I’ve been in this chair since 2013 and the principles that we felt were the most important from day one were balance sheet strength, focusing on full-cycle returns, managing risk, and we’ve always had a component of returning capital to shareholders. But we didn’t think we’d see negative oil. The volatility has been more than we thought, and it tested the bounds of our downside scenarios.

The reason that we came through this, as we did in 2008 and 2014, was because we maintained a strong balance sheet. We’ve maintained low debt levels, and we’ve had a consistent approach to hedging.

One of the big things for us is to take some price risk off the table, so we’ve got a good hedge book. Last year’s cash flows were pretty crummy, but they were okay and most of them came from our hedge book. We’ve got a good hedge book this year, too, which supports our financial flexibility.

Investor: Do you have a target debt ratio?

Dundas: We do. We believe the cyclicality of our sector does not lend itself to high debt levels. As an industry, we used to talk about 2.0x debt-to-funds flow, but it feels like that is an upper limit now. For Enerplus, we have set a long-term target of less than 1.0x. We want to make sure we are in a strong position from not just a resiliency perspective, but also to be able to take advantage of opportunities when they exist.

Post the Hess deal, we did layer on a little bit of debt, but we see a rapid path to deleveraging, certainly if current prices hold. At $55, we will free cash flow more than $300 million this year.

Investor: What is your strategy around free cash flow and reinvestment?

Dundas: This is not a new thing for us. We have a long track record of generating free cash flow and returning capital to shareholders. We were the original Canadian royalty trust, which is effectively the original U.S. upstream MLP, founded back in ’86. We’ve always thought a balanced approach to growth and returning capital to shareholders made sense.

Our capital allocation framework starts with principles of the balance sheet and is designed to withstand the volatility we expect. In a $50 to $55 world, we expect to invest less than 75% of our cash flow which allows us to delever and grow our business. As we advance on our balance sheet objectives we will look for opportunities to continue to return capital to shareholders.

We’re also focused on a sustainable and resilient dividend. Over the past 20 years we’ve always had our base dividend. I think we gave people a sense of the resiliency of our business today with the 10% dividend increase we announced in May.

Investor: What is your overall plan for 2021?

Dundas: We’ve got a pretty heavy inventory of DUCs in North Dakota, so most of our capital is going to be spent on DUCs. We’re on our fourth pad now, and we’ve just reinitiated drilling activity in April.

We’ll run a rig through the end of the year to get us set up for increasing activity as we move into next year. Sometime next year we’d probably pick up a second rig as we continue to execute our development plan.

Investor: Will any of the acquired acreage get capex or rigs?

Dundas: Bruin also had a pretty good backlog of DUCs, so completion activity this year will be on legacy Enerplus and Bruin lands.

We will start drilling on the acquired Hess acreage next year. Most of the capital over the next couple years is still pure development capital, but we plan to allocate some capital to test upside opportunities. We will for sure get to the southeast Williams stuff next year. Maybe this year.

Investor: Are you a capping growth at 3% to 5% indefinitely?

Dundas: We’ve said that 3% to 5% is an outcome of this pricing environment, but I think you have to be careful with being too rigid in your formulas. It’s not quite a magic number, but it’s an important number, low growth versus higher growth.

A growing business is directionally better than one that isn’t, but you need to keep an eye on the sustainability of the business. We’re focused on delivering sustainable free cash flow growth and as part of that you need to manage your production decline rate accordingly. Too much growth puts you on a faster treadmill and can reduce maneuverability during price shocks.

But we do think growth levels for many will be capped at lower levels than we have seen over the last decade as more and more producers focus on free cash flow generation rather than top line growth.

Investor: Do you feel like the economic inventory in the Williston is thinning—or expanding?

Dundas: We’re pretty advanced on the delineation of the core of the core, but to your point, the economic core has extended through technology as well as through higher oil prices. There’s a whole bunch of Bakken you can drill at $65. It’s pretty meaningful.

Yet, our base view is that the Bakken will be managed as more of a free cash flow asset and won’t see a lot more growth. To be clear I think the Bakken will attract a lot of capital—it’s really a strong play in a decent pricing environment. I just think it will be at a more measured pace than it was a few years back.

Investor: Are you concerned that environmentalist legal efforts might shut down the Dakota Access Pipeline? How will that affect Enerplus, and what will you do if that occurs?

Dundas: Coming from Canada, we maybe have a longer history with some of this. Although in the minority, the opposition to development is vocal and they’re opposing development for a lot of reasons, many of which don’t have anything to do with Native American sovereignty. So although it’s hard to handicap what happens, we do believe the recent rulings are directionally quite positive to keep the pipeline open. We believe it would be a strange precedent to shut down a fully operational, safe and modern pipeline which had been granted all of its operating permits.

In the event we are wrong, North Dakota has built up an incredible rail infrastructure, and our view is that there will be rail capacity if DAPL were to get shut in. We think we’d need 400,000 additional barrels per day to move on rail, and we think the first 300,000 can move in the first month and all the rest gets sorted out the month after. If it happens, we will see a wider differential, but we’re not in a situation like Canada was faced with where you actually were required to shut in production for extensive periods of time.

Investor: Would it alter your longer-term development plans if it were to occur?

Dundas: No, I don’t think so. That might be a different answer if we were in a $40 to $50 environment. Today we are forecasting about a $3 differential off of WTI if it remains operational and a $7 differential if the basin needs to clear by rail. That’s $4, and that’s a lot of money, but it still wouldn’t change the economic profile of our project. We’d have less money, the state would have less money and I think it might affect the plans of some others, but I don’t think we’d stop our plans.

“A growing business is directionally better than one that isn’t, but you need to keep an eye on the sustainability of the business. … Too much growth puts you on a faster treadmill and can reduce maneuverability during price shocks.”

Investor: What is your view of how the industry should approach the call for an energy transition away from fossil fuels?

Dundas: Everything we can measure, everything that we can touch, says that demand for our products is resilient and will be needed for decades. So for us energy transition is about improving emissions performance. There’s no question there is a focus on this but, in my opinion, the reality will not be a complete shift away from fossil fuels because I do not think that people and governments will truly be willing to bear the cost.

And even if support could be found financially, I also think the reality of the scale of the change is completely misunderstood. Everything we can see says there’s an incredible need for these products, and nothing’s going to get in the way of that anytime soon. But you can’t ignore the push because I think the push for better products with an improved emission profile will continue to build. And so as an oil and gas industry, we should be aggressively pushing toward continuous improvement.

I think this concept of license-to-operate could actually become easier as companies continue to demonstrate better performance. Five years ago when you flew over North Dakota at night it was embarrassing. Too many flares. People were moving too quickly and we were being wasteful. But it’s much, much better today, and I think five years from now it’ll be much, much better still. Companies are going to be held accountable for their environmental performance and if they’re successful at improving they’re going to make more money doing so.

I look at North American oil and gas companies and the role they can play in this move to a less carbon intensive economy, and I think we should position ourselves to be the preferred supplier of the last molecule of oil and gas ever produced. And that’s going to go on for a long, long time. And there’s absolutely nothing wrong with that whatsoever. We should embrace that. Our mission should be to be the preferred global supplier of responsibly produced oil and gas.

Recommended Reading

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.