Presented by:

[Editor's note: A version of this story appears in the April 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

Glenn Hart’s new natural gas wells in Webb County in South Texas are a few miles from the Dolores/Columbia border crossing that seems to be a bridge to nowhere. But in 1992, it had its reasons for being northwest of Laredo: It’s the Mexican state of Nuevo Leon’s only border crossing. The state’s border with Texas is only about 9 miles long, while Mexico’s five other border states share the other 1,950 miles.

The president and CEO of Rio Grande Exploration & Production LLC, Hart is informally known among business neighbors and associates as the mayor of South Texas, having four decades of working the many formations from conventional to today’s unconventional.

One of his neighbors these days is EOG Resources Inc., which is making a play of the Eagle Ford Shale and Austin Chalk’s natural gas fairway in Hart’s Webb County that is the home of the Laredo/Nuevo Laredo border crossing.

The Eagle Ford’s far southwestern dry gas fairway hadn’t been tapped much in the play’s 13 years relative to the oil fairway that includes Karnes County. The former Petrohawk Energy Corp. announced discoveries in McMullen and La Salle counties north of Webb in October 2008 in the oil and wet gas/condensate window. When announced, more natural gas wasn’t the news investors wanted to hear. Financial markets were in disarray and oil and gas prices had plummeted. Meanwhile, the Barnett and Fayetteville shales were topping their own record outputs month after month and the Marcellus and Haynesville shales had been announced in the 12 months prior.

“More natural gas” played like an earworm of, well, insert the worst earworm ever here.

‘It’s our turn’

Hart started his newest South Texas company in 2017 with backing of Intrepid Investment Management LLC. Now that EOG has joined in Webb County—and Mexico’s natural gas-short profile continues to grow—Hart is gaining neighbors in the Eagle Ford’s southside.

Hart made three wells from one pad just northwest of Laredo, surfacing 100% dry gas and keeping the choke tight. “One of our lessons learned has been to not pull wells too hard,” he said. “So we have opted for longevity and ultimate recovery rather than headline IPs.”

The first well had a 12 million cubic feet per day (MMcf/d) initial rate. “We waited almost a full year and drilled a second and third [in 2021]. They were both better than the first one,” Hart said. The initial rate on each was 14 MMcf/d and pressure was higher. “So we’ve got three really good ones.”

The EUR for each is 14 Bcf. Laterals are between 7,000 ft and 8,000 ft.

Rio Grande E&P was planning two more wells at press time. That includes a first Chalk well, which EOG’s report on its Dorado play shows to be even more productive than the Eagle Ford in the area.

“I’ve been telling people ‘It’s our turn,’” Hart said of natural gas. “We’re the guys that will be providing the electricity in the absence of all the other sources.

“I think the investing public is starting to catch on that that’s how it’s going to be. Natural gas for producing electricity is going to be the future for a while. It’s cleaner and cheaper.”

‘Just crazy’

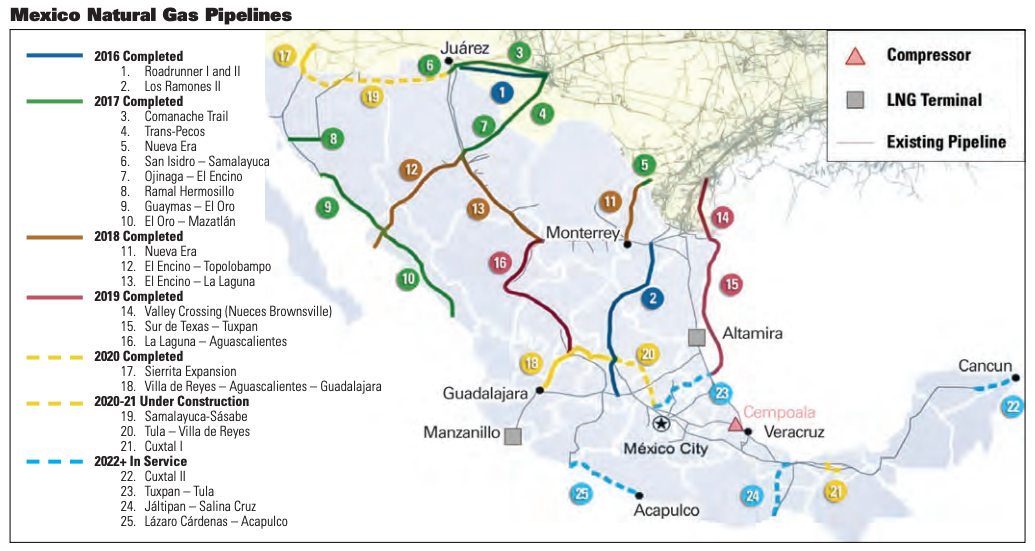

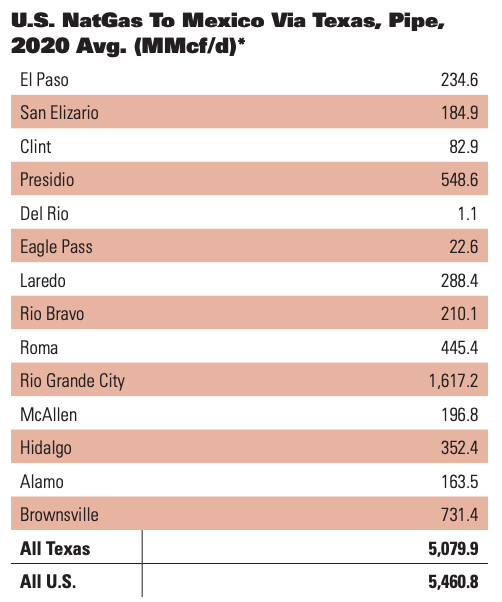

U.S. natural gas exports to Mexico grew in 2020 to close the year at 6.3 Bcf/d, after a 5.2 Bcf/d start. Ten years ago, they were 1.2 Bcf/d. Of current exports south, about 88% comes from pipeline connections at the Texas border, according to the Energy Information Administration (EIA).

As Mexico continues to build out big-pipe infrastructure within its borders, more demand from Texas is expected, Katie Dyl, EIA lead natural gas modeler, wrote in a Wahalajara (Waha hub in West Texas to Guadalajara, Mexico) system report in July.

The 190-mile Nuevo Era pipeline is a straight line from northwest of Laredo to Monterrey, Mexico. On the U.S. side, it begins in the midst of Hart’s leasehold in the area of Texas Highway 255.

Hart said, “I think there’s a lack of knowledge among Americans that there are so many factories and products that are manufactured in Mexico.”

Sidebar:

EOG’S WEBB COUNTY PLAY

EOG Resources Inc. announced this past fall its Dorado play in the gas window of the Eagle Ford Shale and Austin Chalk Formation in Webb County, citing economics of between $1.22 and $1.24 per Mcf.

It had 17 wells—12, Eagle Ford; five, Chalk—by then, estimating 1,250 high-graded, net well locations (530, Chalk; 720, Eagle Ford) on its 163,000 net acres that might hold 21 Tcf. Proximity to international markets, besides via pipe to Mexico, includes two LNG plants—at Corpus Christi and Freeport.

The Chalk wells have an EUR of 22 Bcf gross; Eagle Ford, 19 Bcf gross. Cost is between $6.5- and $7 million per 9,000-ft lateral. Combined thickness is 700 ft—400 ft of Chalk and 300 of underlying Eagle Ford.

As the southern, gassy window of the Eagle Ford is downdip and up to 14,000 ft below the surface, drilling to depth then out is about 4 miles, Bob Brackett, an analyst for Bernstein Research, pointed out in an EOG earnings call.

In their first 12 months online, the Chalk wells produced an average of 3.5 Bcf each from an average of 6,600 lateral ft per well. The Eagle Ford wells produced an average of 2.8 Bcf each in their first year online from an average of 7,700 lateral ft.

All 17 of the initial wells in the play were completed in 2019, according to Ken Boedeker, EOG executive vice president, E&P. EOG plans to bring 15 net new wells online this year, all Chalk, he added.

Leo Mariani, an analyst with KeyBanc Capital Markets Inc., asked in the call about why the push for gas. Bill Thomas, EOG chairman and CEO, said the play has leading economics but also “gas has got a prominent future in the future energy supply. There’s no doubt about that.”

Rod Lewis, also an informal mayor of South Texas and a frequent flyer, hadn’t pulled a permit to drill in Webb County since September 2019. A pilot of both rotorcraft and fixed-wing, Lewis’ headquarters are at the San Antonio airport.

He would buzz Petrohawk’s Eagle Ford discovery wells in McMullen and La Salle counties back in 2008 while they were being drilled and completed, inspecting the amount of pipe out there, thus depth, and also taking notice of the large frac spread.

Lewis pulled 30 new drilling permits in Webb County beginning this past September through January, including in EOG’s area, on Briscoe property, not naming a field thus likely a wildcat.

Mexico’s deregulation of some of its energy market beginning in the past decade “lowered the cost of consuming electricity and made that [manufacturing] sector boom even more. And it’s all fueled by natural gas.”

Before deregulation, natural gas was purchased in Mexico from the national oil and gas company and cost up to $14/Mcf, while it could “be bought from us [in Texas] at $3, $4, $5.”

Many years ago, Hart met with a group of businessmen who were large energy consumers in Mexico. “They were connected enough and wealthy enough to say, ‘We’re mad as hell, and we’re not going to take it anymore.’

“They were paying $12 and $14 an Mcf for their factories there, which is just crazy. Once Mexico deregulated the natural gas situation, even a little company like us can sell gas directly now to a General Motors plant in Monterrey. That was unheard of 10 years ago.”

Suspending wind, solar

Mexico’s new president’s position on wind and solar are also a boon to natural gas demand from Texas. In May, Mexico’s energy ministry directed the power operator, Cenace, to prioritize new generating capacity that is reliable rather than intermittent—that is, not wind and solar.

The country’s grid has 99% coverage and 80,000 megawatts of generating capacity with 12% of that generated from wind and solar, 16% from hydro.

“As a result, in managing the grid, Cenace may give preference to the state-owned utility’s on-demand fuel oil- and natural gas-fired plants over more cost-efficient, but intermittent, privately owned solar and wind power generators,” law firm Kirkland & Ellis LLP reported to clients after the news in May.

The head of Mexico’s National Commission for Regulatory Improvement quit, announcing it in a tweet. Kirkland & Ellis wrote, “Private solar and wind power projects now account for most of the new capacity on the Mexican grid. Approximately 10.74 gigawatts of capacity added to the national grid in 2019 was from solar and wind projects.”

Of the 63 solar farms in Mexico by last May, 24 were turned online in the prior year, “while the contribution of wind power generation to the national grid grew 34% in the same period,” the firm reported.

Another 44 renewables projects were to be turned online in the full-year 2020 and during this year, “representing investments of $6.4 billion.”

Gas-fired power generation

Rodrigo Rosas, a senior research analyst for Wood Mackenzie, told Investor that more natural gas-fueled power generation plants are coming online, such as an 875-megawatt facility in Guadalajara that began operating in October upon connection to the Wahalajara system.

This and next year, a combined 2.2 gigawatts of new gas-fired plants are expected, he said. Prior to adding gas-fired plants and laying the pipe, Mexico’s power generation relied largely on oil in addition to ongoing hydro and geothermal.

Mexico has three LNG-import plants—at Costa Azul and Manzanillo on the Pacific Coast and at Altamira on the Gulf Coast. The Costa Azul facility is planned for conversion to export, Rosas said.

Meanwhile, Altamira near Tampico was displaced by the 2019 opening of the Sur de Texas-Tuxpan pipeline that begins near Corpus Christi, Texas. “Last year, Altamira received only one cargo,” Rosas said. “So it went from 1.8 million tonnes per annum to barely 70,000 tonnes. It is a massive drop.”

Manzanillo’s fate was met with the Wahalajara system leg to Guadalajara coming online in 2020. “Cargos at Manzanillo started to drop,” Rosas said. “Mexico canceled three tankers at the start of the year, so displacement is happening now.”

The pipeline from Manzanillo to Guadalajara has been converted to bidirectional, using tanks at the LNG plant as storage facilities for use in seasonal swings. “Mexico doesn’t have a storage infrastructure in place,” Rosas said.

“So they required LNG to work as a balance mechanism whenever there’s a [gas-supply] issue happening in the main pipeline grid.”

LNG import plants in the U.S. and Mexico that were built in the first decade of this century made sense at the time—before the shale gas boom. The Pacific Coast terminals, in particular, compete with Asia for cargoes, though. And shipments from the Gulf have to traverse the Panama Canal to get there.

Rosas said plans for Manzanillo had been for gas from Peru. But project completion was delayed and, then, Mexico’s administration at the time began to deregulate the country’s gas market.

Sidebar:

TEXAS NATGAS SPACE RACE

On the Gulf Coast at the Texas-Mexico border, Tesla Inc. founder Elon Musk’s SpaceX Texas port is planning to use methane from local natural gas wells that the company plans to drill itself through a subsidiary, according to myriad news reports.

An initial Starship rocket, SN9, was launched in a test in February and crashed upon landing at the Boca Chica Beach pad. A second rocket, SN10, was launched in early March. It returned to the pad but exploded about eight minutes later.

Meanwhile, Amazon.com Inc. founder Jeff Bezos’ family ranch property near Cotulla, Texas, is in the middle of the Eagle Ford Shale fairway in La Salle County and roughly equidistant along I-35 between San Antonio and Laredo.

Bezos’ Blue Origin LLC spaceport north of Van Horn, Texas, in Culberson County is in the midst of the Delaware Basin. Its BE-3 and BE-7 rockets are fueled with liquid hydrogen and liquid oxygen; its BE-4 rocket uses liquid oxygen and liquid methane. It’s using local natural gas to manufacture the liquid hydrogen.

For SpaceX, the thinking is that methane could be manufactured on Mars for refueling ships for return flights to Earth; thus, its fuel of choice is methane, according to an IEEE Spectrum report.

For Blue Origin, its fuel choice is simply due to that it’s readily available and cheaper than kerosene of sufficient quality. Also, Blue Origin’s current plan is pleasure cruises to space on one tank.

According to a SpaceX filing with the FAA, the Texas facility “will be supplied by at least five nearby gas wells, along with two gas-fired power plants,” Bloomberg reported.

The rocket company estimates about a half Bcf is needed to fuel 10 launches a year. A subsidiary, Lone Star Mineral Development, bought mineral rights in the Boca Chica area and an 806-acre lease, Bloomberg added.

SpaceX Texas bought two offshore rigs from Valaris Plc last year, according to the report, adding that “they’ll likely be used as landing pads for SpaceX’s reusable rockets, FAA records show.”

Then Texas cut off the gas

During the near nationwide freeze in mid-February U.S. gas demand set a new record of 152 Bcf/d, according to a Simmons Energy report. The EIA reported Feb. 25 that the prior-week draw from storage was 338 Bcf. It was the second-largest one-week draw in U.S. gas-storage history, according to Tudor, Pickering, Holt & Co. Inc. analysts.

The figure excludes some of what would have been Texas’ demand had the power been on. In the midst of rolling blackouts that turned into just blackouts, Texas Gov. Greg Abbott ordered Texas gas exporters to suspend exports, including to Mexico, until Feb. 21.

Some 5 million natural gas consumers in Mexico had already lost service due to frozen pipeline infrastructure, according to The New York Times.

Reuters reported an estimated $2.7 billion in business losses, including production halts at a General Motors plant and at Volkswagen’s Mexico operations.

Mexico’s demand; U.S. supply

Under the current outlook, “Mexico will continue to pull [non-indigenously sourced] gas primarily from West and South Texas,” Rosas said. And imports via pipeline, which already represented 66% of Mexico’s total gas supply in 2020 “play a crucial role to supply the market.”

At 40% of exports, Mexico is the largest buyer of U.S. natural gas, according to the EIA, and 54% of Mexico’s consumption is industrial, while 46% is power generation. The country’s demand fell to 7.5 Bcf/d in May, but began growing to new records during the second half.

Some of the second-half 2020 growth in U.S. exports south is from the completion of the southernmost segment—the Villa de Reyes-Aguascalientes-Guadalajara— of the Wahalajara pipe system, adding 0.9 Bcf/d, according to Victoria Zaretskaya, EIA lead operations research manager, in an October report.

(Source: Oil and Gas Investor, using EIA data for January-November 2020 averaged by 334 days.)

Completion had been delayed by Mexico’s new president who wanted contracts renegotiated. Mexico-based Fermaca, the Wahalajara system’s owner, was the last holdout, according to Reuters. Other pipeline operators, including Carlos Slim’s Grupo Carso, had come to new terms earlier.

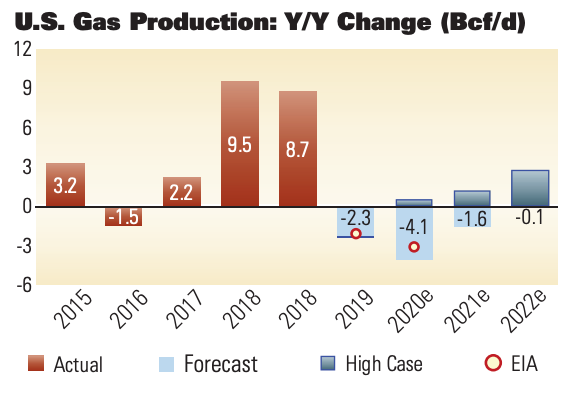

Meanwhile, Nitin Kumar, a securities analyst for Wells Fargo Securities LLC, wrote in early February that U.S. gas supply is declining and this will continue into, at least, 2023.

“A key component of our view is the lack of incremental bank and private debt capital for private operators to grow volumes,” he wrote.

The EIA projects natural gas demand for industrial use and for exports into 2050 to grow—about 6 Bcf/d more for exports and about 3.6 Bcf/d more for industrial—while demand for power generation, residential, commercial and transportation will be mostly flat.

U.S. gas production was about 90 Bcf/d in early February (before winter storms Uri and Viola), down from more than 93 Bcf/d a year earlier, according to J.P. Morgan Securities LLC. Meanwhile, demand was up about 8.7 Bcf/d from a year earlier.

LNG exports were about 11 Bcf/d. The 2019 average had been 3.6 Bcf/d. Pipe exports to Mexico were 6.4 Bcf/d in January, up from 5.3 Bcf/d a year earlier.

J.P. Morgan analyst Arun Jayaram doesn’t expect a “Biden effect” on LNG expansion. “If Biden attempts to slow down new approvals of LNG export facilities, it will likely do little to slow development as some 26 Bcf/d of greenfield projects/expansions are currently fully permitted.”

Recommended Reading

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

Enbridge Sells Off NGL Pipeline, Assets to Pembina for $2.9B

2024-04-01 - With its deal to buy Enbridge’s NGL assets closed, Canada's Pembina Pipeline raised EBITDA guidance for 2024.

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Post $7.1B Crestwood Deal, Energy Transfer ‘Ready to Roll’ on M&A—CEO

2024-02-15 - Energy Transfer co-CEO Tom Long said the company is continuing to evaluate deal opportunities following the acquisitions of Lotus and Crestwood Equity Partners in 2023.