Presented by:

[Editor's note: A version of this story appears in the March 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

“How’s it going?” the Dallas Fed asked E&P executives in December 2020. They had a lot to say. It’s a reminder of what Mom always said: “Never ask a lady how she’s doing when she’s short GameStop at $4.”

One producer replied, “Drillers insisting on bringing rigs back and additional production online will continue to destroy investor dollars.”

Comments included “survive” and “zombification of companies.” One wrote that the reserve-based loan “used to be a valuable industry tool until the financial markets all went berserk and gaga over all things and everything Permian or shale.”

Money for other basins “and especially for conventional development was just eliminated from the conversation,” an executive said. Other independents, “unless you already had assets or flocked to play the shale world, were and are left out.”

The participants were optimistic about 2021 oil and natural gas prices, expecting more than $45 and $2.40, but mostly weren’t expecting to increase capex this year. Instead, their animal spirits are wilding for market share. Their new friend: President Joe Biden.

A producer wrote that restrictions on new drilling—and while capital is leaving for the energy transition space—should rein in fellow operators’ spending, thus rein in new oil supply, thus make for better oil prices.

He wrote, “While the Trump administration gave a big shot in the arm to the industry regarding access and easing up on restrictions, I think the Biden administration will actually help increase commodity prices by reversing that trend.”

But another wrote that, while new regulation will reduce oil and gas supply, President Trump’s policies would have increased demand. “China will take over again when Biden gets into the White House,” he concluded.

‘Creative’

Entering 2021, the federal funds rate was between zero and 0.25%, to which it had been slashed in the spring of 2020. Money’s practically free again and one oil and gas financier told Investor he’s seeing high-yield reentering the upstream. Several producers told the Dallas Fed they’re afraid of the crazy money coming back.

“I am too,” the financier told Investor. “Our industry has the habit of overspending and then volumes grow. I can see that cycle happening again. It starts with the high-yield market.”

A producer told the Dallas Fed in December the 0% interest “is not creating a healthy industry; it merely means that big financial providers and huge corporations can play games with free money. … I have no desire to just churn 0% interest loans ….

“‘No-cost money’ simply enables publicly traded companies to appear successful to investors when, in reality, they churn money for management and financial groups and leave stockholders short of any real returns.”

Another reported that a zero-interest policy after 2008 drove institutional investors to oil and gas “to park capital in ‘creative’ ways, which led to a massive bubble in private equity capital.” Now banks are holding onto bad loans, as their losses will be 80% or more at bankruptcy auction, but what they do get can only be loaned to new customers at 3% or 4%.

“What banker is in a hurry to make that decision?” the producer wrote. “This zombification of companies ensures that capital is not being directed to its highest and best use.”

Consolidation

The Dallas Fed’s district is Texas, northern Louisiana and southern New Mexico. It surveyed 146 energy firm executives—97 E&P firms and 49 oilfield services (OFS) firms—in early December for its quarterly report.

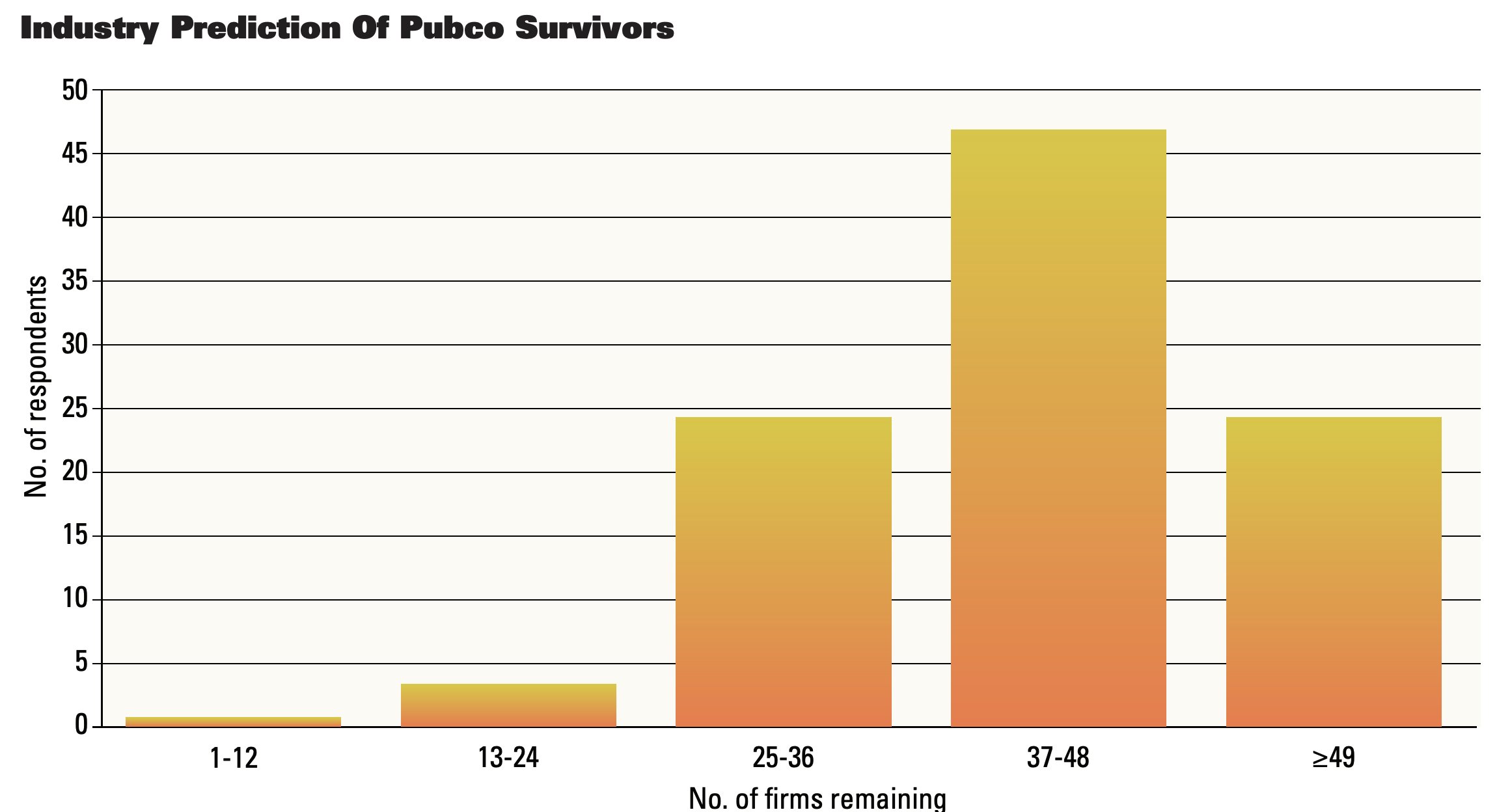

How many of the roughly 60 public E&Ps would be left by the end of 2022? About half of the 115 executives answering this one estimated between three and four dozen. About 25% estimated more than 48; about 25% said between two and three dozen. (One of the 115 forecast a dozen at most.)

Top 15 M&A Deals of 2020 |

||||

| Buyer | Seller | Value ($MM) | $/boe/d | Comments |

| ConocoPhillips Co. | Concho Resources Inc. | $13,337 | $23,698 | MORE |

| Chevron Corp. | Noble Energy Inc. | $13,000 | $28,454 | MORE |

| Pioneer Natural Resources Co. | Parsley Energy Inc. | $7,621 | $23,657 | MORE |

| Devon Energy Corp. | WPX Energy Inc. | $5,631 | $24,705 | MORE |

| Diamondback Energy Inc. | QEP Resources Inc. | $2,155 | $23,963 | MORE |

| Southwestern Energy Co. | Montage Resources Corp. | $874 | $9,505 | MORE |

| Diamondback Energy Inc. | Guidon Operating LLC | $862 | $24,442 | MORE |

| Pure Acquisition Corp. | HighPeak Energy Holdings | $845 | $27,900 | MORE |

| EQT Corp. | Chevron Corp. | $735 | $8,467 | MORE |

| National Fuel Gas Co. | Royal Dutch Shell Plc | $541 | $7,500 | MORE |

| BHP Group Ltd. | Hess Corp. | $505 | $45,909 | MORE |

| San Juan Offshore LLC | Arena Energy LP | $466 | $12,588 | MORE |

| Sixth Street Partners LLC | Antero Resources Corp. | $402 | -- | MORE |

| Bonanza Creek Energy Inc. | HighPoint Resources Corp. | $376 | $12,163 | MORE |

| Castleton Resources LLC | Range Resources Corp. | $245 | $9,188 | MORE |

Susan Cunningham, an industry consultant who retired from Noble Energy Inc. in 2017 as an executive vice president, expects a third will remain eventually. Many publicly held E&Ps are good companies, “but most are mediocre,” she said. “And those are the ones that are not likely to be around. My hunch says it probably needs to be smaller than 50%.”

Using the 80:20 rule, 20% of E&Ps are extremely good and “20% are really bad, and then all the rest are just kind of muddling around in the middle,” Cunningham said. “That to me says, although 20% should survive, I expect it will be higher as there’s always a bit of ranking within the rest.”

Eventually, “maybe 30% in the end [will be left], but I’m including PE-backed companies in that,” Cunningham said.

Welles Fitzpatrick, a career E&P securities analyst who is now CIO for minerals fund Triple Point Capital, expects more than 40 of the roughly 60 public E&Ps will exist at the start of 2023.

“I mean, $50 per barrel is a real lifeline,” he said in late January. Strip improved 25% in just five weeks approaching year-end 2020.

“Between $50 and these emergences from bankruptcy, I think the operator attrition is going to be less than folks anticipate,” he added.

Fitzpatrick expects more attrition if given more time.

“I mean, what do you need to get the operator losses without replacements to reverse? You basically need a new cycle of early-stage investment,” he said, “which means you need a new cycle of private equity money to come in. That’s going to take both time and pricing.”

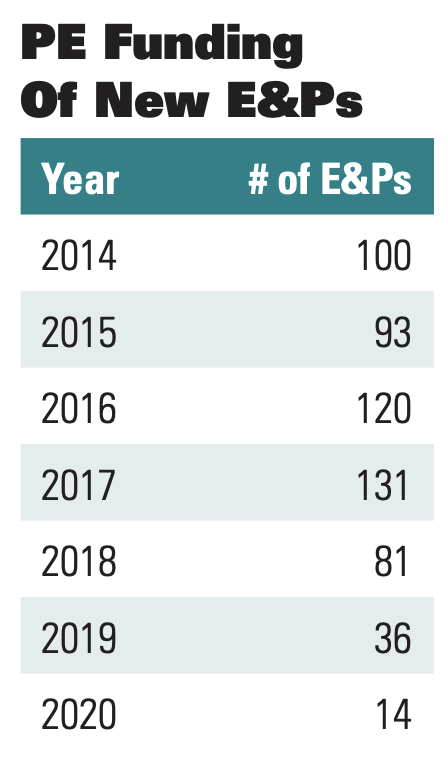

In 2014 and 2015, private equity firms were funding two new E&Ps per week; that grew in 2016 and 2017 to about 2.5 per week.

“That’s closer to one a month now,” Fitzpatrick said.

If private equity isn’t starting many new

E&Ps, where do the serial-startup executives go?

“I think it’s going to be tough to get funded in oil and gas,” he said. “There’s going to be a lot of unfortunate fire sales.”

For now, the A&D market “is still around multiyear lows, so you have to get creative or you’re going to be on the block.”

There are more than 150 privately held E&Ps in the Permian Basin alone, according to a J.P. Morgan Securities LLC count.

SIDE BAR:

THE FUTURE OF PROBABLES

If money isn’t funding the finding of new probables and possibles, what’s the future of exploration?

“From a U.S.-centric perspective, I would agree with that. But not globally,” said Susan Cunningham, a geologist who retired from Noble Energy Inc. in 2017 as executive vice president.

There are people who know how to explore in the conventional and unconventional fields, and they’re going to be around.

“We’re not going to lose that quickly. It doesn’t just disappear,” she said. “However, it may take a while to get back; it will get dusty, so to speak, if people are out of it.”

But the number of people who will know in the future how to explore, “I do think it’s an issue,” she continued. “That will decrease with time [as there are] fewer people actively in it. And then people go on to other things because they need to.”

The tack du jour is to make a business of energy transition. That’s fine, Cunningham said; cleaner air is good, of course. “I think our industry has felt frightened by the [decarbonization trend] for all the obvious reasons,” she said.

But the idea of educating the public about the benefits of oil and gas? Well, “that train has left the station whether we like it or not,” Cunningham said.

Cunningham is among those who have seen firsthand in geologic logs and cores how Earth’s climate has changed many times before mankind existed and has been on a warming trend since the last Ice Age.

“The climate will still change as it always has,” she said. “We will never control the climate. There’s this popular belief that we actually can control the climate, which history tells us as geologists is just not true. We will never be able to make it stable. Nothing stays the same and that is also true of climate. That’s hubris.” But the industry does care about the environment and climate, she added.

“We didn’t know when we started all of this the impact our products could have on the environment,” Cunningham said. “There are very good impacts, and there are concerning impacts. We need to own that.

“But we aren’t bad people. Speaking for myself, I loved the idea of improving the quality of life and increasing life spans, enabling amazing technologies and products that make a really positive difference to people.”

Yet, she concluded, “If everybody just left this industry, the world would be in a world of hurt. I may be a bit Pollyanna, but I do wish we could listen and work together more. Demonizing creates defensiveness. That does not benefit progress.”

Subash Chandra, E&P equity analyst with Northland Securities Inc., said they’re trying to get a better price. The largest E&Ps aren’t interested in small deals, “but smaller companies are—or should be, if they can do an accretive deal,” Chandra said.

Currently, buyers aren’t paying for probable reserves; they’re paying for proved developed producing (PDP) reserves only. Private equity-backed startups’ model had been to create PUDs by drilling some PDP.

“They obviously did not invest to be sold on PDP value only,” Chandra said. “The probable valuations—that’s where the big money was made. Those days are long gone.”

On the other hand, taking equity in a small company combination might be more powerful than selling to a large E&P.

“The smaller company’s equity goes up quite a bit because they can probably create more value from consolidation than a big company,” he said.

The eventual exit value “might be some sort of happy ending to the story,” Chandra added. “It’s nowhere close to perhaps what they envisioned when they put the first dollar in. But it creates opportunity for them as an exit strategy. And a SMID [small and mid] cap publicly traded E&P’s equity may respond very nicely to a deal.”

A breakthrough

An executive with a small independent told the Dallas Fed that he’s been able to do three deals, albeit with “reluctant and/or difficult partners.”

Among the handful struck in 2020 by any E&P was EnCap Investments LP-backed, publicly held Earthstone Energy Inc. buying Warburg Pincus LLC-backed, privately held, Permian-focused Independence Resources Management LLC.

The equity response by January-end was remarkable. Earthstone’s stock price improved 29% from $3.99 at market close Dec. 16 (when the deal terms were priced) to $5.14 at close Jan. 29.

In the same time frame, strip had grown but less—8.7%. As for E&P equities in general, XOP was trailing the improvement in strip, growing 6.5%.

Paying in part with about 12.7 million shares, the equity portion’s value grew from $50.8 million to $65.3 million. The balance of the deal price was paid with $131.2 million from cash on hand and a $120 million increase in Earthstone’s bank facility.

The stock issuance improved the public float, noted Neal Dingmann, E&P analyst with Truist Securities Inc. EnCap and two other 5%-plus shareholders had held 36.8% of Class A; EnCap held 96% of Class B. EnCap’s combined holding was 61% of the company. Post-closing, EnCap’s holding is about 50%.

During Hart Energy’s DUG Permian virtual conference in September, months before the Independence deal announcement, Earthstone president and CEO Robert Anderson said the industry needs consolidation.

“When private equity decides to exit for whatever reason, that will create opportunities,” he said.

The ongoing impasse of buyer/seller expectations, “makes it very difficult to get deals done,” he added. “But we’re persevering and persistent every day, talking to folks about opportunities and using Earthstone as a consolidating vehicle, given we have some great metrics and shine well when it comes to the cost structure of the business.”

Dingmann wrote after the Independence news, “Not only should the deal be immediately accretive, it adds needed scale to the micro-cap [Earthstone].”

It lowered G&A 25% per boe/d. The price paid per core acre was $2,102; the average paid for Independence’s total 38,500 net acres (100% operated; 100% HBP) was $237. Dingmann wrote, “The new Midland Basin acres appear highly complementary to the company’s existing position, and the deal adds some 50% more acreage versus what Earthstone currently holds.”

The price per flowing boe/d was about $20,000. Post-closing, Earthstone’s net debt to EBITDAX is 1.1. It had been 0.8 pre-deal, Dingmann wrote.

RELATED:

Oil and Gas Investor Executive Q&A: Earthstone on the Rise

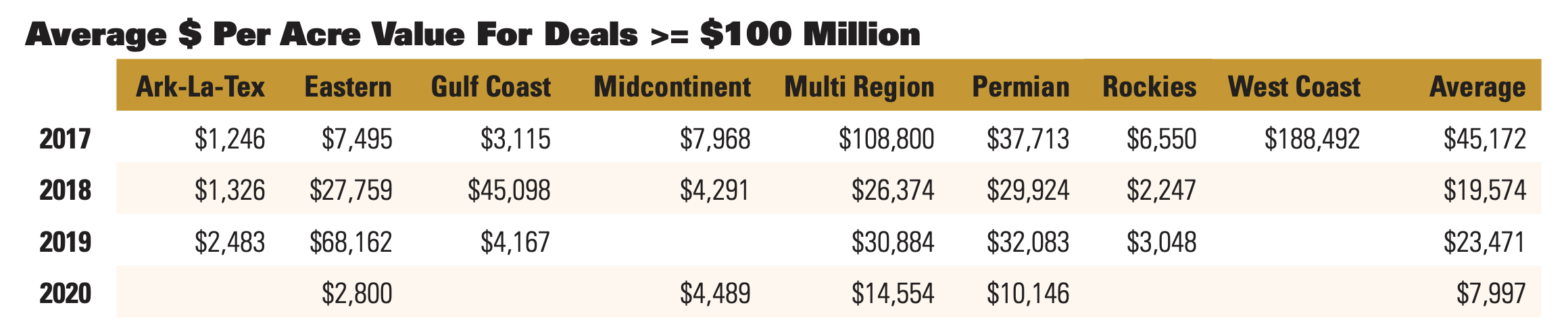

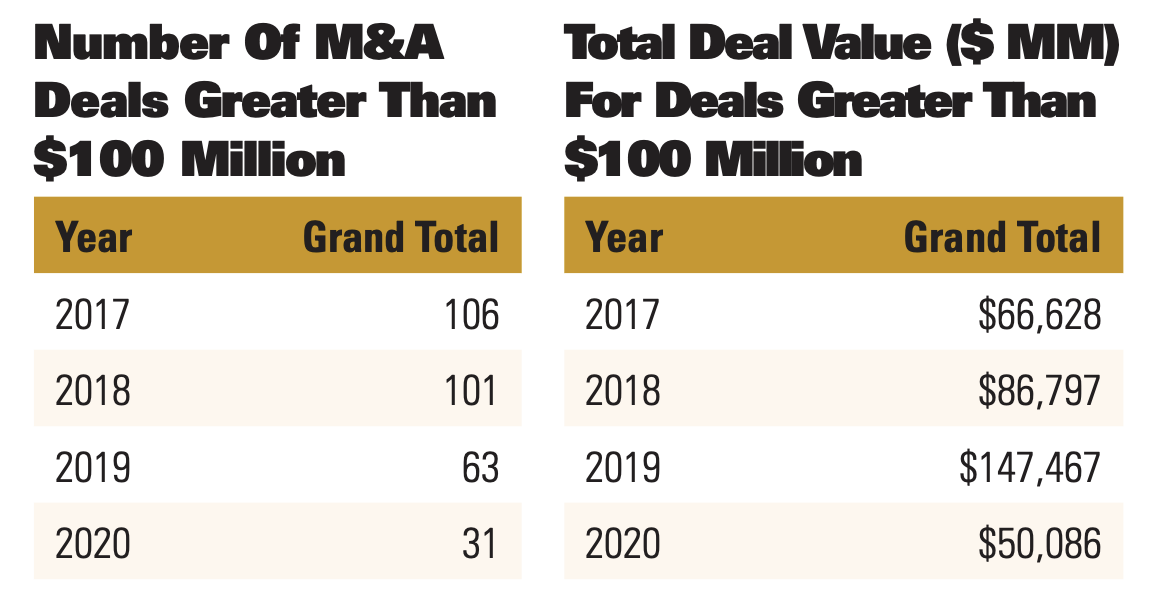

Looking at year-end 2020 transactions of $100 million or more, Arun Jayaram, an E&P analyst with J.P. Morgan, found an average of $8,000 paid per acre, down from $23,000 in 2019 and $45,000 in 2017.

“The lack of M&A activity, despite depressed valuations, clearly shows the declining investor appetite for the sector, which now comprises only about 2.3% of the S&P 500,” Jayaram wrote. But he expects a breakthrough this year with a hefty push by investors.

“Specifically, we think M&A could become easier to accomplish among SMID cap E&Ps as the group continues to clean up their balance sheets,” he said.

And privately held E&Ps? Jayaram wrote that, based on what operators are telling him about the more than 150 in just the Permian Basin, “[we] have a suspicion that the M&A theme in 2021 will not only include public company consolidation but public/private combinations.”

Northland’s Chandra told Investor that private equity will eventually need to resolve their investments; funds do expire.

“As we go forward, you might see the ice begin to thaw in the type of transactions they might be willing to do,” Chandra said.

Exit to what?

Cunningham said privately held E&Ps will find a way.

“There was so much capital availability in terms of an increasing number of PE-backed companies,” she said. “I think most of those are going to go away.” She added that PE-backed shops tend to be very disciplined and profit-driven, and “many will figure out a way to make money.”

Where do the serial-startup executives go from here?

“First of all, I don’t think it’s over,” Cunningham said. The money will look for a new thesis and back those that “don’t have a bunch of baggage.”

The obvious next E&P venture is in consolidating companies and discarded as well as post-bankruptcy assets. “That’s just all about buying those assets at rock-bottom prices,” Cunningham said. And the money’s “going to be quite picky about which assets. I don’t think it’s [over] in terms of PE [-backed E&Ps], but the bloom on the rose is definitely diminished.”

She said rolling up discarded assets from bankruptcy is just one thesis, and the money’s always “very good at coming up with other theses.”

Jeff Bartlett, a founder of Pontem Energy Capital Management LLC, hopes to be among those buyers at some point. Bartlett was previously with Apollo Global Management LLC and Guggenheim Partners. A Pontem co-founder is Skye Callantine, who built and sold Felix Energy LLC and Felix II. Both are owned now by Devon Energy Corp. The third member of the founding triumvirate is Cameron Brown, a former EnCap team member who has worked at Citadel LLC and Lazard Ltd. as well.

Each of the three founders began their careers in the oil and gas field as engineering graduates.

“Every one of Pontem’s team members has a technical background and worked in the industry,” Bartlett said. “We’re people with large-scale operating expertise and actual track records.”

If E&Ps aren’t creating new reserves right now, is the industry just moving sideways? Adrian Goodisman, a longtime upstream M&A adviser formerly with Moelis & Co. and Scotiabank, said several overleveraged E&Ps are struggling to create value for their shareholders. There’s consolidation, and then there’s good consolidation.

Source: Federal Reserve Bank of Dallas

“For example, say you have two companies with assets in the same area and they are headquartered in the same city; most likely you’re going to get operational and G&A savings there,” Goodisman said. “However, if the two companies have assets in different basins and are headquartered in different cities, a successful consolidation may be harder to achieve.”

In a good consolidation, “you’re getting bigger. Bigger is typically better, such as having leverage over vendors for better pricing,” he continued. “So you’re creating value for shareholders.”

Some private E&Ps that are ready to sell are sitting in core leasehold in the middle of large caps. Their assets are identical to their neighbors’ sections, but no one is buying them. Why not?

“Value expectations,” Goodisman said. “There’s probably a price that their neighbor will trade at, but the sellers don’t want to sell at that price. They don’t believe they’re getting full value if they’re only being offered PDP value. If the seller has the luxury of time, you wait for the environment to improve.”

Of the roughly 60 public E&Ps, Goodisman estimates at least 48 remain by year-end 2022, “just because consolidation takes time and value expectations between buyers and sellers are hard to agree on.”

What about by the end of 2025 then? There will be fewer, Goodisman said.

“There will still be consolidation going on for sure, and some companies will be pivoting away from upstream into the renewable space,” he said.

Energy transition land rush

Independents may change their business models from 100% upstream, take advantage of their public company currency “and may pivot to wind or solar,” Goodisman said. “People will nod their heads because that’s the flavor right now.” They may see a favorable response in their stock prices by doing that—because the world is pivoting. “With Biden in power, we’re going down a different path in terms of energy,” he said.

Meanwhile, upstream, “there’s very limited new money coming in,” Goodisman continued. “The capital sources have been burned over the years. So the old game of raising money to drill up shale acreage or even the buy-and exploit strategy—I wouldn’t say it’s done, but it’s very tough because a lot of private equity providers themselves are pivoting away from pure upstream as well.”

He said they are looking to invest in renewables and other parts of the energy value chain.

Northland’s Chandra said, “Some may want to stay and monitor the [E&P] investment; some may want to launch investments in clean tech and other things we’ve seen, such as electric cars.”

Rather than reenter E&P, RSP Permian Inc. (sold to Concho Resources Inc.) founders formed a SPAC, Switchback Energy Acquisition Corp., sponsored by NGP Energy Capital Management LLC, and bought an electric vehicle charging company called ChargePoint Inc.

Covey Park Energy LLC (sold to Comstock Resources Inc.) co-founder Alan Levande is chairman and CEO of Peridot Acquisition Corp., which is to invest in decarbonization, backed by Carnelian Energy Capital Management LP. The Rice brothers are sponsoring Rice Acquisition Corp.; the Cohen family, Broadscale Acquisition Corp.

Ex-Chesapeake Energy Corp. executive John Stice is on the board of Apollo-sponsored Spartan Acquisition Corp. III.

Park Shaper, the former president of Kinder Morgan Inc., is on the board of two Star Peak decarbonization SPACs sponsored by Magnetar Capital LLC.

Source: Federal Reserve Bank of Dallas

By early February, Investor’s count was of 16 SPACs with energy transition plans that have a direct tie to traditional oil and gas management and/or private equity. Raised and to be raised totaled more than $4 billion.

The producer who told the Dallas Fed he was concerned about cheap money flooding E&P again added, “We are seeing the cycle repeat in renewables now.”

His count by mid-December 2020 was of 40 decarbonization SPACs filed altogether and $11 billion raised already.

“These policies are leading us down a path of economic destruction in almost every industry, and we may look like Japan in no time,” he wrote.

As part of the 2015 bill that lifted the U.S. oil export ban, wind and solar tax credits were extended. In December, as part of the budget and stimulus package, they were extended again.

“We are beginning to make investments in the energy transition space,” an OFS executive told the Dallas Fed.

A longtime oil and gas investor told Investor he wonders whether a traditional E&P private equity firm will ever raise a new oil and gas fund. Pontem’s Bartlett said, “I think that’s a fair question, given political and ESG headwinds.”

He expects traditional E&P PE’s will shift to multiple energy sub-sectors going forward, “so they can pivot. When there’s an opportunity in upstream, they’ll direct capital towards upstream.

“But they’ll increasingly invest in renewables and alternative energy. They will seek to maintain the flexibility to do both. So there will still be capital [in oil and gas] from those incumbents with deep LP relationships.”

Bankers too

Meanwhile, E&P investment bankers are broadening as well. Some E&P securities analysts have been reassigned to energy transition desks or asked to do both or let go, according to what operators’ investor relations heads told Investor last fall.

On the reserve-based lending side, there are fewer E&P bankers, according to Haynes & Boone LLP, which counted 20 in its October 2020 survey, down from 30 a year earlier.

A Houston-based E&P lender, Cadence Bancorporation, reported in its year-end 2020 earnings slides in January 2021 that it planned to “determine which existing clients and bank partners are part of go-forward traditional energy strategy and exit those that are not.”

Meanwhile, its plan is to “develop energy-transition-client deposit calling and lending capabilities,” it reported.

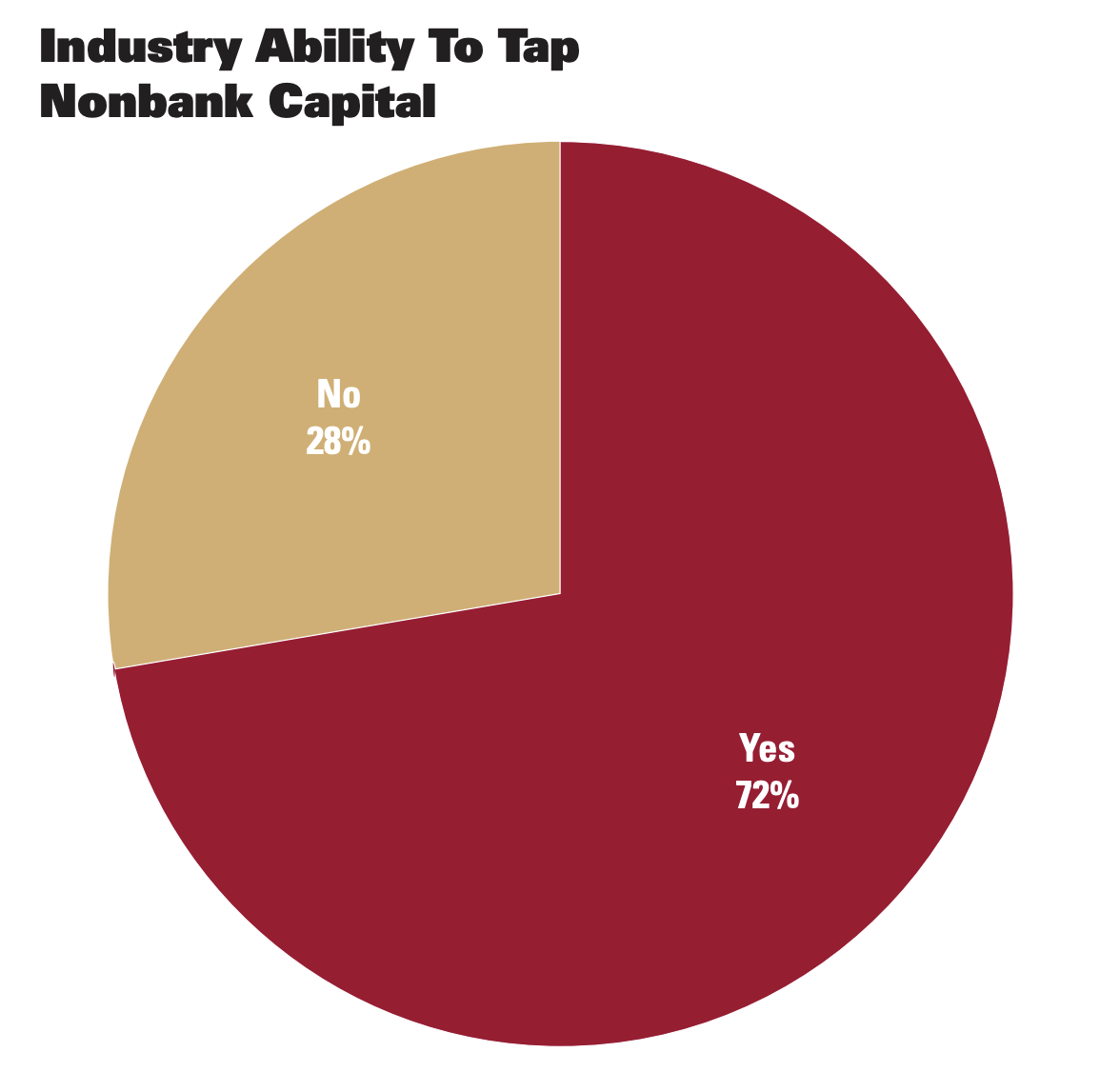

The reduction in the number of E&P lenders is while 28% of oil and gas producers told the Dallas Fed in December that they didn’t expect to be able to access capital this year from sources other than the bank.

A producer wrote, “The pullback of traditional reserve-based lending continues …. The ongoing reduction of capital access is likely a serious problem.”

Another reported, “Our equity sponsor and management are investing additional equity in the company, without which the banks will not allow us to drill.”

Another said, “The investors of our firm have decided to wind down the company.”

Climate wildcatting

Cunningham said E&P leaders building new ventures in energy transition “is a really interesting question because their experience is all about energy.” What’s the next great wildcatting idea “that I can make a lot of money at?”

It fits with the nature of the E&P venturist.

“It is taking a different kind of risk in the energy space, so they’re changing their thesis,” Cunningham said. “I think [energy transition] can make a lot of sense actually.”

Pontem’s Bartlett noted that private equity firms invest for their limited partners. So with the Biden administration and Democratic control of Congress, “you’re just going to have “so many headwinds facing general partners seeking to raise capital for investment in the upstream sector,” Bartlett said. As their fund investors want to invest in renewables, “It’s highly logical [E&P private equity firms] should offer them something they actually want to invest in more so than in upstream.

“It is what it is,” he continued. “I’d do the same thing if I were those firms.”

Triple Point’s Fitzpatrick added, “It’s a hot sector, so I guess it makes sense.”

But, for oil and gas wildcatters, the energy transition doesn’t easily translate, he added.

“It’s a completely different business,” Fitzpatrick said. Some of the experts he’s familiar with “have 30 letters behind their name.”

Chandra said the key to leading any SPAC is “tackling the evaluation” of what you’ll buy.

“And any of these [ex-E&P] guys can do that, right? I don’t think their expertise is going to be as required to run the entity they bought,” he said.

For example, the ex-RSP Permian founders bought ChargePoint. Chandra noted ChargePoint was an existing company with personnel that came with the company.

As for the create-PUDs-and-flip model, “I think those days are over,” Chandra added. “So you’re going to have to have a different pitch.”

If there is $85 oil again? “I know someone will say, ‘Never say never,’ but I’m willing to venture that you can have $85 oil without PE-driven investment returning,” he said.

No new plays?

Just converting PUDs to PDPs isn’t oil and gas exploration. So where is the Lower 48 going forward?

“The bar is high,” Chandra said, “and there’s always a place for exploration, provided that you’re lowering the cost curve.

“I don’t think we ever truly got paid for the high end of the curve. There was the Tuscaloosa Marine Shale and stuff like that. It was very brief, of course.”

The playbook of just growing, though, “is busted,” he said. To revive it requires an answer to “How do we get the market to ever again pay a multiple that’s far beyond what you’re producing?” Chandra said. “I just don’t see it. I don’t think that playbook comes back.”

Meanwhile, decarbonization is probably going to be bumpy.

“It’s probably going to take longer, but there’s one inevitability: It’s coming,” he added. “So why would I overpay for a resource right now? I’ll pay for blowdown value. Maybe I’ll pay a little bit beyond blowdown value. But I’m not paying a multiple for your production. So I don’t know if that market comes back.”

If producers aren’t overpaying for properties, it might keep oil prices higher for longer “in a way that didn’t happen in 2018,” Chandra said. “Capital was flush and all those acquisitions happened, and it absolutely killed the oil-price rally. The companies that remain should benefit.”

It favors “the incumbents; you’re not favoring new shops,” he added.

Pontem’s Bartlett said that at $50 oil, “you can actually make money in this industry.” With expectations for higher inflation, a weaker dollar and strong commodity prices, “you want to be invested in oil and gas producers.”

Chuck Yates, a former E&P private equity manager who runs the podcast “Chuck Yates Needs a Job,” told Hart Energy’s Executive Oil Conference virtual attendees in January that, in oil and gas, “We ran our business like we were holding lottery tickets … . Today, there are no lottery tickets in front of us.

“We have higher prices, and that might be the only one. But there is no mystery shale that’s going to pop up on your acreage. There’s no technology today I see staring in front of us that could have any sort of material change to the business.”

Automation is the future of E&P, Yates said.

“There are probably 75% too many people operating the assets we have today in oil and gas companies,” he said. The business needs “consolidation, technology [and] automation. Do we really need a pumper truck driving by every well every day?”

This is “the age of the plumber,” Yates concluded. The margins are “razor thin.”

Recommended Reading

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

EU Expected to Sue Germany Over Gas Tariff, Sources Say

2024-04-17 - The German tariff is a legacy of the European energy crisis that peaked in 2022 after Moscow slashed gas flows to Europe and an undersea explosion shut down the Nord Stream pipeline.

Pemex to Remain Fiscally Challenged for Mexico’s Next President

2024-04-16 - S&P Global Ratings said Pemex will remain a fiscal challenge for the country’s next president, adding that continued cautious macroeconomic management was key in its ratings on both Mexico and Pemex.

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.