The sun rises Sept. 30, 2019, over Transocean’s Deepwater Mykonos docked at Puerto de Las Palmas. The drillship is currently on contract with Petrobras offshore Brazil. (Source: Ana Iacob Photography/Shutterstock.com)

Presented by:

Buried among talk of an energy transition, oil market volatility, U.S. shale supply chain concerns and inflation woes, a new theme appears to be emerging.

Analysts say offshore oil and gas drilling activity is reawakening.

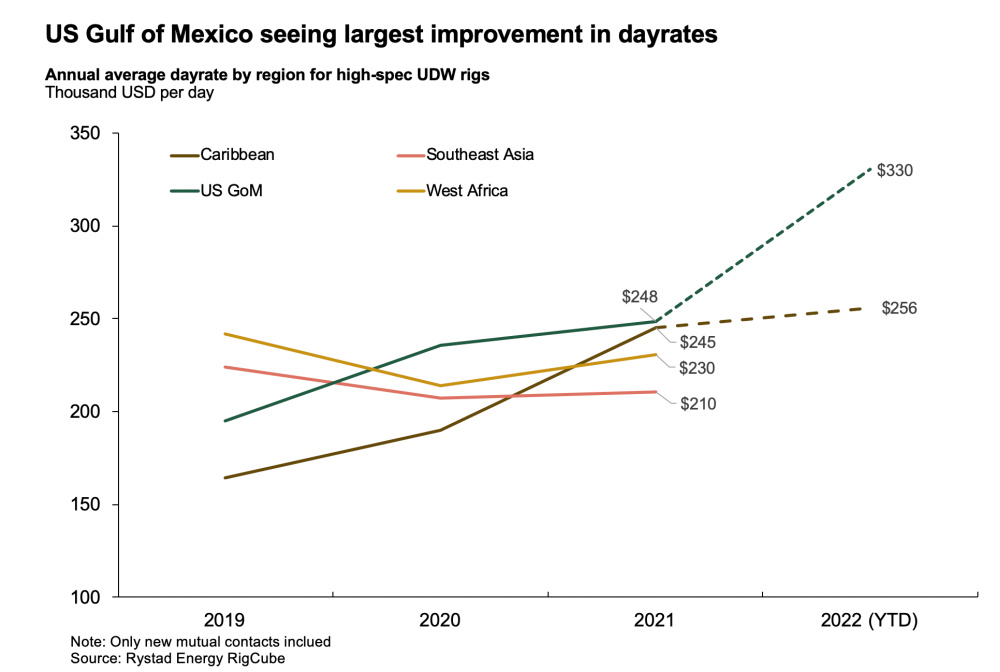

“Quite frankly, offshore has been dead for a decade, [but] offshore is coming back,” said James West, senior managing director and partner at Evercore ISI. “We’ve seen deepwater day rates go from $150,000 at the bottom per day to almost $400,000 in recent months in the Gulf of Mexico.”

The future appears positive for offshore drillers as the world’s needs for energy rise and doors open opportunities to capture value during the energy transition. Like other sectors, offshore drillers continue to recover from challenges brought in part by COVID-19, but optimism abounds with high oil prices and customer demand growing alongside utilization for high-specification rigs, specifically floaters.

“Over the next five to 10 years we see a healthy offshore rig market,” West told Hart Energy, “but limited new frontiers opening up as the fear of stranded assets grows.”

For now, high utilization—which in March 2022 was 100% for deepwater rigs in the U.S. Gulf of Mexico (GoM)—and impressive day rates that included drilling powerhouse Transocean landing in the first quarter a $395,000/day two-well contract in the GoM for its Deepwater Asgard drillship have given hope. The contract was up $100,000/day from its previous contract.

Day rates could go even higher as the market tightens, according to Liz Tysall, senior offshore rig analyst for Rystad Energy.

“We definitely expect to see some rig contracts make it into the $400,000/day range and potentially higher outside of the harsh environment market,” Tysall told Hart Energy.

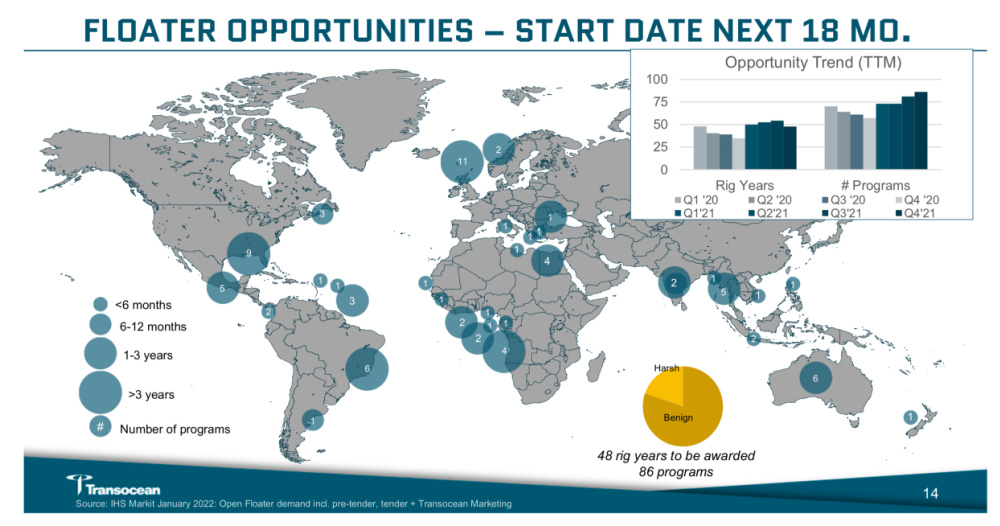

The outlook comes as oil and gas operators step up drilling activity in several regions. Transocean has said it expects overall rig demand to see annual growth of 9% from 21 years in 2021 to 31 years on contract in 2026.

Add to this strong activity for floaters in the Suriname-Guyana Basin, where the Exxon Mobil Corp.-led consortium has been keeping drillships busy, having discovered more than an estimated 10 Bboe of recoverable resources—enough for up to 10 development projects. Utilization is also growing offshore Namibia and South Africa, where TotalEnergies has proven the potential of plays in the Orange Basin.

“The offshore drilling sector is moving back toward (and in some areas surpassing) the pre-pandemic levels witnessed at the end of 2019,” Tysall said.

Besides improvement in day rates and rig demand, she added that contracting activity has also picked up.

“Certain benefits are shifting back towards the drilling contractors such as E&Ps paying for mobilization fees and some rig upgrades,” she said. “Improvements are being driven by increased consumer demand now that pandemic restrictions are easing, a rise in the oil price and energy security concerns.”

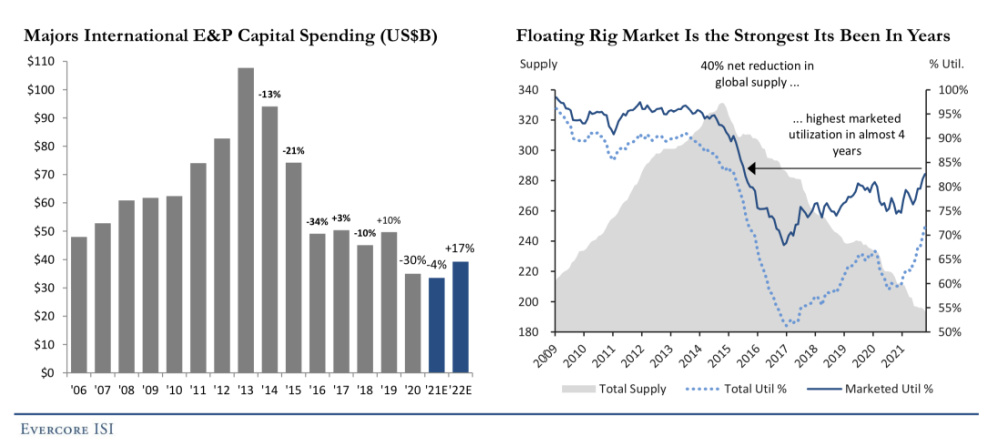

A pickup in exploration activity in frontier plays and international E&P spending, as West pointed out in a March webcast, is also contributing to the offshore comeback.

“With reserve replacement ratios at all-time lows for the IOCs and even the NOCs, we’re beginning to search for these new reserves,” West said. “This disproportionately is positive for a company like Schlumberger, which dominates in the offshore and has a big exploration-focused business, but also for the offshore drillers Transocean, Noble and Valaris.”

While opportunities to put rigs to work are up, the supply of rigs ready to clock in is tight with attrition at play even as utilization rises.

“I think the market is about to be surprised by the lack of rig availability and the day rates being commanded by the asset owners,” West said.

Driving Activity

Fleet utilization has nearly rebounded to levels seen in March 2020 as demand steadily improves but is not yet back to levels of early 2020, according to Terry Childs, head of Westwood Global Energy Group’s RigLogix.

Marketed utilization hit 85%, up from the 79% at year-end 2020, Childs said during a Bloomberg Intelligence webinar in March. The figure, which excludes cold-stacked units, is just below the 87% reported in March 2020.

The improvement comes thanks in part, he said, to attrition as well as higher demand. Utilization is “not as bad as it certainly could be,” Childs said. “We could in for a decent year.”

Since September 2014, RigLogix data show, nearly 325 rigs have been retired, more jackups and semisubmersibles than drillships, while just over 160 rigs have been delivered. Potential contracts this year could lead to more deliveries, which remain “lackluster” at the moment, he said.

“When you get into an upturn in the market, which we’re certainly in now, for the most part, attrition slows down, so certainly something to watch for there as well,” he said.

Of the main rig types, drillships appear to be on a “strong run.” By February, global marketed floating rig utilization had risen to 84%, up from 81% a year earlier, dominated by activity in the so-called Golden Triangle which comprises the GoM, South America and Africa.

Data show marketed utilization for floaters at 88% offshore Africa, where contracted drillships include the Maersk Voyager offshore Namibia; 96% in South America, with activity offshore Guyana, Suriname and Brazil; and at 96% in the U.S. GoM, where drillships in use include the Diamond Ocean BlackLion at the BP-operated Mad Dog Phase 2 development

“Ultra-deepwater rig demand is virtually sold out in the U.S. Gulf of Mexico and the remainder of the Golden Triangle looks very tight this year and into early 2023,” Tysall added. “Oil companies have gotten used to all the ‘bells and whistles’ on a high-specification drillship, and E&Ps are requiring that rigs be outfitted with certain types of equipment, such as MPD, in their tender documents.”

Only 17 floaters were retired in 2021—the second fewest since 2014.

“I think there’s certainly still some attrition candidates,” Childs said, however, activity is slowing down attrition.

Tysall agreed, pointing out about 45% of idle floaters are cold stacked.

“Attrition has definitely served to move the floater market towards a more balanced state,” she said.

Looking at the floating rig contract backlog for drillships and semisubs, Childs again pointed out how activity in the Golden Triangle is ahead of other parts of the world. The backlog for new fixtures between 2019 and 2021 jumped to 43 in South America, up from 23, led by Petrobras; 23, up from eight in the GoM; and to 14, up from eight, in Africa.

“While the GoM moved the fastest, the rest of the Golden Triangle is playing catch up. Petronas has fully contracted local deepwater assets in Brazil and is now tendering for additional equipment, while the majors who have entered Brazil are also negotiating for incremental rigs to join the market,” West said. “West Africa is the laggard, but most of the majors are now seeking rig supply for additional work and I expect that market to tighten as well.”

Newbuilds are in the making, but it’ll take some time before they become available.

“There are about 20 floater newbuilds still in the shipyards but these are unfinished and do not have spare parts,” West said. “To mobilize for work is likely a $50-$100 million capital cost and day rates above $400k are needed for this level of investment.”

Of the 20 or so floaters to be delivered, Tysall said realistically only about half of those rigs will be delivered. “And deliveries will only happen if there is a term contract with strong day rates.”

Looking Forward

What could the rest of 2022 and next year hold for the sector?

“We expect five to seven newbuild floating rigs to be delivered, but we think also 15 to 20 could be removed from the fleet,” Childs said. “So, we still should see a net decline in supply.

“Obviously, we believe demand is going to increase quite substantially in the floating rig fleet. You couple that with the supply decline, we should see utilization increase. It may depend on that attrition level and the level of how much demand goes up, but we should still see a pretty decent number there.”

More M&A activity could also be in store for offshore drillers, the analysts said.

Denmark’s Maersk Drilling announced in November its plans to merge with U.S.-based Noble Corp. in a $3.4 billion deal, relocating to Houston and operating as Noble. That news came after Noble acquired Pacific Drilling in April 2021.

“That activity, as many of you know, is certainly not over,” Childs said of M&A. “There’s rumors of potential combinations, sales, et cetera.”

It’s not a question of “if” but “who and when” M&A deals will happen, he added.

With utilization at 100% in the U.S. GoM, analysts expect little availability for the rest of 2022 and into 2023. “There are some shorter jobs and whatnot, but not a lot of movement just because there’s nothing to sign at the moment.”

Elsewhere, operators are expected to pick up activity next year offshore Norway, where the semisubmersible market has been described as “a bit depressed” lately. Only three requirements are in the rig inquiry stage, Childs said.

In southeast Asia, he said there are five active tenders with 2022 start dates, but recent retirements of semisubmersibles are cause for concern. He does, however, expect to see some improvement in rates, which could approach the $200,000/day mark.

Globally, analysts forecast utilization rising to 88% in 2022, up from more than 70% last year. Childs called it a “bold prediction” and doesn’t think it will be far off the mark. That’s assuming no major market or regulatory curveballs. “I think the floating market looks pretty good for this year and probably into early ‘23 as well.”

Not limited by oil and gas, offshore drillers are also diving into the energy transition space.

“The rig operators will continue to improve drilling performance through new technology and also decarbonize their operations,” West said. “They will also increasingly look at geothermal and CCUS as avenues of growth as well as offshore wind power.”

Nabors Industries Ltd. is adding more ultradeep drilling technology to its portfolio with its $8 billion investment in GA Drilling, a geothermal technology company that specializes in plasma drilling.

Transocean Ltd. also moved further into the renewables energy market with its purchase of a minority interest in Ocean Minerals Ltd., a provider of cobalt and rare earth minerals sourced from the seabed. The company is also using its Transocean Enabler semisubmersible to drill a well and sidetrack for the Northern Lights Carbon Transport and Storage project, led by Equnior, Shell and TotalEnergies, on the Norwegian Continental Shelf.

With carbon capture and storage project scopes varying across regions and the market evolving, Tysall said Rystad sees demand in this area primarily for rigs that can drill in shallow water areas.

“Reducing carbon is on the agenda for most E&Ps and there is an ever-stronger call for oil companies to take a leadership role when it comes to reducing their carbon footprint,” she said. “Drilling contractors are also adopting emission reduction technologies and have begun upgrading rigs with technologies such as NOx SCR Systems as well as software systems to help manage diesel consumption. Some E&Ps are also adopting contract terms that incentivize and reward such initiatives on the part of the drilling contractor.”

Oil and gas drilling offshore will still be needed, however, to meet demand in the short to medium term.

“The offshore drilling market can be expected to continue on an improvement trajectory over the next four to five years,” she said. “Offshore production is a competitive resource that will remain relevant.”

Recommended Reading

Range Resources Plans Flat Production Target in 2024

2024-02-23 - Gas producer Range Resources is focusing on system flexibility to respond to market trends.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

Antero Poised to Benefit from Second Wave of LNG

2024-02-20 - Despite the U.S. Department of Energy’s recent pause on LNG export permits, Antero foresees LNG market growth for the rest of the decade—and plans to deliver.

Turning Down the Volumes: EQT Latest E&P to Retreat from Painful NatGas Prices

2024-03-05 - Despite moves by EQT, Chesapeake and other gassy E&Ps, natural gas prices will likely remain in a funk for at least the next quarter, analysts said.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.