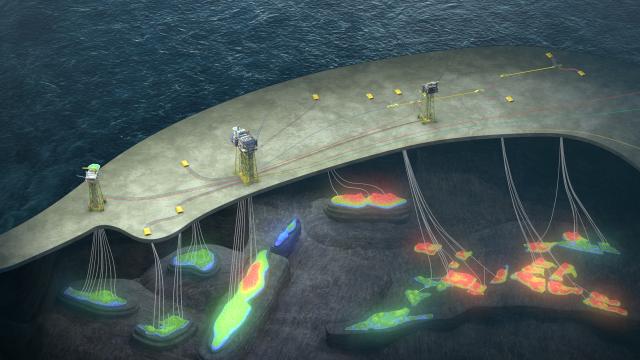

Krafla, Fulla and Nord of Alvheim (NOA) together constitute the area called NOAKA, which is being renamed Yggdrasill. (Source: Aker BP)

Aker BP is closing out 2022 with a commitment to invest more than NOK 200 billion ($20.3 billion) in its Norwegian shelf assets.

Earlier this month, Aker BP submitted 10 plans for development and operation (PDOs) and a plan for installation and operation to Norway’s Ministry of Petroleum and Energy. The projects involved include Yggdrasil (formerly NOAKA), Valhall PWP-Fenris, Skarv Satellite Project and Utsira High.

Øyvind Seljebotn, Aker BP’s senior vice president of exploration and reservoir development, described the PDO package as a “gigantic industrial commitment” during the PDO handover, according to the Norwegian Petroleum Directorate.

Kalmar Ildstad, director of license management in the NPD, said, “The plans submitted by Aker BP contain several important elements for further development of the resources on the Norwegian shelf. The plans include establishing new infrastructure in new areas, further developing fields that are currently producing, utilizing available capacity in existing infrastructure in addition to developing resources in an entirely new type of reservoir.”

Yggdrasill plans

The most comprehensive plan covers what will be called the Yggdrasil area in the North Sea, where Aker BP is projecting investments of about NOK 115 billion ($11.7 billion). The area consists of three fields that contain a total of 19 petroleum deposits, with more discoveries expected in the years ahead, the NPD said.

Aker BP CEO Karl Johnny Hersvik said, “Through the development of the Yggdrasil area, which is the largest of the projects, we aim to set new standards for field development and operation using new technology, data-driven decisions and work processes, remote operations and unmanned platforms.”

NOAKA consists of the North of Alvheim (NOA), Fulla and Krafla license groups. The area, located between Alvheim and Oseberg, contains around 650 millions barrels of oil equivalent (MMboe) of recoverable reserves, and production is expected to begin in 2027.

The development concept consists of an unmanned production platform to the north developed by Equinor (Krafla UPP) and a processing platform with well area and living quarters developed by Aker BP (NOA PdQ) to the south. That PdQ is planned with low manning levels and is also being developed to be periodically unmanned after a few years of operation.

The Frøy field will be developed with a normally unmanned wellhead platform that will be tied back to NOA PdQ. The area represents an extensive subsea development with a total of nine templates; 55 wells are planned in the area.

Aker BP has lined up new names for the groups and facilities in the area.

The southern license group, previously NOA, will be assigned the field name Hugin. The northern license group, previously Krafla, will be assigned the field name Munin.

Fulla will keep its name. The PdQ platform in the south will be named Hugin A, the NUI platform will be named Hugin B and the UPP platform to the north will be named Munin.

The project area comprised by the overall development of Hugin, Fulla and Munin will be named Yggdrasi after the world tree in Norse mythology.

According to Equinor, the unmanned Munin platform is the first of its kind. It will be remotely operated from onshore and will be built without a helicopter deck, living quarters and lifeboats. Access and stays at the platform will be accomplished using service operation vessels. Systems and functions have been reduced to the bare necessities in order to realize the unmanned concept.

Future-oriented solutions have been chosen to facilitate a large extent of data-driven decisions based on continuous monitoring of processes and equipment, Equinor said. For example, maintenance planning will be optimized using digital twins.

Gas will be exported through a shared pipeline from Hugin A via Munin platform to Statpipe, while oil will be exported through a shared pipeline from Hugin A to the Grane oil pipeline. Separate joint ventures have been established for the export pipelines for gas and oil with Equinor as operator.

The project will be developed with a shared power supply from shore, operated by Aker BP. Connection to the central grid is planned in Samnanger in Vestland County, which will contribute to low emissions of CO2 from the area.

The entire area will be remotely operated from an integrated operations center and control room onshore in Stavanger.

Until the PDO was submitted, Equinor had been the operator for Krafla. After the PDO was submitted, Aker BP took over as operator, making the company the operator for the entire area in both the development and operations phases.

Aker BP has also entered into about NOK 50 billion in agreements related to NOAKA, conditional on Norwegian authorities approving the PDOs, including:

• Aker Solutions as part of the Fixed Facilities Alliance for topsides and jackets for NOA PdQ and Frøy NUI;

• Siemens Energy as part of the Fixed Facilities Alliance for electrical, instruments, control systems and telecommunications;

• Subsea 7 as part of the Subsea Alliance for subsea umbilicals, risers and flowlines;

• Aker Solutions as part of the Subsea Alliance for the subsea production system;

• Aibel for the Krafla UPP topsides; and

• Hitachi Energy for electrical equipment for the onshore facilities for power from shore.

Aker BP has also secured rig capacity in the market and deliveries of critical equipment, as well as vessels for all major installation lifts. Equinor has entered into an agreement with NKT for the power cable.

Hugin license partners are operator Aker BP with 87.7%, LOTOS with 12.3%. Fulla license partners are operator Aker BP with 47.7%, Equinor with 40% and LOTOS with 12.3%. Munin license partners are operator Aker BP with 50% and Equinor with 50%.

Valhall and Fenris plans

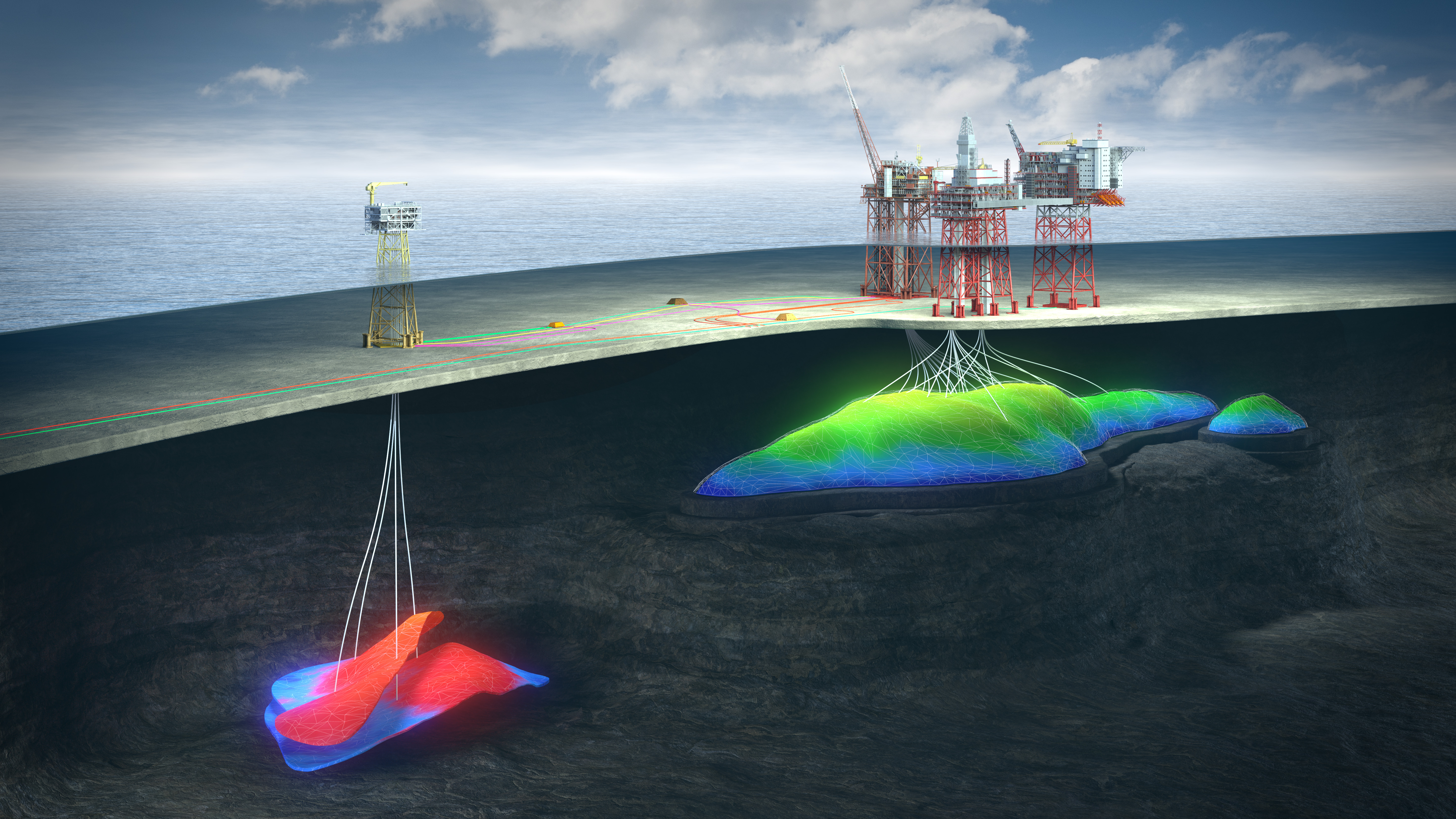

Aker BP’s revised PDO for the Valhall Field and new PDO for the Fenris Field feature a new centrally located production and wellhead platform bridge-linked to the Valhall central complex with 24 well slots and an unmanned installation with eight slots at Fenris tied back subsea 50 km to the production and wellhead platform.

Total recoverable resources are estimated to 230 MMboe gross, with 160 MMboe at Fenris (formerly King Lear) and 70 MMboe at Valhall. The total resource potential enabled by the Valhall PWP-Fenris development – including life-time extension, drilling of new wells and identified future upsides – is estimated at around 500 MMboe.

The development plan includes a total of 19 wells, with 15 at Valhall and four at Fenris. Production starts for the joint development project, located in the southern part of the North Sea, are planned for the second and third quarters of 2027, respectively.

In addition, the project will add gas capacity to Valhall and enable Valhall to serve as a hub for potential new gas discoveries in the future.

The project will also modernize Valhall to continue operating when parts of the current infrastructure are phased out in 2028.

Total investments in the Valhall – Fenris development are estimated at NOK 50 billion ($5 billion).

Aker BP has awarded contracts, conditional on PDO approval by the authorities, to:

• ABB and Aker Solutions through the Fixed Facilities Alliance for the production and wellhead platform and Fenris topside and jacket fabrication;

• Subsea 7 Norway through the Subsea Alliance for subsea umbilical riser flowlines;

• Aker Solutions through the Subsea Alliance for subsea production systems; and

• Aker Solutions through the Modifications Alliance for the modification scope at Valhall field center.

In addition, Aker BP and Jacktel AS have entered a contract for the accommodation unit ‘Haven’ in 2026-2027.

Partners in Valhall include operator Aker BP with 90% and Pandion with 10%. Partners in Fenris include operator Aker BP with 77.8% and PGNiG with 22.2%.

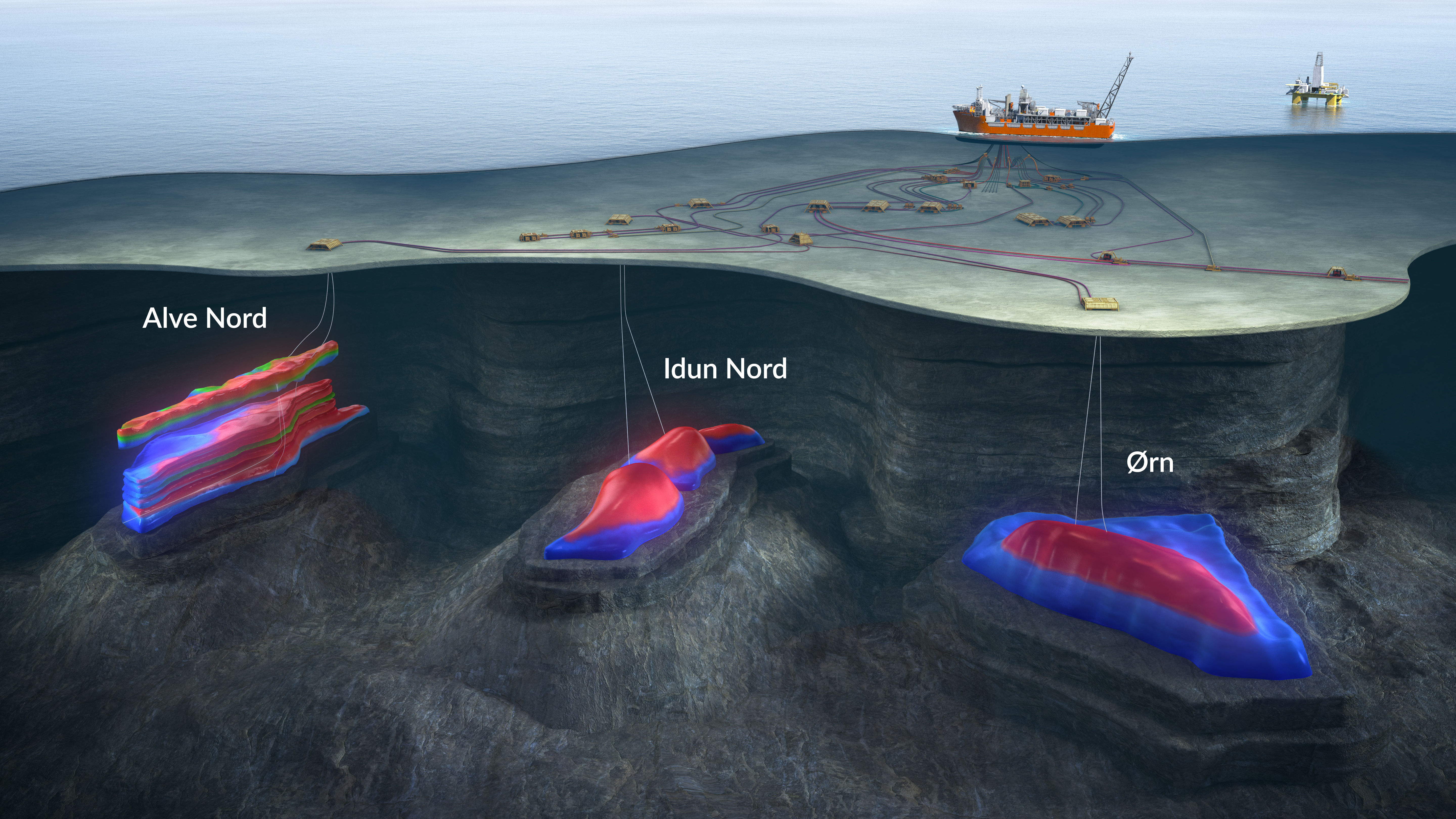

Skarv satellite plans

Aker BP plans to develop the Alve Nord, Idun Nord and Ørn gas and condensate discoveries in the northern part of the Norwegian Sea using subsea tiebacks to the Skarv FPSO. The NOK 17 billion ($1.7 billion) investment in the Skarv satellite project will extend the lifetime for the Skarv FPSO. The project targets recoverable resources estimated at 120 MMboe, mostly gas. Production is expected to begin in the third quarter of 2027.

Aker BP submitted three different PDOs for the satellite developments. Each of the developments comprises a four-slot template and two wells, tied back subsea to the Skarv FPSO in the northern part of the Norwegian Sea.

“The development of the three discoveries is coordinated by one project team to reduce costs through common infrastructure and harvest synergies across the deliveries,” Kristine Gunnarshaug, project manager, said.

Aker BP has entered execution contracts, contingent on PDO approval by Norwegian authorities, with:

• Subsea 7 through the Subsea Alliance for subsea umbilical riser flowline;

• Aker Solutions through the Subsea Alliance for the subsea production system;

• Aker Solutions through the Modification Alliance for modification of the Skarv FPSO; and

• License partners in Alve Nord include operator Aker BP with 68.1%, Wintershall DEA with 20% and PGNiG with 11.9%. Partners in Idun Nord include operator Aker BP with 23.8%, Wintershall DEA with 40% and Equinor with 36.2%. Partners in Ørn include operator Aker BP with 30%, PGNiG with 40% and Equinor with 30%.

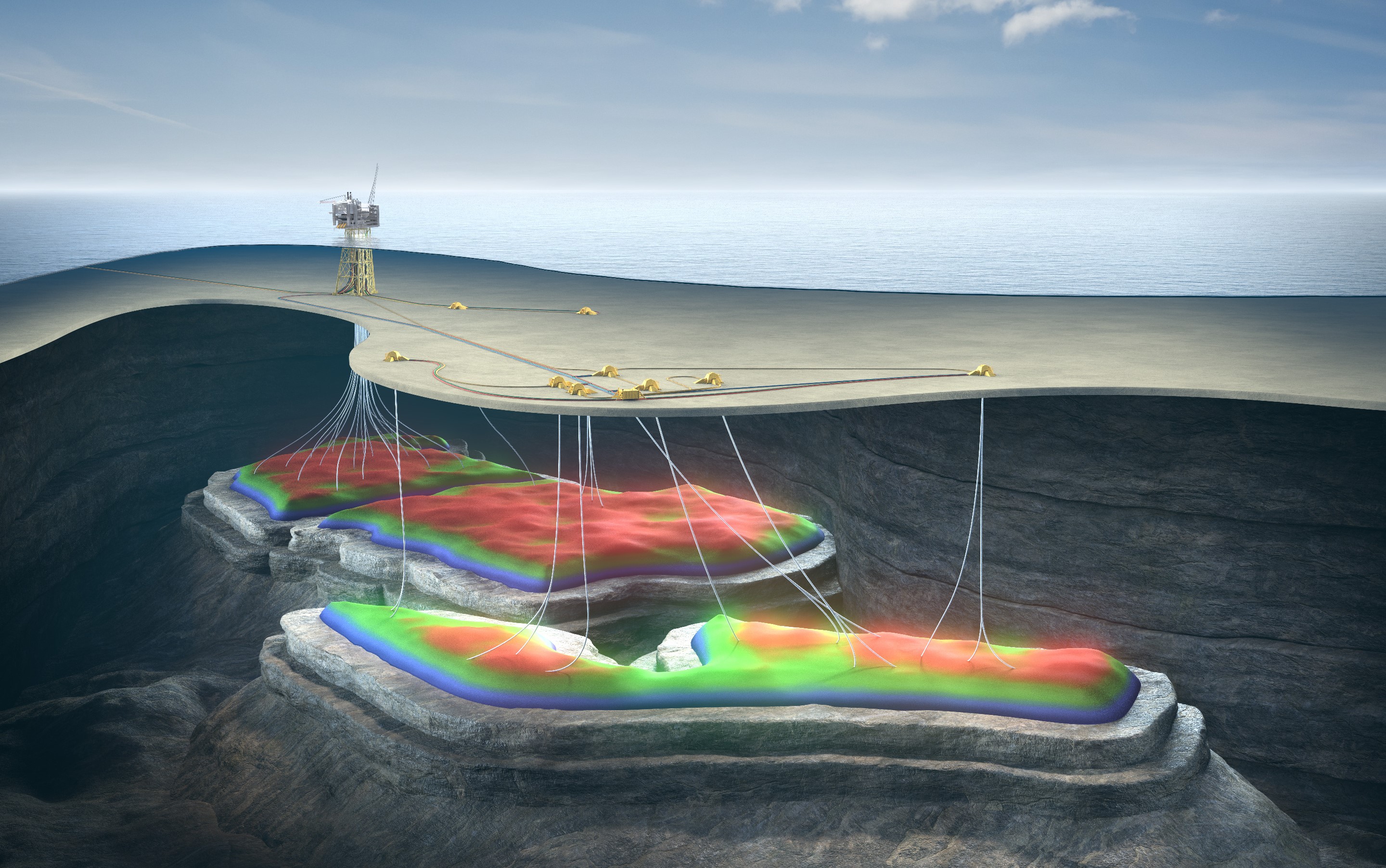

Utsira High plans

The NOK 21 billion ($2.1 billion) Utsira High project bundles together three subsea tiebacks to the Ivar Aasen and Edvard Grieg platforms in the central part of the North Sea.

The Utsira High Project will develop recoverable resources of 124 MMboe. Drilling will commence in third quarter of 2025, with production start-up scheduled for the first quarter of 2026 for Solveig and Troldhaugen (formerly known as Rolvsnes) and the first quarter of 2027 for Symra (formerly named Lille Prinsen). Symra ties back to the Ivar Aasen platform and Solveig and Troldhaugen tie back to the Edvard Grieg platform.

Troldhaugen is the first development on the Norwegian Continental Shelf with a reservoir mainly consisting of weathered and fractured basement rock, or granite. Oil deposits in bedrock have until now not been considered technically and economically viable for production because granitic bedrock is usually very dense. But if the granite is cracked and water has dissolved the minerals, it may be saturated with hydrocarbons, Aker BP said.

All producing fields on the Utsira High will be operated with electrical power from shore, so CO2 emissions from the production phase will be low.

Partners in Symra include operator Aker BP with 50%, Equinor with 30% and Sval Energi with 20%. Partners in Solveig Phase 2 include operator Aker BP with 65%, OMV with 20% and Wintershall DEA with 15%. Partners in Troldhaugen include operator Aker BP with 80% and OMV with 20%.

Recommended Reading

The Secret to Record US Oil Output? Drilling Efficiencies—EIA

2024-03-06 - Advances in horizontal drilling and fracking technologies are yielding more efficient oil wells in the U.S. even as the rig count plummets, the Energy Information Administration reported.

NextDecade Targets Second Half of 2024 for Phase 2 FID at Rio Grande LNG

2024-03-13 - NextDecade updated its progress on Phase 1 of the Rio Grande LNG facility and said it is targeting a final investment decision on two additional trains in the second half of 2024.

DUG GAS+: Chesapeake in Drill-but-don’t-turn-on Mode

2024-03-28 - COO Josh Viets said Chesapeake is cutting costs and ready to take advantage once gas prices rebound.

CERAWeek: Tecpetrol CEO Touts Argentina Conventional, Unconventional Potential

2024-03-28 - Tecpetrol CEO Ricardo Markous touted Argentina’s conventional and unconventional potential saying the country’s oil production would nearly double by 2030 while LNG exports would likely evolve over three phases.

Woodside’s Pluto Train 2 Nears 2026 Start Up with Modules Delivery

2024-02-21 - First 3 of 51 modules have arrived on site in Western Australia for the onshore LNG project that will receive gas from the offshore Scarborough project.