Ensco Plc and Rowan Cos. Plc completed their merger April 11, forming an industry leading offshore driller newly named EnscoRowan Plc.

The companies had agreed to the merger in October 2018. The all-stock transaction was valued at about $2.4 billion at the time.

The merger between the offshore drillers faced some headwinds, including opposition from one of Rowan's largest shareholders, hedge fund Canyon Capital Advisors. The dissent led the companies to agree late January to amend the terms of the transaction agreement.

RELATED: Offshore Drillers Ensco, Rowan To Combine In $2.4 Billion Merger

Under the amended terms, Rowan shareholders will receive 2.75 Ensco shares, instead of the original 2.215, for each Rowan share. As a result, Rowan shareholders ended up with 45% of the combined company, instead of the expected 39.5% from the original merger agreement. Ensco shareholders now hold a 55% stake instead of their originally projected 60.5%.

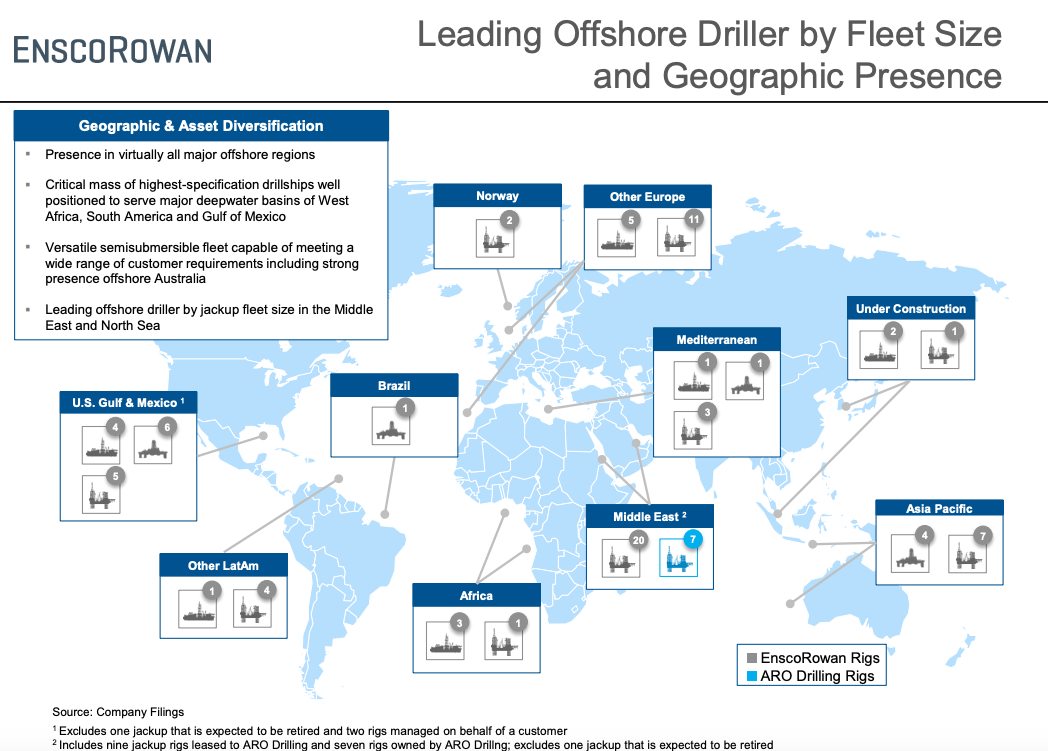

Combined, EnscoRowan’s breadth will now span six continents in nearly every major deepwater and shallow-water basin around the world including the Gulf of Mexico, Brazil, West Africa, North Sea, Mediterranean, Middle East, Southeast Asia and Australia. The combined company owns 82 rigs including 28 floaters, of which 25 are ultradeepwater, and 54 jackups with a combined backlog worth $2.7 billion.

In October, Luke M. Lemoine, senior oilfield service analyst with Capital One Securities Inc., estimated combined, EnscoRowan would rank second behind Transocean Ltd. in total floater fleet and “firmly as the largest worldwide jackup contractor.”

EnscoRowan will be led by Tom Burke, previously president and CEO of Rowan. Ensco President and CEO Carl Trowell now serves as the combined company’s executive chairman. Jon Baksht will continue in his current role at Ensco as senior vice president and CFO at the combined company.

Trowell said in a statement April 11, “The combination of Ensco and Rowan creates an industry-leading offshore driller across all water depths, establishing a stronger company capable of thriving throughout the market cycles. Our increased scale, diversification and financial strength will provide significant advantages to better serve our customers and unlock long-term value for our shareholders. We are excited to move forward together as a combined company.”

Following the closing of the transaction, ordinary shares of EnscoRowan have been consolidated through a 4:1 reverse stock split, resulting in approximately 197 million ordinary shares outstanding.

In conjunction with the closing of the transaction and the termination of the Rowan revolving credit facilities, EnscoRowan’s banking group agreed to increase the borrowing capacity under its unsecured revolving credit facility of about $2.3 billion through September 2019, and about $1.7 billion from October 2019 through September 2022.

Morgan Stanley & Co. LLC acted as lead financial advisor to Ensco. HSBC Securities (USA) Inc. and Citigroup Global Markets Inc. also provided financial advice to Ensco. Ensco’s legal advisors are Gibson, Dunn & Crutcher LLP and Slaughter and May. Goldman Sachs & Co. LLC served as financial advisor to Rowan, and Kirkland & Ellis LLP served as legal advisor.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.