Occidental’s acquisition of Anadarko Petroleum in 2019 was the largest deal of the decade and the fourth-largest oil and gas deal ever, according to Enverus. (Source: Anadarko Petroleum/Shutterstock.com)

Over the past decade, which saw both the shale land grab and one of the worst oil market crashes, the U.S. oil and gas industry experienced a whirlwind of deal-making with total dollar value reaching into the hundreds of billions.

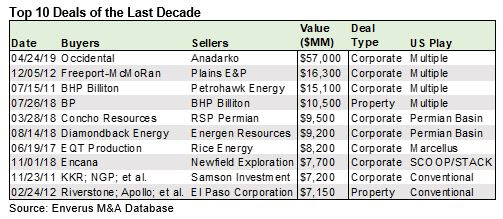

However, the largest oil and gas deal in the U.S. of the decade is this past year’s acquisition of Anadarko Petroleum by Occidental Petroleum Corp., according to a new report published by energy data provider Enverus on Jan. 2.

In total, Enverus tracked $775 billion of U.S. oil and gas M&A this decade, with 73% spent on shale assets. Though by the end of the decade, asset buying has grown largely out of favor as E&Ps turn to corporate consolidation to meet investor demands that have emerged in recent years.

“Investors who funded the shale revolution over the last decade have become vocal in advocating for payouts and cut back on providing new capital,” Enverus Senior M&A Analyst Andrew Dittmar said in the report. “That flowed through to limited M&A and a negative reaction to deals for much of the year.”

Occidental’s acquisition of Anadarko highlighted 2019’s consolidation in the shale patch. The deal, which Enverus values at $57 billion, including debt, is in the ballpark of Exxon Mobil Corp.’s 2009 acquisition of XTO Energy Inc. as the most spent on shale in a deal. Enverus estimates 75% of the deal value in Occidental’s acquisition of Anadarko was in shale, including the Permian Basin.

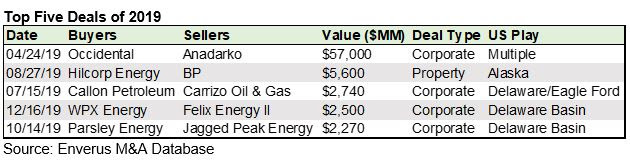

In 2019, the Enverus report said U.S. oil and gas M&A reached a five-year peak of $96 billion. However, the annual total was substantially skewed by Occidental’s acquisition of Anadarko.

Backing out the Occidental/Anadarko deal, 2019 saw $39 billion in deals or just one-half of the average $78 billion for annual U.S. oil and gas M&A during the last 10 years.

The Permian Basin continues to be a key driver of U.S. oil growth and a significant contributor to M&A, the Enverus report said.

RELATED:

The Permian at 100: The Play That’s Changing Everything

In particular, the Permian accounted for more than 60% of deal value during fourth-quarter 2019. Also, most of 2019’s marquee deals focused on the Permian.

After Occidental/Anadarko, 2019’s largest corporate deals were Callon Petroleum Co.’s $2.7 billion merger with Carrizo Oil & Gas, WPX Energy Inc.’s $2.5 billion buy of private Felix Energy II LLC, and Parsley Energy Inc.’s $2.3 billion acquisition of Jagged Peak Energy Inc.

Enverus also noted that WPX’s acquisition of EnCap Investments LP-funded Felix in December was notable for several reasons.

Besides being the largest deal of the fourth quarter and the fourth largest deal of 2019, the firm said the acquisition of a premier private equity position in the Permian Basin shows there are still exits available for the “built to sell” model of private equity portfolio companies.

“In the last 10 years, we watched U.S. shale upend global energy markets and transform the U.S. into a net energy exporter,” Dittmar concluded. “We’re now at an inflection point where shale matures from a growth industry to one that generates dividends and share buybacks for its investors. Completing that transition and setting the stage for the next 10 years will likely require a round of consolidation and 2020 sets up the needed pieces for this to occur.”

Recommended Reading

Exclusive: Can NatGas Save the 'Fragile' Electric Grid?

2024-02-28 - John Harpole, the founder and president of Mercator Energy, says he is concerned about meeting peak electric demand and if investors will hesitate on making LNG export facilities investment decisions after the Biden administration's recent LNG pause, in this Hart Energy LIVE Exclusive interview.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

Exclusive: Activists Sending 'Wrong Signal' on US LNG

2024-02-23 - Anne Bradbury, the CEO of the American Exploration & Production Council, says the Biden administration's pause on U.S. LNG export approvals sends a wrong message about the importance of LNG to the American economy and the climate, in this Hart Energy LIVE Exclusive interview.

Exclusive: Scott Tinker Says Pausing LNG Ups Coal Use

2024-02-20 - In this Hart Energy LIVE Exclusive interview, Scott Tinker, chairman of Switch Energy Alliance, talks about energy security globally, and dives into the effects of the Biden administration's LNG pause.

Exclusive: Andrew Dittmar Expects Increased Public M&A in 2024

2024-02-15 - In this Hart Energy LIVE Exclusive, Andrew Dittmar, Enverus Intelligence's senior vice president, compares 2023 consolidation to what he expects in 2024, including more public to public deals.