Occidental’s acquisition of Anadarko Petroleum in 2019 was the largest deal of the decade and the fourth-largest oil and gas deal ever, according to Enverus. (Source: Anadarko Petroleum/Shutterstock.com)

Over the past decade, which saw both the shale land grab and one of the worst oil market crashes, the U.S. oil and gas industry experienced a whirlwind of deal-making with total dollar value reaching into the hundreds of billions.

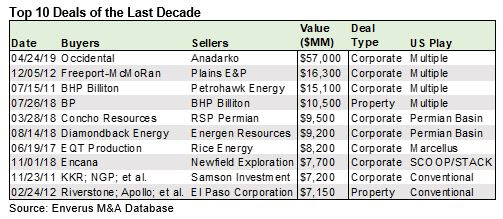

However, the largest oil and gas deal in the U.S. of the decade is this past year’s acquisition of Anadarko Petroleum by Occidental Petroleum Corp., according to a new report published by energy data provider Enverus on Jan. 2.

In total, Enverus tracked $775 billion of U.S. oil and gas M&A this decade, with 73% spent on shale assets. Though by the end of the decade, asset buying has grown largely out of favor as E&Ps turn to corporate consolidation to meet investor demands that have emerged in recent years.

“Investors who funded the shale revolution over the last decade have become vocal in advocating for payouts and cut back on providing new capital,” Enverus Senior M&A Analyst Andrew Dittmar said in the report. “That flowed through to limited M&A and a negative reaction to deals for much of the year.”

Occidental’s acquisition of Anadarko highlighted 2019’s consolidation in the shale patch. The deal, which Enverus values at $57 billion, including debt, is in the ballpark of Exxon Mobil Corp.’s 2009 acquisition of XTO Energy Inc. as the most spent on shale in a deal. Enverus estimates 75% of the deal value in Occidental’s acquisition of Anadarko was in shale, including the Permian Basin.

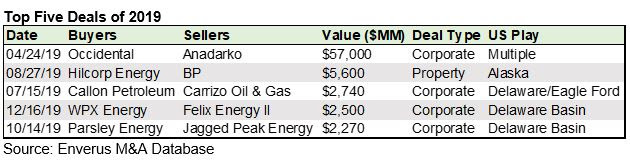

In 2019, the Enverus report said U.S. oil and gas M&A reached a five-year peak of $96 billion. However, the annual total was substantially skewed by Occidental’s acquisition of Anadarko.

Backing out the Occidental/Anadarko deal, 2019 saw $39 billion in deals or just one-half of the average $78 billion for annual U.S. oil and gas M&A during the last 10 years.

The Permian Basin continues to be a key driver of U.S. oil growth and a significant contributor to M&A, the Enverus report said.

RELATED:

The Permian at 100: The Play That’s Changing Everything

In particular, the Permian accounted for more than 60% of deal value during fourth-quarter 2019. Also, most of 2019’s marquee deals focused on the Permian.

After Occidental/Anadarko, 2019’s largest corporate deals were Callon Petroleum Co.’s $2.7 billion merger with Carrizo Oil & Gas, WPX Energy Inc.’s $2.5 billion buy of private Felix Energy II LLC, and Parsley Energy Inc.’s $2.3 billion acquisition of Jagged Peak Energy Inc.

Enverus also noted that WPX’s acquisition of EnCap Investments LP-funded Felix in December was notable for several reasons.

Besides being the largest deal of the fourth quarter and the fourth largest deal of 2019, the firm said the acquisition of a premier private equity position in the Permian Basin shows there are still exits available for the “built to sell” model of private equity portfolio companies.

“In the last 10 years, we watched U.S. shale upend global energy markets and transform the U.S. into a net energy exporter,” Dittmar concluded. “We’re now at an inflection point where shale matures from a growth industry to one that generates dividends and share buybacks for its investors. Completing that transition and setting the stage for the next 10 years will likely require a round of consolidation and 2020 sets up the needed pieces for this to occur.”

Recommended Reading

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

ARC Resources Adds Ex-Chevron Gas Chief to Board, Tallies Divestments

2024-02-11 - Montney Shale producer ARC Resources aims to sign up to 25% of its 1.38 Bcf/d of gas output to long-term LNG contracts for higher-priced sales overseas.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.