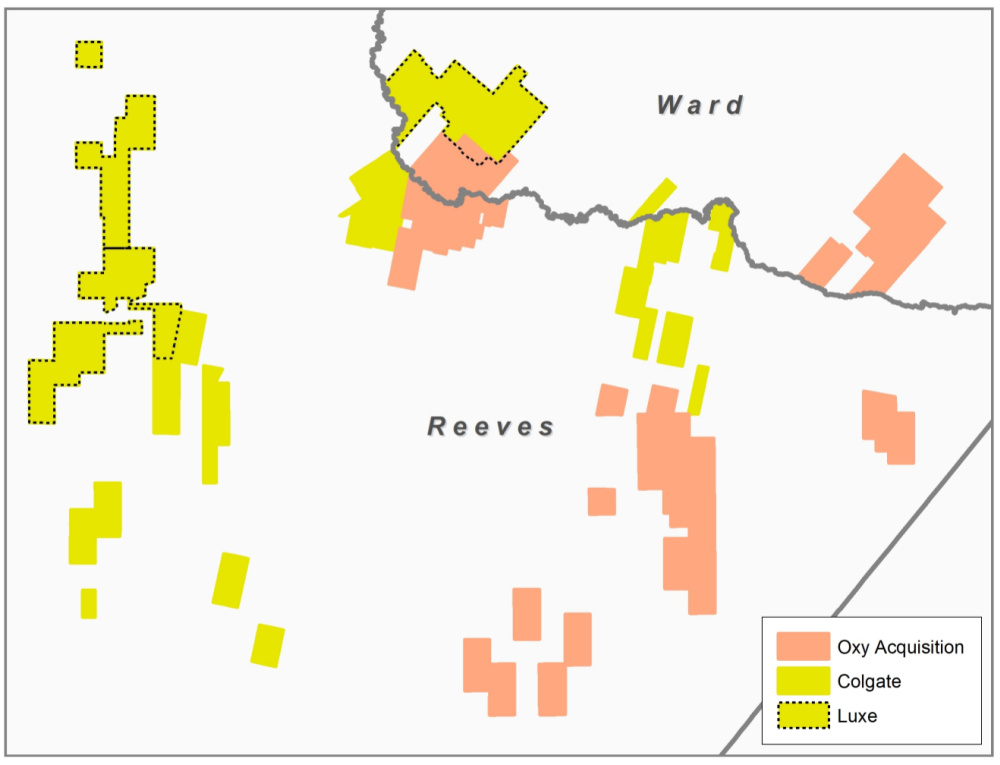

The acquisition from Occidental Petroleum includes roughly 25,000 net acres adjacent to Colgate Energy’s existing position in Reeves and Ward counties, Texas, in the southern Delaware Basin. (Source: Hart Energy)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Occidental Petroleum Corp. agreed on June 10 to sell Permian acreage located in the southern Delaware Basin in West Texas the Houston-based company described as “non-strategic” to privately held Colgate Energy for $508 million.

The transaction signals progress in meeting the debt reduction goal Occidental set following its acquisition of Anadarko Petroleum in 2019, which caused its debt to balloon. This year, the company is planning to complete between $2 billion and $3 billion in asset sales to reduce its debt.

Meanwhile, the acquisition is Colgate’s second this month so far as the company agreed to acquire privately held Luxe Energy LLC in the Permian Basin as well in an all-stock transaction on June 2. Both acquisitions, according to Co-CEO James Walter, truly puts Colgate in a differentiated position.

“These two transactions complement each other perfectly, creating a scaled business with increased relevance in public markets, and ample liquidity to execute on our highly accretive development program,” Walter said in a statement on June 10.

Colgate was founded in 2015 by Walter and Will Hickey, who also serves co-CEO, with initial equity commitments from Pearl Energy Investments and NGP. Based in Midland, Texas, the company is actively developing properties in Reeves and Ward counties, Texas, and New Mexico’s Eddy County, according to its website.

In his statement, Walter noted the equity contribution from the Luxe deal helped put Colgate in a place where it could fund a cash acquisition of this size from Occidental Petroleum while remaining within its debt parameters.

The acquisition from Occidental includes roughly 25,000 net acres adjacent to Colgate’s existing position in Reeves and Ward counties, Texas, in the southern Delaware Basin. Current production is approximately 10,000 boe/d from about 360 active wells.

“The acquisition of these assets in the core of the southern Delaware Basin is a transformational deal for Colgate that checks all of the boxes of our acquisition criteria,” Hickey said. “It is a great mix of low decline production and high rate of return locations that will immediately compete for capital with our existing portfolio.”

Pro forma for the acquisition, Colgate’s position in the Permian Basin will cover roughly 83,000 net acres located primarily in Reeves, Ward and Eddy counties. The company said it anticipates running a five to six rig program by year-end 2021 with estimated average net daily production of about 55,000 boe/d.

Also, pro forma, the company said it is estimating a 2022 EBITDAX of about $750 million an Nymex pricing, or $875 million excluding projected hedge settlements. Plus, due to strong high yield market conditions the company’s anticipated pro forma borrowing base is currently over $550 million with potential for further equity funding providing optionality for ultimate financing of a transaction, a company release said.

The effective date of the transaction is April 1, with closing expected by both Colgate and Occidental in third-quarter 2021.

Occidental’s proceeds from the sale will be applied toward debt reduction, which will bring the total to over $1.3 billion of the planned $2 billion to $3 billion for the year, according to President and CEO Vicki Hollub.

“We continue to advance our divestiture and deleveraging goals while delivering value for our shareholders,” Hollub said in a statement on June 10.

Hollub added that Occidental has divested more than $9 billion of assets since closing the Anadarko deal in August 2019. The company’s long-term net debt stood at roughly $35.5 billion as of March 31, according to a regulatory filing.

Recommended Reading

Marketed: KJ Energy Operated Portfolio in East Texas

2024-04-16 - KJ Energy has retained TenOaks Energy Advisors for the sale of its operated portfolio located in East Texas.

Exclusive: Pat Jelinek on Decarbonization Efforts, M&A Outlook

2024-04-16 - Oil and gas leader for EY Americas Pat Jelinek discusses trends in the Lower 48 like consolidation and why decarbonization is "more important" in the near term than the energy transition, in this Hart Energy Exclusive interview.

EnQuest Selling Stake in North Sea Golden Eagle Oilfield, Sources Say

2024-04-16 - EnQuest has struggled in recent years with high debt levels and a drop in profits after Britain imposed a 35% windfall tax on North Sea producers.

Kimmeridge Withdraws SilverBow Deal to Focus on E&P’s ‘Broken’ Board

2024-04-16 - Investment firm Kimmeridge said it had withdrawn its offer to combine its Eagle Ford E&P with SilverBow Resources as it promotes a slate of independent directors for SilverBow’s board at the company’s May annual meeting.

EQT Strengthens Appalachian Position in Swap with Equinor

2024-04-16 - EQT, the largest natural gas producer in the U.S., is taking greater control of the production chain with its latest move.