Western Midstream Partners has assets located in the Rocky Mountains, North-central Pennsylvania, Texas and New Mexico. (Source: Anadarko Petroleum Corp.)

Occidental Petroleum Corp. is reportedly exploring the sale of the midstream MLP that Occidental is set to inherit through its pending takeover of Anadarko Petroleum Corp.

Bloomberg first reported the rumors on June 24 citing unnamed sources. According to the Bloomberg report, Occidental is working with a financial adviser to market half of Anadarko’s interest in Western Midstream Partners LP and its general partner.

Proceeds from the rumored sale would be used to support its $57 billion acquisition of Anadarko Petroleum, which the companies agreed to in early May. The transaction, expected to close in the second half of 2019, comprises 78% cash and 22% stock plus the assumption of Anadarko debt.

A sale of Western Midstream would follow strategic maneuvers already orchestrated by Occidental in its takeover battle for The Woodlands, Texas-based independent with Chevron Corp. These include a $10 billion financing deal with Warren Buffett's Berkshire Hathaway Inc. and an agreement to sell Anadarko’s African assets for $8.8 billion.

Analysts with Tudor, Pickering, Holt & Co. (TPH) noted the pace of Occidental’s financing moves to date—the Buffet and Africa transactions were announced within the span of a week— which the analysts said indicated that deal consummation and financial flexibility are the company’s top priorities. Meanwhile, the associated cost of capital is a secondary consideration.

“Given the decline in the commodity backdrop, the urgency around deleveraging has likely only increased,” the TPH analysts wrote in a June 26 research note. “With a singular focus on realizing cash proceeds to improve the balance sheet, we suspected a discounted offer may be made to financial partners for [Occidental’s] roughly $7.4 billion equity stake in [Western Midstream Partners].”

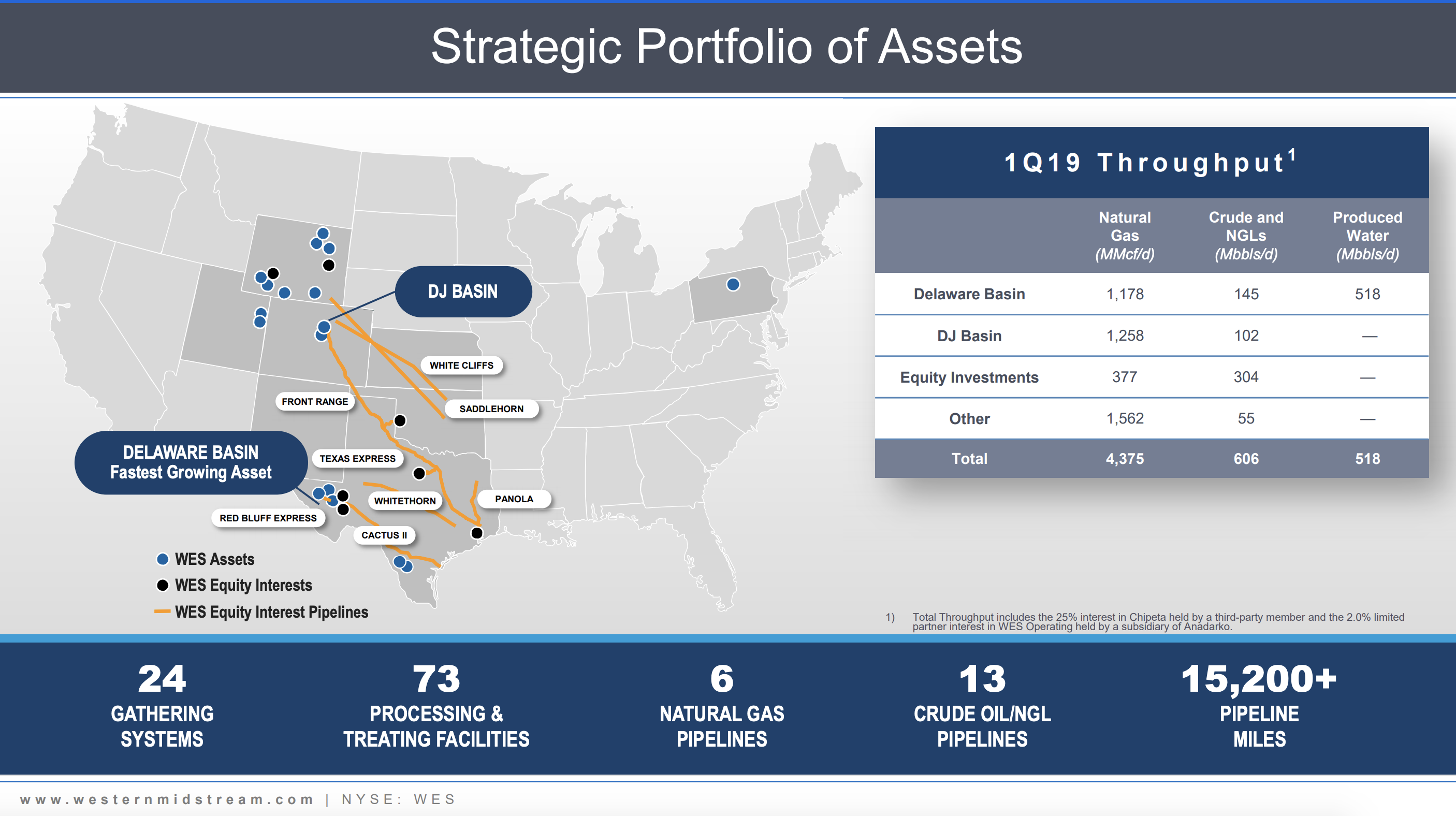

Western Midstream has assets located in the Rocky Mountains, North-central Pennsylvania, Texas and New Mexico. Anadarko owns 55.5% of Western Midstream and all of its general partner, according to filings with U.S. Securities and Exchange Commission.

(Source: Western Midstream Partners LP May 2019 Investor Presentation)

The sale would also follow the recent purchase of fellow midstream MLP, Buckeye Energy Partners LP, to a private-equity firm. Commenting on the Buckeye acquisition announcement in early May, Stacey Morris, director of research at Alerian, said the transaction highlighted the ongoing disconnect between how public markets vs. private-equity companies are valuing midstream companies, particularly MLPs.

However, TPH analysts believe that “[the] media rumor of a potential sale of about 50% of the stake may indicate that buyers of that scale have been limited despite the recent [Buckeye Partners] buyout of more than $10 billion.”

Further, the analysts said the retention by Occidental of roughly 50% of the equity stake in Western Midstream would exceed prior expectations and limit balance sheet impact.

“Given sector valuations, we see a bid in the low $30’s as reasonable translating to a modest premium from trading range,” the TPH analysts wrote.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.