Largely believed to be key to the takeover battle that erupted over Anadarko Petroleum is the company’s nearly 600,000 gross-acre position in the Permian’s Delaware Basin. (Source: Hart Energy/Shutterstock.com)

The massive acquisition of Anadarko Petroleum Corp. by Occidental Petroleum Corp. for $38 billion will have only a slight impact on the remaining Permian Basin players who are seeking deals, according to Drillinginfo analysts.

“Wall Street is still very bearish overall on the exploration and production sector,” said Andrew Dittmar, a mergers and acquisition analyst with the Austin, Texas-based energy analytics company. “They are not particularly supportive of acquisitions.”

Dittmar and Tyler Krolczyk, another mergers and acquisition analyst for Drillinginfo, discussed the Permian Basin and how the remaining players could be impacted after Occidental’s purchase of Anadarko during a recent webinar.

Anadarko agreed to the deal with Houston-based Occidental on May 9 after backing out of an earlier merger agreement made with San Ramon, Calif.-based Chevron Corp.

Houston-based Occidental’s offer for Anadarko, which received approval by the U.S. Federal Trade Commission (FTC) earlier this month, is comprised of 78% cash and 22% stock. The total value of the transaction is roughly $57 billion including the assumption of debt. In comparison, Chevron’s earlier offer was worth about $48 billion comprised of 75% stock and 25% cash plus debt.

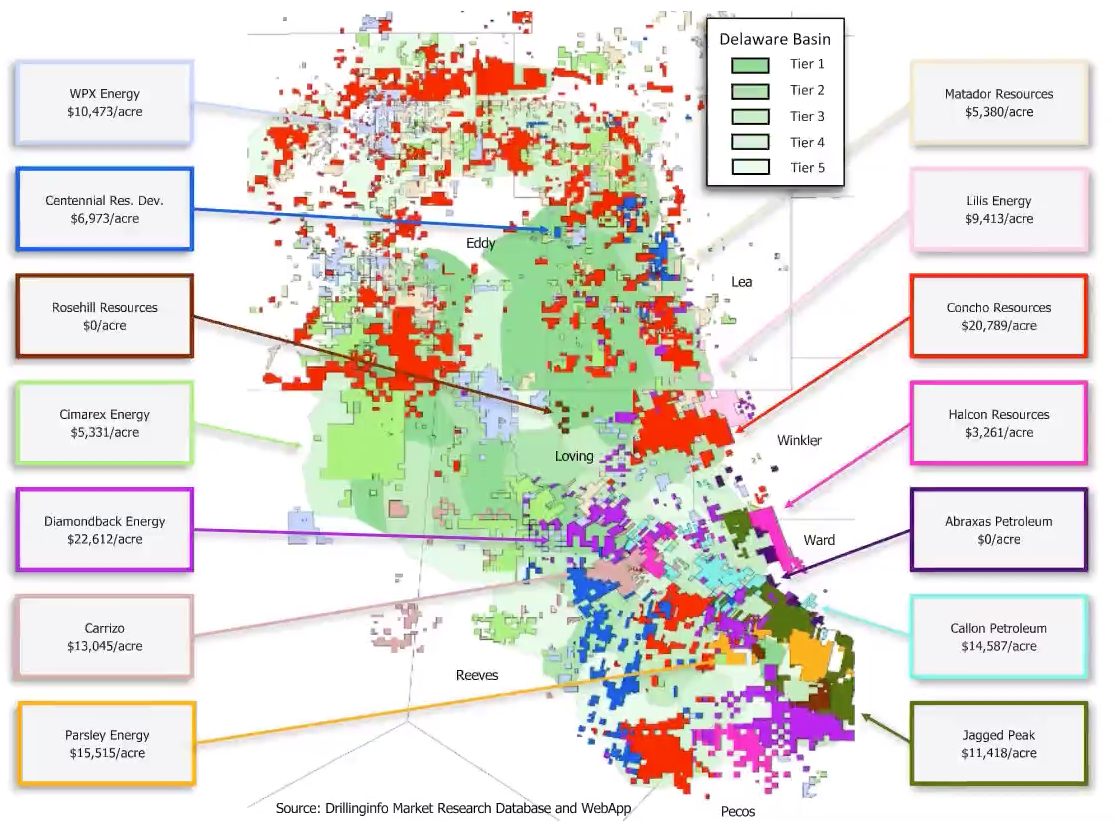

Anadarko, based in The Woodlands, Texas, is one of the world’s largest independent E&P companies and its assets included deepwater projects offshore Africa and in the U.S. Gulf of Mexico plus a position in Colorado’s Denver-Julesburg Basin. Largely believed to be key to the takeover battle that erupted over Anadarko is the company’s nearly 600,000 gross-acre position in the Permian’s Delaware Basin.

The Permian Basin remains highly fragmented and its assets are profitable because of the low cost to produce oil from the region, said the Drillinginfo analysts.

According to Dittmar, the current market valuation of E&P companies in the Permian Basin have dropped by over 50% since the 2016 to 2018 period. He noted that the dollar per acreage amount at that time was $50,000 per acre or more in deals for public E&P companies.

Today, however, Wall Street is valuing top operators in the Permian Basin at $20,000 per acre after adjusting for the value of existing production.

“The market is repricing what they deem acreages to be worth,” he said. “The public companies are trading at a significant discount now to where they were before.”

Still, the Permian Basin remains the most attractive unconventional plays in the public energy market because of its breakeven costs, particularly in the Delaware Basin, Dittmar said.

Wall Street bankers and analysts remain “skeptical” on whether E&P companies can generate free cash flow although there are still many potential acquisition targets available, he added.

Per Dittmar, three of the top independent companies in the Permian Basin are Diamondback Energy Inc., Pioneer Natural Resources Co. and Concho Resources Inc. He explained the companies are viewed as top tier operators due to their acreage plus they trade at a significant premium on a dollar per acre basis and with a forward EBITDA multiple to the smaller sized companies.

Although deals have been scarce in recent years due to the volatility of crude oil prices, Dittmar said the Permian Basin region remains a good acquisition target for public companies.

“We think from a structural and valuation perspective that consolidation still makes a lot of sense in the Permian,” he said.

The region has many potential and attractive acquisition targets. The problem, he said, is that companies are refraining from seeking deals because of the fear of a negative reaction from their shareholders,.

The trepidation is real for Occidental as well. The company’s shareholders criticized the takeover of Anadarko, including activist investor Carl Icahn who filed a lawsuit against Occidental in May due to the transaction.

One of the main issues for the backlash is the disparity on values—what buyers are willing to pay compared to the prices that sellers would accept, Dittmar said.

Another driver adding to a slowdown of deals is the volatility of commodity markets, especially as the price of crude oil dips into the high $40s and then falls back to the low $50 range.

Unless buyers are more optimistic on prices or sellers capitulate and are willing to accept lower premiums on deals, Dittmar expects the standstill in mergers may remain.

“A lot of companies have a good line of sight to free cash flow, but Wall Street is not accepting promises,” he said. “They want to have the results in free cash flow in hand before they return to E&P stocks.”

Until then, Dittmar believes the outlook on consolidation will remain uncertain.

“The market will have to get past the bid-ask spread before you see any kind of rush into deals,” he said.

Recommended Reading

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

US Drillers Cut Oil, Gas Rigs for Second Time in Three Weeks

2024-02-16 - Baker Hughes said U.S. oil rigs fell two to 497 this week, while gas rigs were unchanged at 121.