Upon completion of the transaction, Oasis Petroleum will own approximately 21.7% of Crestwood common units. (Source: Crestwood Equity Partners LP)

Oasis Petroleum Inc. agreed to sell its midstream affiliate in a $1.8 billion transaction that CEO Danny Brown said gives the Houston-based independent E&P company an advantage in future M&A activity.

“Oasis is now well-positioned to further participate in industry consolidation opportunities,” Brown commented in an Oct. 26 release.

Oasis recently closed on a $745 million acquisition of Diamondback Energy’s Bakken asset on Oct. 21, completing its transformation into a pure-play Williston Basin operator. The strategic shift included the sale of its Permian Basin position on the upstream side through a series of transactions earlier this year.

In its release on Oct. 26, Oasis said that Oasis Midstream Partners had entered into a definitive agreement under which it will merge with Crestwood Equity Partners LP in an equity and cash transaction.

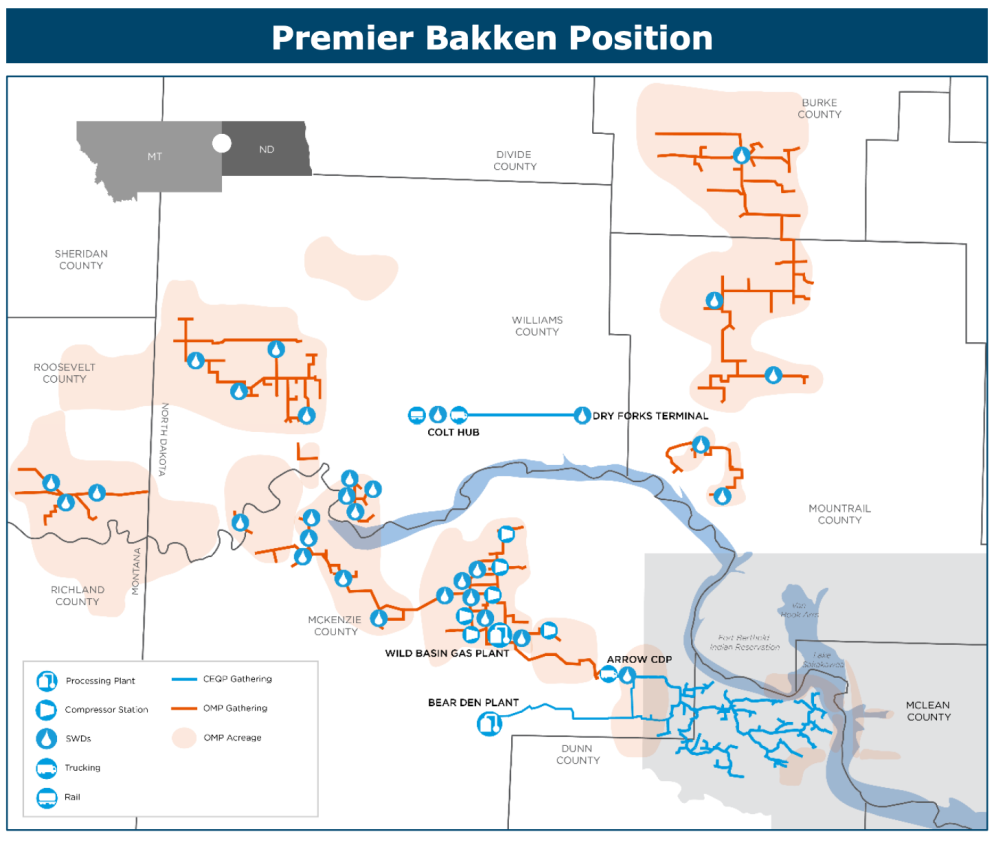

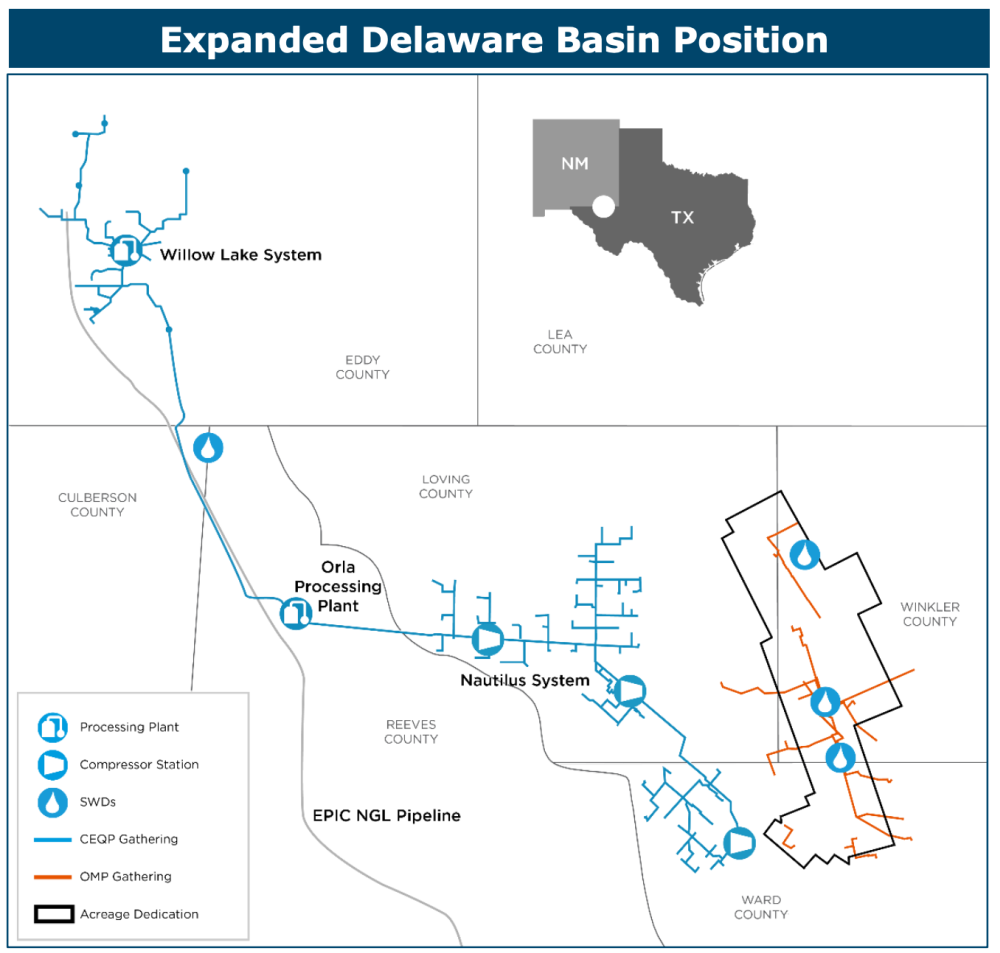

Oasis Midstream Partners, which went public in September 2017, was formed by Oasis as its sponsor to own, develop, operate and acquire a diversified portfolio of midstream assets. The company’s current assets are located in the heart of the oil-rich Bakken and Permian basins, according to its website.

“The combination of OMP and Crestwood immediately enhances value for Oasis shareholders while increasing transparency with deconsolidated financial reporting, highlighting the Company’s E&P operations,” Brown said.

In exchange for Oasis’ approximately 33.85 million OMP common units and non-economic GP interest, Oasis will receive $160 million in cash and 21 million common units in Crestwood, representing an attractive valuation of roughly 8x 2021E OMP EBITDA, according to the release.

Upon completion of the transaction, Oasis will own approximately 21.7% of Crestwood common units. Public OMP unitholders, which will receive 0.87 units of Crestwood common units for each unit of OMP owned as part of the transaction agreement, are expected to own approximately 35% of Crestwood’s outstanding common units.

“Additionally,” Brown continued, “Oasis expects to benefit from its remaining ownership in the new Crestwood which, following this accretive merger, will be a larger, more diversified midstream entity with a strong balance sheet and an attractive outlook.”

In a statement commenting on the transaction, Robert G. Phillips, chairman, president and CEO of Crestwood, touted the strong industrial logic of the company’s acquisition of Oasis Midstream explaining that the transaction “perfectly aligns with our stated strategy of consolidating high quality midstream assets in our core operating areas.”

“This transaction enhances our competitive position in the Williston and Delaware basins,” Phillips said in a release, “enables Crestwood to capture substantial operational, commercial, and capacity synergies as we integrate the Oasis Midstream assets into our existing operations, and substantially expands the long-term contract acreage and inventory dedications of our gathering and processing portfolio.”

Crestwood was originally formed through a partnership in 2010 with First Reserve to pursue investments in midstream assets located in unconventional resource plays. The Houston-based company currently owns and operates midstream assets located primarily in the Bakken Shale, Delaware Basin in the Permian, Powder River Basin, the Appalachian Basin’s Marcellus shale play and the Barnett Shale in North Texas.

In addition to expanding Crestwood positions in the Williston and Delaware basins, the company expects the Oasis Midstream acquisition to provide an opportunity to realize approximately $45 million in commercial and cost reduction synergies plus drive substantial accretion to distributable cash flow, resulting in the acceleration of its return of capital strategy to its common unitholders.

“Importantly, we are completing this transaction during a period when macro oil and gas fundamentals are exceptionally supportive of upstream development and there is increasing demand for midstream infrastructure and services,” Phillips noted.

The total transaction value of approximately $1.8 billion includes the assumption of Oasis Midstream’s outstanding debt of roughly $660 million as of Sept. 30.

In the aggregate, the total consideration for the transaction represents an at-the-market transaction based on the closing prices for OMP and Crestwood on Oct. 25, and implies an enterprise value for the combined companies of about $6.9 billion, the release said.

In connection with the transaction, Oasis Petroleum will also receive the right to appoint two representatives to Crestwood’s board of directors, subject to ongoing ownership thresholds.

The transaction terms were reviewed, negotiated and approved by the conflicts committee of the board of directors of the general partner of Oasis Midstream. Additionally, Oasis Petroleum has agreed in a support agreement to vote its Oasis Midstream common units representing approximately 70% of Oasis Midstream common units in favor of the transaction.

The transaction is expected to close first-quarter 2022, subject to customary closing conditions.

J.P. Morgan Securities was lead financial adviser, Intrepid Partners LLC served as financial adviser, and Baker Botts LLP was legal adviser to Crestwood for the transaction.

Morgan Stanley & Co. LLC and Tudor, Pickering, Holt & Co. were financial advisers to Oasis Petroleum and its affiliates. Vinson & Elkins LLP was the company’s legal adviser. Jefferies served as financial adviser and Richards, Layton & Finger, P.A. was legal adviser to the conflicts committee of Oasis Midstream.

Recommended Reading

Diamondback Energy to Acquire Permian’s Endeavor for $26B

2024-02-11 - Diamondback Energy will acquire Endeavor Energy in a cash-and-stock agreement that will create a Permian juggernaut with a combined value of more than $52 billion in a merger of near equals.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Elk Range Royalties Makes Entry in Appalachia with Three-state Deal

2024-03-28 - NGP-backed Elk Range Royalties signed its first deal for mineral and royalty interests in Appalachia, including locations in Pennsylvania, Ohio and West Virginia.

Making Bank: Top 10 Oil and Gas Dealmakers in North America

2024-02-29 - MergerLinks ranks the key dealmakers behind the U.S. biggest M&A transactions of 2023.

Diamondback, Verde Plan Converting Permian Natgas to Gasoline

2024-02-13 - Diamondback Energy subsidiary Cottonmouth Venture LLC has entered into a joint development agreement with Verde Clean Fuels to build a natural gas-to-gasoline facility in the Permian Basin.