NuStar Energy LP agreed to sell its St. Eustatius Terminal on May 10 to Prostar Capital in a stock purchase agreement with $250 million.

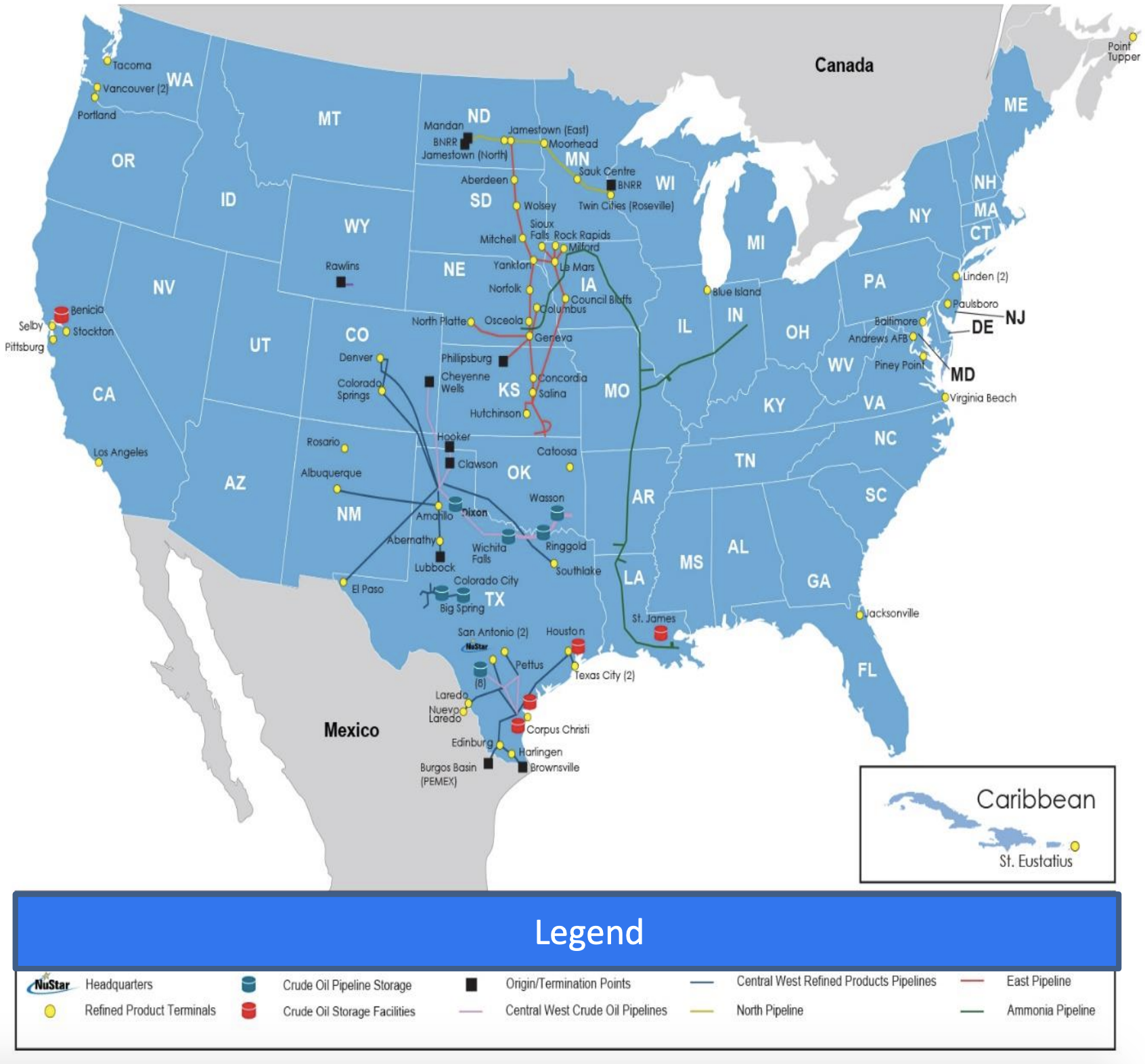

The sale marks NuStar’s exit from the Caribbean, where the storage terminal facility is located, as the San Antonio-based company focuses on growing its core assets in North America including in the Permian Basin.

“We are pleased that this sale allows us to re-deploy the sales proceeds to improve our financial metrics and fund our growth projects for our core business in North America,” Brad Barron, president and CEO of NuStar, said in a statement.

In 2019, Barron said NuStar will focus on its Permian Crude System and other Permian Basin-driven opportunities like its Corpus Christi export facility projects as well as projects along the West Coast of the U.S.

The buyer of NuStar’s St. Eustatius Terminal, Prostar Capital, is a private investment firm established in 2012 to invest in global midstream energy infrastructure assets.

The St. Eustatius Terminal consists of 60 commercial tanks and associated deepwater jetties and pipelines, with a total storage capacity of 2.3 million cubic meters. Located in the Caribbean region, the facility serves several key trading countries, said Steve Bickerton, senior managing director of Prostar.

“We are excited to be acquiring a high-quality terminal facility with many key strategic advantages, including a location at the crossroads of global and regional oil trade, long-term customer relationships with major global oil traders, a strong local operations team, and a highly flexible infrastructure that allows for capacity expansion as growth opportunities arise,” Bickerton said in a statement.

Prostar has originated and managed energy infrastructure investments representing more than $400 million of equity capital invested. The firm operates from offices in Sydney, Hong Kong and Greenwich, Conn.

NuStar first quarter results included non-cash impairment charges of $328 million, related to its St. Eustatius operations, which resulted in a net loss of $278 million for first-quarter 2019.

Barron said he expects to close the transaction by the end of second-quarter 2019.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Proven Volumes at Aramco’s Jafurah Field Jump on New Booking Approach

2024-02-27 - Aramco’s addition of 15 Tcf of gas and 2 Bbbl of condensate brings Jafurah’s proven reserves up to 229 Tcf of gas and 75 Bbbl of condensate.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.