Equinor landed a record third-quarter profit on Oct. 28, driven by all-time-highs in European gas prices, and raised its dividend payout despite a lower 2022 output forecast.

The Norwegian oil and gas producer's adjusted earnings before tax for July-September rose to $24.3 billion from $9.77 billion a year earlier, beating the $23.5 billion predicted in a poll of 26 analysts compiled by Equinor.

"The Russian war in Ukraine has changed the energy markets, reduced energy availability and increased prices," CEO Anders Opedal said in a statement.

"High production combined with continued high price levels resulted in very strong financial results," he added

Equinor, majority-owned by the Norwegian government, became Europe's largest supplier of natural gas this year as Russia's Gazprom cut deliveries amid western support for Ukraine.

Equinor's previous profit before tax record was $18 billion and was set in the first quarter.

It now expects its output to grow by 1% in 2022 compared to last year, down from a previous projection of 2% as the Johan Sverdrup Phase 2 development was set to come on stream later in the fourth quarter than originally planned.

Equinor blamed operational issues at several other fields but did not elaborate on when the Sverdrup increase could occur.

Junior partner Aker BP earlier this week said it expected Sverdrup Phase 2 to come on stream in early December, two months later than it had previously predicted.

Phase 2 is expected to increase Sverdrup's production capacity by 220,000 boe/d just as the European Union's ban on Russian seaborne crude imports comes into an effect in December.

Equinor lifted its extraordinary dividend, paid as a result of high oil and gas prices, to $0.70 per share for the third quarter from $0.50 in the second, corresponding to an increased payment of about $640 million.

The company kept its regular quarterly dividend payment at $0.20 per share and maintained plans for share buybacks of $6 billion in 2022.

Europe's benchmark TTF front-month wholesale gas contract soared to a record 343.08 euros per megawatt hour (MWh) in August, but has since fallen to 106.5 euros/MWh due to falling demand, full storages, mild weather and rising LNG supply.

It remains more than four times higher than before Russia began to throttle supplies last year.

Equinor has said it sells most of its gas output on a day-ahead or month-ahead price basis.

"Of course, the [gas] prices in Europe are very high. We have offered long-term contracts to make sure we can have commercial deals that can keep prices more stable," Opedal told Norwegian broadcaster NRK.

The EU has said it plans to coordinate some of its gas purchases in the hope of bringing down prices.

"We will cooperate with those buying institutions planned in the EU and negotiate gas prices in the future," Opedal said.

Equinor, which makes most of its profit from production in Norway, paid $17 billion in taxes during the third quarter and is not subject to additional windfall payments to the government, which owns 67% of its shares.

Equinor's net profit for the quarter amounted to $6.72 billion, while larger European rivals Shell and TotalEnergies on Oct. 27 each reported profits of more than $9 billion.

Equinor's Oslo-listed stocks have risen 59% year-to-date, outperforming a 24% rise in European petroleum stocks thanks to its big gas reserves.

Recommended Reading

Darbonne: The ESG Sword: BlackRock's Life, Death by ESG

2024-04-17 - BlackRock, the $10 trillion investment manager, is getting heat for too much ESG investing, while shareholders are complaining it’s doing too little.

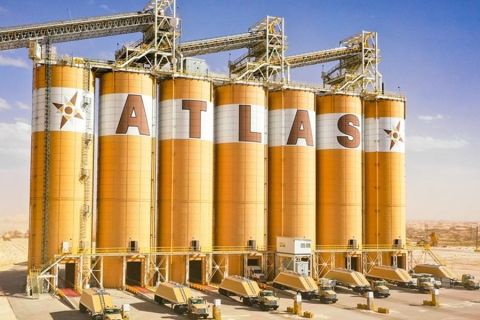

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.