The Johan Sverdrup Field, located in the North Sea offshore Norway, is scheduled to start production in October. (Source: Equinor)

Though the average size of discoveries is smaller than in the past, Norway believes its continental self has more to give as production rises toward what could be a new peak in 2023.

But getting more barrels from the ground will require continued exploration drives, including near mature and existing fields, maintaining infrastructure to enable tiebacks and use of EOR to help unlock resources trapped in tight reservoirs, according to the Norwegian Petroleum Directorate (NPD).

“A great deal of oil and gas has been discovered which is not currently covered by production plans. However, new and more cost-effective technology, better use of data and innovative ways of working could make these resources also profitable,” Ingrid Sølvberg, director of development and operations for the Norwegian Petroleum Directorate (NPD), said in the report. “Technology and expertise are fundamental for a high and energy-efficient level of production in the future. That calls for both the ability and the willingness to make a continued commitment.”

A plus is that cost controls and efficiency improvements gained in recent years have enhanced economics for offshore developments. Operating costs fell on average by 30% between 2013 and 2017, according to the report.

“New solutions, including automation and remote operation, improved use of data and more efficient operation could further reduce costs and help to increase production even more,” the NPD said in its recently released resource report.

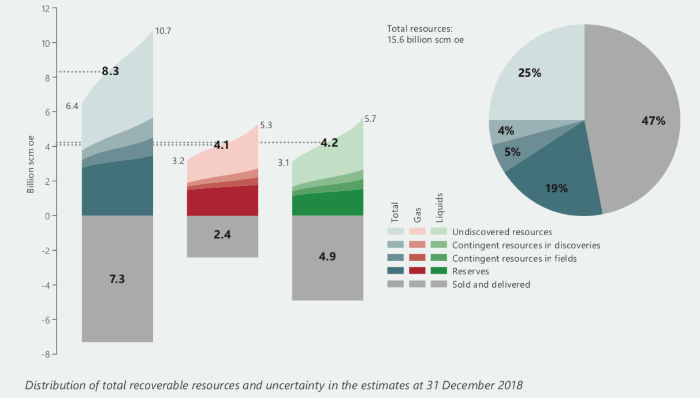

The NPD estimates 8.3 billion standard cubic meters (Bscm) of recoverable resources remain on the Norwegian Continental Shelf (NCS), mostly in the North Sea. About half of this is already proven in fields and discoveries, the NPD said.

Of the 660 million standard cubic meters (MMscm) of oil equivalent resources in the discovery portfolio, NPD said about 360 MMscm are liquids, and the rest is gas. Developing these resources would require about NOK400 billion (US$43.8 billion) in investment.

The NPD also pointed out that although the number of discoveries hasn’t changed much since 1999, the average discovery size is about three times smaller. The average size dropped to 7.8 MMscm of recoverable oil equivalent from 20.8, forcing companies to make smaller resource bases profitable. “This has so far been successful,” NPD said in the report.

Many companies have improved the economics of offshore developments, both on the NCS and elsewhere like the U.S. Gulf of Mexico, by utilizing existing infrastructure and taking a phased approach to development.

The NPD said it believes this will be the most common development solution for discoveries. Plans indicate about 80 discoveries will take this route toward developing roughly 500 million scm of recoverable oil equivalent.

Subsea tiebacks comprise the bulk.

There is also potential to add resources by redeveloping some of the 25 fields shut down on the NCS if technology development, new infrastructure and positive market changes steer the fields toward profitability.

The Tor Field, near Ekofisk in the Norwegian North Sea, was among the NPD’s examples. The field was shut down in 2015, but ConocoPhillips and partners plan to redevelop it. Plans include a two-by-four slot subsea production system, tied to the Ekofisk complex, with eight production wells.

“Total capital investments are in the range of NOK 6.0-6.5 billion (US$600-$800 million) gross and first production is targeted toward the end of 2020,” ConocoPhillips said in July. “The selected development concept has robust economics and a cost of supply below USD 30.”

Meanwhile, more major developments slated for startup, including Johan Sverdrup in the North Sea this year and Johan Castberg in the Barents Sea in 2022, are expected to add to production volumes.

But fields already in production have “substantial remaining oil reserves,” though they make up only 15-30% of the original reserves. These fields include Snorre, Valhall, Grane, Heidrun and Ekofisk. Likewise, gas fields—including Snøhvit, Oseberg, Ormen Lange and Åsgard—also have substantial reserves left.

“Efforts to adopt improved recovery measures, so that all resources of commercial value to society get produced, are therefore important,” the report said.

Already, some 150 projects—mainly new wells—were underway in 2018 to increase oil and gas production, possibly paving the way toward the recovery of 200 MMscm of oil equivalent.

But EOR methods could further increase volumes, including the so-called “challenging barrels” in tight reservoirs, according to the NPD.

A study conducted by the NPD in 2018 revealed there could be an estimated 2,000 MMscm of oil equivalent in place in 42 discoveries and fields. Norway’s North Sea had the highest mapped volumes in place for oil at 750 MMscm, while the Norwegian Sea had the highest for gas at 420 Bscm.

“Achieving profitable production from tight reservoirs calls for measures to increase exposure to the wells, so that the oil and gas flow better. This can be done by fracturing the formation close to the wells and/or by drilling many well paths in the tight zones,” NPD said in the report.

“Various types of fracturing and multilateral wells are currently the most relevant methods for recovering resources in tight reservoirs. Fracturing combined with acid stimulation is used on the carbonate fields in the Ekofisk area,” it said. “Tiny-hole technology is also appropriate in a number of places, with many holes in the same well increasing exposure to the reservoir and allowing oil and gas to flow more easily into the wells.”

NPD added that water and gas injection combined with fracturing can also improve recovery.

In all, the recovery potential was put at 450 MMscm oil equivalent for the 42 discoveries and fields covered in the study.

Recommended Reading

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.