Northern Oil and Gas Inc. will deepen its inventory within the core of the Williston Basin with an acquisition on April 22 from Flywheel Energy LLC worth more than $310 million.

The nonop-focused E&P based in Minneapolis will acquire the Williston Basin properties of VEN Bakken LLC consisting of roughly 18,000 net acres, 100% HBP. Production from 86.9 net producing wells included in the acquisition is expected to reach about 6,600 barrels of oil equivalent per day (boe/d) during the second half of 2019.

Northern Oil and Gas agreed to pay the Flywheel Energy subsidiary $165 million in cash, a $130 million 6% three-year senior unsecured note due 2022 and roughly 5.6 million shares of Northern’s common stock for the assets. The company said it does not anticipate accessing the public equity or debt markets for the transaction.

Flywheel Energy began as Valorem Energy in early 2017 with backing from the Kayne Anderson Private Energy Income Fund. Valorem acquired its interests in the Williston Basin from Linn Energy Inc. for $285 million by December 2017, which the Flywheel organization continues to retain, according to the company website.

In August 2018, the Kayne Anderson fund committed a second time to the management team with $700 million of equity in the form of the newly-formed Flywheel Energy. Concurrently, Flywheel also agreed to buy Southwestern Energy Co.’s Fayetteville Shale business for $1.865 billion in cash. The transaction, which closed December 2018, also included the assumption of about $438 million of future contractual liabilities.

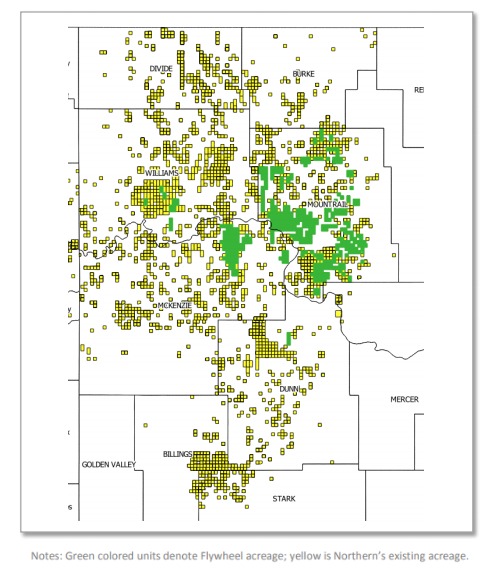

Williston Basin Acquisition Map

(Source: Northern Oil And Gas Inc. April 2019 Presentation)

Northern Oil and Gas expects the acquisition from Flywheel to further crystalize its identity as the largest pure-play Williston nonoperator

Pro forma the Flywheel acquisition, Northern nonoperated position in the Williston Basin covered roughly 157,000 net acres producing about 36,000 boe/d during fourth-quarter.

Northern CEO Brandon Elliott said the Flywheel acquisition adds durable cash flows, core drilling inventory, hedges and low leverage.

“This transaction furthers our stated goals of allocating capital to generate free cash flow in low commodity prices, keep debt metrics low, and grow our debt-adjusted cash flow per share,” Elliott said in a statement.

The assets are expected to generate roughly $44.9 million in cash flow from operations (unhedged) during the second half of 2019, with an estimated capex of $15.6 million.

The transaction also includes 2.7 net wells in process and 47.5 net undrilled locations across the heart of the Williston Basin. Operators on the assets include Encana Corp., ConocoPhillips Co., Slawson Exploration, Hess Corp., Whiting Petroleum Corp. and Continental Resources Inc.

Nick O’Grady, CFO of Northern, estimates the acquisition price is less than 3.5 times cash flow, which means the asset should see multi-year production growth while being self-funding and still generating excess free cash flow.

“The additional size and scale provided from this acquisition serve to continue to grow our borrowing base and reduce our per unit G&A costs to industry-leading levels,” O’Grady said in a statement.

Northern said it expects the acquisition will close July 1, which will also be the effective date of the transaction.

Law firm Vinson & Elkins advised the Flywheel Energy subsidiary in the transaction.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.

Ozark Gas Transmission’s Pipeline Supply Access Project in Service

2024-04-18 - Black Bear Transmission’s subsidiary Ozark Gas Transmission placed its supply access project in service on April 8, providing increased gas supply reliability for Ozark shippers.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Scathing Court Ruling Hits Energy Transfer’s Louisiana Legal Disputes

2024-04-17 - A recent Energy Transfer filing with FERC may signal a change in strategy, an analyst says.

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.