Chevron became Noble Midstream’s largest customer following its all-stock acquisition of Noble Energy last year. (Source: Chevron Corp.)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Noble Midstream LP has agreed to Chevron Corp.’s offer to acquire all shares of Noble Midstream it doesn’t already own in an all-stock transaction valued at roughly $1.32 billion.

The U.S. oil major said it had reached the agreement with Noble Midstream on March 5, roughly a month after announcing a slightly smaller offer to buy out the pipeline operator.

Chevron became Noble Midstream’s largest customer following its all-stock acquisition of Noble Energy last year. The U.S. oil major cited increased alignment on governance of the Noble Midstream assets as the primary strategic rationale.

“We believe this buy-in transaction is the best solution for all stakeholders, enabling us to simplify the governance structure and capture value in support of our leading positions in the D-J and Permian basins,” Colin Parfitt, vice president of Chevron Midstream, said in a statement on March 5. Parfitt also serves as board chairman of Noble Midstream’s general partner.

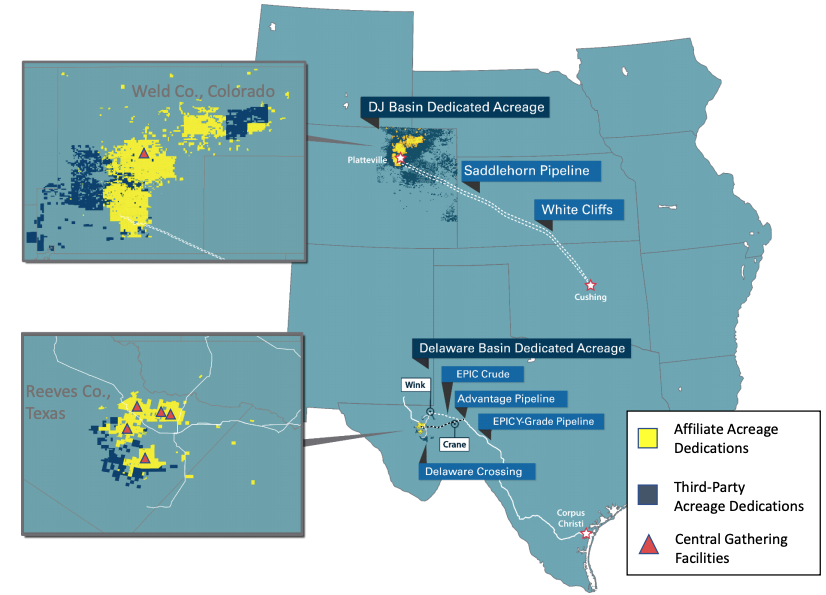

Noble Midstream is an MLP originally formed by Noble Energy and indirectly majority-owned by Chevron. The company provides crude oil, natural gas, and water-related midstream services and owns equity interests in oil pipelines in the Denver-Julesburg (D-J) Basin in Colorado and the Permian’s Delaware Basin in Texas.

Chevron holds a roughly 62.5% stake in Noble Midstream, according to a filing from October.

Under the new agreement, Chevron offered to acquire all 33.925 million publicly held common units representing the LP interests in Noble Midstream not already owned by Chevron and its affiliates in exchange for 0.1393 Chevron shares.

As of the closing price of Chevron stock on March 4, the offer translates to about $14.56 per Noble Midstream share. Under the original offer, announced in early February, Noble Midstream shareholders would have been paid roughly $12.47 per share.

RELATED:

Chevron Offers to Acquire Noble Midstream in Equity Exchange

The transaction is expected to close in the second quarter, according to a Chevron release. A subsidiary of Chevron, as the holder of a majority of the outstanding common units, has voted its units to approve the transaction.

The conflicts committee of the Noble Midstream board, comprised entirely of independent directors, unanimously approved the merger following consultation with its independent legal and financial advisers. The merger was subsequently approved by Noble Midstream’s board.

Citi is acting as financial adviser to Chevron with Latham & Watkins LLP serving as legal adviser. Janney Montgomery Scott is financial adviser and Baker Botts LLP is legal adviser to the conflicts committee of the Noble Midstream board.

Recommended Reading

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.

Post $7.1B Crestwood Deal, Energy Transfer ‘Ready to Roll’ on M&A—CEO

2024-02-15 - Energy Transfer co-CEO Tom Long said the company is continuing to evaluate deal opportunities following the acquisitions of Lotus and Crestwood Equity Partners in 2023.

TC Energy’s Keystone Back Online After Temporary Service Halt

2024-03-10 - As Canada’s pipeline network runs full, producers are anxious for the Trans Mountain Expansion to come online.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.