Chevron became Noble Midstream’s largest customer following its all-stock acquisition of Noble Energy last year. (Source: Chevron Corp.)

Noble Midstream LP has agreed to Chevron Corp.’s offer to acquire all shares of Noble Midstream it doesn’t already own in an all-stock transaction valued at roughly $1.32 billion.

The U.S. oil major said it had reached the agreement with Noble Midstream on March 5, roughly a month after announcing a slightly smaller offer to buy out the pipeline operator.

Chevron became Noble Midstream’s largest customer following its all-stock acquisition of Noble Energy last year. The U.S. oil major cited increased alignment on governance of the Noble Midstream assets as the primary strategic rationale.

“We believe this buy-in transaction is the best solution for all stakeholders, enabling us to simplify the governance structure and capture value in support of our leading positions in the D-J and Permian basins,” Colin Parfitt, vice president of Chevron Midstream, said in a statement on March 5. Parfitt also serves as board chairman of Noble Midstream’s general partner.

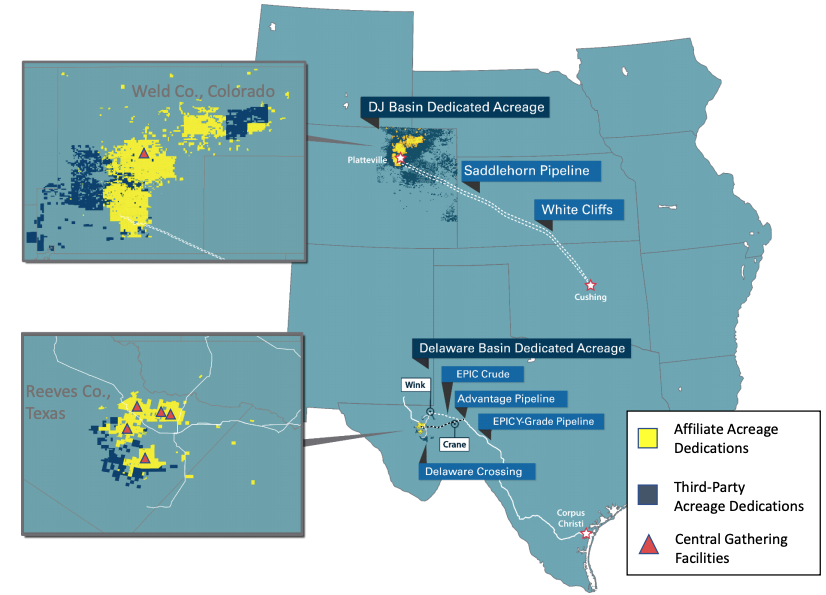

Noble Midstream is an MLP originally formed by Noble Energy and indirectly majority-owned by Chevron. The company provides crude oil, natural gas, and water-related midstream services and owns equity interests in oil pipelines in the Denver-Julesburg (D-J) Basin in Colorado and the Permian’s Delaware Basin in Texas.

Chevron holds a roughly 62.5% stake in Noble Midstream, according to a filing from October.

Under the new agreement, Chevron offered to acquire all 33.925 million publicly held common units representing the LP interests in Noble Midstream not already owned by Chevron and its affiliates in exchange for 0.1393 Chevron shares.

As of the closing price of Chevron stock on March 4, the offer translates to about $14.56 per Noble Midstream share. Under the original offer, announced in early February, Noble Midstream shareholders would have been paid roughly $12.47 per share.

RELATED:

Chevron Offers to Acquire Noble Midstream in Equity Exchange

The transaction is expected to close in the second quarter, according to a Chevron release. A subsidiary of Chevron, as the holder of a majority of the outstanding common units, has voted its units to approve the transaction.

The conflicts committee of the Noble Midstream board, comprised entirely of independent directors, unanimously approved the merger following consultation with its independent legal and financial advisers. The merger was subsequently approved by Noble Midstream’s board.

Citi is acting as financial adviser to Chevron with Latham & Watkins LLP serving as legal adviser. Janney Montgomery Scott is financial adviser and Baker Botts LLP is legal adviser to the conflicts committee of the Noble Midstream board.

Recommended Reading

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.

Exclusive: ‘Reality Has Hit,’ NatGas Not Just a Bridge Fuel, Landrieu Says

2024-04-11 - The Biden administration's LNG pause is "disappointing" and natural gas is a "solution to energy woes," co-chairs for Natural Allies for a Clean Energy Future Senator Mary Landrieu and Congressman Kendrick Meek told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

CEO: Linde Not Affected by Latest US Green Subsidies Package Updates

2024-02-07 - Linde CEO Sanjiv Lamba on Feb. 6 said recent updates to U.S. Inflation Reduction Act subsidies for clean energy projects will not affect the company's current projects in the United States.

Global Energy Watch: Corpus Christi Earns Designation as America's Top Energy Port

2024-02-06 - The Port of Corpus Christi began operations in 1926. Strategically located near major Texas oil and gas production, the port is now the U.S.’ largest energy export gateway, with the Permian Basin in particular a key beneficiary.