Wing Resources nabbed $100MM in NGP backing for Permian minerals deals. (Source: Shutterstock)

Private equity firm NGP continues to partner with Wing Resources in pursuit of mineral and royalty deals in the Permian Basin.

Dallas-based Wing Resources raised $100 million in new equity commitments from NGP for Wing Resources VII LLC, the management team’s seventh partnership with NGP, the companies announced April 20.

NGP invested in Wing Resources VII through NGP Royalty Partners II LP, the firm’s most recent private equity fund aimed at buying mineral and royalty interests.

The Wing Resources team continues to be led by President and CEO Nick Varel, who founded the Permian-focused mineral and royalty acquisition company in 2016.

“We are excited to continue our partnership with NGP to build a premier mineral and royalty acquisition platform focused on delivering superior risk-adjusted returns to its stakeholders,” said Varel. “The Wing VII team believes our mineral and royalty expertise, along with strong equity backing and industry relationships, will enable us to continue creating value in today’s dynamic market environment.”

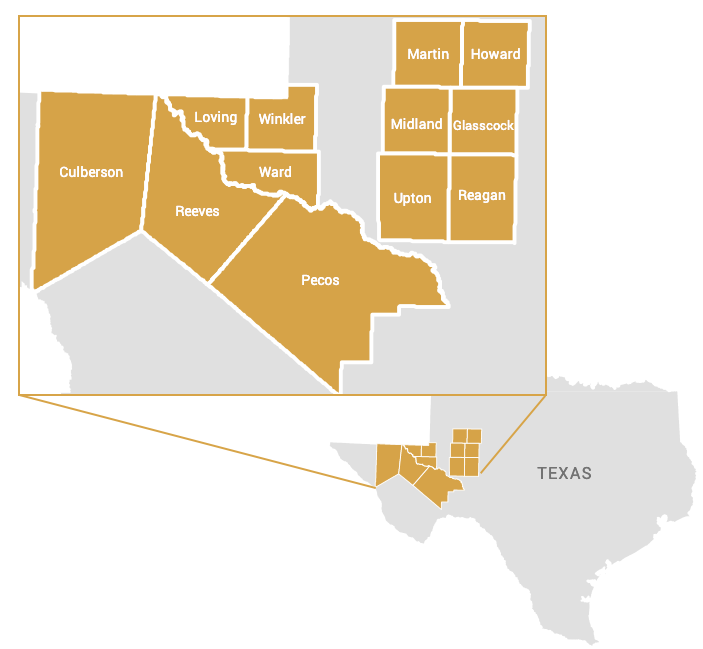

Wing VII plans to continue to focus its mineral and royalty acquisition strategy focused in the Permian’s Midland and Delaware basins.

In 2019, Wing sold oil and gas minerals in the Permian Basin to coal production company Alliance Resource Partners LP for $145 million in cash.

Alliance said it added roughly 9,000 net royalty acres in the Midland Basin through the Wing asset acquisition.

“Nick and the Wing team have built an incredible mineral and royalty franchise with demonstrated results for investors,” said Peter Ray, principal at NGP. “We believe Wing’s highly talented team coupled with its market vision will continue to position the company for long-term success.”

U.S. oil and gas mineral and royalty transactions reached a record $6.8 billion in 2022, according to data from RBC Richardson Barr. That’s nearly double the previous record of $3.5 billion in 2018.

Recommended Reading

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.