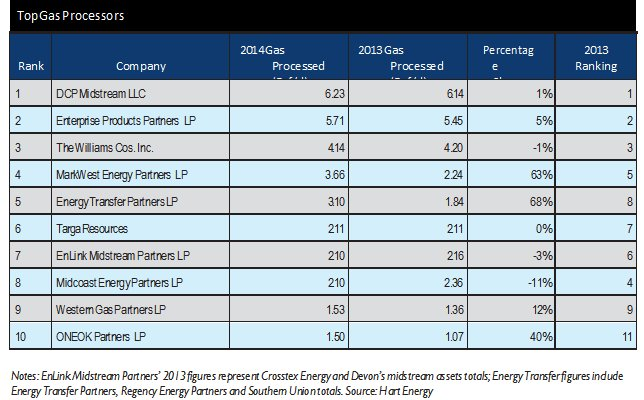

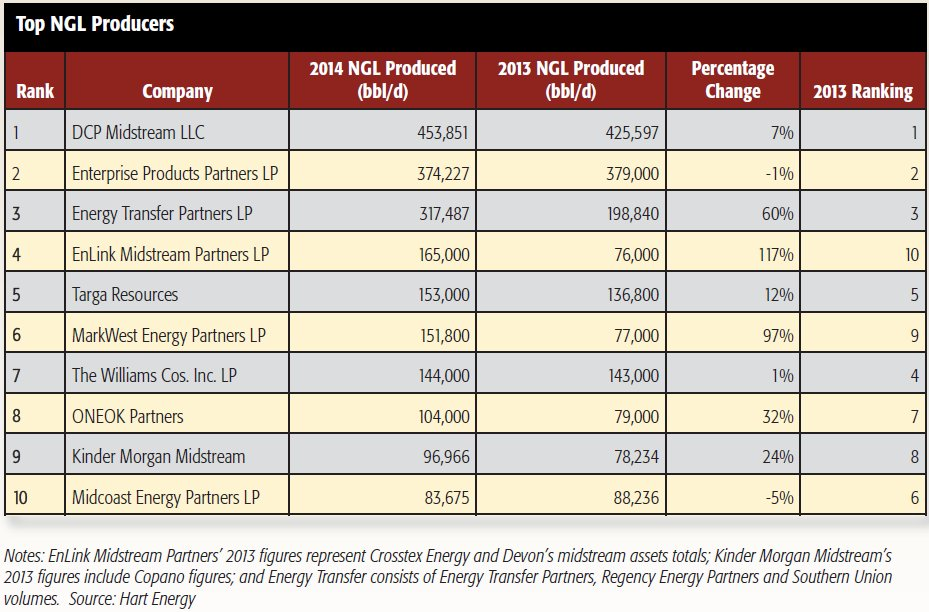

There’s been a great deal of upheaval in the oil and gas industry in the past 12 months. While the midstream was not immune to these changes, the impact was less severe. This was evidenced by the relatively static nature of Midstream Business’ annual gas processor and NGL producer rankings, which saw the top three spots in both categories remain unchanged while still showing growth.

That makes it eight straight years that DCP Midstream LLC has topped both categories with Enterprise Products Partners LP taking second place each year. For the first time in our rankings, the No. 3 spot in both categories was retained by the same companies. Energy Transfer Partners LP and The Williams Cos. Inc. held their positions on the NGL producers and gas processors rankings, respectively.

Only one new entrant made its way onto the charts as ONEOK Partners LP moved into the top 10 NGL producers. Of course, ONEOK was already one of the top 10 processors.

These figures are sourced and tabulated from the companies and reviewed by an anonymous vetting group of industry experts assembled by Hart Energy. The criteria for our rankings remain the same: Results are based on all volumes processed and produced at companies’ processing plants and fractionators for the prior calendar year. Our results are tabulated the following year to allow for final accounting of figures by companies.

That isn’t to say that there aren’t major movements taking place in the rankings as MarkWest Energy Partners LP and EnLink Midstream Partners LP both experienced impressive gains. Interestingly, each company’s performance is indicative of two of the biggest stories in the midstream over the past 12 months.

Location benefits

As the rig count has decreased, more producers are focusing on drilling in the Marcellus, Utica and Eagle Ford shales—as well as the Permian Basin— because of the economics represented by those plays. MarkWest is the largest processor in the Marcellus, which helped the company increase its processing volumes by 63% in 2014. The company’s total 2014 processing volume of 3.66 billion cubic feet per day (Bcf/d) was backed by more than 2.5 Bcf/d in the Marcellus. While the company adds processing capacity, it is slowing down the schedule for when this capacity will come online in order to match the demand of producers.

“Over the course of 2014, we brought online 920 million cubic feet per day (MMcf/d) of Marcellus processing capacity with the completion of five new plants,” Frank Semple, chairman, president and CEO of MarkWest, said during the company’s fiscal year 2014 earnings conference call. “We’ve adjusted the completion dates for nine of those 15 plants under construction. This will allow us to provide just-in-time capacity to support our customers and increase the utilization of our existing facilities. Upon the completion of the announced projects, we will increase our Marcellus processed capacity to 4.9 Bcf/d and fractionation capacity to over 360,000 barrels per day (bbl/d).”

MarkWest also experienced a 97%increase in NGL production from its 2013 figures. Based on current rig counts, further gains can be expected in 2015 as about 90% of its capex is in the Marcellus and Utica. The company, which recently announced it would be acquired for $15.63 billion by MPLX LP, will increase its processing capacity to 8.2 Bcf/d and fractionation capacity to more than 600,000 bbl/d.

The merger with MPLX, which is one of the largest NGL logistics companies in the Appalachian Basin, will further increase capacity and build up the midstream infrastructure in the Marcellus and Utica.

Opportune time for growth

One company that has already benefitted from a merger has been EnLink, which vaulted from 10th to fourth in the NGL producer rankings while taking a slight decrease in the processor rankings with relatively flat volumes. The company, which was created through the merger of Crosstex Energy Inc. and Devon Energy Corp.’s midstream assets, has been one of the midstream’s most active players.

Even though the company did not officially begin operations until March 2014, EnLink posted impressive figures. The company’s NGL production increased 117% from 76,000 bbl/d in 2013, when Devon and Crosstex reported combined figures, to 165,000 bbl/d in 2014. There was a small decline in gas processing, which was a reflection of the focus on crude and liquids production in EnLink’s core areas of operation.

Crosstex already had a pretty sizable asset base in the Permian prior to this merger but is able to improve on this position due to achieving investment-grade status through the equity raise in the merger as well as having a larger portfolio. The new company made a pretty big splash at the start of 2015 when it announced the $600 million acquisition of Coronado Midstream Holdings LLC. This was one of the first large acquisitions in a slumping market.

EnLink has also gone about diversifying its asset base as well as focusing on core areas, which included both acquisitions and divestments.

“After we completed [the creation of EnLink], we executed a series of divestments and acquisitions that have now placed us in four oil-oriented areas–one up in Canada, the heavy oil SAGD [steam-assisted gravity drainage] project; and three oil-oriented areas on the U.S. side: the Permian Basin, the Eagle Ford and an emerging play we have in the Powder River Basin in Wyoming,” Barry Davis, EnLink’s president and CEO, said during the company’s 2015 analyst conference in New Orleans.

During the company’s second-quarter earnings call, Davis stated that EnLink’s competitive advantages–stability, diversity, scale and a strong partnership with Devon Energy Corp.–are helping it weather the difficult market conditions.

“We have good diversity of basins and services, which is important in a downcycle like this. We have operations in some of the best long-term plays such as Permian, Eagle Ford, Cana Woodford and a market-driven position in Louisiana. We have a strong investment grade balance sheet, which enables us to invest in organic growth projects and capitalize on strategic M&A opportunities. Finally, our strong sponsorship from Devon provides a key competitive advantage by supporting our business with dropdowns, organic growth opportunities and fee-based contracts with minimum volume commitments,” he said during the earnings call.

In 2014, EnLink added 3.4 Bcf/d of new processing capacity, including the 60 MMcf/d Bearkat processing plant in Glasscock County, Texas. In addition to the Coronado acquisition, the company will be adding 100 MMcf/d of processing capacity in the first half of 2016 through the construction of the Riptide processing plant in Marin County, Texas.

Enterprise improves position

Enterprise Products Partners LP also benefitted from a diverse asset base that touches all aspects of the midstream with tremendous scale throughout much of the country. At the end of the first half, the company’s asset base had a$48 billion value with 49,000 miles of natural gas, NGL, crude oil, refined products and petrochemical pipelines; 225 million bbl of NGL, refined products and crude storage capacity and 14 Bcf of natural gas storage capacity; 24 gas processing plants; 22 NGL and propylene fractionators; and Houston Ship Channel import/export capability.

Though Enterprise’s processing and NGL production figures were relatively stable, the company is not resting on its laurels and has been very active with its growth strategy. Not only is Enterprise leading the way in condensate and ethane exports, it is also building various infrastructure in the Permian and at Mont Belvieu.

“We have announced the construction of two cryogenic processing plants to serve the Delaware Basin that are expected to begin service next year,” a company spokesperson told Midstream Business. “The South Eddy, N.M., facility will have a capacity of 200 MMcf/d and is scheduled to begin service in the first quarter of 2016. The Waha, Texas, cryogenic plant is planned for the third quarter of 2016 and will have a capacity of 150 MMcf/d with 75 MMcf/d net to Enterprise. This project is a 50:50 joint venture with Occidental Petroleum Corp.”

The company has also been active in the M&A market with the completion of a $5.9 billion acquisition of Oiltanking Partners LP, which added marine terminals and crude and petroleum products storage capacity, in early 2015.

Enterprise also reached an agreement to acquire EFS Midstream LLC, which includes gathering, treating, compression and condensate processing services in the Eagle Ford, for $2.15 billion from Pioneer Natural Resources Co. and Reliance Industries Ltd. This acquisition includes 460 miles of gas-gathering pipelines, 10 central gathering plants, 780 MMcf/d of gas treating capacity and 119,000 bbl/d of condensate stabilization capacity. Terms call for Pioneer and Reliance to dedicate their Eagle Ford acreage under 20-year contracts with Enterprise for gas processing, NGL transportation and fractionation and gas, processed condensate and crude transportation services.

“We expect additional upside from being able to offer available capacity on these assets to other producers,” Mike Creel, Enterprise CEO, said during the company’s second-quarter earnings call.

Enterprise is also redeploying capital from its $1.5 billion sale of its offshore Gulf of Mexico pipeline assets to Genesis Energy LP into growth opportunities in the Eagle Ford and Permian.

“We believe we will earn higher returns on capital from this redeployment and it’s consistent with our disciplined approach to growth,” Creel said. He added that the company has completed $9 billion of acquisition and capital growth projects in the past three quarters with another $8.3 billion of projects under construction.

Possible megamove

Energy Transfer Partners (ETP) continues to experience major gains. The company remained the third-largest NGL producer following a 60% improvement to 317,487 bbl/d while also moving up from the eighth-largest gas processor to the fifth spot in our rankings following a 68% improvement to 3.1 Bcf/d.

Two years ago, company officials forecasted the firm would become the largest NGL producer in the nation in 2015. It remains to be seen whether ETP can overtake both DCP Midstream and Enterprise Product Partners next year, but there can be no denying the success the large acquisitions of its general partner, Energy Transfer Equity, has had on its operations.

In fact, one of the biggest stories this year has been Energy Transfer’s pursuit of The Williams Cos. While it remains to be seen whether this super merger can be pulled off—so far Williams has rejected any overtures from Energy Transfer—it should be noted that the combined figures of ETP and Williams would top both rankings.

Other deals by Energy Transfer should not be discounted either.

“Not to suggest that we’re preying on the weak, but there’s some assets that fit us very well, that we believe, consolidated into the Energy Transfer family, would make more money. That’s just reality,” the company’s chairman and CEO, Kelcy Warren, said during ETP and ETE’s joint conference call to discuss second-quarter earnings.

Energy Transfer officials remain bullish on the midstream despite the downturn. They not only seek acquisitions, but also continue to announce new construction projects. Warren said that now was not the time to stop the buildout, but rather find more opportunities.

“The pipeline business will overbuild until the end of time. That’s what competitive people do. We’ve done it; others have done it around us. You must scavenge a product from others when you see volumes decline. How do you do that? You provide more services than your peers do. You provide more optionality. This is something we will always live through. [Companies] that give guidance and then turn around and have a bad financial reporting period and then throw all of us under the bus, they say, ‘Don’t focus on us—focus on the industry. This is an industry problem.’ That’s a little frustrating for me,” he said.

This frustration is warranted as there is every indication that while producers are feeling the pains associated with a down-pricing cycle, the midstream has been relatively insulated so far. In fact, the industry has grown in 2015 with further growth anticipated in 2016. While these growth rates are likely to be lower than a few years ago when the crude and liquids markets were booming, demand growth is expected to increase in the years ahead. This will place even greater need for both production and midstream infrastructure and should see the gas processing and NGL production figures grow even larger than they are this year.

DCP Midstream Stays The Course

DCP Midstream LLC once again topped Midstream Business’ natural gas processors and NGL producer rankings, but this year was vastly different for the industry than in the past. While commodity prices plunged, the midstream was largely stable with projects advancing, MLPs meeting distributions and the sector maintaining a solid presence in the public and private markets.

However, all wasn’t picture-perfect for the midstream, and the 2016 outlook could be murkier if commodity markets keep sputtering.

Midstream Business spoke with Wouter van Kempen, chairman and CEO of DCP Midstream Partners and chairman, president and CEO of DCP Midstream, to get his insight into the changing landscape and how the DCP enterprise will continue to grow.

“When the rig count declines by 60%, you’re obviously going to see an impact in midstream. However, there are always silver linings, and the gathering and processing segment is really a real estate business where location matters,” he said.

What this has meant for the industry is that there is a renewed focus on the core areas of plays with good economics and where producers best understand the geology and the cost of operating. It is this focus on core areas that has caused production to remain strong despite this drop in rig count.

According to van Kempen, as companies move from trying to develop new plays, efficiencies would be expected to increase, but the rate at which they’ve improved this year has been surprising. The level of production created through these efficiencies is making it difficult for commodity prices to recover.

“We continue to see very significant production and supplies coming our way whether its NGL, gas or crude. Supply hasn’t really gone down in any material way” he added.

So far the downturn hasn’t seen a significant decrease in midstream activity because operators are focusing on core areas in which producers are operating. “We continue to invest and put capacity in place where it’s needed and where we think we can fill it up quickly. We’re not a ‘build it and they will come’ company. We’re a company that tries to be very closely linked to our producer customers and depending on their needs we build capacity. That means we have very high utilization rates in our assets,” van Kempen said.

One such example is the 200 million cubic-feet-per-day (MMcf/d) Lucerne 2 processing plant in the Denver-Julesburg (DJ) Basin. The facility was brought online at the end of June and it averaged 85% capacity in August with DCP anticipating capacity filling up quickly. DCP also recently brought the 200 MMcf/d Zia II processing plant online in order to meet the needs of producers in the southeast New Mexico portion of the Delaware Basin.

Growing organically

The company also continues to benefit from its diverse asset base in different basins as it has interests in many of the major basins in the country. “If you’re relying on one area or asset and that area is doing well, then you’re doing well, but when prices and activity go down, then you’ll struggle. Having a portfolio like ours, helps to weather the storm in a downturn,” he said.

This asset base also continues to present the company with organic growth opportunities, which typically have less risk due to their lower multiples while being more accretive.

“We’ve grown in this way to the tune of billions and billions of dollars over the last couple of years. At the same time, we look at acquisitions and see if they fit our profile. Over the last few years, transactions have been fully valued with pretty high prices. I think there will be a time over the next couple of quarters if we continue to be in an environment with low commodity prices that there may be more attractive acquisition opportunities,” he told Midstream Business.

Another long-utilized approach that continues to perform well for the company is its integrated-system strategy, which is designed to achieve critical mass in a region by plumbing together multiple assets in the area together in regions such as the Midcontinent, DJ and Permian basins and the Eagle Ford Shale.

“Given our size and scale, this strategy has served us well and continues to serve us well. We like plants to be connected to each other because it creates optionality if drilling decreases around one plant since you can move in volumes from other areas. It also increases reliability for our customers if there is planned maintenance or another outage around a plant as you can move volumes somewhere else,” he said.

Challenging time

van Kempen noted that despite these positives, there have been challenges. “We’re not sitting here with rose-colored glasses on and saying everything is great. We had to do some very difficult things as a result of this downturn. In January, we were one of the first companies to take a staff reduction in this cycle.”

This reorganization was being developed prior to the downturn as company officials felt the need to resize some of its corporate infrastructure, specifically closing some of its field offices related to its legacy operations and prior mergers and acquisitions. Officials also sought to consolidate operations at its Denver headquarters and its offices in Houston. “When crude prices started to tumble in October and November, we took these discussions to the next level so we could effectuate those reductions in January,” he said.

The company’s publicly traded partnership, DCP Midstream Partners, also decided to not increase distributions in 2015 to ensure sustainability as the rig count began to drop last fall.

“We’ve never cut distributions in the past 10 years, and we don’t want to be in a place where we have to do so. That means being prudent and keeping an eye on what’s coming ahead of the market. We’re building additional coverage and trying to make sure DCP Midstream Partners’ balance sheet is in good shape for the future,” he said.

The downturn has also encouraged the company to review its asset base for those that may not fit current strategies. van Kempen said that so far in the past 12 months, DCP Midstream has divested $200 million of assets, including a non-operated interest in a processing plant in the Midcontinent and an interest in a small gathering system in West Texas. “These were underperforming assets that weren’t a great fit with our overall strategy and footprint,” he added.

This footprint will fuel growth in the future as the company anticipates demand for additional gathering and processing capacity in the DJ Basin, as well as additional processing capacity in the Southeast New Mexico portion of the Permian Basin.

DCP Midstream is in the process of becoming less exposed to commodity prices in some portions of its footprint, which will help to improve results going forward.

“We are about 95% fee-based at the partnership level and continue to add fee-based or hedged projects. We tend to be more POP [percentage of proceeds] and commodity exposed in some of the more historical basins like the Permian and Midcontinent. A lot of these are the last bastions of those types of contracts. We’re working very actively to make sure we can get an adequate return under every scenario,” van Kempen said.

Recommended Reading

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.