Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

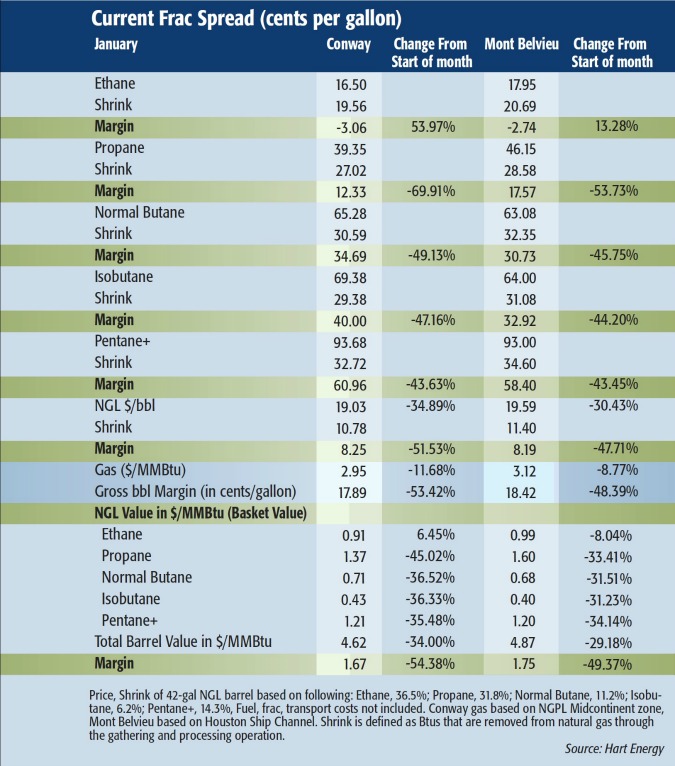

The temperatures experienced in much of the U.S. to start 2015 are an unwelcome cold blast from the past for most Americans, but natural gas and NGL producers are hoping that they bring a price surge similar to last winter.While temperatures are in the same range as last year’s infamous polar vortex, into January, prices hadn’t surged.

Short of an extended cold spell, it is extremely unlikely gas and propane prices will begin to approach the levels of last year due to the degree they’ve fallen in the past few months. Though storage was worked off in fairly short order last winter, prices were much stronger at that time.

Indeed, propane at the Conway, Kan., NGL hub was four times as valuable and Mont Belvieu, Texas, hub propane was nearly three times as valuable at the start of 2014 than current values. Natural gas prices were $1 per million Btu (MMBtu) greater than their current levels.

The propane storage overhang is so large that it will require a combination of both heating and export demand to be worked off. Propane prices will likely have to continue to follow crude prices to encourage LPG exports.

As propane prices plunge, ethylene manufacturers have been cracking the product more. This will help to work off some of the storage overhang, but it is unlikely that crackers will make any widespread shift from ethane to propane. Ultimately, ethane will remain the preferred ethylene feedstock, but the increased competition from propane, butane and naphtha aren’t helping.

While new construction of midstream infrastructure is a positive for the long term, it is having an impact on netbacks at the moment as transportation and fractionation costs have increased to cover construction costs. With NGL prices tracking lower, it is making it even harder for producers as margins are further hampered.

Traditionally, ethane required a frac spread margin of more than 6 cents per gallon to achieve true profitability once transportation and processing costs were factored in.

The biggest question for the NGL market is: When does the freefall in crude oil prices stop? While global and domestic production and storage levels are high, the U.S. Energy Information Administration reported that in the week ending Jan. 2, crude reserves decreased by more than 3 million barrels (MMbbl), yet industry expectation was for slightly less than a 1 MMbbl build. This indicates that domestic demand is stronger than expected, but West Texas Intermediate crude only experienced a minimal price improvement.

Frank Nieto can be reached at fnieto@hartenergy.com or 703-891-4807.

Recommended Reading

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

Tax Credit’s Silence on Blue Hydrogen Adds Uncertainty

2024-01-31 - Proposed rules for the 45V hydrogen production tax credit leave blue hydrogen up in the air, but producers planning to use natural gas with carbon capture and storage have options.

US Finalizes Big Reforms to Federal Oil, Gas Drilling

2024-04-12 - Under the new policy, drilling is limited in wildlife and cultural areas and oil and gas companies will pay higher bonding rates to cover the cost of plugging abandoned oil and gas wells, among other higher rates and costs.

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.

New US Rules Seek to Curb Leaks From Drilling on Public Lands

2024-03-27 - The U.S. Interior Department finalized rules aimed at limiting methane leaks from oil and gas drilling on public lands.