NGL’s Mesquite acquisition also highlights the increasing public participation in the produced water arena, say analysts with Tudor, Pickering, Holt & Co. (Source: Hart Energy/Shutterstock.com)

NGL Energy Partners LP is on the path to becoming the largest water transportation and disposal company in the Delaware Basin where operators are currently facing a flood of produced water volumes.

The Tulsa, Okla.-based midstream operator agreed May 14 to combine all of the assets of Mesquite Disposals Unlimited LLC with NGL’s water solutions business. NGL plans to fund the $890 million acquisition with a mix of perpetual preferred units and warrants.

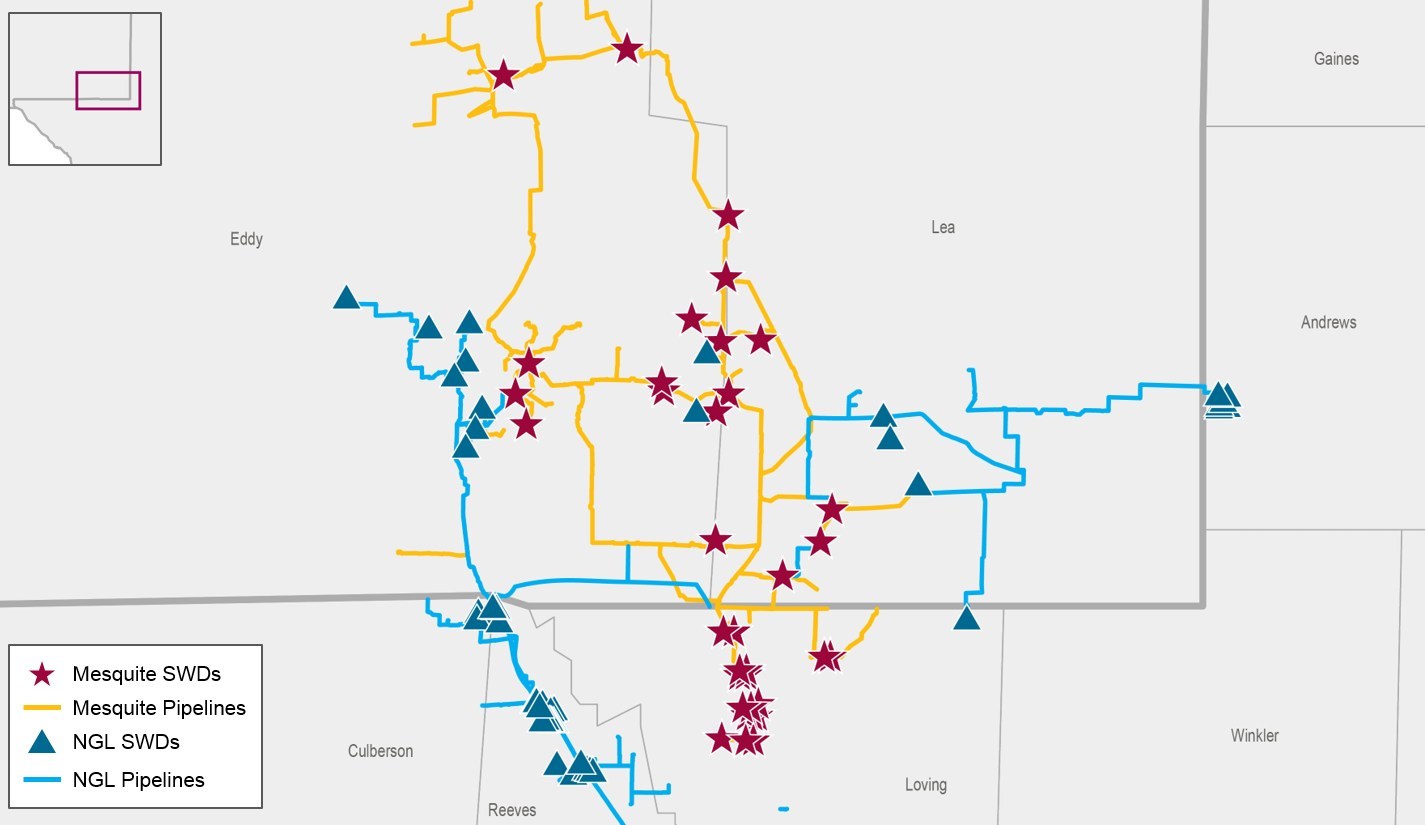

Mesquite is a privately held operator focused on produced water disposal in the Northern Delaware Basin with 35 saltwater disposal wells across New Mexico’s Eddy and Lea counties and Loving County, Texas. The company has roughly 1 million barrels per day (bbl/d) of disposal capacity under long-term acreage dedications and minimum volume commitments.

Analysts with Tudor, Pickering, Holt & Co. (TPH) expect the Mesquite acquisition to roughly double NGL’s total permitted disposal capacity to more than 2 million bbl/d.

pipelines and pipeline rights of way. (Source: NGL Energy Partners LP)

“Transaction highlights increasing public participation in produced water arena as water disposal increasingly shifts to midstream domain given proliferation of long-term [10-15 year] contracts and attractive Northern Delaware economics [five to six water-oil ratio],” the TPH analysts said in a research note on May 15.

Wall Street has taken notice of West Texas’ water management needs. Wood Mackenzie recently called the water management business the industry’s new golden goose.

More than a dozen water-related infrastructure deals have taken place in the Permian over the last three years, and the pace of transactions is expected to pick up considerably in 2019, according to a WoodMac report published in April.

RELATED: WaterBridge Takes Form In Permian Basin’s Wild West

Ryan Duman, principal analyst with Wood Mackenzie’s Lower 48 upstream team, estimates that operators in the Permian Basin are generating roughly 12 million bbl/d of produced water. By comparison, the Permian produces a little over 4 million bbl/d of oil, according to estimates by the U.S. Energy Information Administration in March.

“There is more water being produced than oil in the Permian and that trend is expected to continue,” Duman told Hart Energy.

Depending on the crude forecast, Duman believes the basin could easily reach 19 million to 20 million bbl/d of produced water by 2025.

Mike Krimbill, NGL’s CEO, said the Mesquite acquisition will create “the redundancy required by our producers to manage produced water by connecting a gathering system to multiple 24-inch pipelines.”

About 95% of Mesquite’s current system volumes are delivered via pipeline. Mesquite SWD Inc. will remain the operator of the Mesquite assets led by Mesquite’s current management team including Mesquite CEO Clay Wilson.

NGL said it expects to close the Mesquite transaction in July. Barclays is financial adviser to NGL for the transaction. Winston & Strawn LLP is acting as the company’s legal counsel. The Winston & Strawn team was led by Bruce Toth of the Chicago office. The law firm’s Houston team was led by Jeff Smith and Isaac Griesbaum.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.

Haynesville’s Harsh Drilling Conditions Forge Tougher Tech

2024-04-10 - The Haynesville Shale’s high temperatures and tough rock have caused drillers to evolve, advancing technology that benefits the rest of the industry, experts said.