NextEra Energy Partners LP plans to sell its STX Texas midstream assets in the Eagle Ford Shale and Pennsylvania’s Meade natural gas pipeline to streamline its finances and position itself as a fully renewables-based company.

The company plans to launch a sales process for its STX assets in 2023 and then the Meade assets in 2025, John Ketchum, NextEra’s chairman, president and CEO, said during a May 8 earnings call.

“We believe the pipeline assets are very attractive given their contracted nature and the markets they serve, and over the years we have received unsolicited interest to acquire them,” he said.

NextEra executives said the South Texas pipelines generated EBITDA of $185 million in 2022 while Meade Pipeline produced $106 million, according to East Daley Analytics.

The STX pipelines are highly contracted assets centered on the NET-Mex pipeline, which supplies 26% of Mexico’s natural gas capacity out of Texas, according to Morgan Stanley. Meade carries “no volumetric risk, situated complementary to Transco in a region where new pipelines are extremely challenging to build,” Morgan Stanley analyst David Arcaro wrote in a May 9 report.

Overall, NextEra owns seven natural gas pipeline assets and 4.3 Bcf of natural gas pipeline capacity in Texas and Pennsylvania. Ketchum said the divestitures would serve to enhance the company’s financial stability and its reputation.

“Some investors believe the natural gas pipeline assets dilute an otherwise clean, renewable energy portfolio,” John Ketchum, NextEra’s chairman, president and CEO, said during a May 8 earnings call.

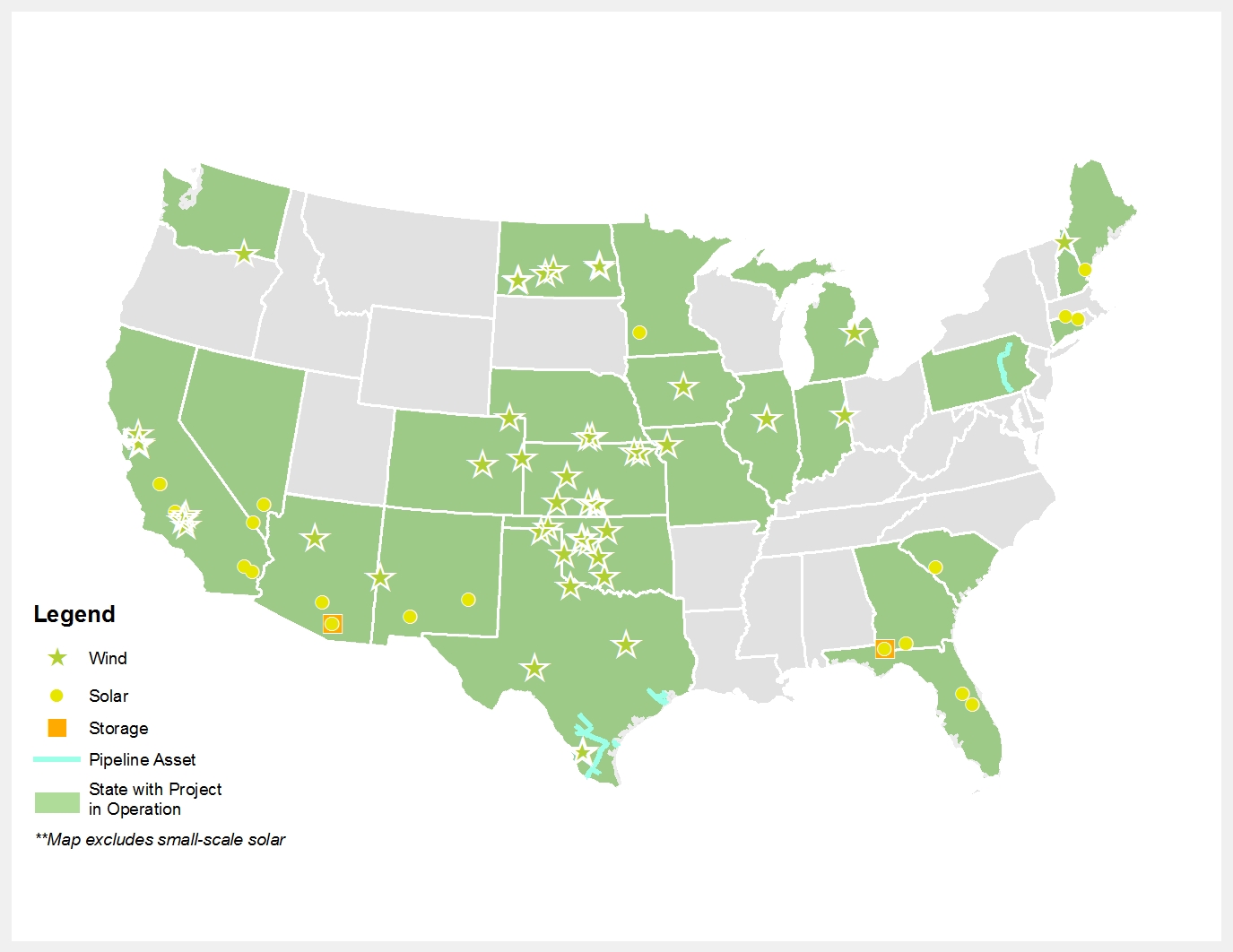

Excluding NextEra’s natural gas pipelines, the company will own projects that deliver “high quality cash flows” in 30 states, serving 85 customers via contracts with an average remaining contract life of 15 years, he said.

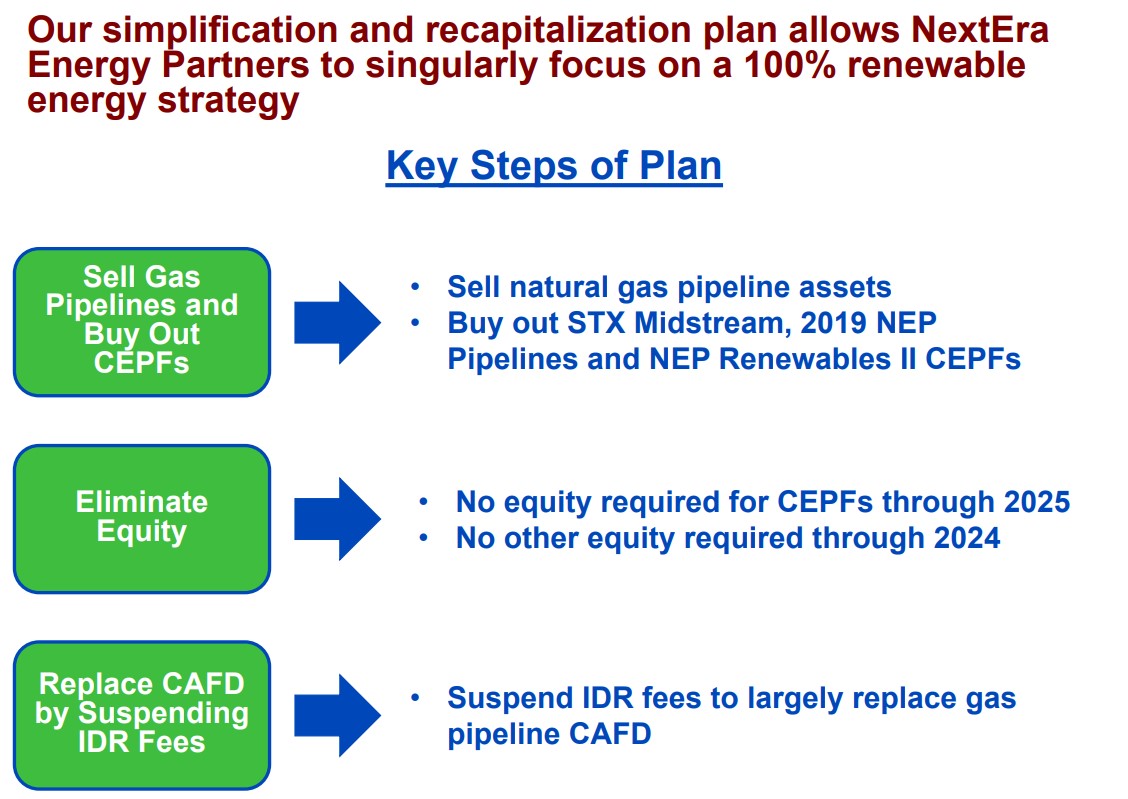

The sale would also simplify the company’s capitalization and eliminate the need to issue any equity in connection with the NextEra’s convertible equity portfolio financings (CEPF) through 2025, Ketchum said.

Texas, Pennsylvania midstream divestitures

NextEra’s largest South Texas asset is the NET Mexico pipeline, which moves Eagle Ford gas from the Auga Dulce hub to a border crossing near Rio Grande City, Texas, Andrew O’Donnell, director of equity research for East Daley, wrote in a May 17 commentary.

“The NET Mexico pipeline is contracted for 1.9 Bcf/d of capacity; flows over the last 30 days have averaged closer to 1.5 Bcf/d,” O’Donnell said.

The Meade Pipeline Co., a holding company that represents a 39% interest in the Central Penn Line, is a segment of Williams’ Transcontinental pipeline system in Pennsylvania.

NextEra acquired interest in the Central Penn Line in late 2019 for $1.37 billion. That segment of the Transco line has been flowing at or near nameplate capacity, O’Donnell said.

Combined, the assets contribute about 20% to NextEra’s total cash available for distribution.

Arcaro said Morgan Stanley’s midstream team considers NextEra’s midstream assets “good … with solid contracts and attractive geographic positioning, which could be a possible fit for several companies with existing Texas intrastate gas pipelines.”

However, he pointed to potential challenges in finding a buyer.

“There may be a fairly limited number of prospective buyers (including likely limited infra/PE buyers at current interest rates), a large asset sale process going on at another midstream company, and there are cheaper valuations available for gathering and processing assets on the market.”

NextEra streamlines finances

NextEra Energy Partners stock had declined by 25% year to date on fears of significant dilution from equity issuances this year to buy out CEPF financings along with additional equity required to achieve cash flow growth targets, Arcaro said.

That has also challenged NextEra Energy’s outlook, with its stock underperforming the utilities group by 4% since April.

Arcaro said the “decisive actions” to sell the midstream portion of the business resolves multiple overhangs on NextEra and its subsidiary NextEra Energy Inc. The two companies agreed to suspend incentive distribution right (IDR) payments, which means parent NextEra will need no equity until 2025 and no CEPF buyouts until 2026, Arcaro said.

NextEra Energy Partners will also have the ability to continue hitting 12% growth through 2026, he said.

Proceeds from the divestitures, net of project debt, are intended to be sufficient to buy out $1.515 billion of remaining CEPF from 2023 to 2025.

“The 2026 buyout is small, limited to the $294 million Genesis Holdings financing, and the company doesn't plan to raise more capital with CEPF structures going forward,” Arcaro said.

The company would need to reach a transaction multiple of at least 9.5x enterprise value to EBITDA with any excess proceeds put toward financing NextEra growth, he said.

“Now with no equity needed for a significant period of time, and a continued ability to grow and acquire assets from NEE [NextEra Energy Inc.] in the interim, we think the bear case for NEP of heavy dilution and an expectation that the stock could eventually price in minimal future growth has now become much less probable,” Arcaro said.

For NextEra’s subsidiary, the arrangement offers improved visibility into the continued viability of NextEra Energy Partners and its ability to acquire assets, “preserving the capital recycling strategy for the company.”

The reduction in the IDR payments represents just $0.02 in earnings per share NextEra Energy Inc.

Recommended Reading

Orange Basin Serves Up More Light Oil

2024-03-15 - Galp’s Mopane-2X exploration well offshore Namibia found a significant column of hydrocarbons, and the operator is assessing commerciality of the discovery.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.