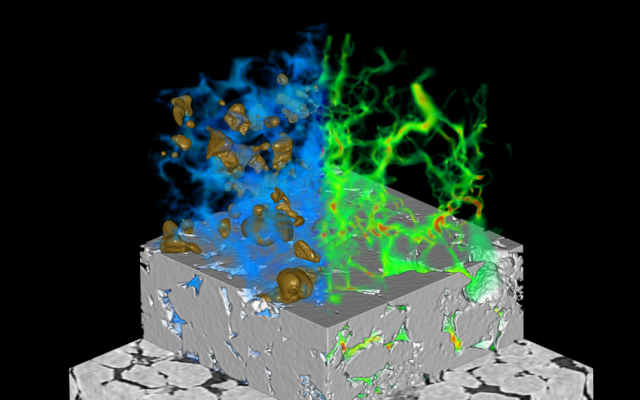

Virtual core analysis is used to determine critical flow-related rock properties. (Source: Exa Corp.)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

For the first time, operators and drillers can leverage predictive computational software to assess relative permeability, which is used to accurately and efficiently assess reservoir output and rock formations. As a result, reservoir analysis time is reduced from up to 12 months to just a few days or weeks.

David Freed, vice president of Exa Corp.’s oil and gas division, called the technology a huge disruption in the way downhill rock formations are valuated and how wells are drilled. The traditional methodology to obtain core analysis data is to undertake challenging and tedious laboratory tests that can require months or even a year to conduct.

“It takes a lot of time to process the rock samples and get them ready for the tests, and then it takes quite some time to push the multiphase fluid mixture through the core sample to get the flow properties,” Freed said. “You need this information to populate a reservoir model that will be used to plan how you want to operate that field or to look at field recovery options such as enhanced oil recovery.”

These rock properties are sometimes referred to as the petrophysical properties of the rock types. Exa has made it possible to carry out this process digitally in days, starting by taking several small samples of the rock and imaging them with a micro-CT scanner. The technology is similar to a medical CT; however, it can achieve higher resolutions, allowing it to image down to the pore scale of the rock.

“By having these 3-D images that resolve the porous space of the rock we can then do a fluid flow simulation and digitally predict how the fluid mixture will flow through the rock and therefore get these same petrophysical properties of the rock,” Freed said. “The difference is that the imaging process takes a few hours, and then the simulations take a couple of days. You’re replacing a process that probably could have taken months or even a year.”

At the Abu Dhabi International Petroleum Exhibition and Conference in November, BP presented multiyear data showing results from its use of the industry’s first relative permeability software solution. BP is the first in the industry to deploy and formally present results from Exa’s DigitalROCK software, representing a disruptor in the way downhole rock formations are evaluated and wells drilled.

Rapid Analysis

Saving time is beneficial for exploration companies. Often, companies will delay a decision until they have reliable enough data, while just making an estimate at other times. That estimate could be wildly inaccurate, which can delay the project and reduce operational efficiency.

It is not only in pre-production that access to rapid and accurate data can be utilized. There are often secondary or tertiary recovery projects where there is a possibility to recover more oil, but companies cannot quickly get enough certainty to proceed with a project. According to Freed, that is where this technology can be a game changer.

“There are a lot of different places where accurate reservoir modeling and simulation is very important and plays a role in deciding what to do. That could be planning where you’re going to put the wells and which wells should be production wells versus injection wells if you’re doing secondary recovery,” he said. “Even before you complete that first well, it’s good to know whether you’re likely to be doing enhanced oil recovery on that field later, because it changes the decisions you make around how to complete the well.

“You might use more expensive parts in certain places if you know that the field life is going to be very long and that you’re going to want to put various things down that well to do the enhanced oil recovery,” Freed added.

Another advantage of the technology is that it can reduce the volume of samples. In a traditional sampling, 6 m to 15 m (20 ft to 50 ft) of whole 6-in. diameter core is collected along with drill out plugs.

“We can use some of that same whole core material to do the digital analysis, but what’s really exciting is that you can use this digital method without having to get whole core,” Freed said. “You can use it on what’s called mud chips, which are just small pieces of rock that come up with the drilling mud. It can also be used on sidewall or rotary cores that can be obtained with a wireline tool, which is far less expensive than obtaining whole core.”

Moving Beyond 3-D

The imaging technology itself has been around a long time and in its day was a major breakthrough, allowing analysts to see what is happening at the grain and pore level. It would give a strong sense of mineral composition and the porosity of the rock all in 3-D, enabling users to get a strong sense of the appearance of the pore space.

“But now, once you have that image, you feel like ‘I want to analyze to understand the geo-mechanical properties of this rock; I want to be able to look at fluid flow in this rock,’” Freed explained. “Now you can do that. We can use that image as the input geometry to a full simulation and get those essential petrophysical properties that they really need for accurate reservoir modeling. We’ve really moved the ball down the field in terms of being able to use data.

“Like many industries, the catalysts have been interdisciplinary groups of people coming together to solve the tough problems necessary to make the whole thing work in a coherent way, to get reliable results,” he added. Following work that BP undertook and presented, Exa said it is in talks with supermajors and national independent oil companies to demonstrate the technology with some companies utilizing the technology in a production environment.

“The data will be available much faster, and you can afford, both in time and cost, to have so much more data and so much better statistics about your rock properties,” Freed said. “I think it’s going to change the ability of the industry to leverage reservoir modeling and be able to make better decisions faster around how to operate the field, and I think they’ll be able to do more oil recovery because the risks will be lower.”

Recommended Reading

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2024-01-26 - The oil and gas rig count, an early indicator of future output, rose by one to 621 in the week to Jan. 26.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.