In March, a new tight shale gas play opened up for drilling in North Carolina.

Now all that’s left is for explorers to find out what’s there.

On March 16, North Carolina Gov. Pat McCrory signed new hydraulic fracturing rules into law. Companies can now apply for fracking permits in the state, with the possibility for drilling to begin later in the year.

“This is just an opportunity for North Carolina to get into the game of energy development and to do it in a safe and responsible way,” said David McGowan, North Carolina Petroleum Council (NCPC) executive director.

How much of an opportunity remains to be seen? The best guess by the North Carolina Department of Environmental and Natural Resources (DENR) is based on a couple of wells drilled in the Sanford sub-basin.

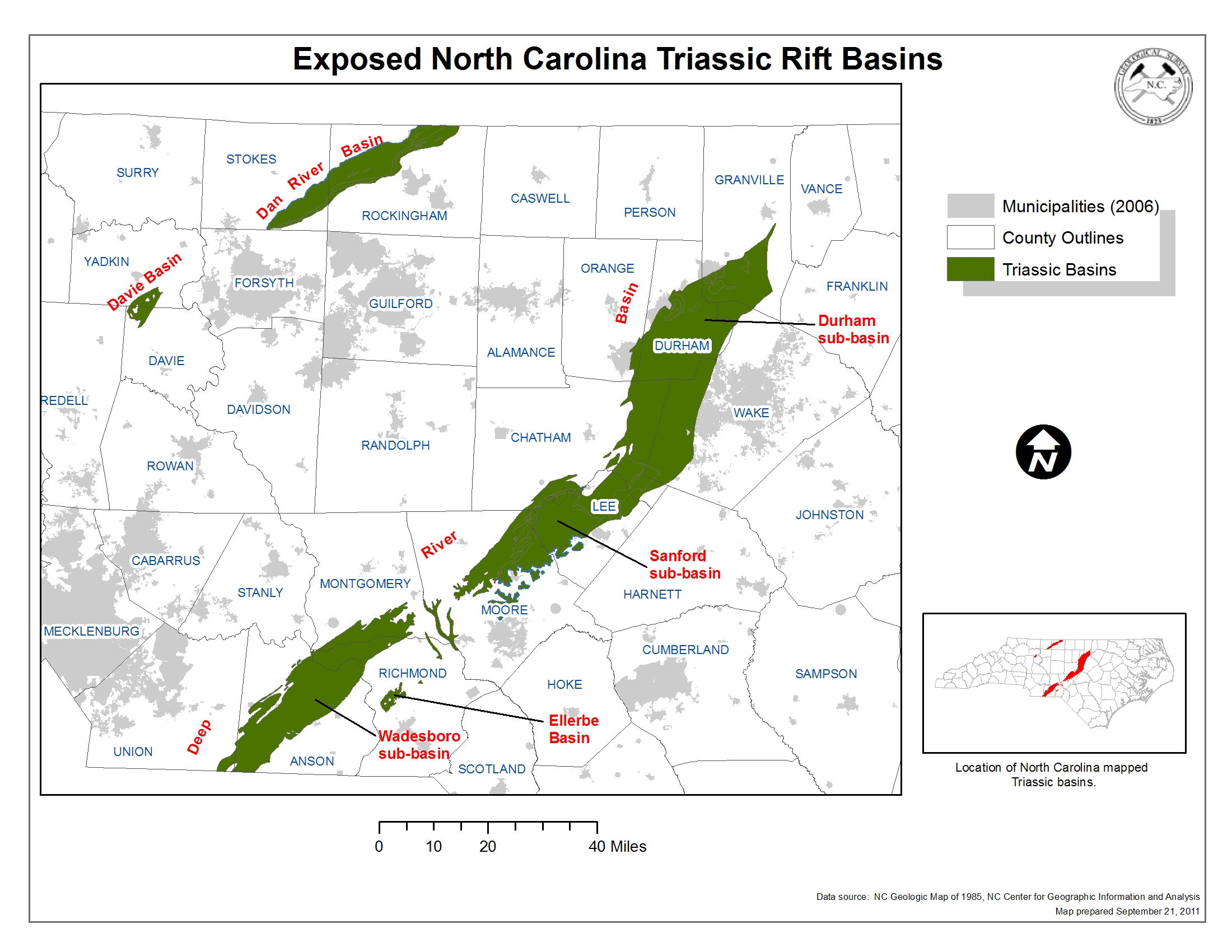

The sub-basin represents a small fraction of the total Triassic Basin formations in the state—about 59,000 acres out of a total of 785,000 acres.

At 160-acre spacing, 368 wells could be drilling the Sanford, for a volume of technically recoverable gas of 309 billion cubic feet (Bcf) of gas, according to the DENR.

The state is still a frontier area though. With the exception of a handful of test wells and old vertical wells, there hasn’t been any significant onshore oil and gas development in North Carolina, McGowan said.

The information that is available about the state’s resources is estimates that have been conducted by both the U.S. Geological Survey (USGS) and North Carolina Geological Survey (NCGS) in the past several years, he said.

“We really won’t know the extent of the interest and potential development possibilities here until some of that exploratory work is conducted,” he said.

“We really won’t know the extent of the interest and potential development possibilities here until some of that exploratory work is conducted,” he said.

Deep River

The Dan River Basin is the primary basin that has been assessed by the USGS and NCGS).

It’s a fairly narrow basin that stretches from the Virginia/North Carolina line to the South Caroline/North Carolina line.

The primary target area within the broader Deep River Basin is located in the Sanford sub-basin. The shale formation can be found at depths generally ranging between 2,100 and 6,000 feet below the surface. The formation has a maximum thickness of 800 feet and an average thickness that ranges from 180 to 540 feet, according to a report by the NCGS.

Conditions in the Triassic basins of North Carolina are not identical to those found in Pennsylvania or other gas-producing states. North Carolina’s basins are lacustrine shales, or lake shales, which are different from the big marine shale plays, said Kenneth Taylor, North Carolina state geologist.

However, tests have shown the rock contains condensate, he said.

“That means what we have basically in some plays is the difference [between] making big money or making some money,” Taylor said.

Interest in the Triassic Basin shale deposits in parts of North Carolina’s Lee and Chatham counties has grown in recent years, according to the USGS. More than 9,000 acres were leased within the Sanford sub-basin by oil and gas companies in 2012.

According to Taylor, interest has been piqued.

Taylor has received feedback from several companies in the past couple of years who were seeking more information on the area’s formations and infrastructure.

Infrastructure in North Carolina is not in place and would need to be built out. However, Taylor said the state’s resources could be potentially an “all-in region usage.”

“This can be used a 100% locally,” he said. “It would not be exported out by pipeline.”

New Law

Horizontal drilling and hydraulic fracturing became legal in North Carolina by Act of the N.C. General Assembly in 2012. The same Act required rules and regulations to be established for permitting by a newly formed Mining and Energy Commission.

McGowan said the commission spent two and a half years drafting regulations. The process has been “very methodical and deliberate,” he said.

The commission has incorporated a number of API standards as well as other statutes into their regulations in order to insure the state’s resources are developed safely and responsible when the time comes, he said.

“They have done extensive research of other states’ regulations and identified examples of things that worked very well and maybe things that didn’t work as well and tried to incorporate that into our rulemaking,” he said.

Taylor helped update the state regulations from its previous “1945-era rules.”

“We now have a regulatory framework that is modern where things like using FracFocus, well construction standards and thinks like that are now all codified in our rule set,” said Taylor, who is also a member of the Mining and Energy Commission.

North Carolina is the 34th state in the country to allow fracking operations to drill for natural gas.

The NCPC is a division of API, which represents all segments of America’s oil and natural gas industry.

Recommended Reading

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.