A view from a rig on Eclipse Resources’ Utica Shale operations during 2015. (Source: Mike Robinson/Hart Energy)

Eclipse Resources Corp. (NYSE: ECR) and Blue Ridge Mountain Resources Inc. completed its merger on Feb. 28 and emerged as a new Appalachian Basin producer with its sights set on cash flow neutrality.

In late August 2018, Eclipse and Blue Ridge Mountain agreed to merge in an all-stock transaction with Blue Ridge stockholders receiving 4.4259 shares of Eclipse common stock for each share of Blue Ridge stock. At the time, the transaction was valued to be worth about $345 million.

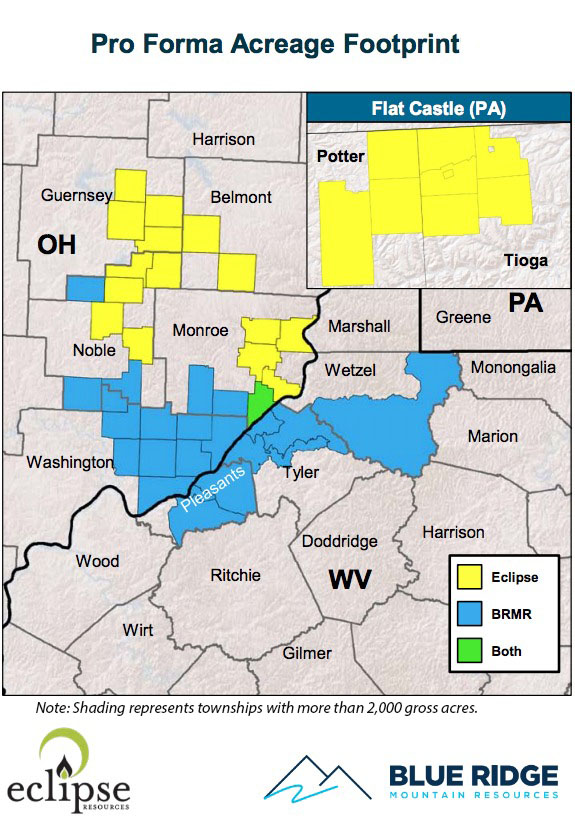

The resulting combination, newly-dubbed Montage Resources Corp., holds about 227,000 net effective undeveloped acres currently focused on the Utica and Marcellus shales of southeast Ohio, West Virginia and North Central Pennsylvania.

RELATED: Appalachia Players Eclipse, Blue Ridge Mountain To Merge

Montage began trading on the New York Stock Exchange under the ticker “MR” with a 15-to-1 stock reverse split effective March 1. Additionally, Eclipse’s standalone borrowing base of $225 million has been increased to $375 million for the combined company, which Mike Kelly, senior analyst with Seaport Global Securities LLC, said is a more than 150% boost to Montage’s liquidity.

Right out of the gate, Montage laid out plans in a separate release on Feb. 28 to reach cash flow neutrality by the end of 2019.

In 2019, the company expects to maintain a capex of between $375 million and $400 million with roughly 55% allocated to liquids-rich locations and the remaining 45% to dry gas locations.

In its company release, Montage said it will shift the focus of its two-rig drilling program in 2019 to reducing cycle times and improving capital efficiency in order to accelerate cash flow and achieve the highest possible returns.

The company’s plans to optimize operational parameters include reducing its planned lateral length spuds to an average of roughly 11,700 feet and lowering its initial development pad size to about four initial wells per pad. Additionally, about 90% of its 2019 capex has been earmarked for drilling and completion activity in order to maximize the return on invested capital.

“We’re encouraged by Montage’s new strategy to focus on maintaining a healthy balance sheet and generating free cash flow,” Kelly said in a March 1 research note. “Montage’s current valuation looks attractive at 4.5 times, which is 0.8 times below the peer average at 5.3 times and its [greater than] 20 years of inventory provides ample [net asset value] upside.”

Montage’s president and CEO, John Reinhart who previously served as the head of Blue Ridge Mountain prior to the merger, said the company’s 2019 guidance demonstrates “a strategic shift underway” with an increased focus on financial, operational and organizational efficiencies.

For 2019, Montage is projected to grow production by roughly 16% over results last year from Eclipse and Blue Ridge. The company estimates net daily production sale volumes for 2019 to be between 500 million and 525 million cubic feet equivalent per day.

Reinhart said the production growth will be the result of Montage’s deep inventory of both liquids-rich and dry locations in the Utica and Marcellus shales, which Eclipse and Blue Ridge estimated to total 735 net locations from the combination.

“We believe the quality and depth of the company’s inventory of locations will allow us to achieve double-digit production growth while focusing on cash flow generation in our highly economic core areas,” Reinhart said in a statement. “We are excited to announce a capital program in 2019 that we expect to be predominantly funded from operating cash flow and augmented by existing liquidity while providing cash flow neutrality by the end of 2019.”

Jefferies LLC was financial adviser to Eclipse for its merger Blue Ridge, and Norton Rose Fulbright US LLP was its legal adviser. Vinson & Elkins LLP was legal adviser to EnCap Investments, the majority stockholder of Eclipse. Blue Ridge’s financial adviser was Barclays and Bracewell LLP was its legal adviser.

Montage Resources is scheduled to release a full breakdown of the merger and the company’s plan forward at an analyst day to be held on March 20.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.

US NatGas Output to Decline in 2024, While Demand Rises to Record High, EIA Says

2024-04-09 - The EIA projected dry gas production will ease in 2024 as several producers reduce drilling activities.