Presented by:

“If there were ever a situation where it is appropriate to say ‘it’s different this time,’ this is it,” said J. R. Weston, associate analyst for midstream and NGL, Raymond James. “That is because there really are several things that are structurally different about the North American gas market this time. First, there is the huge pull of LNG exports, as well as the pipeline exports to Mexico. Those two, together, now account for about 20% of U.S. production.”

The other major difference is capital discipline. “The financial support for the upstream is much different,” Weston said. “We’ve been vocal about that. As a result, we only anticipate 1 to 3 Bcf/d of cumulative supply growth from 2020 to 2022. We used to see growth of 8 to 9 Bcf/d per year in 2018 and 2019, mostly from associated gas. Now, just about the only incremental supply growth that is responding to prices are private operators in the Haynesville.”

The net of significant demand and muted supply response is higher prices. “At present, prices are responding to the relatively low storage,” Weston said. “Because of increased exports, total days of supply will continue to drop in 2022, even as we rebuild storage. Physical markets are going to remain tight. People were aware of all these factors, but I don’t think many connected the dots.”

Modeling weather patterns in line with the 10-year average, Raymond James is projecting domestic gas prices to stay in the $4.25 to $5.25 per MMBtu range through 2022. “Above $5, the market is partially pricing in the risk of a winter weather event. We are a little bearish versus the strip on prices at the end of the winter if we have ‘normal’ weather. But the bull case from a weather event could be $10, $15 or even higher. The skew is definitely to the upside.”

There has definitely been a shift in capital allocation in the upstream oil and gas industry, said Devin McDermott, equity analyst and commodity strategist at Morgan Stanley. “Investors and operators had been focused on growth for at least a decade, if not longer, and that drove persistent oversupply. From 2010 to 2020, the U.S. market for natural gas doubled, but the price fell by half.”

The shift in philosophy has mostly been affected by investors, McDermott noted. “Persistent oversupply had been driven by persistent overinvestment. That started to change before the pandemic, but the collapse of prices accelerated and expanded it. The focus is now on generating cash flow, return on capital.”

That new capital discipline is one of the two major structural changes that will affect the gas supply equation, and thus prices, in the coming years, McDermott detailed. The other is infrastructure.

“Supply growth is coming from three main areas: the Appalachian region, the Haynesville and associated gas from the Permian,” he said. “There has been a significant slowing, even a stoppage, of major transportation projects. Pipeline projects continue to be delayed or canceled, mostly because permitting is so challenging. So, there is a physical constraint on growth, especially in Appalachia.”

Progress toward brownfield expansions

On aggregate, McDermott expects a modest structural increase in North American gas prices. “The last five years were a sub-$3 period,” he said, “not counting weather-related fluctuations. We see the next few years as a $3 to $4 period. We don’t see the recent $5 to $6 range as sustainable, the difference being mostly the fact that storage is below normal.”

Against the capital and infrastructure constraints, McDermott anticipates meaningful but not massive increases in demand, mostly from LNG exports. Noting the cancellation of several plans for greenfield liquefaction terminals at the end of the first big phase of export-oriented investment, McDermott reckons that the first steps in the next phase of investment will be incremental.

“We are already seeing progress toward incremental brownfield building,” he said. “Cheniere [Energy Inc.] is advancing its stage 3 expansion, supported by significant contracts from Glencore and Chinese buyers. Venture Global, the private equity-backed development in Plaquemines, La., has also gotten sizable contracts with Chinese buyers. Those are also notable because they signal strong renewed interest from China after a multiyear pause.”

Other than the U.S., McDermott sees Russia and Qatar as most likely to add major LNG export capacity. He did note the two North American projects on the Pacific—LNG Canada at Kitimat, British Columbia, Canada, and Costa Azul in Baja California, Mexico—but does not anticipate those are the start of any new geographic centers of LNG.

“There is potential expansion at Costa Azul, but growth in gas exports from the U.S. into Mexico should only be modest from here. The country is close to its target for gas into the power generating sector,” he said.

“You never say never, but we are modeling our LNG growth in North America out of the U.S. Gulf Coast. That is where the infrastructure and the skilled labor are.”

While growth is the long-term forecast, the near-term road is likely to be bumpy. “It used to be that fuel switching was the buffer for rebalancing North American gas prices,” said McDermott. “That has been notably absent in this current price cycle, mostly because of the reduced role of coal-fired generation. That is another structural change. Combined with the large volume of LNG exports, this is making North American gas prices more volatile. Global tightness now affects the Henry Hub price. That linkage is here to stay.”

Producers’ response to higher gas prices is definitely a matter of capital allocation, said Richard D. Weber, CEO of PennEnergy Resources LLC, a gas producer in the Marcellus Shale.

“The improvement in prices has improved rates of return on new drilling, but that is not the only thing we think about. Capital availability, investor demands, target capital ratios, the availability of infrastructure to support growth and drilling inventory are all important considerations.”

GROWTH CONTINUES IN REGIONAL LNGWhile investors and operators consider the next wave of deepsea LNG capacity, there is plenty of action in regional LNG, also called smallscale LNG.  In December 2020, Pivotal LNG’s Towanda facility in the middle of the Marcellus Shale at Wyalusing, Pa., supplied LNG to fuel a ship at the Port of Hamilton, Ontario, Canada. That was a first on the Great Lakes and a milestone in the evolution of regional shipping. With a production of 50,000 gal/d and 180,000 gallons of onsite storage, Towanda’s market includes commercial and industrial users as well as local gas utilities and power generation facilities. “Towanda was considered a toe in the pool by Dominion [Energy Inc.] for small-scale LNG,” said Roger Williams, vice president of commercial LNG and gas development at BHE GT&S, a Berkshire Hathaway Energy company. “There is a better established market in the Northeast than anywhere else to sell into while new markets, like bunkering, are developed. The key market is winter peaking, given the lack of new pipeline capacity or expansions.” Bunkering is the second leg, which is done at the JAX terminal in Jacksonville, Fla., and also via truck out of inland facilities in Pennsylvania and Alabama. JAX LNG is a joint venture between NorthStar Midstream and Pivotal LNG, a subsidiary of BHE GT&S. “Truck-to-ship is proven but is not ideal,” said Williams. It’s more a matter of establishing viability toward growth in both markets and permanent loading facilities to support those. The third leg of opportunity for regional LNG is to replace heavier hydrocarbons in existing industrial markets. “That is a large but highly fragmented segment,” said Williams. “There are an awful lot of propane, diesel and fuel oil boilers in the country. LNG is a much more environmentally friendly alternative and can readily be supplied by truck.” The logistics for all three legs are primarily road transport and local storage. LNG is moved by dedicated trailers that are insulated but not refrigerated. Conventional tractors are used, but drivers have to be trained and certified in operational and safety procedures. BHE has a small fleet of trailers but relies mostly on specialized third-party logistics providers. Winter delivery to power utilities is on a contract basis for base load volumes, supplemented by spot deliveries as the local distribution companies see their summer storage depleted. Bunkering at JAX is done by a shuttle barge that is loaded at the liquefaction and storage facility and then goes to the vessel. The LNG for bunkering in Hamilton was delivered by truck and loaded via portable storage and pumping equipment. “Ultimately more permanent facilities would be installed,” Williams explained. “That could either be barge-to-ship as is done at JAX or on-wharf storage directly to ship.” The latter approach is what is used at Eagle LNG in the same area. In September 2020, privately held Eagle LNG Partners received Federal Energy Regulatory Commission authorization for a $500 million greenfield LNG export facility and terminal in Jacksonville. It will produce 1.65 million gal/d with 12 million gallons of storage. There will also be marine- and truck-loading capabilities onsite. Eagle already operates an LNG facility at Maxville, inland from Jacksonville, and a ship bunkering facility on the Crowley Marine wharf in Jacksonville. JAX is in the process of tripling its output and doubling storage. “We are likely to expand again there,” said Williams. “The marine fuel sector is very large, with long-term growth as older ships are replaced by new ones designed for flexible fuels.” Beyond that, LNG is shooting for the moon. “LNG to replace kerosene derivatives to fuel rockets is being developed by every major U.S. space operator,” said Williams. “It is much more available and economical than specialty rocket fuel. The first launch using LNG fuel is expected next year.” Cape Canaveral is only 160 miles from Jacksonville, so an easy truck run down the east coast of the state. |

Cash is king

At PennEnergy, Weber explained, “we are generating significant free cash due to higher prices, strong well performance and our continued control of costs. Over the past few years, we have targeted low single-digit growth rates and have generated strong free cash flows, which have been used primarily to reduce debt. With a total debt-to-EBITDA ratio now approaching 1x, our priority is to begin paying a significant quarterly distribution to our investors.”

Given the clear growth in demand and the ability—not eagerness to be sure, but ability— of producers to meet that demand, the question keeps falling back to infrastructure to get molecules to market.

Considering the long-standing frustrations of producers in the Marcellus and other Appalachian plays, Weber was quite diplomatic in reiterating that “there is limited takeaway from our basin. That lack of transportation does not encourage aggressive growth.”

While that situation persists, the philosophy of investors has changed. “They like to see return of capital versus growth,” he added.

“We are in a maintenance-plus mode, growing our production just a few percent a year,” Weber said. “Most of our colleagues, but not all, are in the same mode. That situation is likely to continue unless there is some significant change in infrastructure to enable more natural gas to be exported out of the Appalachian Basin. As producers we certainly could accommodate one or more new large LNG export facilities. There is clearly a huge demand overseas. But we don’t anticipate any significant new infrastructure in the Northeast in the foreseeable future.”

Detailing the inventory that would support such increased supply, Weber stated that PennEnergy has more than 1,000 undrilled locations, as well as a very low decline rate. “Our PDPs [proved developed producing] are declining at only about 14%, which translates to a very low capital intensity. We are producing about 750 million cubic feet of natural gas equivalents per year. Running less than one rig equivalent per year, we are able to grow production at about 5% and still generate significant cash flow.”

Without giving away any secrets, Weber said that the low decline rates are a function of the rock PennEnergy has, specifically its high level of organics. “We also make very efficient fracs and don’t pull on our wells as hard as others do. We look more to ultimate recovery than to high initial production rates.”

That well efficiency extends above ground. “For us, methane emissions are not a significant issue,” said Weber. “We have always considered environmental stewardship to be a core value, and for us, that includes maintaining very low methane emissions, among other things. The Marcellus Shale represents one of the largest, scalable, clean-burning resources in the world that could enable the United States and other trading partners to meet our climate goals.”

ESG verification will be a prerequisite

To provide more transparency to its lenders, investors and customers, PennEnergy has engaged Project Canary to certify each of its producing wells as responsibly sourced gas (RSG). That process is expected to be completed in the first quarter of 2022.

“An independent verification of whether a producer is producing responsibly sourced gas, such as a certification from Project Canary, will soon be a prerequisite to be a supplier of natural gas in North America,” Weber said. “Those producers who can’t get RSG certified will struggle.”

In the Midcontinent, “the Rockies gas world is controlled 100% by private investors,” said David H. Keyte, chairman and chief executive of Caerus Oil and Gas LLC. “All the public companies have left. We have good economic and environmental performance and great markets that we service.”

Still, at present “we are in a no-growth mode regardless of price. The amount of hedges in producer portfolios is taking much of the gusto out of the gas price increase,” said Keyte. “That is going to continue until those hedges roll off, so at least for the intermediate term. Until then, the production response to higher prices will be muted.”

Even after that, there is not likely to be any great rush to turn the taps. “There is some skepticism regarding the availability of capital to the upstream,” Keyte said. So, at present, “producers are restoring their balance sheets to pristine condition, and capital spending will be restrained because of the demand for distributions by investors.”

The investment community sentiment and climate activist’s focus on ESG are impacting companies’ will to grow. “The ESG mandates from both business and government will have the effect of restricting supply growth,” Keyte said. But, nonetheless, “here in Colorado, we have been under zero-emissions requirements for a while and have shown that natural gas production can occur efficiently and economically without the need for flaring.”

On the demand side, “increasing exports on top of growing domestic demand are very positive for prices,” said Keyte, “that is for the short, medium and long term.”

When conditions turn positive for increasing supply, it will likely have to come from the drill bit. “The industry has harvested a significant number of drilled uncompleted wells over the past few years,” he said. “When prices are low, that is about the only way we could add production. We’ve pretty well chewed through that inventory over the last year or two. What is left uncompleted at this point is probably uncompleted for a reason.”

As the North American natural gas market is rebalanced, new geographic affiliations are emerging, Keyte noted. “From our acreage in the Rockies, our markets are Midwest and the West Coast. Those markets are in good shape in terms of relative prices. We are about a buck ahead of Appalachia and sell at a premium to Nymex.

“While Louisiana and Texas have access to LNG markets, until the Costa Azul project [on the Pacific coast of Mexico] comes into service, Rockies gas won’t have meaningful access to LNG,” Keyte said. “As of now, it does not look like the Jordan Cove project [in Oregon] is being built anytime soon, although the market exists and LNG shipments would clearly reduce emissions from India and Asia.”

The fuel that came in from the cold

Natural gas “is certainly now an emphasized and interesting part of the ‘alternative energy’ category,” said Bryan Benoit, national managing partner for energy at advisory firm Grant Thornton. “It’s not as in vogue as renewable per se, but it is one of the more interesting sides of traditional energy with coal and oil. There is now a strong link between gas and power generation. As interest in ESG and renewable power grows, that will stimulate domestic and international demand for natural gas.”

Getting that gas out of the ground and to market in the current environment may have new and unique challenges, Benoit noted. “Given the new administration, political influences, as well as new infrastructure factors, there are discussions at executive levels suggesting gas could go higher than it already has, testing historical highs. Look at electricity rates in the U.K., up four to five times, and the demand for natural gas across Europe may push these higher.”

Across an ideal global market any such vast price differential would draw supply and stimulate production. “But global LNG is still emerging,” said Benoit. “Some companies have been investing in LNG for more than a decade, but it is far from optimal, and markets are evolving. There was a time just a few years ago that it seemed there was going to be too much too soon—both in the U.S. and worldwide. Now it seems that there is not enough soon enough.”

While noting that several of the major liquefaction terminals in the U.S. can add incremental throughput, Benoit cautioned that the next big wave of export capacity is not likely to be in service until the latter part of 2023.

“The entire discussion at the NorthAm Energy Capital Assembly in October was around how investment was moving toward sustainability and environment. Some speculated oil and gas companies may earn more from putting carbon dioxide back in the ground than extracting hydrocarbons. There are kinder ESG headwinds because it is the cleaner side of the business. And clearly some of the successes in LNG today are driving capital to that segment in an expedited way as well.”

When major LNG export from North America was first contemplated, capital providers were concerned that, rather than realizing Asian or European prices in North America, the result would be bringing world prices down nearer North American numbers. In the event it seems that the original hopes were closer to the truth.

“The North American price is going to be closer to the global norms than where we have been to this point. The entire economies of China and India are almost all still coalpowered. If you believe that has to change, then you must believe prices will continue to climb marginally over the long term. Perhaps flaring gas becomes a thing of the past at these prices.”

That represents a considerable change from just a few years ago when “it seemed like gas would be $3 forever,” said Steve Hendrickson, president of petroleum engineering firm Ralph E. Davis Associates, “but I’ve been bullish on gas for a while. It was just a matter of when the fundamentals would turn. It was the resumption of economic growth after the pandemic.”

Gas is the logical choice

It was also the renewed emphasis on renewable energy. “The more we rely on intermittent sources of renewable energy, the more we need a reliable power source that can step in,” said Hendrickson. “Natural gas is the logical choice. There is a clear synergy between gas and renewable power.”

In North America in particular, Hendrickson expects the current trends to continue. Notably, “there is the slow and certain death of coal. It’s going away. Politicians can’t save it, it’s done; the only question is when we will hold the funeral.” The other continuing trend is the growth of LNG in North America and worldwide.

Predictions are fraught at any time, but the middle of winter may be the worst time to try to predict short-term and even medium-term prospects for gas prices.

“There can always be spikes in winter,” Hendrickson said, “but broadly, with the supply response to higher prices in the autumn, it is reasonable to expect that prices will come down somewhat.”

Among all the supply, demand, logistics and pricing variables, Hendrickson suggested that one has settled into a relatively steady state: exports. “North America is sending about 11 Bcf/d of LNG over the water and about another 7 Bcf/d by pipe to Mexico. The latter is the Energy Information Administration figures for April through June. Taken together, that is about all we can expect at present. It’s not like anyone is about to add 2 Bcf/d of LNG or other exports in the short term.”

There is also some stasis in supply, at least in the East. “The Appalachians are producing about 34 to 35 Bcf/d,” said Hendrickson. “Most of the capacity in that region was installed in the 2010s, and we are now starting to crowd it. There is maybe another 10% to go.”

Hendrickson sees a similar dynamic in other regions, mostly governed by the shifting economic model upstream. “It seems obvious that the lease-drill-prove-sell model could not last forever. And sure enough, operators drilled themselves straight off the cliff. But the industry has regained capital discipline, and at some point, prices are going to become so good that operators will pick up rigs again.”

That next phase of expansion has a chance to be sustainable, said Hendrickson, “as long as there is no pressure to prove and turn acres. There does not seem to be at present. Quite to the contrary, there is a greater concentration of acreage these days which could make production growth more measured.”

There is also an understanding, he added, even an appreciation, that governance matters. Most sources noted that multiple studies have confirmed how operators with robust environmental compliance, sound governance and high safety performance are consistently more profitable than competitors that are not.

“ESG metrics and pressures are having an effect,” Hendrickson explained. “Acreage and production is being concentrated in the hands of larger companies that are subject to greater scrutiny. That is especially true of the publicly traded ones. It also applies to operators owned by the big private-equity firms because much of that money comes from pension funds and university endowments. Most of those now have ESG mandates, and that works its way down the food chain.”

Recommended Reading

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

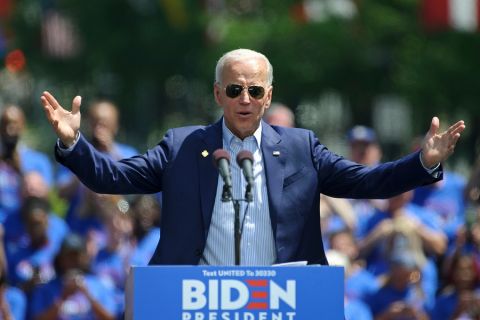

Belcher: Election Year LNG ‘Pause’ Will Have Huge Negative Impacts

2024-03-01 - The Biden administration’s decision to pause permitting of LNG projects has damaged the U.S.’ reputation in ways impossible to calculate.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

Vietnam Seeks Delicate Balance Among US, China, Russia

2024-02-08 - Ongoing U.S. tensions with China and Russia offer Vietnam an opportunity to boost economic ties with the former if American investors can steer past geopolitical smokescreens and destine funds for infrastructure, power and LNG projects all somewhat tied to Vietnam’s manufacturing sector.