Hydrogen is on the table as the best next fuel for transportation. And it has street cred: It’s the highest-performing fuel among the options.

Transition to it comes with many challenges. They’re resolvable. But doing so will take much time and money for global replacement of crude oil in transportation.

“Vintage people like me might be wondering, ‘Hydrogen again, huh? How long is this going to last this time?’” Susan Stuver, GTI (formerly known as Gas Technology Institute) senior manager, Hydrogen Technology Center, said in the institute’s hydrogen webinar, “The Role of Hydrogen in a Decarbonized Future,” in July.

The lure of hydrogen is justified, though, she added: “It can be used to support the decarbonization of hard-to abate sectors—those that are energy-intensive or require high heat applications, such as heavy industry. Places where electrification just isn’t going to work.”

In transportation, Chevron Corp. and Cummins Inc. have teamed to promote hydrogen. Andy Walz, president, Americas fuels and lubricants, Chevron, said in a press release, “Hydrogen is just one lower carbon solution we are investing in that will position our customers to reduce the carbon intensity of their businesses and everyday lives.”

Chevron is also collaborating with Toyota Motor Corp., which has teamed with several other companies in various industries.

In marine application, TotalEnergies SE (formerly Total SA) and Technip Energies NV are collaborating on hydrogen use in existing and new LNG facilities as a carbon offset toward Total Energies’ plan to be carbon neutral by 2050.

In commercializing hydrogen, Baker Hughes Co. and Bloom Energy Corp. plan pilot projects in several decarbon areas, including hydrogen production. “The companies will target applications such as blending hydrogen into natural gas pipelines, as well as onsite hydrogen production for industrial use,” they reported.

“These efforts are geared toward accelerating the transition to the hydrogen economy.”

In hydrogen compression, Baker Hughes is also collaborating with Air Products & Chemicals Inc.

The Williams Cos. Inc. and Microsoft Corp. have teamed to “explore lower carbon opportunities with a focus on the development of a hydrogen economy, renewable natural gas products, carbon capture utilization and storage and energy storage solutions,” they reported.

In North Dakota, midstream natural gas operator Bakken Energy LLC and Mitsubishi Power Americas Inc. plan to build “a world-class clean hydrogen hub,” they reported.

“This hub will be composed of facilities that produce, store, transport and consume clean hydrogen. It will be connected by pipeline to other clean hydrogen hubs being developed throughout North America.”

It will produce “blue hydrogen,” which uses natural gas while capturing and sequestering the carbon part of the CH4.

North Dakota Gov. Doug Burgum said in a press release, “Blue hydrogen represents a huge opportunity for synergies with our existing energy development. And these are exactly the innovative strategies that will bring North Dakota one step closer to being carbon neutral by 2030 with an all-of-the-above energy approach.”

Mike Hopkins, CEO of Bakken Energy, said, “We believe that clean hydrogen derived from natural gas, with the carbon captured and with its cost advantages, is the best way to accelerate the adoption of hydrogen.”

Texas Gulf Coast

GTI’s Stuver said in the July webinar, “The reason why the Houston/Texas Gulf Coast area is rapidly growing for hydrogen is because it’s already a base for hydrogen in the U.S.”

The region produces about a third of what’s used in the U.S.

And “it’s home to about 48 hydrogen production plants, more than 900 miles of pipelines and a subsurface storage system using salt caverns,” she said.

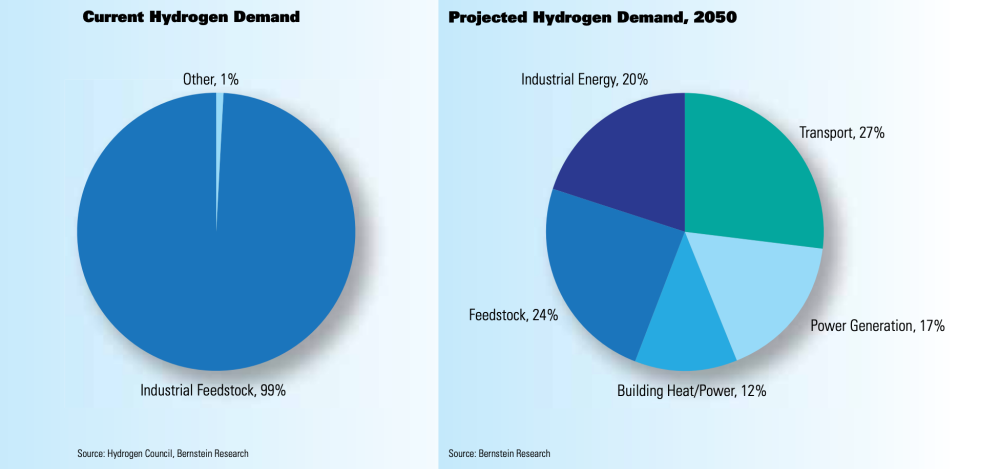

Brian Weeks, GTI senior director of business development, noted that more than 90% of hydrogen demand is for use in ammonia, refining and methanol. For cars and trucks, a hurdle is consumer “station anxiety,” he added.

Meanwhile, there is opportunity in marine use, he said. The International Maritime Organization has adopted a goal of reducing sulfur content in marine fuels. Weeks said, “Hydrogen (itself) is not being looked at currently as an option in marine fuel, but ammonia could be.”

A hurdle is also in hydrogen transport. “There’s increasing interest in using existing natural gas pipeline infrastructure,” Weeks said. “Either blend it, replace the line as a pure hydrogen pipeline or put the hydrogen pipeline in the existing natural gas right of way.”

Outside of commercial prospects, an incentive to the pipeline operator is that it would be decarbonizing its portfolio.

“By combining hydrogen,” Weeks said, “particularly generated from renewable resources (that is, water, using wind and/or solar), the pipeline operator can then honestly make claims that it is decarbonizing its product by adding a zero-carbon Btu carrier among its products.”

Currently, most hydrogen pipeline projects are in the EU; one is in California.

As for storage, it’s primarily in salt-dome caverns. “We have not tried storing hydrogen in depleted reservoirs or aquifers yet,” Weeks said. “The jury’s out whether we can modify existing caverns for hydrogen use, but we do believe the potential is tremendous.”

Embrittlement is a concern with existing pipeline infrastructure, Stuver added. “Hydrogen can actually diffuse through steel.”

There are grades of steel that can handle hydrogen. But the current infrastructure’s specs are “one of the reasons why ammonia is easier to transport.”

Weeks added that the boiling point of ammonia is minus 28 F, while the boiling point of hydrogen is minus 423 F, “just a few degrees above absolute zero.”

Like “deep space,” Stuver added.

It has to be transported at low pressure. “You pressurize it; the boiling temperature is higher,” Weeks said.

But, “we have been operating hydrogen pipelines for decades and safely” at low pressure and using softer steels, he added. Needing to transport hydrogen isn’t “a roadblock to hydrogen injection. It can be mitigated.”

Commercialization

Mitsubishi is working to develop a salt-dome storage hydrogen hub in Utah, it reported in a press release. And it has a deal with Texas Brine Co. LLC toward hydrogen storage in salt caverns on the East and Gulf coasts.

In a Zoom session in May hosted by the Global Alliance Powerfuels association, Tahmid Mizan, manager, global regulatory affairs, for Exxon Mobil Corp., was asked how hydrogen will become cost-competitive.

Mizan said blue hydrogen is a traditional industrial hydrogen “with carbon capture bolted onto it. That’s one option that’s probably deployable in large scale.”

Its cost is more than grey hydrogen and less than green hydrogen, he said.

Still, all three “require additional technology to make them more and more competitive,” he added. “I think, early on, and maybe for a significant amount of time, policy support will be required to commercialize them.”

Two oil and gas executives planned a special purpose acquisition company (SPAC), Integrated Energy Transition Acquisition Corp., to buy assets in natural gas midstream, LNG and blue hydrogen. Chris Close was CFO of Preferred Sands Inc.; Richard Westerdale II was joint venture rep for Exxon Mobil in the Gorgon (Australia) LNG project. The planned SPAC’s board includes Angela Minas, formerly CFO of DCP Midstream Partners LP.

In the S-1 filed earlier this year, Integrated Energy acknowledged that, “while hydrogen, in itself, is a clean fuel, the process of producing hydrogen is energy-intensive and has carbon byproducts.”

But, it noted, blue hydrogen, while made from natural gas, includes capturing and storing the carbon byproduct.

NASA was the first space agency to choose hydrogen as its rocket fuel back in the 1950s. NASA also uses hydrogen in powering spacecraft.

“By combining hydrogen, particularly generated from renewable resources (that is, water, using wind and/or solar), the pipeline operator can then honestly make claims that it is decarbonizing its product by adding a zero-carbon Btu carrier among its products.” —Brian Weeks, GTI

Upon returning from Earth’s thermosphere in July, Jeff Bezos said in the post-flight conference that liquid hydrogen, which was used in the New Shepherd rocket, is too much power for just a suborbital flight.

But his startup, Blue Origin, chose it for the first-generation rocket because it’s what will be needed to fuel the bigger missions, using the planned New Glenn rocket then the next iteration, New Armstrong.

“It’s the most powerful, highest-performing rocket fuel in the world,” Bezos said.

Also, when used alongside liquid oxygen, “it’s the most environmentally benign propellant you can choose. When you burn liquid hydrogen with liquid oxygen, you get H2O. It’s water.”

In Earth-based vehicles, Integrated Energy reported to prospective shareholders that hydrogen fuel cells “are two to three times more efficient than an internal combustion engine running on gasoline and produce zero emissions.”

It added that South Korea and Japan have hydrogen transportation plans. Meanwhile, “China, the largest hydrogen producer in the world, has forecasted that it will see hydrogen demand more than double in 20 years.”

Yes, but no

Jefferies Group hosted a hydrogen webinar in July with Paul Martin, a Canada-based chemical process engineer who writes frequently on alternative fuels and describes himself as a “tireless advocate of a fossil fuel-free future.”

With hydrogen, though, he’s not on board. “[Martin] does not see hydrogen as a viable means of solving the energy decarbonization problem due to fundamental inefficiencies with its development cycle,” reported Jefferies analysts Ahmed Farman (utilities), Philippe Houchois (auto) and Giacomo Romeo (oil and gas).

Instead, he “sees hydrogen’s applications in energy storage/transport as limited and believes the long-term solution lies in more widely connected grids, renewables and improvements in battery technology.”

Martin converted his 1975 Triumph Spitfire into an electric vehicle. Most of the challenge appeared to be in derusting the body and replacing the rotted frame. (Spoiler: It was soon totaled by a Dodge Ram 2500.)

Martin said producing a hydrogen fuel cell results in 63% energy loss in a best case and using it as a source of heat results in 37% energy loss. “With this, the expert sees hydrogen as an extremely inefficient means of storing/ transporting energy and therefore unviable,” the Jefferies analysts reported.

In cars, Martin “sees hydrogen as neither effective nor efficient. For trucks, a similar argument is made for short distance, while for long distance the fuel logistics are seen as a major barrier.”

In pipeline transportation, a blend of 20% hydrogen in a natural gas pipe, “the medium- and high-pressure pipes—made from hard steel— would have issues transporting hydrogen.

“Hydrogen is abundant and carbon-free. Most importantly, it has an immensely high energy density per unit of mass, which makes it versatile as a fuel and an ideal replacement for hydrocarbons in hardto-decarbonize sectors such as transport, industry and heating.” —Bernstein Research

“Secondly, as hydrogen is less energy dense than natural gas, replacing the latter with 20% of hydrogen leads to a 14% energy loss. Overall, the expert believes that electrification, via heat pumps, is a more suitable solution for decarbonizing heating than hydrogen.”

The best use of hydrogen? Pretty much how it’s already used, which is, according to the Energy Information Administration (EIA), petroleum blending, metals, fertilizer, food processing and rocket fuel.

The Jefferies analysts wrote that, according to Martin, “using hydrogen to make e-fuels, via a reverse of thermodynamics, while possible, is a weak-efficient solution.”

‘Station anxiety’

The current EIA findings are that hydrogen in vehicles has to overcome what Weeks at GTI said: “station anxiety.”

The EIA wrote that “people won’t buy those vehicles if hydrogen refueling stations are not easily accessible, and companies won’t build refueling stations if they don’t have customers with hydrogen-fueled vehicles.”

Of the roughly 50 hydrogen refueling stations in the U.S., nearly all are in California, according to the EIA.

Toyota’s position is that cars and trucks should be hybrid electric/gasoline rather than fully electric, “the industry’s strongest voice opposing an all-out transition to electric vehicles,” according to a New York Times report.

The automaker’s position has been surprising in the sector. “Even as other automakers have embraced electric cars,” The Times reported, “Toyota bet its future on the development of hydrogen fuel cells—a costlier technology that has fallen far behind electric batteries—with greater use of hybrids in the near term.”

Bernstein Research analysts prepared a 274- page report on the potential of hydrogen in the push to net-zero.

“Hydrogen is abundant and carbon-free,” they wrote. “Most importantly, it has an immensely high energy density per unit of mass, which makes it versatile as a fuel and an ideal replacement for hydrocarbons in hard-to-decarbonize sectors such as transport, industry and heating.”

The cost is falling, they added. A great deal of platinum is needed in hydrogen fuel cells and other metals are needed in hydrogen infrastructure. But the Bernstein analysts believe sourcing these metals will not be an issue.

Recommended Reading

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.

FERC Again Approves TC Energy Pipeline Expansion in Northwest US

2024-04-19 - The Federal Energy Regulatory Commission shot down opposition by environmental groups and states to stay TC Energy’s $75 million project.

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.