Presented by:

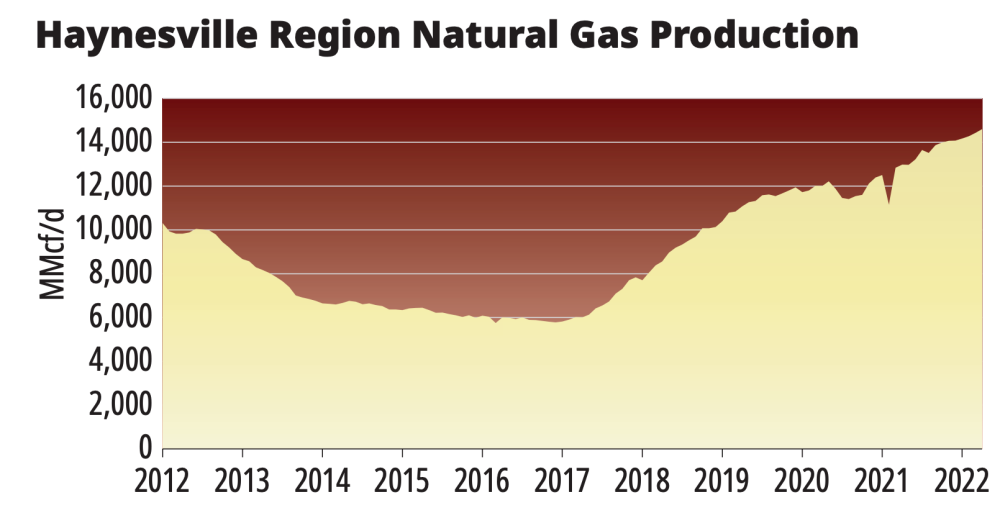

In early April, the No. 2 U.S. rig count was the Haynesville’s 77, second only to the mighty Permian Basin, according to Enverus’ count.

In 2016, the count had dropped to as few as 24. The intersection of new well productivity and iron count was met in 2015, as new-well results began to improve from about 4 MMcf/d to some 12 MMcf/d today, per the U.S. Energy Information Administration (EIA).

While productivity could be attributed to producers reining in their focus to the core as gas prices fell to average some $2, overall Haynesville output grew, though, from 6 Bcf/d to now more than 14 Bcf/d.

Comstock Resources Inc. reported in February having brought online two 15,000-ft laterals with IPs between 41 MMcf/d and 48 MMcf/d.

“Adding dry-gas Haynesville to its wet-gas Marcellus provides ‘optionality that clearly differentiates Southwestern from its peers.’” —Bill Way, Southwestern Energy

Haynesville operators’ combined 14 Bcf/d is enough alone to supply the 13 Bcf/d that U.S. LNG exporters are shipping—nearly all of it from the Gulf Coast. The Haynesville and Marcellus’ combined 50 Bcf/d is as much as all U.S. gas production totaled 20 years ago.

“The play has exceeded my expectations,” said Rob Turnham, who was president and COO of one of the Haynesville’s original producers, Goodrich Petroleum Corp., which was sold in December. “Completion methodology is recovering a higher percentage of the gas in place than originally thought.”

It was expected that more gas would be surfaced with more proppant and water per foot, along with tighter cluster and stage-interval spacing.

“But our original estimate [in 2008] was 2 Bcf per 1,000 ft of completed lateral versus the 2.5 Bcf we were achieving when we sold the company,” he said.

Goodrich was bought by privately held EnCap Investments LP-backed Paloma Partners VI Holdings LLC for $480 million in cash and debt assumption.

“The play has exceeded my expectations.”—Rob Turnham

Also buying into the Haynesville is Marcellus-focused Southwestern Energy Co., which was the founder of the Fayetteville Shale play in 2004. It added the Haynesville last year, signing a deal in June for Indigo Natural Resources. It followed that by picking up GEP Haynesville LLC in November.

Southwestern president and CEO Bill Way told investors this February that, soon after its deals, gas fundamentals “strengthened materially, improving the economic value of the transactions.

“Our strategic entry into Haynesville was well-timed,” he said. Adding dry-gas Haynesville to its wet-gas Marcellus provides “optionality that clearly differentiates Southwestern from its peers.”

$2.69 strip to $5.59

What happened last year is that, exiting winter 2020 to 2021, which saw a large Asian draw on U.S. gas, U.S. futures didn’t collapse, as they typically do. Instead, all futures rose, including shoulder months.

And the margin became less vast. January gas and September gas, for example, narrowed to a sub-20% price difference. Continuing into year-end 2021, price differences narrowed to within pennies.

Contributing to this was that the Wahalajara Pipeline from the Permian Basin’s Waha hub to Guadalajara, Mexico, came online in the fall of 2020, bringing capacity to up to 7 Bcf/d of West Texas gas across the border and lightening some of the tamping on gas prices.

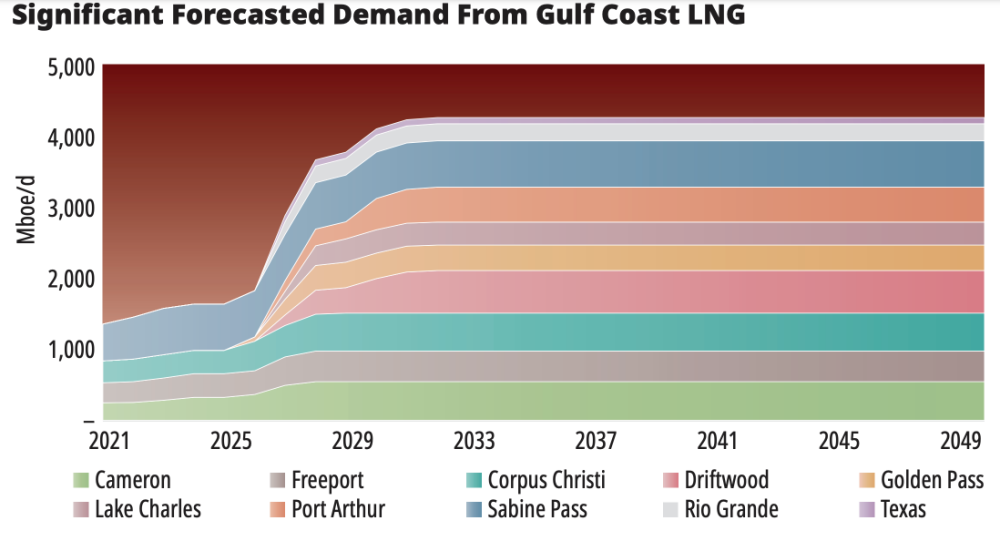

Meanwhile, demand for U.S. LNG that was approaching capacity of some 13 Bcf/d didn’t decline.

The 12-month strip on Jan. 4, 2021, was $2.69, according to Piper Sandler Research. In July of 2021, it was $3.76.

This past April 1, in the midst of western European vows to discontinue sourcing gas from Russia, strip was $5.59.

Getting Btu ‘on the water’

In addition to Southwestern, Chesapeake Energy Corp. is also a Marcellus producer. Southwestern’s Way said entering the Haynesville provides “direct access to LNG and global sales points and lowered [our] overall risk profile.”

Chesapeake, the Haynesville’s founder, had sold some of its leasehold over the years. In 2021, it bought newly public Vine Energy Inc. In the Marcellus, it bolted on as well, picking up Chief E&D Holdings LP and Tug Hill Inc.’s nonop interests.

“We are pretty excited about the ability to take some of our molecules and get them on the water.” —Mohit Singh, Chesapeake Energy Corp.

Mohit Singh, Chesapeake CFO, told investors in late February, in response to whether Chesapeake is working on internationally priced gas contracts, “We are pretty excited about the ability to take some of our molecules and get them on the water.”

Chesapeake is talking with potential counterparties but not near having anything to announce, he said. “So more to come on that.”

In January, U.S. LNG exports totaled 354 Bcf with roughly 262 Bcf going to Europe and Turkey, per the EIA: 60 to the U.K.; 50, France; 49, Spain; 45, Turkey; 16, the Netherlands; 14, Belgium; and the balance to Croatia, Greece, Italy, Lithuania, Poland and Portugal. A year earlier, U.S. exports were 305 Bcf, with 93 going to Europe and Turkey.

“Booming production from the Haynesville is expected to continue growing through the next decade, adding 50% to its current daily volumes,” Wood Mackenzie analysts report.

Adding LNG capacity

Haynesville gas makes a mostly straight line to three existing Louisiana LNG export terminals—Sabine Pass, Hackberry and Calcasieu Pass.

Tellurian Inc. began construction in February of its long-delayed, 2-Bcf/d Driftwood export project north of Hackberry, proceeding with self-funding.

“Everybody is now scrambling for the ability to source gas in different places.” —Charif Souki, Tellurian Inc.

“What remains to be done is to finalize the financing,” Charif Souki, Tellurian executive chairman and co-founder, reported on March 29 in his vlog. It’s a $12 billion project to be funded with two-thirds debt and one-third equity.

“We expect to finalize all of these conversations within the next 90 days.”

In a March 28 vlog, he spoke of the invasion of Ukraine: “It brings tears to your eyes.” In recent comments by leaders of European nations, “everybody is now scrambling for the ability to source gas in different places,” he said.

“And yet we are sitting here not quite making our mind up to allow American gas production to reach global shores in general and particularly in Europe today in a moment of crisis.”

The Biden administration has reported it is now fast-tracking new-facility and expansion permitting.

Souki said the U.S. now has “120 million [annual] tonnes that are permitted and ready to go that need to be brought to the market as soon as possible.”

Driftwood is among those. “It’s one of these moments in life when things get put into perspective,” he said. “There are more important things that are happening today that are tragic and at the same time inspiring. Hopefully we at Tellurian can make a small contribution.”

Sempra Energy, operator of Cameron LNG at Hackberry, is working on adding another train, this one having capacity of 6.75 million tonnes per year. It is also developing Port Arthur LNG near Sabine Pass.

Three Louisiana projects by other developers could redirect Gulf of Mexico gas into LNG for export, reducing offshore gas’ competition with onshore gas.

The global gas call

Turnham said U.S. Gulf Coast LNG “could be called the largest green initiative in the world.”

“The Haynesville is incredibly advantaged.” —Dick Stoneburner, Pine Brook Partners LP

As more terminals are built, “the Haynesville will only grow more important.” “As an industry, we should push for more gas production and LNG export capabilities while eliminating well emissions, providing the world with better options than relying on Russia and others, while taking market share from coal and becoming energy independent once again.”

Dick Stoneburner, who was president and COO of Haynesville co-leader Petrohawk Energy Corp., said that after all the cycles since the play’s discovery was announced in early 2008, “history is smiling down on the Haynesville right now.”

Marcellus growth is constrained by the inability to get more big pipe into the ground. “Those problems simply do not exist in the Haynesville and the associated Gulf Coast infrastructure.”

So that leaves the Haynesville to answer the global gas call. “The Haynesville is incredibly advantaged,” Stoneburner said, “with a resource that can deliver significant volumes very quickly and get them to market without the constraints of the Marcellus, which is the only other major shale gas basin in the Lower 48 that can truly help with supplying the world with natural gas.”

More gas, less cost

Southwestern’s Way said more than 75% of U.S. gas demand growth is expected to happen along the Gulf Coast, and that’s where 65% of Southwestern’s gas is sold.

The operator expects to average 8.5 rigs and 3.5 completion crews in its Haynesville property this year for up to 75 wells and 55% of total D&C spend. Its Marcellus spend is expected to D&C up to 65 wells.

Its fourth-quarter 2021 Haynesville wells had laterals averaging 6,900 ft for $1,600 a foot. IPs were more than 26 MMcf/d “and continue to strengthen,” Clay Carrell, Southwestern COO, said.

Comstock’s chairman and CEO Jay Allison told investors in mid-February that “our drilling inventory has never been more valuable or stronger.”

Haynesville pure-play Comstock reported that, as oilfield costs have risen, its push to longer laterals has resulted in less expensive D&C per foot. D&C in the fourth quarter was $1,027 per foot ($413/ft to drill; $615/ ft to complete), which was 2% less than in the third quarter “and flat compared to our full-year 2020 D&C costs,” Dan Harrison, Comstock COO, said.

The operators’ first two 15,000-ft Haynesville laterals, the Talley #1 and #2, came on with 41 MMcf/d and 48 MMcf/d.

Last year, it added 49,000 net acres for $57.7 million or $1,178 per acre, Allison said. Among its deals, it added some 17,000 net adjacent acres in East Texas for $35 million that means 44 laterals Comstock already planned on its own property can be extended.

More M&A

Drilling inventory “is the holy grail of E&P companies,” Allison said. “I think that’s why you have a lot of M&A in the last year or two years.”

In addition to Chesapeake buying Vine, Southwestern buying Indigo and GEP, and Paloma buying Goodrich, Diversified Energy Co. Plc entered with a Cotton Valley package for $117 million and followed with buying operator Tanos Energy Holdings III LLC for $116 million.

“Our drilling inventory has never been more valuable or stronger.” —Jay Allison, Comstock Resources Inc.

At press time, Aethon Energy was reportedly selling its Louisiana Haynesville assets. Nitin Kumar, analyst for Wells Fargo Securities LLC, described Aethon in January as “one of the fastest-growing gas operators in the U.S. onshore.” It holds more than 320,000 net acres, with some 170,000 of these in Louisiana.

Prior to 2021, Japan’s Osaka Gas took 100% ownership of Sabine Oil & Gas Corp. It also owns 8.3% of Freeport LNG’s export capacity. Japan’s Tokyo Gas increased its holding to 70% in Castleton Commodities International LLC’s Haynesville operator, now known as TG Natural Resources, which holds some 304,000 net acres.

Other formations

Is there any way to grow a Haynesville footprint other than buying into it?

Stoneburner said, “I do believe there is a reasonable chance that the play could expand if a company is willing to take some geologic risk.”

While at Petrohawk, “we worked hard at trying to convince ourselves that there was an eastern extension, but it gets very deep very quickly, and what little subsurface control that existed was not all that supportive.”

Going north, the facies lack enough organic shale. “I think the one area that has yet to be tested adequately is to the south. I don’t suspect that it would open up a lot of acreage, but I do recall that there were subsurface data points that made an extension in that direction pretty interesting.”

How about the Cotton Valley and Hosston, overlying the Haynesville? “I think the shallower formations are, for the most part, fully exploited,” Stoneburner said.

Turnham added, “The productivity and economics in those shallower zones don’t compete with the Haynesville if the acreage is in the core of the play.”

Otherwise, the means of leasehold growth that is remaining is by pocketbook, Turnham said. “There is likely more room for smaller farm-ins, joint ventures and transactions in East Texas versus in North Louisiana, where traditional M&A will continue due to a small number of companies controlling the core of the acreage.”

Recommended Reading

Thanks to New Technologies Group, CNX Records 16th Consecutive Quarter of FCF

2024-01-26 - Despite exiting Adams Fork Project, CNX Resources expects 2024 to yield even greater cash flow.

Cheniere Energy Declares Quarterly Cash Dividend, Distribution

2024-01-26 - Cheniere’s quarterly cash dividend is payable on Feb. 23 to shareholders of record by Feb. 6.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.