Total U.S. wind production in February was 23,047 thousand MWh. Pictured are thousands of wind turbines in Mojave, Calif. (Source: Shutterstock.com)

[Editor's note: A version of this story appears in the July 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

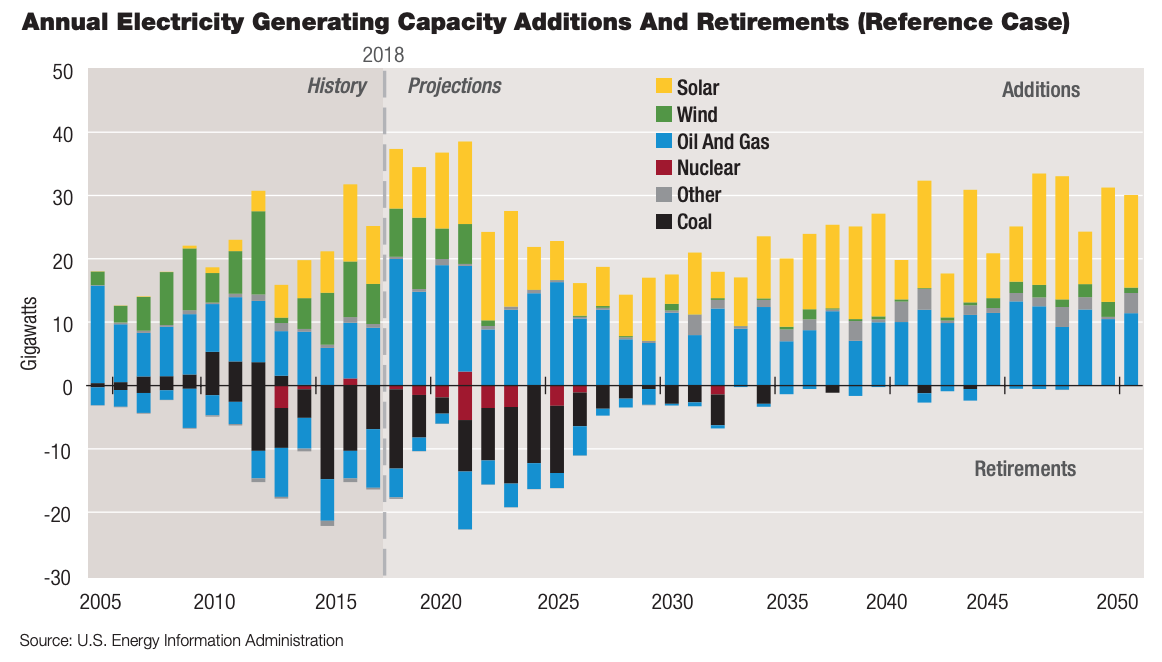

This summer, odds are 40% that any light switch in the U.S. is powered by natural gas—or, as the grid is source-indifferent, that 40% of the power is derived from natural gas. That’s up from a 35% chance during the summer of 2015 and 14% in 1997, according to the U.S. Energy Information Administration (EIA).

Odds that power’s coming from wind, solar and other non-hydro renewables are 9%, with wind’s share alone being 6%, up from less than 1% in 1997. As for coal, there’s a 25% chance, down from 28% last summer.

The growth in natgas and non-hydro renewables’ share of the U.S. power market has taken place while overall U.S. power demand is growing as well. Total demand in 2001, for example, was about 3.4 trillion kilowatt-hour (kWh). In 2018, it was about 4 trillion kWh.

activity level in

the U.S., outside

of traditional

investment

hurdles, “has

been to me

nothing short

of astonishing,”

said Andrew

Ellenbogen,

managing

director of power

and renewables at

EIG Global Energy

Partners.

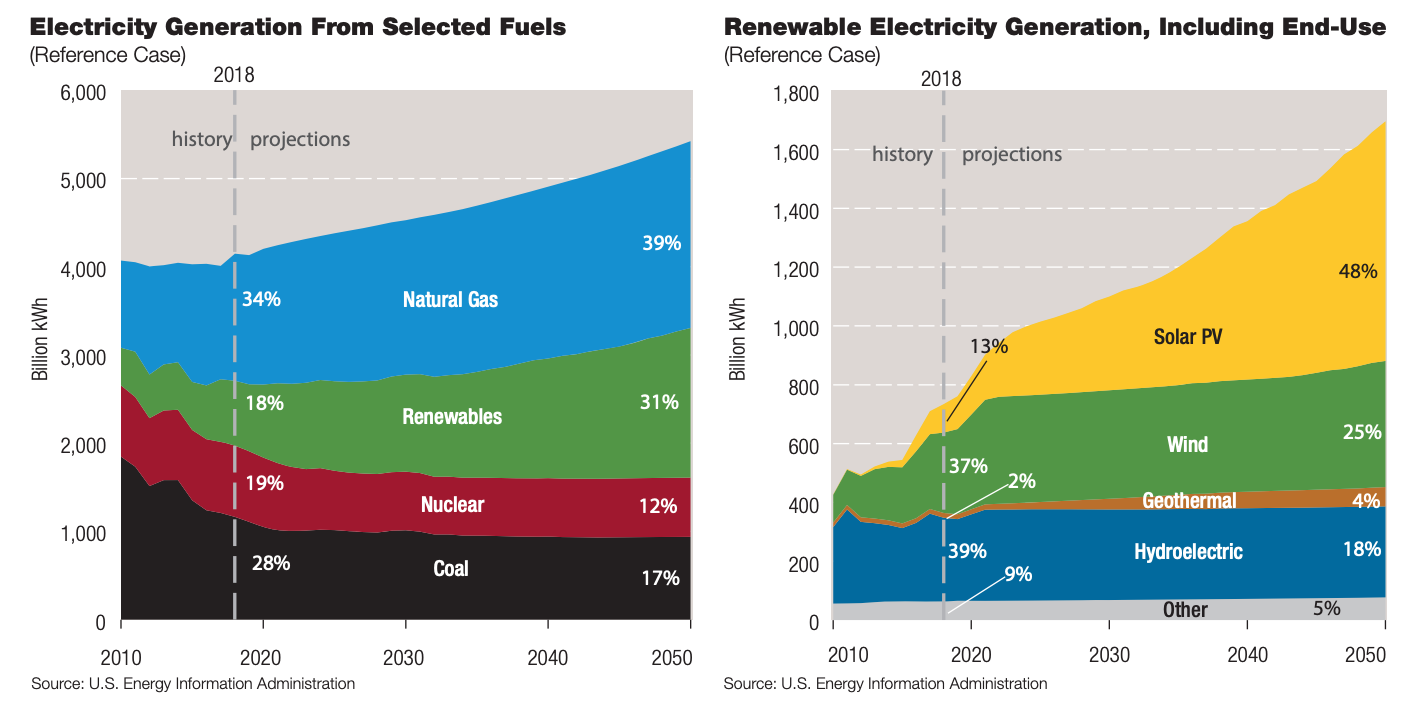

The forecast for 2050 is more than 5 trillion kWh, according to the EIA’s 2019 Annual Energy Outlook, which expects demand to grow an average of 1% a year, plus or minus 0.2%.

For 2050, it forecasts natgas will have a 39% market share while renewables, including hydro, grow to 31%. Within that group, solar is expected to provide 48%; wind, 25%; hydro, 18%.

Coal is expected to decline to 17% in 2050; nuclear, from 19% to 12%.

Generally, natgas and renewables, including hydro, are forecast to have a combined market share of 70% in 2050. This is in contrast to a combined market share of 52% in 2018. Meanwhile, coal use in powergen in 2018 was about as much as was used in 1980, according to the EIA.

For all of 2019, the EIA expects U.S. electricity to be derived 37% from natgas; coal, 24%; nuclear, 19%; 7%, hydro; and 11%, non-hydro renewables.

Investment ‘Model’

As renewables are presenting as the greatest competitor today to natgas’ future market share, what’s the investment model? For now, that’s complicated, according to Andrew Ellenbogen, managing director, power and renewables, for EIG Global Energy Partners. The firm invests globally in energy and related infrastructure.

“That doesn’t mean we don’t spend a lot of time looking at it. We look at it. We’re firm believers in the role of solar and other renewables going forward.”

EIG has current investments in natgas power generation and in a biomass project in the U.S., as well as in oil and gas production and transportation and LNG export. It has select investments in the U.S. solar and wind space.

Abroad, however, it has been more active in solar and wind, along with hydro investments, as well as biomass and oil and gas production and infrastructure.

There are a couple of leading reasons why its activity in wind and solar is less in the U.S. right now, Ellenbogen said. “No. 1 is tax equity winds up crowding out a lot of the capital needed.”

Solar and wind projects have been benefitting from federal tax code incentives. Wind comes with a production tax credit; solar, an investment tax credit. With wind, the tax credit is per megawatt hour produced.

“So you have to have taxable income against which to use that credit and, oftentimes, these projects don’t have taxable income, so they have to find a partner that can utilize that tax credit.”

With solar, the tax credit “represents 30% of your upfront costs. That’s a much more front-end-loaded tax credit, which can make it even harder for the project itself to monetize.”

The partner that has taxable income absorbs the tax attributes of the project. “You have someone paying an upfront dollar amount in order to receive that stream of tax benefits.” That reduces how much capital is still needed from other sources to build the project.

There is also a depreciation tax benefit. A partner may buy this upfront as well. “So it’s basically a form of capital. You’re parceling out certain attributes of the project in certain pieces.”

As a result, the capital that’s still needed can become limited in total quantum. The projects tend to have a relatively high capacity for senior leverage, “which is lower-cost capital, which is often best sourced from traditional commercial banks.”

Offtake agreements have supported leverage in the 60% “and even up to 80% ballpark—perhaps more. And I mean total leverage, when you take into account the tax equity and the debt.”

to get the scale

in renewables to

be able to fuel

the U.S. or the

world [alone],”

said Danny Rice,

co-founder of

Rice Investment

Group.

With tax equity and senior leverage, “it leaves a relatively modest gross dollar quantum required for the remainder of the capital structure.”

A third concern has been the returns. “Returns are quite tight,” he said. EIG is waiting to see these better reflect the risk/return profile.

Federal tax breaks are to begin unwinding after this year. As future projects become more merchant in nature or take on more counterparty credit risk in the offtake, leverage levels will likely decline. “So I think the opportunity is coming our way,” Ellenbogen said.

Overall, the current limitations, which EIG believes are melting away, are “really the tax equity, it’s the high senior leverage, which leaves limited additional capital required, and it’s where the returns are today on the risk/return profile.”

Abroad, however, the fundamentals are different. Europe, for example, is a net energy importer. The U.S. has sub-$3 natgas. For Europe, the landed price of LNG in the U.K., for example, was $4.61 in an April assessment by the U.S. Federal Energy Regulatory Commission. In Spain, it was $4.88; in Belgium, $4.99.

“The price against which renewables have to compete is much higher,” he said. Meanwhile, “tax equity [in projects] doesn’t exist there, so that’s not an issue.”

‘Astonishing’ Activity

Nevertheless, the renewables activity level in the U.S., outside of traditional investment hurdles, “has been to me nothing short of astonishing,” Ellenbogen said. “There is a huge amount going on in the U.S. and there will continue to be. The build-out in solar and wind has been really quite incredible.”

Texas wind farms, for example, represent more than 20 gigawatts of capacity in an approximately 100-gigawatt power system. “That’s a huge percentage in a state like Texas that you might not think about as a renewables-friendly kind of place.”

Meanwhile, in California, “which you would think is a renewables kind of place, the penetration of solar has been roughly similar [to Texas] in the total system there.”

In February, for example, the No. 1 producer of U.S. wind power was Texas with 6,615 thousand megawatt-hours (MWh), according to the EIA. Oklahoma was No. 2 with 2,142 thousand MWh. Total U.S. wind production in February was 23,047 thousand MWh.

As for solar, the No. 1 U.S. producer was California with 2,274 thousand MWh. No. 2, North Carolina, was a longshot behind at 440 thousand MWh. The U.S. total was 5,867. (Editor’s note: At press time, the newest EIA data was for February, which might not be the windiest or sunniest month in any particular state. The data are provided anecdotally.)

__________________________________________________________________________________________________

RELATED:

Consumer Awareness Helping Create Opportunities For Solar, Wind In Texas

Solar Sector Launches Lobbying Push To Preserve Key Subsidy

__________________________________________________________________________________________________

For EIG and other private-equity investors, Ellenbogen said, “I don’t think it’s too far off that the opportunity set will expand.” The odds are that the tax breaks—first adopted in 1992 when U.S. prospects were dim for new natural gas supply—won’t be renewed again.

“I think, this time around, the [renewables] industry feels like it has gotten to a point where it’s reasonable for those to tail off and they’re coming down in a sort of tapered fashion. Our working assumption is that they are not likely to be renewed.”

Offtakers are already shifting from the classic power purchase agreement (PPA) to corporate PPAs. “The best credits have probably been secured already, so credit quality is going to be declining in that camp.”

Then, there is the potential for merchant projects. “As tax equity rolls off and as projects take on more unique offtake agreements and more merchant exposure, the opportunity set for us [in the U.S.] will expand. We see that coming pretty soon.”

Environmental, Social

The environmental and social shift of U.S. corporations has resulted in large offtake from consumer-facing brands—Google, Apple, Microsoft, Walmart, Citi, Kellogg’s, The Lego Group, for example—for newbuild renewable projects in the form of PPAs.

In these, a power user can reach or work toward its goal of 100% renewable-derived electricity in its operations—no matter if the solar in Arizona or wind in West Texas that it’s contracted is technically what it’s using at the data center, distribution center, office or store.

Some can be sure of where the power they’re using came from, at times. Target Corp., for example, has rooftop solar panels as well as PPAs.

Danny Rice is long on U.S. natgas, but he has investigated the fundamentals of renewables’ economics and is following the story as it continues to unfold. Rice was a founder of Appalachian gas producer Rice Energy Inc., which is now part of EQT Corp., where he is a board member.

He and fellow Rice Energy co-founders lead private-equity investments Rice Investment Group, which is focused currently on oil and gas production, midstream, field services and energy technology.

Clearly, social- and environmental-driven underwriting of new farms via PPAs—in addition to farm-owner tax breaks—have supported the growth. “They are doing it more on the social good than for the economics,” Rice said.

On a smaller scale, a homeowner may install rooftop solar panels “and he’s going to pay 100% of that cost himself and he knows it might pay out in 80 years.”

From an investment point of view, “how do you compete against someone who’s willing to make a negative return? You cannot compete against the cost of that capital. It’s challenging to compete against folks who aren’t doing it for the economics.”

Rice sees renewable-derived power generation as more suited to infrastructure funds than to private equity. “The returns are a lot thinner because you’re talking about infrastructure and there are infrastructure funds designed for that.”

Recently, KKR acquired an equity interest in a partnership with NextEra Energy Partners LP involving 10 utility-scale U.S. wind and solar projects with a combined 1,192 megawatts of capacity. Rice said, “So you see folks putting money in it. It’s just not the traditional type of energy private-equity firms doing it. It’s a different business proposition.”

The risk profile is different; the return profile is different. “It just doesn’t make sense for the traditional PE model in energy.”

Wind and solar farms have “no real operating cost. The fuel is free.” The cost is in the construction “and, then, you’re just realizing that return over 30, 40, 50 years. So it becomes an annuity type of product.”

Natgas’ Share

Where will natgas fit on the power grid in the future? As a private-equity investor in U.S. energy, Rice said, “you certainly need to have an opinion on where natural gas prices are going to be long term. Are solar and wind going to replace natural gas on the power-generation side longer term?”

What Rice sees is solar and wind capturing greater market share but natgas capturing a greater share as well. They’re taking it away from coal and nuclear. “So that bodes well for natural gas.”

contribution to

the grid has been

growing, “natural

gas is definitely

still dominating.

Renewables are

increasing, but

they’re still a

minority,” said

Rob Allerman,

Drillinginfo senior

director of power

analytics.

Would natgas become the swing producer, kicking in when the U.S is short solar and wind? Rice doesn’t see it that way. He sees natgas as the mainstay, with solar and wind contributing.

“You’re not going to get the scale in renewables to be able to fuel the U.S. or the world [alone].”

That’s even if it’s sunny and windy all day, every day. “You’re not going to be able to build that scale to achieve what the world consumes each day. So you need natural gas and coal and nuclear not just as a backup but as your primary fuel source.”

Without the tax breaks, it’s nonintuitive for a private-equity investor to pick solar and wind today. “Now, if we take a super-long view, I think it’s inevitable renewables will continue to be of greater importance—because economics will eventually work and also just because, from a social perspective, folks are going to push renewables even if economics don’t work.”

But, for renewables to work long term, natgas prices would have to exceed the all-in, per-British thermal unit cost of solar and wind. Without any good reason to expect natgas prices to grow to $6 and more on an unrelenting basis, “the competitiveness of these renewable sources just gets pushed a little bit longer in time.”

The natgas strip is flat and associated-gas production continues from liquids-rich plays, such as the Permian Basin, where the price for the gas isn’t what’s driving whether the wells get drilled.

Rice said, “So, if I were making a long-term bet on solar and wind working, I would probably be investing in natural gas in the short term because the only way those [other] two sources compete is if natural gas prices rise incredibly over the next decade or two.”

Further out, when the view is that the Marcellus play, for example, is becoming depleted, “that is naturally going to be a signal that we need to develop new energy sources, and that’s kind of where solar and wind start to play a more active role.

“Natural gas prices will rise, allowing solar and wind to become more competitive.”

The Battery

Drillinginfo Inc.’s power group forecasts U.S. supply and demand. While renewables’ contribution to the grid has been growing, “natural gas is definitely still dominating. Renewables are increasing, but they’re still a minority,” said Rob Allerman, Drillinginfo senior director, power analytics.

He agrees with forecasts, such as the EIA’s, that natgas, wind and solar will have the greatest share of the power supply long term. “Natural gas continues to be relatively inexpensive, especially when you look at the price of coal. It just continues to price coal out.

“That’s going to continue. There isn’t any indication natural gas is going to become more expensive.”

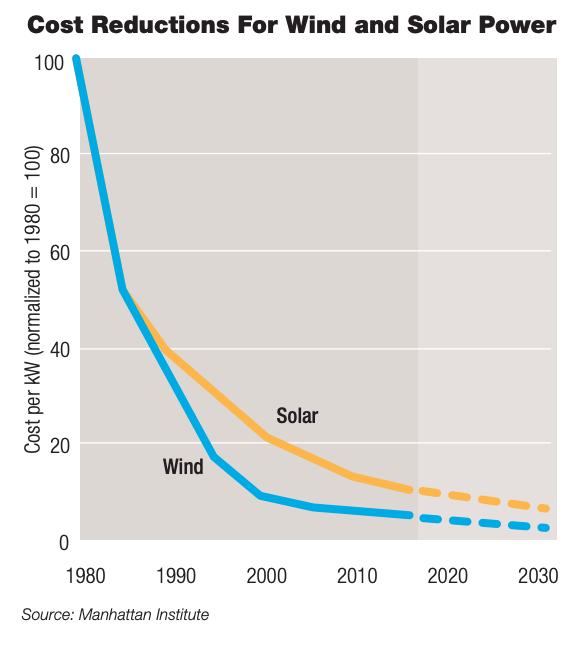

Meanwhile, as technology continues to advance in wind and solar, Allerman expects the price for these will become lower, putting further pressure on coal and nuclear.

Utility-level battery storage—being able to store excess power generated during periods of non-peak demand for use during peak demand—may contribute. “It’s not quite there to be economically viable, but it’s being worked on considerably. It will eventually be in the energy mix,” Allerman said.

Battery storage has many hurdles to overcome, according to Mark Mills, a Manhattan Institute senior fellow. He wrote in March, “The annual output of Tesla [Inc.]’s Gigafactory, the world’s largest battery factory, could store three minutes’ worth of annual U.S. electricity demand.

“It would require 1,000 years of production to make enough batteries for two days’ worth of U.S. electricity demand. Meanwhile, 50 to 100 pounds of materials are mined, moved, and processed for every pound of battery produced.”

Outside of tax breaks, environmental and social impetus, and other factors that have supported wind and solar developments, the natural laws of solar and wind are unyielding, he wrote.

In his report, “The ‘New Energy Economy:’ An Exercise In Magical Thinking,” Mills played the physics card: “Solar arrays can’t convert more photons than those that arrive from the sun. Wind turbines can’t extract more energy than exists in the kinetic flows of moving air.”

Mills is a faculty fellow at Northwestern University’s McCormick School of Engineering and Applied Science. Applying natural law, the odds of wind and solar overtaking hydrocarbons in power generation are unlikely.

“Scientists have yet to discover and entrepreneurs have yet to invent anything as remarkable as hydrocarbons in terms of the combination of low-cost, high-energy-density, stability, safety and portability,” he wrote.

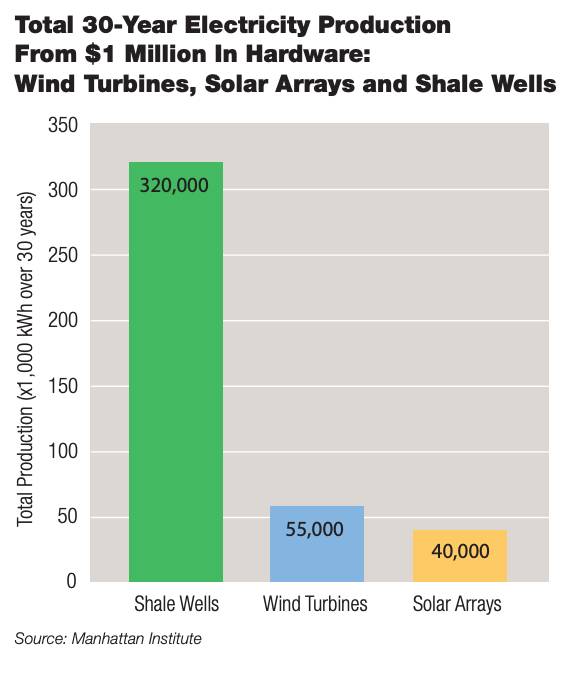

A $1-million spend on wind or solar will result in about 50 million kWh over 30 years, “while an equivalent $1 million spent on a shale rig produces enough natural gas over 30 years to generate over 300 million kWh.”

Wind and solar technology have advanced considerably, but further advancements will be small, he added. “No tenfold gains are left.” The physics boundary for the photovoltaic cell is 34% photon-electron conversion; “the best … technology today exceeds 26%.”

The boundary for wind is 60% kinetic conversion; “commercial turbines today exceed 40%.”

He concluded, “Hydrocarbons—oil, natural gas and coal—are the world’s principal energy resource today and will continue to be so in the foreseeable future.”

China, India

produce about 50 million kWh over 30 years,

while a similar spend on a shale well will

produce enough natgas to generate more than

300 million kWh, according to Mark Mills,

senior fellow, Manhattan Institute.

Rice is among the unknown, but likely overwhelming, number of Americans concerned about climate change. When looking at what will have the greatest effect on global power demand—and the carbon-based-derived byproduct, CO2 emissions—“you really need to look at China and India because you have two nations that are moving from not being very well developed to becoming middle class.”

The Manhattan Institute’s Mills wrote, “When the world’s poorest 4 billion people increase their energy use to just 15% of the per-capita level of developed economies, global energy consumption will rise by the equivalent of adding an entire United States’ worth of demand.”

Rice said that, first, “you need to get them onto natural gas as soon as you possibly can. It’s the only fuel source right now that has the size, scale and cost to allow them to get off coal.”

That may be LNG imports from the U.S.—“or Australia, or Qatar. It doesn’t matter. If you’re really looking at controlling CO2 emissions, we really need to focus a lot on those two countries.”

per kWh will be small, according to Mark Mills,

senior fellow, Manhattan Institute.

Rice is disappointed the U.S. quit the Paris Agreement, a nonbinding pact. “Whether or not you agree with the targets that were set, you don’t have a seat at that table now to have those conversations with those countries about what they do with their fuel sources going forward.

“If you don’t solve for China and India, it’s all for nothing. The world needs to work with India and China to get them off coal and get them to natural gas soon as soon as we possibly can.”

The EIA forecasts U.S. CO2 emissions will decline 2.1% this year and 0.8% in 2020 as a result of more renewable-derived power, less coal-fired supply and expectations of near-normal temperatures. Emissions had grown 2.7% in 2018 as a result of a warm summer and cold winter, it reported.

Pavel Molchanov, a senior vice president and equity research analyst for Raymond James & Associates Inc., wrote last November that U.S. CO2 emissions have declined to 14%—the 1990 level—from an all-time high in 2005. The EU’s emissions have fallen 22% to 10%.

Meanwhile, emissions by China, which produces 26% of the world total, and India have quadrupled. China overtook the U.S. as the No. 1 emitter in 2006.

“Simply put,” Molchanov wrote, “all of the world’s increase in CO2 emissions in recent decades has come from emerging markets.” Industrialized countries’ share was 64% in 1990; in 2017, 38%.

Not reaching the 2-degree-Celsius max in average global temperature set in the Paris Agreement would require halving global emissions by 2050, he wrote.

The overall, macro-fundamentals of natgas are why Rice and the investment team are long natgas. Rice said, “It becomes that solution not just for the U.S. but for most of the global economy as we transition to a cleaner energy future.”

It’s portable. And “it’s cheap. It’s prevalent. It’s able to meet the energy needs of the world,” Rice said.

“You hope wind and solar can get there on their own, but they need tax credits today. Their costs are declining at a decreasing rate.

“So natural gas is pretty darn critical. It’s the most critical one out there, I think.”

Nissa Darbonne can be reached at ndarbonne@hartenergy.com.

Recommended Reading

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

Exclusive: ‘Regulatory Tsunami’ a Top Priority for American Producers, Says AXPC’s Bradbury

2024-04-22 - Regulatory considerations have significant implications for how oil and gas companies evaluate risk, and it’s a top priority for American energy producers right now, said American Exploration & Production Council CEO Anne Bradbury at CERAWeek by S&P Global.

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.