Pumpjacks extract oil from an oilfield in Kern County, California. (Source: Shutterstock.com)

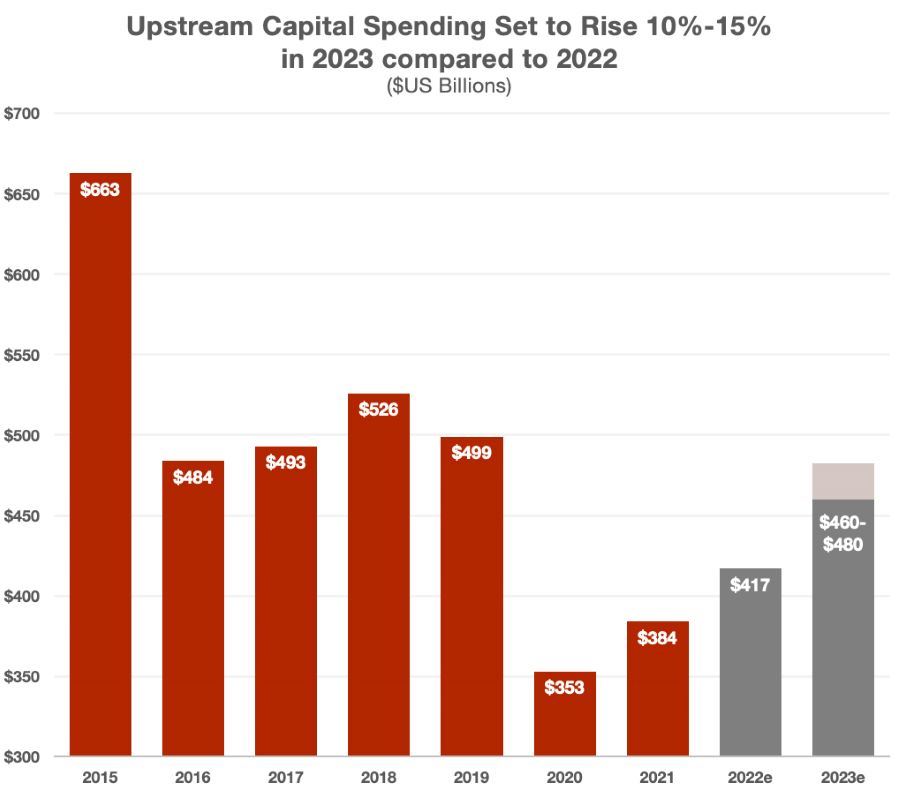

Upstream capital spending is set to reach $460 billion to$480 billion in 2023, up 10% to 15% sequentially compared to 2022, according to Moody’s Investor Service.

Overall spending though this year will come in lower than the levels seen between 2015 and 2019, Moody’s vice president and senior credit officer Sajjad Alam said Jan. 5 in the company’s report titled “Demand and policy uncertainty will temper the energy industry's overall strength in 2023.”

“More than half of the incremental spending in 2023 will go just to cover cost inflation, leaving relatively little capital for volume growth,” Alam said. “Rising costs for oilfield services globally, a tight labor market in the U.S. and lingering supply-chain delays will all limit any E&P company efforts to expand production capacity quickly in 2023.”

Each dollar reinvested will generate fewer volumes, lower margins and less return on invested capital, Alam said. That shouldn’t spoil the party for upstream companies set to benefit from favorable supply and demand in 2023.

The upstream sector is poised for another strong year, even though energy prices and free cash flow (FCF) will not be on par with levels seen last year. Many producers are expected to generate FCF and have capacity to reduce leverage, maintain or increase shareholder returns and pursue acquisitions or reinvestment opportunities, Alam said.

Sharp price swings are expected due to supply and demand uncertainties, which could impact the long-term investment decisions of many companies, he warned – and U.S. shale producers aren’t excluded from the list.

Oil and natural gas c prices are expected to trend lower in 2023 amid global economic uncertainties, according to forecasts from institutions such as the World Bank, the Energy Information Administration (EIA), Wells Fargo and Enverus.

RELATED

Commodity Prices in 2023: EIA, World Bank, Others Weigh In

“Breakeven costs have been rising across all geographies, and producers focused on U.S. shale basins are gradually exhausting their top drilling locations over time,” Alam said. “Yet reinvestment rates will remain low by historical standards with most companies planning to dedicate only 50% to 70% of their operating cash flow to maintain productive capacity.”

Some stronger companies could opt for acquisition and consolidation opportunities instead of dedicating more capital to drilling activities in order to minimize inflation risks, surplus supply and shareholder resentment.

“Margins for services such as hydraulic fracturing will not improve substantially in 2023 after a great expansion in 2022,” Moody’s vice president and senior analyst James Wilkins said in the company’s report. “As supply-chain restrictions ease, OFS [oilfield services] companies will add new frack spreads to the market to meet demand, potentially alleviating high prices. Tight capacity for wireline and drilling product lines imply higher margins for those segments in 2023.”

Wilkins said he still expects oilfield service companies to benefit from increased demand for their services to come from rising capex from the upstream sector. Service providers are expected to keep a keen focus on “cash flow and return on investment, rather than pursuing greater market share,” the analyst said.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.