Montage Resources Corp. is divesting a noncore asset sale in its Ohio Utica condensate development area to an international third-party.

In a company release on July 22, Montage said it entered into a non-binding letter of intent for the sale of its existing noncore Ohio Utica wellhead gas and liquids gathering infrastructure in exchange for a cash payment of $25 million. The transaction is expected to close fourth-quarter 2020.

“We are extremely pleased to be working with this well-established third-party on the sale of these noncore assets and the proceeds will provide the company the ability to reduce leverage, enhance liquidity and maintain its already strong balance sheet,” President and CEO John Reinhart said in a statement.

RELATED:

Executive Q&A with Montage Resources CEO John Reinhart featured in the September 2019 edition of Oil and Gas Investor

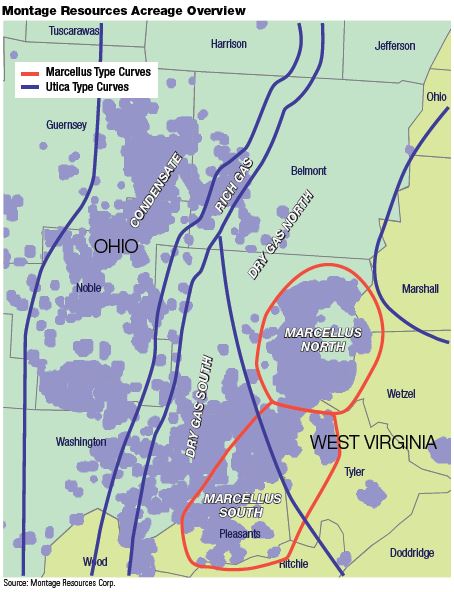

Montage Resources is an E&P company based in Irving, Texas, with approximately 195,000 net effective core undeveloped acres currently focused on the Utica and Marcellus shales of southeast Ohio, West Virginia and north-central Pennsylvania.

The company will release its second-quarter 2020 financial and operational results after the market close on Aug. 6.

In preliminary second-quarter results announced on July 22, Montage anticipates its production for the quarter will be near the high end of the previously announced range of between 535 MMcfe/d and 555 MMcfe/d.

In April, the company shut-in low margin production in its liquids-rich producing areas, primarily impacting its Utica condensate production, due to the historic crash in oil prices. However, on July 22, Montage said substantially all production had been returned to sales by June 1.

Additionally, Montage lowered its full year 2020 capex guidance range to between $120 million and$140 million, from its previous $130 million to $150 million range. The company expects the capex adjustment won’t impact its full year 2020 production due to a “persistent” focus on cost and efficiency gains.

“Our demonstrated results continue to reinforce value-enhancing progress toward improvements in efficiency gains, cost reductions, shortened cycle times and ongoing well outperformance,” Reinhart continued in his statement. “We believe the demonstrated capability of the team at Montage and the flexibility of the company’s assets will enable us to maintain a relatively stable year-over-year production profile from a prudent amount of capital expenditures, while sustaining the company’s commitment to debt reduction and cash flow generation.”

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.