The Exxon Mobil precursor Standard Oil was first listed among the 30 blue-chip companies in the Dow Jones industrial average in 1928. By 2007, the fossil fuel behemoth peaked as the largest publicly traded company in the world—in any industry—with a market capitalization of more than $500 billion.

But then came the Great Recession and the tech boom and the energy transition and, finally, the pandemic. The bottom seemingly fell out and Exxon Mobil was unceremoniously dumped out of the Dow in 2020 with a market value of just—relatively speaking—$178 billion.

But then came vaccines and demand resurgence and the war in Ukraine and record-breaking profits of $56 billion in 2022. Now, the Texas Juggernaut’s market cap again inches closer to $500 billion, once more easily leading the way as the largest investor-owned energy company in the world.

The developed world again seems to recognize the value, or at least the necessity, of oil and gas—and Exxon Mobil is front and center.

With the purchases of XTO Energy and the Bass family holdings, Exxon Mobil has transformed itself into a shale powerhouse, especially in the booming Permian Basin. And the company emerged as an exploratory pioneer in South America, turning tiny Guyana into an important part of the global oil landscape.

Despite pulling out of Russia for political reasons and seeing somewhat disappointing results in Brazil, Exxon Mobil is on an upward trajectory, aiming to hit 1 MMboe/d from the Permian and 1.2 MMboe/d from Guyana by 2027.

Chairman and CEO Darren Woods, a 30-year Exxon Mobil veteran and Texas A&M University alum, came up on the refining side of the business. So, he sees the whole value chain and prioritizes Exxon’s Growing the Gulf Initiative for pipeline, petrochemical, refining and LNG growth along the Texas and Louisiana Gulf Coast. There are major chemicals and plastics expansions at the Baytown and Baton Rouge complexes, a new petrochemical campus near Corpus Christi, historic refining growth in Beaumont and the construction of Golden Pass LNG.

The Permian growth helps to feed downstream expansions, and that West Texas footprint could rapidly expand if Exxon seals the deal on a longtime flirtation with the top Midland Basin driller, Pioneer Natural Resources, in a sale that could easily exceed $70 billion.

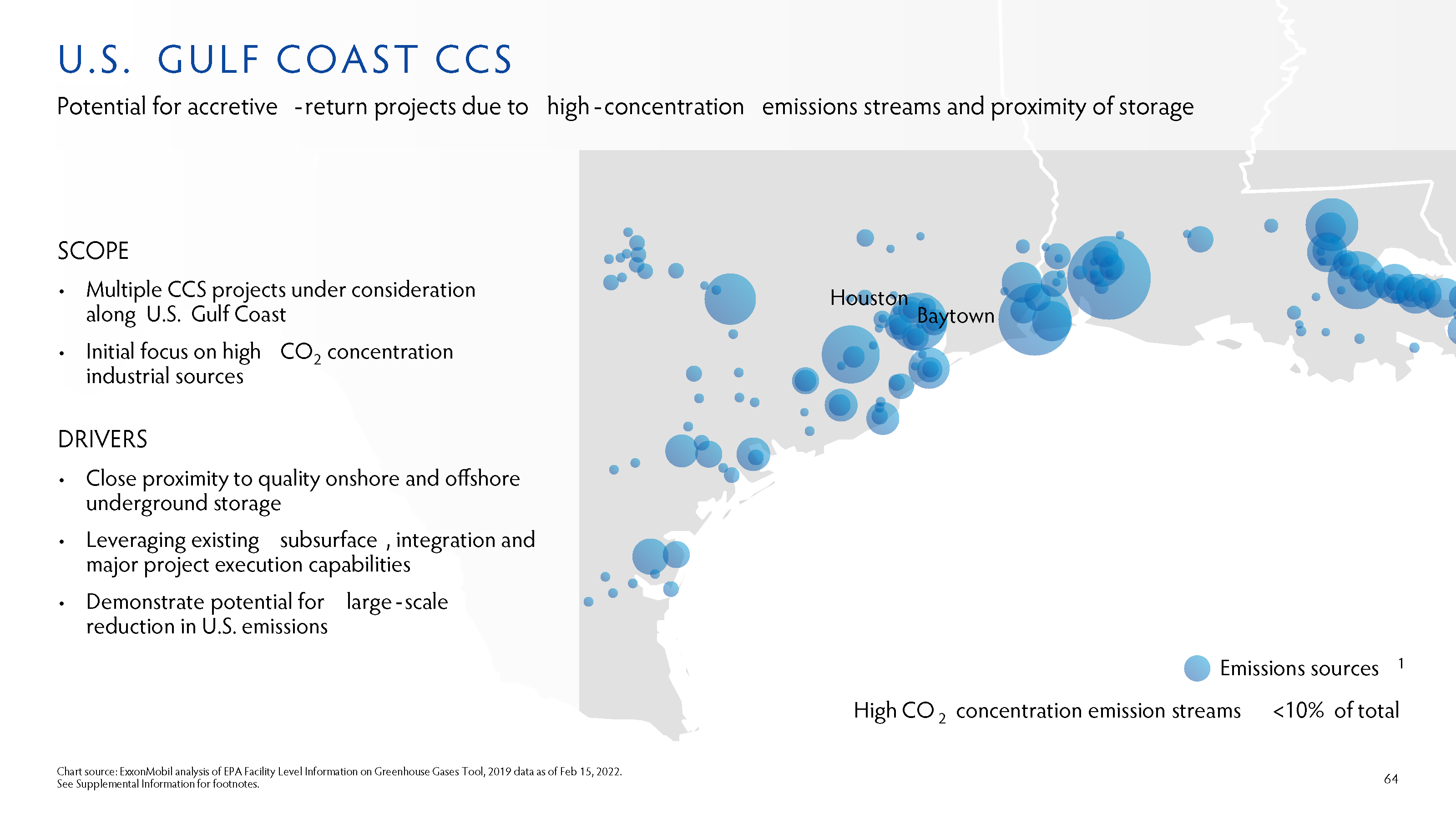

And Exxon Mobil is now leaning into the energy transition—not with wind and solar—but with carbon capture, hydrogen, renewable diesel and more.

Hart Energy Editorial Director Jordan Blum sat down with Woods in an exclusive interview to discuss all of the successes and challenges. This interview was conducted before the speculative mid-April Pioneer news, which Exxon Mobil declined to discuss.

Jordan Blum: Big picture, how is Exxon Mobil focusing more and more on North and South America, especially given the rise in global demand, the withdrawal from Russia and European taxation concerns?

Darren Woods: That’s where the opportunities that we have in our portfolio are most attractive and most competitive, so that’s where we’re putting our emphasis. My expectation would be that, over time, that will change based on where the opportunities present themselves. We continue to look all around the world. The nice thing about our industry is it’s connected. It’s a pretty efficient market, so we go where the resources are, and where we can bring a competitive advantage and differentiate ourselves.

So, our approach will be fairly diversified. We actually think from a risk management standpoint, given some of the uncertainties associated with governments and how administrations change with time, that having a portfolio that’s not dependent on any one place to be successful is a good strategy, which I think proved true with the assets that were expropriated in Russia. If you look at the size of that ($3.4 billion impairment charge), in the scheme of everything else we were doing, certainly the company was able to manage through that.

JB: In North America, obviously, the Permian is king. Exxon Mobil is roughly a top-five producer in the Permian and a very active driller. What’s the current importance of the Permian, along with production goals and targets?

DW: A key success factor in our industry and for us as a company in producing oil and gas is ensuring that, from a cost-of-supply standpoint, we’re on the low side, the left-hand side of the cost-of-supply curve. So, as we’re going through the cycles, irrespective of how low the price goes, there’s a price setter that’s out there that has a higher cost to produce than we do, which gives you a guaranteed margin.

In the Permian, several years back we used this phrase using a baseball analogy: small ball. And, when we first acquired XTO and participated in that, we kind of continued to play that short game. But we’re long-ball hitters as a big company. And so we challenged ourselves to define, “What does the long-ball game look like in the Permian?” In the Permian, you know where the resource is. It’s not a question of going out and finding the resource. It’s really a question of, how do you most effectively extract the most of it? That’s the big challenge in the Permian.

And so, we set ourselves up to approach this as a manufacturing issue and drive efficiency and effectiveness, and bring technology here into play in the Permian to try to maximize the recovery. We’re still on that journey. But the work that we’ve done in bringing that new approach to the Permian has driven our performance to lead the industry, and driven our cost of supply well below $40/bbl, which then makes it resilient. So, it’s a critical part of the portfolio and one where we think we bring some unique advantages that we haven’t fully realized yet. So, I see a lot of upside to the Permian.

JB: I know you’re doing more with automated rigs and you have the 1 MMboe/d production goal, but is there much concern about drilling inventory shortages and the core-of-the-core areas being drilled up?

DW: I would go back to when we thought about the approach we wanted to take here. At the time, I would say broader industry was very focused on high initial production rates, so they were drilling the sweet spots and getting those rates high. We, actually, in looking at it, said what we want to do is maximize recovery. That’s the right answer from an NPV (net present value). Rather than focus on the sweet spot and get high initial production rates, we focused on maximizing recovery, which led to this cube development that we’ve been working on and continuing to optimize.

The intent there is to drill in a way that maximizes full recovery, so we didn’t go down the path of sweet-spot, high-production rates. We’re not seeing the same challenges as many others out there that kind of went for the best. As you hit your sweet spot, you’re taking energy out of system, so to speak, so recovery becomes harder and harder. I think we’ve avoided the problem that a lot of people are talking about. We have a pretty deep well inventory, so I think we feel pretty comfortable with the plans that we have in place.

By the way, we don’t really set targets. We develop plans. In my expectations, we’re going to meet those plans (laughs). In my organization, they understand that. So, we’ve got a really good plan we’ve been delivering on pretty consistently. So, I’ve got a lot of confidence we’ll hit that 1 MMboe/d by 2027.

JB: I know it’s not super obvious for everyone from the outside looking in, but can you elaborate on how the Permian is feeding growth across the value chain?

DW: Yeah, we’ve got a lot going on. If you look across our businesses, on the oil side of the equation, it’s obviously a depletion business. There’s growing demand and depleting resources, so it’s a big challenge to make sure we’re investing to try to certainly offset depletion, but then to grow production in total, which we’ve been fairly successful at doing here lately.

If you look at the chemical business, it’s a growing business. The challenge there is less about depleting resources and more about growing the market, and to maintain market position, and to penetrate deeper with our performance products. You’ve got to keep investing in that space.

And, then, in the refining business, it’s less about growth and more about evolving your production profile and your yield patterns to meet the evolving demand and the mix of products, so, higher-value products and lower-carbon products.

As we looked across all that, the Gulf Coast in the U.S. has elements of each of those things. As we were looking into the opportunities there, we saw a lot of synergy in connecting all of those. And understanding the quality of the crudes that we’re bringing on, and maintaining that quality as we ship it through the pipelines, and delivering it into our refineries and taking into account that quality allows us to optimize the operation. We become more efficient and get better yields on our plants to run more stably. One of the advantages with our big footprint is you can leverage a lot of the existing infrastructure and capacities in place. So, it lends itself to the incremental investment that we’ve made versus a grassroots plant somewhere else in the world.

JB: In that same vein, with macro demand, how important has LNG become for Exxon Mobil with Golden Pass LNG and other potential projects?

DW: We felt for as long as I’ve been in this job (January 2017) that Golden Pass LNG was going to be an important part of the mix. We never wavered from that concept. We felt like that was a logical extension of our portfolio. Our view was the LNG market would grow bigger and deeper, which would lead to more opportunities to trade. So, the Golden Pass opportunity really allowed us to lean into what we believed would be a rapidly growing market with more liquidity and more tonnes moving around from different regions. We also believed that the U.S. would be the marginal source of supply, so having an advantaged LNG facility on that marginal production layer gave us an opportunity to build that. So, we stuck with that. Even as we went through the pandemic, that was one of the few projects that we did not pause, because we recognized that was going to be needed.

The big challenge with LNG is production comes on in fairly large chunks, so you have these periods of real tightness, which we certainly saw last year. Then we’ll get into some point in the future where there’s a whole lot of supply, and oversupply in the market, and the market gets weak. Our strategy is not to try to time those cycles, but to make sure what we build is resilient to the bottom of those cycles.

JB: Pivoting to the Low Carbon Solutions business, you’re not doing a ton specifically with renewables, but you’re doing a lot with the broader energy transition. Going through some quick hits: there’s the low-carbon hydrogen facility in Baytown, advanced plastics recycling center, the carbon capture partnership with Mitsubishi, renewable diesel with Imperial Oil in Canada and more.

DW: Let me start with your observation that we’re not going into renewables. One of the misconceptions when people talk about us being an energy company, they think power generation. Well, we’re not in the power-generation business. We’re not in the electron business. We’re in the molecule transformation business. We’ve looked at wind and solar and whether it makes sense to get into the electron business. But we don’t have a particular competency in that space. If there isn’t an advantage we can bring to that marketplace, then why pursue it? Others can do it just as well as we can. If they need money, we can write checks. If you look at molecule transformation, we have for 140 years effectively found and transformed hydrogen and carbon molecules into products that the world needs. If you think about us powering gasoline cars or diesel trucks, we make products that people use every day. I don’t think I can make it through an hour without touching some product that comes out of our chemical plants. That’s all about this molecule transformation.

So what are we focused on? Carbon capture and storage. That’s capturing CO2 molecules and transporting them and storing them underground and using our subsurface understanding to do that effectively.

Hydrogen is the same thing. It’s using our project capabilities, technology and partnerships to develop hydrogen. Renewable diesel is the same thing too. Those are just a different type of hydrogen and carbon bonds.

So, there’s a synergy that exists with our core capabilities and competencies, and that’s where we’re making our investments. We’re using the exact same criteria that we’re using in our base business, which is, first and foremost, it’s got to generate a return. At the end of the day, we’ve got a responsibility to generate a return for our shareholders.

JB: Some of these low-carbon ventures are mega projects in their own rights?

DW: Absolutely. Our Baytown hydrogen project by most definitions is considered a mega project at $7 billion.

JB: Going south a bit, how is Guyana progressing? The announcements have slowed a bit, but the discoveries keep coming. Is it hard to understate the importance of Guyana to Exxon Mobil right now?

DW: As [Hess Corp. CEO] John Hess said, it’s one of the largest finds in the last decade. So, I think it’s important for the world and, obviously, very important for the Guyanese and the wealth and investment it will bring to Guyana, which, on a per-capita basis, is a poor country.

For us, it’s obviously a very important growth piece of our portfolio, like the Permian is. I think we worked really hard to do that in the most responsible way and in a way that’s capital efficient. But, at the same time, quicker. If you look at what we’ve done there, we’re actually bringing that resource to market at a rate that, frankly, most in the industry haven’t been able to achieve, let alone sustain over the course of several projects. So, we’ve got a really good rhythm going, and that was the intent—this idea to just stay focused and keep cranking. We have this enormous resource that gives you the luxury of developing, call it a programmatic approach to capital projects. It’s not that we’re not tailoring each project to the resource. But, having a consistency of purpose in that space, I think, brings great benefit, which allows us to continue on a very efficient pace of bringing those resources in. It’s a big part of our growth engine, so it’s very, very important. But, as I said, we look at it in context of, while it’s very important, it can’t be a singular focus. We’ve got to continue to look for opportunities all around the world to have a diversified portfolio to continue to fill that pipeline.

JB: Any thoughts on the Guyana government talking about having tougher political negotiations going forward as they become more learned and with more companies getting involved?

DW: I think there’s a dialogue that gets reported on quite a bit. I won’t comment on that. But I’ll just say we have a really, I think, sound and effective relationship with the government. I’ve been there several times for meetings. Our management teams are there. I think they recognize the value that we brought. I think, above and beyond the production, it’s not just what we’ve done, but how we’ve done it. The integrity and value system that we bring, the straightforward approach we take in discussing the opportunities with them, the transparency we bring. I think we’ve established a level of trust, and we’ve gained a lot of credibility with what we’ve delivered. We’ve done exactly what we said we were going to do. Those relationships evolve with time and that will continue to happen as more interest and more success comes to Guyana. It’s the natural evolution.

JB: Looking at geographic boundaries next door, are you still pretty bullish on Suriname as well?

DW: The fundamental value driver when you look at these opportunities is the quality of the rock. You don’t know that until you drill these wells and get into the rock. So I would say our bullishness of any area is really a function of the quality of the rock. You can see some structures and have a view of what you think might be there, but until you get the holes down and see what you’ve got, I try to maintain a level of calm, so to speak (laughs). I try not to get too excited about these things because it’s a challenging business and there’s a lot of uncertainty you’ve got to manage.

JB: With a global focus and all the shale learnings with XTO, does that translate much, whether it’s in the Vaca Muerta in Argentina or somewhere else?

DW: One of the things I’ve been very focused on since getting this job is the size of our company and the business that we have across the spectrum. The way we were organized, historically, we actually had a lot of that capability siloed off in different areas of the business. It made the learning and transferring more difficult. If you see the transformation we’ve been making in the company, we’ve established now three businesses (Upstream, Product Solutions and Low Carbon Solutions) and have centralized the capabilities that are common to these businesses and are critical to the delivering of these businesses.

We have consolidated all of our technology organizations into one corporate technology organization and the alignment around capabilities. So, the common capabilities required in the Permian, believe it or not, some of those technical capabilities are also relevant to what we’re doing in our refineries and in downstream. The same people are working on those things because they’re now working based on capabilities. It makes their jobs a hell of a lot more interesting and satisfying because they’re able to move from one area of the business to another and apply their expertise in a way that brings value to different businesses. But, at the same time, it allows them to get better by learning from different experiences and the work they’re doing across the portfolio.

JB: You mentioned marginal barrels earlier. How has the market changed since the shale boom with the marginal price of barrels and how that influences your low cost-of-supply strategy?

DW: If you go back in time before shale, the world was short crude. So, the view at the time, and I would say our own organization fell into that, was the market will bear whatever cost is required to bring a needed resource on. At that time, there was a lot of heavy oil coming out of Canada, so the marginal cost of supply was much, much higher. I think the potential of shale was not fully realized in terms of just how far you can drive that cost down and make that the new marginal supply. That’s been a huge shift in the marketplace. If you look structurally at the resource that sits on the end of the cost-of-supply curve, that shale coming in at the lower end of the cost of supply has pushed all the other resource types out and really brought down that marginal cost of supply. As demand moves around, you’re now at a structurally lower price point in the marketplace. That really influences how we think about where we need to be positioned on that cost-of-supply curve, and why we’re so focused on having a resiliency to very low prices because of that role that shale has played.

JB: In terms of emissions, you’re aiming to hit net zero in the Permian by 2030 and then worldwide in 2050, in terms of operated assets from Scope 1 and 2 emissions. Can you elaborate on how you get there?

DW: Net zero in the Permian, we’re well on our way to achieving that. So, the business has developed that plan to execute and achieve that. It basically requires replacing a lot of equipment to reduce emissions, and then electrification, and also working with power generators to get in renewable power. You’ve got to do the math, in terms of understanding what it’s going to require, and then you’ve got to have a plan to execute that math. We’ve done both of those things. So, our organization knows exactly what it needs to do to achieve that. I feel really good about what we’re doing. It’s not some pie-in-the-sky concept. It’s happening—steel in the ground—demonstrating that.

I think it’s very important to show you can grow production and reduce emissions. Those are not mutually exclusive things. Thinking longer term, to the extent that the world continues to focus on net-zero and moving to a lower-carbon economy, developing value chains that have very low carbon emissions, if not zero, I think plays into what will be in demand in the future. So, setting ourselves up along that value chain to be positioned to develop products with no carbon footprint, I think will position us for what could lie ahead in the future.

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.