After years of being considered a refuge for oil and gas investors during a downturn, the midstream sector’s ability to ride the waves of volatile commodity prices appears, this time around, headed toward a belly flop.

The midstream sector’s crisscrossing thoroughfares, which transport commodities across the country and to the sea, have for years managed to stay strong even in weak oil and gas markets. Midstream’s insulation was, in large part, thanks to unrelenting spending for new infrastructure. But after building out colossal infrastructure projects, companies within the midstream sector find themselves squeezed just as their assets were settling in for a comfortable middle age.

The unforeseen impacts of the pandemic and price shocks resulting from the OPEC+ supply war have dazed midstream companies. Decline, not growth, in EBITDA now seems possible for some companies. And their burden doesn’t end with finances. Costly legal and regulatory battles have clouded once epic pipeline plans. And the 2020 election, in which a green energy-focused Democrat leads in the polls, adds even more uncertainty to the mix.

In a first, Moody’s Investors Service said in June that it had changed its outlook to negative from stable, citing the twin shocks of falling demand and oversupply. Moody’s predicted that EBITDA in the sector would decline by at least 5% in 2020.

Andrew Brooks, Moody’s vice president and senior credit officer, said that, across the board, all sectors of the energy space are negative. However, midstream had previously fared well during prior downturns, including the price volatility of 2015-2016, which Brooks attributed to EBITDA growth from massive capital spending.

Now a more mature sector, opportunities for rapid organic growth in midstream are scarce as infrastructure demands have met the needs of shale producers. Midstream spending is projected to be down roughly 20% to 30% or more in 2020 and through next year. Without high levels of spending, there’s limited tailwind for the sector.

That’s made the midstream space more susceptible to the weakness felt by upstream companies challenged by low oil prices, in particular. Still, underlying contractual agreements with upstream operators give midstream companies far more stability than oilfield services and independent E&Ps.

While midstream “doesn’t bear the full brunt of weakness upstream in terms of volumes and low commodity prices, nonetheless, there’s enough to put a dent in EBITDA in the future together with just this significant decline in capital spending on new assets within the midstream space,” Brooks said. “We haven’t seen a decline in EBITDA performance in the midstream space up until now.”

On Wall Street, midstream companies have taken a beating. Through July 15, the Alerian Midstream Energy Index fell 32% in 2020 compared amid a 38% drop in the S&P 1500 Composite Energy Index. Morgan Stanley analyst Stephen C. Byrd wrote in a July report that midstream operators are expected to announce better earnings and upward guidance revisions for the second quarter.

But, Byrd said, other factors would weigh down the sector.

Hang-ups

In a relatively short press release on July 5, Dominion Energy Inc. and Duke Energy Corp. jointly called it quits on the Atlantic Coast Pipeline—despite a definitive 7-2 win in the U.S. Supreme Court the previous month.

In bowing out, the companies cited ongoing legal challenges, a projected three-and-a-half-year delay until pipeline startup as well as inflated costs, which had doubled from roughly $4.75 billion to $8 billion.

“Recent developments have created an unacceptable layer of uncertainty,” the companies said.

The next day, a federal court ordered closed the Dakota Access Pipeline (DAPL)—a conduit for Bakken crude operated by Energy Transfer LP—pending an extensive environmental review.

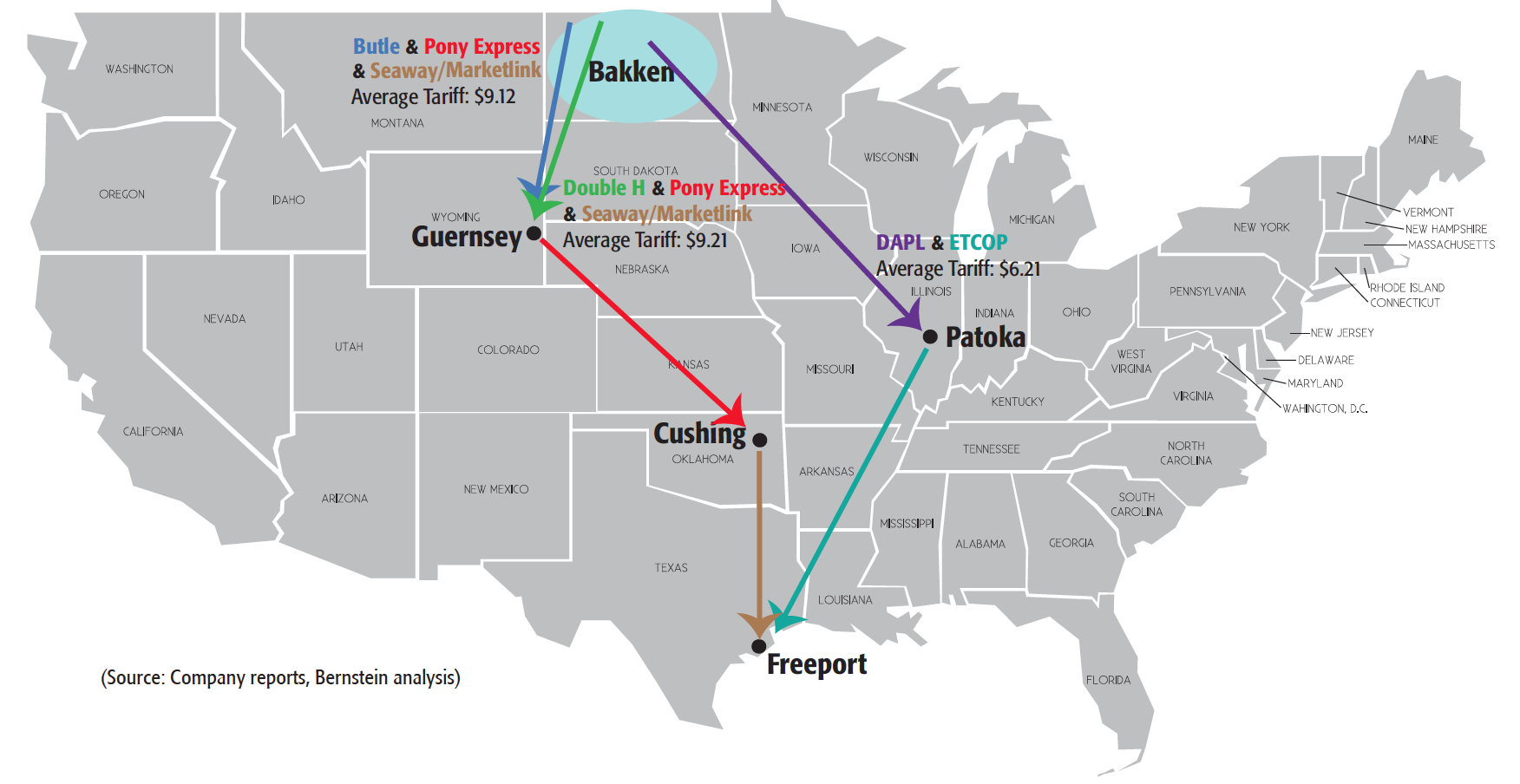

“The order, the first of its kind for an in-service oil pipeline, goes into effect in 30 days, although this ruling could still be appealed in higher courts. DAPL, as the project is known, carries roughly half a million barrels a day of crude from the Williston Basin to Midwest refineries,” Raymond James analysts wrote on July 7.

Pointing to the DAPL and Atlantic Pipeline decisions, Morgan Stanley sees the continued threat of regulatory risk and the November election starting to act as an overhang on the midstream sector.

“News flow collectively has increased concern that large-scale new midstream project development will be materially limited by legal and regulatory challenges,” Byrd and Morgan Stanley analysts said. “Following the election in November, a potential [Joe] Biden administration could usher in a more stringent regulatory environment for new pipelines as well.”

Brooks said regulatory challenges have long been a part of assessing risk in the midstream sector.

“Regulatory risk—whether it’s at the federal level, whether it’s state [or] local, whether it’s grassroots opposition—it’s always been there, but it’s become more acute,” he said. “Part of this is ‘not [in] my backyard.’ Part of this is just opposition to fossil fuels as a matter of principle, that we should be relying more on renewables and green energy. And part of it is kind of a backdoor opposition to fracking.”

Opponents of pipelines and fossil fuels have also become more sophisticated in obstructing projects through legal and legislative mechanisms. Coupled with the volume of required regulatory filings, agencies involved to issue permits and other regulatory hurdles, project delays have become the norm.

Still, with the midstream sector already under strain, investors may need to shift future sector growth investment elsewhere. Recession and commodity uncertainty may encourage a flight to high-quality companies with strong balance sheets.

That sets up a scenario in which companies redirect cash flows to focus on a reduction of leverage and creation of free cash flow. Morgan Stanley argues that shifting to project high-grading, capital restraint and lower debt could result in expansion on de-risked funding strategies without growth.

“If managed conservatively, with a sober view of industry growth and caution around terminal value risk, we believe the more stable, cash-generative businesses within the sector could resonate with new groups of value investors over time,” Byrd said.

But those companies still need E&P production, which is arguably the weakest link as producers struggle to maintain sustained cash flow. Compared to last year, U.S. producers have cut budgets by 47% and announced 1.5 MMbbl/d of supply curtailments.

Morgan Stanley expects investors to begin migrating toward companies with more secure balance sheets, actual demonstrated capital, limited exposure to regulatory risk and “comparatively stable EBITDA with advantaged or at least manageable exposure where it exists.”

The firm recently upgraded Enbridge Inc. and Williams Cos. Inc. to overweigh. Enbridge benefits from a stable EBITDA profile and less regulatory risk for completion of one of its pipelines. Williams’ already enjoys positive free cash flow generation and may benefit from the DAPL shutdown. The company has also begun to increase activity in the Marcellus and Haynesville.

With expectations of months of more recovery ahead, however, much of the midstream sector’s fortunes rest on a solvent and active upstream sector that is already experiencing unprecedented hardships and potential bankruptcies.

Hiccups

Among the powerhouse producers in the Bakken, companies include Continental Resources Inc., Hess Corp., Marathon Oil Corp. and WPX Energy Inc.

Bernstein noted that it could take up to a year to get an environmental impact statement from the Army Corp. of Engineers, forcing some crude to be transported by rail. At those prices, many large producers may find differentials impassable. Elevated differentials in a $40 price environment would make Bakken oil revenues “barely enough to cover cash costs and not enough to incent new rigs.”

Outside of the Bakken, oil production is also expected to be thin.

U.S. crude output is expected to fall by about 5% in 2020 to 11.6 MMbbl/d, according to a July 7 report by the U.S. Energy Information Administration (EIA). Next year, production is forecast to decrease by nearly 10%, or 1.2 MMbbl/d compared with 2019. The EIA noted its estimates were made before a court-ordered DAPL to cease operating by early August.

Beyond oil production, Morgan Stanley said midstream firms face the risk of the deteriorating credit quality of their E&P customers. During the 2015-2016 downturn, midstream contract rejects were not widespread. But markedly stressed E&P companies “will ratchet up demand for contractual concessions from the midstream operators, particularly if economic contraction deepens.”

Through June 30, production companies have already sought bankruptcy protection for about $30.6 billion in debt—already eclipsing the total for each of the past three years, according to the Haynes and Boone LLP bankruptcy monitor.

Moody’s has tallied “13 E&P bankruptcies in the E&P companies that we rate through mid-July,” Brooks said adding, “We clearly haven’t seen the end of that.”

The potential of contract rejection by E&Ps going through bankruptcy is a risk for the midstream sector as well, according to Brooks.

“These are all executory contracts, which can clearly be rejected in bankruptcy,” he said. “This time around, I think that, first of all, banks are less willing to help struggling E&P companies get through this downturn. So, there’s a much shorter leash in terms of propping these companies up.”

With multiple potential twists and turns—including rejecting contracts for better terms—Brooks said bankruptcy decisions are likely to be made “contract by contract.”

“I think the risk is clearly there, and it’s probably only going to increase as the upstream guys struggle through this difficult operating environment,” he said.

As survival mode continues in E&P circles, a badly needed shot of confidence was delivered to the midstream sector on July 5. Berkshire Hathaway Inc., headed by investor Warren Buffett, agreed to buy Dominion Energy’s natural gas transmission and storage assets for $9.7 billion, including $4 billion cash.

Despite its setbacks with the Atlantic Pipeline, Dominion is a formidable infrastructure company with more than 7,700 miles of natural gas transmission lines, 20.8 Bcf/d of transportation capacity and 900 Bcf of operated natural gas storage. The company also owns additional working storage capacity and partial ownership of an LNG export, import and storage facility.

Such deals may be difficult, generally, said Stacey Morris, director of research for Alerian.

“With the volatility in oil prices, it becomes harder to value oil-oriented upstream and midstream assets,” she said. “Different views on oil prices likely result in different views on what an asset is worth. From a midstream perspective, transactions will likely require visibility on expected throughput volumes.”

However, the implied EBITDA multiple for Dominion’s assets was a “modest” 10x compared to midstream companies and those focused on natural gas pipeline transportation.

“While the transaction multiple is not rich, it is positive to see a large investment in midstream energy infrastructure by a renowned investor,” she said. “Unfortunately, headlines surrounding the shutdown of DAPL, and to a lesser extent the cancellation of ACP, are shifting the focus in midstream today to regulatory and litigation risk.”

Recommended Reading

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.