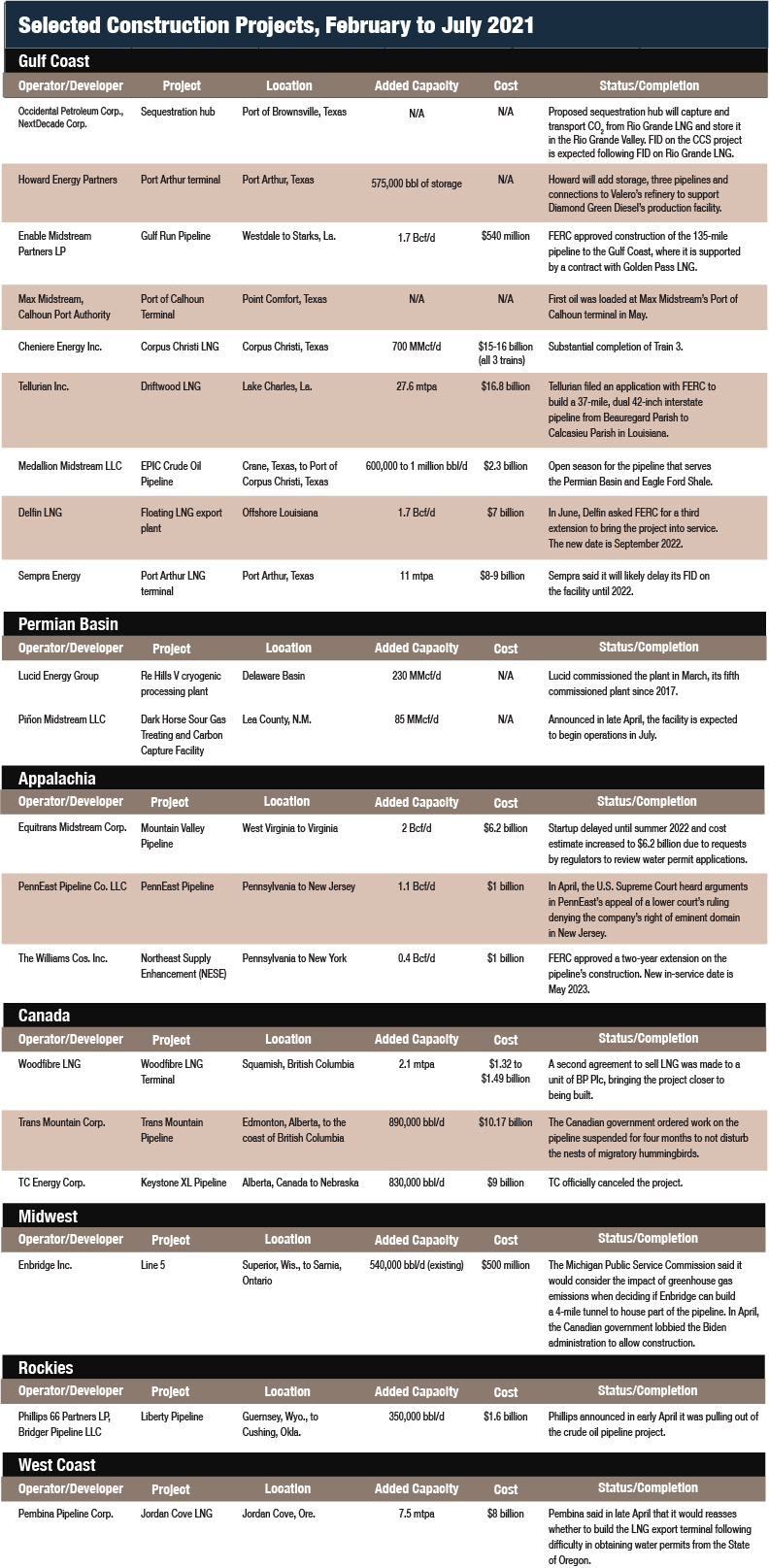

The second-quarter midstream project list is headed by construction on the Gulf Coast. (Source: Hart Energy; Maksim Safaniuk/Shutterstock.com)

Domestic oil and gas consumption may be static or declining, but other parts of the world are hungry for U.S. exports. Gulf Coast construction bears that out.

Most of the projects reaching completion or moving forward are located on the coast of the energy-friendly states of Texas and Louisiana. They include export terminals, pipelines to terminals and projects to support green initiatives, in the cases of Occidental Petroleum Corp. and its partner, NextDecade Corp.; and Howard Energy Partners’ project at Valero’s Port Arthur, Texas, refinery.

Elsewhere, construction progress is harder to find. Delays and cancellations, caused by economic and/or regulatory issues, cast doubt on whether a lot of folks’ hard work will come to fruition. Below is a list of selected recent projects, followed by a summary with links to stories. More coverage can be found on the Hart Energy website.

Gulf Coast

• Occidental Petroleum Corp.’s venture capital arm is ramping up its CO2 sequestration business with its backing of a sequestration hub to handle CO2 captured from NextDecade Corp.’s planned Rio Grande LNG export facility.

Oxy Low Carbon Ventures LLC’s (OLCV) project will move CO2 captured from the plant and place it in permanent geologic storage. OLCV’s long-range plans include construction of sequestration plants across the U.S. and, eventually, the world.

The company’s announcement in March followed NextDecade’s announcement that it would develop one of North America’s largest carbon capture and storage facilities at the LNG terminal at the Port of Brownsville, Texas.

NextDecade expects to make a final investment decision (FID) on Rio Grande LNG in 2021.

• Another green project was announced in mid-May when Howard Energy Partners said it would expand its Port Arthur, Texas, facility to accommodate production from Diamond Green Diesel’s plant at Valero’s refinery.

Diamond Green Diesel (DGD), a 50:50 joint venture between Valero Energy Corp. and Darling Ingredients Inc., announced its 470 million gal/year renewable diesel production facility in January. The plant is scheduled to begin operations in the second half of 2023.

Howard will build tank storage to handle 575,000 barrels of renewable diesel feedstock and finished product, along with three pipelines and associated connections, to Valero’s Port Arthur refinery. The project also includes seven miles of rail track and associated rail unloading/loading facilities, truck unloading facilities and a Panamax-class-capable deepwater dock.

The new facilities will be able to handle multiple products along with capacity for third-party shippers.

• Enable Midstream Partners LP secured Federal Energy Regulatory Commission (FERC) approval to build its 135-mile Gulf Run Pipeline, which will link several natural gas-rich regions to the Gulf Coast. It is backed by a 20-year deal with Golden Pass LNG.

• The Calhoun Port Authority and Max Midstream, a Texas-based energy company, on May 12 announced the first successful loading of Texas oil at the Port of Calhoun Terminal in Point Comfort, Texas. This marks the official beginning of the new partnership between the Calhoun Port Authority and Max Midstream to ship Texas oil to global markets.

“For the first time, we have moved oil across our docks, and it’s just the beginning,” said Todd Edwards, president and CEO of Max Midstream. “We will offer a comprehensive package of services—from transporting oil across Texas, to getting it to the port, to fueling the ships that will take the product to the European market. This is a great first step, and we are excited for the future of what’s to come.”

• Just days before the end of the first quarter, Cheniere Energy Inc. announced the substantial completion of Train 3 at its Corpus Christi liquefaction project, allowing it to take care, custody and control of the train from Bechtel Oil, Gas and Chemicals Inc.

The facility, the country’s first greenfield LNG export terminal, has three trains in operation, boasting a production capacity of 15 mtpa.

• Tellurian Inc. filed plans with FERC to build a 37-mile, dual 42-inch diameter interstate pipeline from Beauregard Parish to Calcasieu Parish in Louisiana. The gas pipe will support the Driftwood LNG plant, which is expected to begin construction in first-quarter 2022.

• Medallion Midstream LLC announced an open season in May for its EPIC Crude Oil Pipeline, which is transporting 600,000 bbl/d from the Permian Basin and Eagle Ford to the Port of Corpus Christi. Maximum capacity for the pipe is about 1 million bbl/d.

• Delfin LNG asked FERC for an extension—its third—to bring its floating Delfin LNG Terminal into service. The company blamed global economic conditions related to the recovery from the COVID-19 pandemic.

• Sempra Energy told analysts in early May that FID on its Port Arthur LNG export facility, expected in 2021, would probably be delayed to 2022.

CFO Trevor Mihalik cited the continued impacts from the global COVID-19 pandemic on energy markets as the reason to table the decision. The LNG project is one of 13 in North America in which FIDs were expected this year. Most were carried over from 2020 and some from 2019.

“At this time, given this work and the continued impacts of the pandemic on the global energy markets, it is more likely that final investment decision at Port Arthur will move to next year,” Sempra CFO Trevor Mihalik said.

Permian Basin

• Lucid Energy Group commissioned its Red Hills V cryogenic processing plant in the first quarter. The plant’s capacity of 230 MMcf/d brings Lucid’s total natural gas processing capacity in the northern Delaware Basin to 1.2 Bcf/d.

The company’s operations service producers in Edy and Lea counties, N.M.

Privately-held Lucid is backed by a joint venture formed by Riverstone Holdings LLC and the asset management division of Goldman Sachs Group Inc.

• Newcomer Piñon Midstream LLC announced in April that construction had begun on its greenfield Dark Horse Sour Gas Treating and Carbon Capture Facility in Lea County, N.M. The project is the first purpose-built sour gas infrastructure of its kind in the Delaware Basin.

The company, founded in December 2020, said it intends to provide long-term, economic and environmentally responsible solutions to the sour gas problem that has constrained development in the northeastern Delaware Basin. Piñon has partnered with Black Bay Energy Capital.

The project includes a centralized amine treating facility, an 18,000-foot-deep acid gas sequestration well and 30,000 horsepower of full NACE field compression. The facility can be expanded to treat up to 400 MMcf/d of sour gas. The assets gather and treat natural gas containing any concentration of H2S and CO2 and can deliver treated sweet gas to multiple third-party gas processing plants.

“Not only does our project provide a comprehensive solution for sequestering CO2 and H2S, it also substantially reduces flaring and greenhouse gas emissions in southeast New Mexico,” said Piñon Midstream co-founder and President Steven Green.

Dark Horse, underwritten by a substantial long-term dedication from anchor producer Ameredev II LLC, is expected to begin full operations in July. Piñon purchased a second amine treating plant that is scheduled to be installed and operational in the fourth quarter. At that time, the company’s total sour gas treating capacity will reach about 170 MMcf/d.

Appalachia

• In May, Equitrans Midstream Corp. said the Mountain Valley Pipeline had experienced another delay and another increase in price. The estimated cost of the natural gas project is now $6.2 billion.

Startup is expected in summer 2022, which aligns with forecasts from several analysts. The JV had said the pipeline would start operations by the end of 2021. Mountain Valley is owned by units of Equitrans, the operator, and NextEra Energy, Consolidated Edison, AltaGas and RGC Resources.

Equitrans attributed the delay to requests by environmental regulators in Virginia and West Virginia to the U.S. Army Corps of Engineers. The regulators sought to extend the 120-day review period to evaluate the pipeline’s water quality certification applications.

The applications stem from a decision the JV made in February to withdraw its previously approved Nationwide Permit 12, which allowed the pipeline to cross several water bodies under one authorization. Instead, it filed about 300 separate stream crossing permits with the Corps.

• The U.S. Supreme Court heard arguments in late April over the attempt by Enbridge Inc. and the JV building the PennEast Pipeline to seize land owned by the state of New Jersey.

The 1938 Natural Gas Act allows private energy companies to seize “necessary” land if they have received certification from FERC. The law allows private companies to exercise eminent domain, otherwise the exclusive right of government.

Justice Stephen Breyer noted that the Natural Gas Act was necessary because states had objected to pipelines being built.

“That’s been the understanding for the last 80 years,” he said.

The justices appeared sympathetic to the state’s arguments but cautious about issuing a ruling that would overturn the longstanding understanding of the law. Chief Justice John Roberts noted that the state of New Jersey was opposed to construction of the pipeline, meaning a ruling that favored the state would put PennEast and other projects like it in jeopardy.

The 116-mile PennEast will have a capacity to move 1.1 Bcf/d from the Marcellus shale to customers in Pennsylvania and New Jersey. President Joe Biden’s administration backs PennEast in its case. The court was expected to decide the case in June.

Canada

• Canadian LNG developer Woodfibre LNG said in early May that it completed a second deal to sell LNG from its proposed export plant in British Columbia to a unit of oil major BP Plc. The agreement takes on added meaning in a year that has seen several LNG project cancellations.

The contract calls for Woodfibre to sell 0.75 mtpa of LNG to BP’s BP Gas Marketing Ltd. over 15 years on a free on board (FOB) basis. That will increase BP’s total LNG off-take to 1.5 MTPA from the proposed 2.1-MTPA plant.

Woodfibre said it is on target to making a FID in third-quarter 2021. Analysts expect the plant, estimated to cost between $1.32 billion and $1.49 billion, will produce first LNG around 2025.

• In late April, the Canadian government ordered a four-month halt to construction of a segment of the Trans Mountain Pipeline to protect nests of the migratory Anna’s hummingbirds.

The order applied to a 1-km stretch along the pipeline right-of-way and did not change the expected in-service date. Work continued on all other areas of the 1,150-km route.

Environment and Climate Change Canada issued a written order to halt any activity, including tree felling with heavy machinery on the site. The order lasts until Aug. 20 when nesting season ends.

• Almost five months after President Joe Biden revoked a key permit for the project, TC Energy Corp. officially canceled the Keystone XL Pipeline, which was designed to move 830,000 bbl/d of crude from the Alberta oil sands to Steel City, Neb. The project had struggled to secure permits for about a decade.

Midwest

• Canada is pushing on several diplomatic fronts against Michigan’s efforts to close the Line 5 cross-border oil pipeline.

Ottawa’s strategy is to repeatedly raise the issue of Enbridge Inc.’s Line 5 with numerous U.S. counterparts—including President Joe Biden—to get them to pressure Michigan’s Democratic Gov. Gretchen Whitmer to keep the pipeline open. Whitmer wrote an opinion piece in the Washington Post in mid-May, explaining her determination to shut down Line 5.

Rockies

• Phillips 66 Partners LP pulled the plug on the long-deferred Liberty Pipeline, which was proposed to support oil production growth in the Rockies and the Bakken shale regions. The company said it will take a hit of between $180 million and $210 million in the first quarter due to its decision to exit the project.

The 700-mile Liberty Pipeline was proposed to transport light crude oil from Guernsey, Wyo., to the Cushing, Okla., hub. The roughly $1.6 billion project had been put on hold more than a year ago when the oil market crashed at the onset of the COVID-19 pandemic. Another Phillips 66 project, the Red Oak Pipeline from Cushing to the Texas Gulf Coast, was canceled in October. It had been deferred at the same time as Liberty.

West Coast

• Canada’s Pembina Pipeline Corp. put development on hold for its Jordan Cove LNG export plant in Oregon, according to an appeals court filing. In the April 22 filing, Pembina said it was assessing “the impact of recent regulatory decisions involving denial of permits or authorizations necessary for the project to move forward.”

The company asked the U.S. Court of Appeals for the District of Columbia Circuit to place the case in abeyance pending the outcome of that re-assessment.

The $8 billion Jordan Cove is one of several major energy projects that have failed to move forward. Others examples include TC Energy Corp.’s $8 billion Keystone XL crude pipeline, Williams Cos. Inc.’s roughly $1 billion Constitution natural gas pipeline and Dominion Energy Inc.’s $8 billion Atlantic Coast gas pipeline.

FERC approved construction of Jordan Cove and its Pacific Connector gas pipeline in March 2020, but the project failed to receive water permits from Oregon.

Recommended Reading

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Aramco Reports Second Highest Net Income for 2023

2024-03-15 - The year-on-year decline was due to lower crude oil prices and volumes sold and lower refining and chemicals margins.