EagleClaw Midstream, with numerous operations in the Delaware Basin, including produced water gathering and disposal at its Mustang plant, is intent on being an ESG frontrunner. (Source: EagleClaw Midstream)

There are enough acronyms in the midstream world to fill a dictionary, but in recent months, one set of initials has generated more buzz than others. ESG (environmental, social and governance) focused documenting directives have emerged on the forefront of discussions throughout the energy sector—and beyond—as leaders acquiesce to a new level of investor expectations related to quantifiable results.

Such initiatives have become a critical component of the license to operate, research shows. BlackRock Inc. in mid-2020 surveyed its clients to better understand the motivations and obstacles behind sustainable investing. It received feedback from 425 investors across the world, representing $25 trillion in assets under management.

More than half, or 54%, of survey respondents, said they considered sustainable investing to be fundamental to investment processes and outcomes. Related to ESG, 88% of respondents named the environment as the top priority, citing global warming.

The rising importance of ESG documentation is reflected in daylong seminars by industry majors such as The Williams Cos. Inc. In January, the company hosted its inaugural virtual investor ESG event, where it highlighted its several-year, progressive journey toward environmental sustainability. The company—which said it plans to reduce emissions by 56% by 2030 from 2005 levels—discussed its climate commitment, strategies and technologies during a series of executive-level presentations.

“By integrating ESG practices throughout the company and into our everyday operations, we hold ourselves accountable through transparent interactions with customers, employees and shareholders,” Williams’ president and CEO Alan Armstrong told Hart Energy. “In recent years we have significantly increased efforts to tell our story around these themes.”

The midstream sector has also recognized that satisfying ESG-focused directives isn’t just the right thing to do—it’s becoming a necessary component to success. The investment community is demanding oil and gas companies implement the guidelines into their business plans, particularly related to the environment. Midstream companies are responding through the implementation of new programs on monitoring and reducing emissions, and by incorporating renewable energy sources into their operations. As well, they’re working to offset their carbon footprint through environmental programs and energy transitions.

“ESG has become front and center across the board, not just for the midstream sector, not just for the energy industry, but for investors at large,” Pearce Hammond Jr., managing director of equity research at Simmons Energy, told Hart Energy. “Also, with the new administration, the expectation is there is going to be more pro-environment [measures], and so that’s going to put even more emphasis on the ‘E.’ It’s become a more dominant narrative.

“More and more investors are integrating ESG into their decision-making process. And so, you would assume that an investor is making investments where they feel like they can earn the highest rate of return.”

Sustainable Investments

If you think ESG reporting is a game of greenwashing, think again. A growing number of midstream companies are displaying quantifiable results, as numerous studies show the increasing role ESG is playing in attracting lucrative investment dollars.

McKinsey & Co. in a February 2020 survey of executives and investors found that 57% of respondents believe ESG programs create shareholder value, a figure on par with results from a similar survey in 2009.

However, the survey also showed that a growing number of investors are seeing the short- and long-term value in ESG programs. More than 65% of respondents now see value in the short term, up from 41% about a decade ago. About 93% of survey participants are now seeing social programs as a positive long-term investment contributor, up from 77% in 2009.

The BlackRock Investment Institute said in February that combating climate change will likely incentivize economic improvements throughout the next 20 years. Sectors that shift toward net-zero greenhouse gas emissions goals will likely see higher returns, it said.

The green energy transition could result in a cumulative output gain of almost 25% during the next two decades, compared with the outcome if no climate change action were taken, the institute said.

“While the global green energy transition will benefit economic growth broadly, there are some asset classes and sectors better positioned than others as we shift to a net-zero world,” Simona Paravani-Mellinghoff, global chief investment officer of solutions at BlackRock’s multi-asset strategies and solutions business, said in a press release.

“We expect investor capital will flow toward these more sustainable assets, creating outperformance for green investments and separating leaders from laggards.”

Help from Above

in December, the Energy Infrastructure Council (EIC)—together with the GPA Midstream Association—released its first midstream company ESG reporting template. Comprised after nearly a year of company and investor collaboration and thorough review of best practices, the template is designed to help companies present ESG metrics accurately, concisely and consistently.

“Many EIC member companies are at various stages of their ESG journey, and we really felt that it was critical to provide leadership at the association level. So, we established a board-level working group co-chaired by leaders in ESG. The mission of the working group was to provide, best practices and guidance to help move our companies forward,” EIC president and CEO Lori Ziebart told Hart Energy. “ESG continues to be an ever-important focus for the association and our members.”

Right now, more than 100 ESG ranking and reporting templates are available, provided by firms with varying degrees of industry knowledge. Many of those guidelines were created by generalists, meaning some midstream companies are assessed on metrics that don’t apply to them. The EIC set out to create a reporting framework that would provide more meaningful data to investors. To ensure widespread adoption, GPA Midstream joined the effort.

“We felt it was important to develop a template with industry ESG and technical experts, together with investor input in order to provide metrics that are important not only to the companies, but to our investors and a wide range of stakeholders that are looking to analyze this type of information,” said Ziebart.

Developing the template was no easy task. It took stakeholders nearly a year to compile and agree on the most relevant types of information and metrics. Many iterations were created before the EIC and GPA Midstream published the final version.

Taskforce members began by reviewing the ESG landscape, including best practices among EIC member companies, ESG standard setters and raters and other trade associations.

Throughout the months, the taskforce met weekly with an assortment of professionals, ranging from ESG experts and IR professionals, to operational and technical experts. It also consulted heavily with its member investors, to obtain their perspectives and guidance.

The template is designed to be the most relevant set of ESG guidelines for midstream investors and provide information on the ongoing evolution of other ESG reporting standards. It defines ESG metrics and provides companies with a series of questions related to environmental activity, diversity, board oversight and more.

“We feel that for it to be meaningful, it needs to reflect the evolving ESG landscape journeys of midstream companies, while also meeting the needs of investors,” Ziebart said.

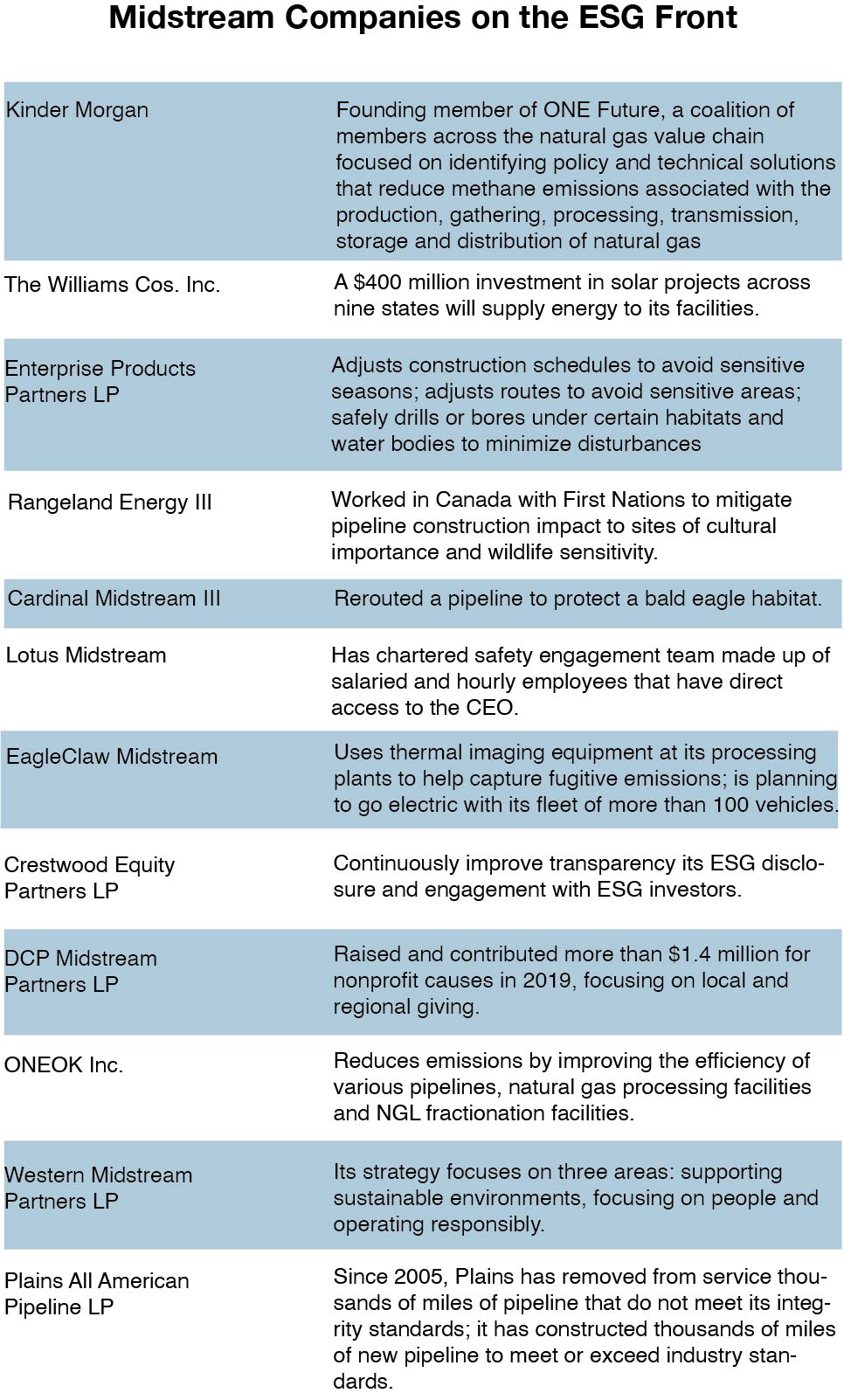

In February, just two months after the template was released, the EIC, together with GPA Midstream, announced that several of their member companies had completed the ESG reporting template. Among the early adopters were Crestwood Equity Partners LP, Enterprise Products LP, ONEOK Inc., Western Midstream Partners LP and The Williams Cos.

Other companies, including DCP Midstream Partners LP, Energy Transfer LP, Magellan Midstream Partners LP and Plains All American Pipeline LP, publicly announced they were in the process of gathering data. Right now, the EIC said there are about 10 companies in the process of completing the reporting template.

The EIC is ultimately hoping for widespread adoption to provide companies and investors with a greater overview of ESG progress throughout the midstream sector. Other agencies such as the Edison Electric Institute (EEI) and the American Gas Association (AGA) have been successful in establishing ESG metrics for a longer period of time, and their reporting framework is now commonly used within the industry. The EIC consulted the EEI before releasing its own template.

“EEI and AGA have had great success in getting widespread adoption of their template. Investors and other stakeholders look to that template to be able to make informed decisions about the ESG progress that member companies are making,” Ziebart said.

“We firmly believe that, like the EEI/AGA template, [our] midstream reporting template—which provides accurate, quantifiable, durable and comparable company ESG metrics—will receive widespread adoption and serve as a valuable resource to investors and stakeholders alike.”

An Investment Perspective

For venture capital firms such as EnCap Flatrock Midstream, meeting ESG standards is nothing new. It has been a core value for the firm since its 2008 inception, and those values carry over to its portfolio companies, said EnCap Flatrock managing director Morriss Hurt.

“We want to ensure that we have alignment with the companies in our portfolio in this area,” Hurt told Hart Energy. “It’s not just about maintaining your license to operate. It’s also a core part of the way we do business.”

One of its portfolio companies, Stakeholder Midstream, in 2019 installed an emissions injection system, which sequesters CO2 rather than emitting the greenhouse gas. The company also executed an expansion in one of its processing plants to accommodate gas that was previously flared by producers.

Meantime, EnCap Flatrocks’s portfolio company, Cardinal Midstream III, recently received a commendation from the Oklahoma Department of Wildlife Conservation for rerouting a pipeline to protect a bald eagle habitat it had identified.

“It was the right thing to do. Sure, it was more expensive, and at a minimum this falls under maintaining a license to operate,” Hurt said. “But these are things that you should do—and want to do—and we view these practices as necessary for responsible midstream operators.”

Its portfolio company, Rangeland Energy III, worked in Canada with First Nations to mitigate pipeline construction impact to sites of cultural importance and wildlife sensitivity.

Lotus Midstream extends strong governance beyond the boardroom and into the field, said Abigail Rimel, an EnCap Flatrock vice president.

“They have a chartered safety engagement team made up of salaried and hourly employees that have direct access to the CEO to really make sure that the safety programs are robust and implemented in a comprehensive way,” Rimel told Hart Energy.

“We recognize that maintaining a focus on ESG is not only the right thing to do but critical to our long-term strategy and stakeholder support. Given the increasing importance to our stakeholders, we believe it’s critical to both managing the operations and the risks associated with the businesses we invest in.”

Keeping Up with the Changes

ESG reporting is evolving, and as it progresses, so too does EnCap Flatrock’s approach. To help its companies keep pace with best documenting practices, the firm has implemented numerous audits and reviews regarding internal financial controls, cybersecurity, and policies and procedures.

“This goes to ensuring consistent and strong governance practices across our portfolio,” Rimel said.

Internally, EnCap Flatrock has established an ESG committee comprised of investment and accounting professionals to ensure the topic remains top of mind. To enhance documentation, it has engaged an outside firm to help establish, benchmark and improve ESG reporting practices and metrics for its funds, portfolio companies and various stakeholders. The partnership will help EnCap Flatrock formalize the need for more consistent ESG disclosures and improve its collection of metrics as it looks to aggregate data from across its portfolio. The goal is to have a firm-wide set of ESG data available to share with investors and stakeholders.

Some EnCap Flatrock portfolio companies are enhancing their ESG disclosures in the form of sustainability reports, while others are preparing to do so.

From an industry engagement perspective, EFM has joined the EIC.

“As the largest pure-play midstream investment firm in the country, we want to be an active part of this dialogue, both learning from companies that are doing really well, as well as guiding and leading the conversation as ESG reporting evolves,” Rimel said.

Talk of the Town

Although ESG directives might have hardly garnered a thought a few years ago, the topic is now significant enough to dominate daylong discussions and conferences among midstream majors such as The Williams Co.

The Williams Cos.’ annual sustainability report, set to be released this summer, uses qualitative descriptions and quantitative metrics to lay out its policies, practices and performances across the ESG board. Understanding the link between sustainable operations, corporate stewardship and long-term financial success, Williams’ ESG efforts can be seen across the company, from executive boardrooms, to everyday operations.

Forward-thinking Leadership

Williams’ focus on near-term, tangible emissions reductions is led by charting a path to net-zero emissions by 2050. Its admittedly rigorous strategy is backed by a dedicated renewables team and a $400 million investment in solar projects across nine states that will supply energy to its facilities. It expects the first solar project to go online in 2023.

As well, Williams is increasing the delivery of renewable natural gas (RNG) by partnering with energy companies in Washington, Idaho, Ohio, and Texas to transport methane emissions captured from landfills or dairy farms. Its Northwest Pipeline is interconnected with four RNG facilities (two were brought online in the past year), and the company said it is pursuing additional RNG partnership opportunities.

Harnessing the power of hydrogen is another emerging opportunity where Williams has recently begun committing time and resources.

“Williams’ nationwide footprint is well-positioned with end-use demand, particularly in highly populated areas, to participate in hydrogen-based energy storage and transport,” Armstrong said. “Our ability to blend hydrogen into our existing system is a significant advantage and has the potential to accelerate the use of hydrogen in reducing carbon emissions.”

The company, which is a member of the Clean Hydrogen Future Coalition, plans to advance its hydrogen roadmap this year to showcase how Williams can play a role in bringing clean hydrogen to market.

Williams also co-led the EIC’s midstream ESG reporting template initiative and was among the first companies to document its ESG efforts through the template.

“Our desire to lead in this area is driven by our core values and always striving to do what is right,” Armstrong said. “Williams is focused on sustainable operations, including ready-now solutions to address climate change. We will leverage our natural gas-focused strategy and technology that is available today to focus on immediate opportunities to reduce emissions, scale renewables and build a clean energy economy—but we also are looking forward and anticipating future innovations and technologies that we can use our key energy networks to deliver on the next phase of energy transition.

“As a leader in this space, we hope to challenge others to establish similar goals.”

The Early Mover Advantage

EagleClaw Midstream, the largest privately operated midstream services provider in the Delaware Basin, has been an early mover in the ESG space. It announced in January that it successfully implemented numerous ESG-related initiatives, ranging from the use of renewable energy sources, to supporting economically disadvantaged communities during the pandemic.

The company in April became the first midstream company in the Permian Basin to source 100% of its electricity for operations from solar and wind. Its switch to renewable energy will help EagleClaw Midstream reduce emissions, its CEO Jamie Welch said.

“For us, it was a tremendous benefit,” Welch told Hart Energy. “It obviously does create a very nice, and I think very positive, environmental message statement for our producers.”

On the social side, the company has helped push struggling Texans through the ongoing COVID-19 pandemic. The Midland, Texas-based company offered financial support to local residents and made donations to area food banks. It also helped schools with sanitization efforts and donated computers to help students with remote learning.

“This time last year, in the Midland area particularly was quite crushing for many people,” Welch said. “Obviously we saw oil prices just plummet. And we saw a tremendous amount of redundancies, furloughs and reductions in force throughout the energy industry. So we really went out of our way, as a company, to come together and make sure that we gave back to the community.

“I think it galvanizes the spirit of this company. Giving back is such a critical element of who we are and what we do every day.”

Welch added that EagleClaw Midstream crossed another significant sustainability milestone in 2020 with the addition of Laura Sugg as the first independent member to its board of directors. Sugg is a longtime energy industry executive and the second of two women who serve on the EagleClaw Midstream board.

Getting with the Program

EagleClaw Midstream is financially backed by Blackstone Energy Partners and I Squared Capital, which have dedicated teams focused on ESG for their portfolio companies. EagleClaw Midstream established its own ESG program more than a year ago, engaging many of its senior executives to work together to consolidate data and better document the company’s undertakings.

In February 2020, the company hired Jim Schwartz, who as senior director of sustainability was tasked with working with leadership to coordinate and create a workflow. An outside consultant was commissioned to bolster those efforts. The company hopes to release its first ESG report later this year.

EagleClaw Midstream reports in alignment with the Sustainability Accounting Standards Board, Global Reporting Initiative, Task Force on Climate-related Financial Disclosures and the GPA Midstream Association standards.

Documenting and consolidating all of EagleClaw Midstream’s data was a time consuming and challenging task, said Welch.

“It’s been a very large endeavor to compile all the historic data because obviously it goes back, but we want to make sure that all the data is accurate so what we put out there presents and conveys a very accurate measure of our performance,” Welch said. “It takes a village to pull this together. But invariably, the product—and what it says and what it reflects about our company—is pretty important. It has been a lot of work from a lot of people, but it is well-justified and certainly I think it’s a good story to tell.”

A Demonstration of Progress

EagleClaw Midstream’s efforts in being an EGS frontrunner have helped satiate the demands of both the public and investors, Welch said.

“I think we were very early to clue into the fact that public investors, and our own shareholders, were already craving data and information about our environmental track record, more so environmental than I will say, social and governance,” he said. “Let’s face facts: The oil and gas industry has a somewhat negative image in the eyes of the public because of its environmental track record. In recent years, the industry has focused on further advancing its role in the whole discussion on climate change and the impact on the planet.”

Welch said he’s particularly proud of his company’s work reducing emissions and its carbon footprint. It uses thermal imaging equipment at its processing plants to help capture fugitive emissions and is planning to go electric with its fleet of more than 100 vehicles.

In today’s world, he said, midstream companies must take such forward-thinking initiatives to garner public support and attract investments.

“The world is all about choice and for investors, it’s no different,” Welch said. “We have made conscious decisions to be at the bleeding edge as it relates to taking actions on the ESG side. I think it makes it easier for investors… You need to show to them that you are actually more a part of the energy transition.”

A Mutually Beneficial Agreement

Any midstream company wishing to win the sought-after dollars of investment companies in today’s world must show that they’re serious about operating in an environmentally responsible manner. It could mean selling off assets that don’t align with current requirements, correcting methane leaks or building new pipeline to boost hydrogen, said Simmon’s Hammond.

“You’re seeing more and more companies dedicate more time and resources to this,” Hammond said. “I think that the midstream companies actually have a key role to play in the ultimate decarbonization that’s going to unfold over the next number of decades.”

Lessening the environmental footprint of energy projects can pay off in more ways than one for midstream companies, he said. For instance, ensuring equipment is not leaking methane into the atmosphere would give a company the ability to capture more gas while satisfying the requirements of investors.

“Ultimately, that would be good for both parties,” Hammond says. “You’d have more natural gas to sell so you’d have revenues to offset the cost of the enhanced regulations. I think that for midstream, there’s certainly some things that they can do.”

The Social Aspect

From the social perspective, ESG directives can be more broad-ranging, including fair pay for women and an expectation of diversity in the workplace. Board members and management teams, in particular, are expected to reflect an inclusive company culture.

In some respects, such affirmative action-type demands have been controversial, since they could hinder recruiting efforts, said Hammond.

“If you’re a shareholder, you want the best people serving on your board and you want the best people serving on the management team to deliver the best-run company,” he said. “And you need to be open-minded about finding the right people and meeting diversity and inclusion goals. Companies are making it work, but it takes time.

“The struggle is to be open-minded and be fair, and allow everybody to compete for the positions. But you also have to make sure you get the right people running your companies. The thing that a lot of these investment companies look at is the board. These boards are very white male-dominated, and they’re trying to make them less so moving forward.”

Resistance to the Rules

Companies that resist the ESG guidelines are likely to find it harder to operate in the midstream space, said Hammond, adding they’re also likely to face a higher cost of capital.

“It’s going to be harder to raise money,” he said. “There’s probably a certain number of investors that won’t consider you. And so you have a limited pool of investors to pick from. So, hence your cost of capital would be higher making it more expensive to raise money.”

Recommended Reading

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.