For the first time since first-quarter 2018, U.S. midstream sector deal activity took a backseat to upstream in the second quarter of this year.

But Joe Dunleavy, U.S. EU&M deals leader at PricewaterhouseCoopers (PwC), said midstream investing and deals are still active. He added the upstream jump in the second quarter hinged primarily on one megadeal—Occidental Petroleum Corp.’s acquisition of Anadarko Petroleum Corp.

In fact, two other megadeals in the second quarter were in the midstream sector: Marathon Petroleum Corp.’s midstream consolidation and IFM Investors’ acquisition of Buckeye Partners LP. In total, upstream A&D totaled $74 billion for second-quarter 2019 compared to the $36.5 billion spread out over 18 midstream deals.

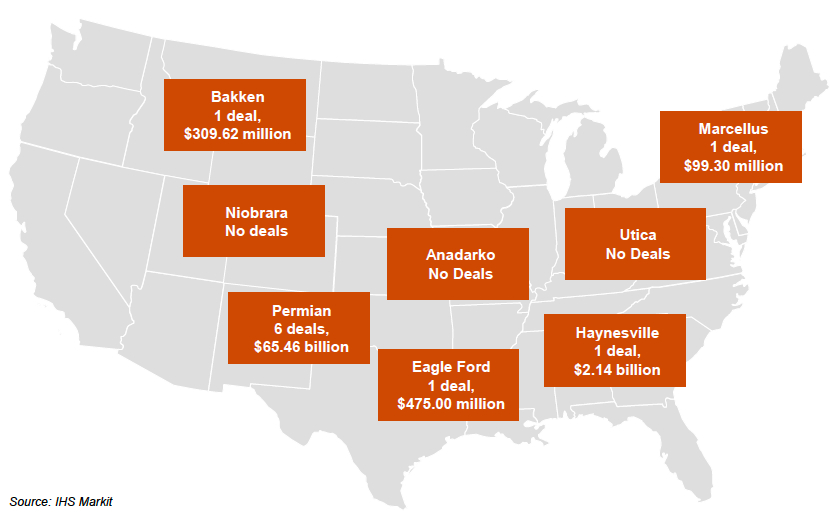

Upstream Shale Deals-Second Quarter 2019

“It’s a sector that is filled with investors, and it’s a sector that I expect to be popular, notwithstanding this quarter. It fell below the upstream in terms of transactions but it’s not like it fell off the map,” Dunleavy said. “We had 14 midstream deals in the first quarter of 2019 and we had 18 in the second quarter. If you look at the upstream, in the first quarter of 2019 there were nine upstream deals and there happened to be 20 in the second quarter.”

Hart Energy's Transaction Database: Information of assets, buyers and sellers, deal values and more. Updated every day.

But Dunleavy did acknowledge that midstream deals are down because investors are cautious when it comes to the activity in the sector. Upstream production remains high, but having enough infrastructure to move that production to market continues to be a concern for investors.

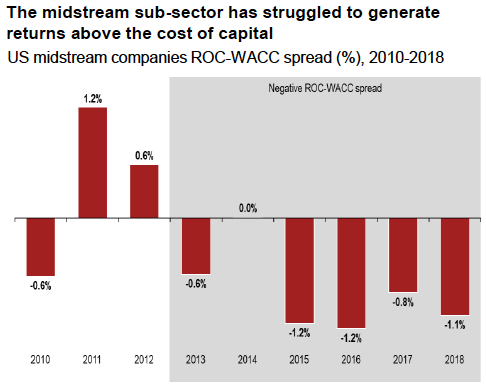

PwC’s second-quarter 2019 deals report said U.S. midstream companies have struggled to return to pre-downturn valuations and deliver value to shareholders above the cost of capital over the last six years, despite consistent production volume growth and margin recovery.

The report indicates a disconnect between investor expectations, and performance has been driven by fundamental changes in the industry landscape. The sector has seen issues such as increased contract risk due to E&P bankruptcies, a shift in investor mix and financing landscape and increased time and complexity of regulatory approvals, which affects how, or if, deals get done.

“I think they are cautious,” Dunleavy said of midstream investors. “There is a concern about the sector as a whole. The midstream has its challenges, but having said all of that you can stand back and say, `Where are we from a midstream infrastructure perspective? There is infrastructure that is still needed.’”

The expectation is the U.S. is becoming more of an exporter of crude oil, which means more production from major shale plays like the Permian Basin will make its way to the Gulf Coast. Dunleavy said this should also mean an uptick in building and spending in key export cities like Corpus Christi.

“The buildup we are seeing with pipelines in the Permian … When you build all of those pipelines to take the product out of the Permian, it’s got to go somewhere so you move the infrastructure and midstream build to where product is going,” he said.

Dunleavy added he sees an increase in investing and deals in the midstream space.

“You have other basins in the country where maybe the production is down but historically we have still had a need for pipelines,” he said. “So going north to the Bakken or throughout the country, there is still a need for pipeline infrastructure and midstream infrastructure. The market right now is seeing a downturn but the long term I think it’s a viable area for M&A.”

The outlook is for midstream M&A to remain active as exports ramp up, according to PwC.

“If the projections are right and we are a net exporter you are going to need the midstream infrastructure to get product to the coast to be able to be exported,” Dunleavy said. “So you are going to see continued activity.”

In the coming quarters, Dunleavy said he wouldn’t be surprised if the midstream sector moves ahead of upstream in deals. But he added midstream companies will have to change how they do business going forward, moving away from the supply approach.

“In doing your due diligence now you have to look at that production profile, you have to look at the contract,” Dunleavy said. “The companies that consider M&A will expect a change in how buyers are looking at midstream assets before they acquire them.”

Terrance Harris can be reached at tharris@hartenergy.com

Recommended Reading

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.