Ryan Savage, vice president and general manager for The William Cos. Inc.'s Pennsylvania and New York operations, speaks Dec. 4 at Hart Energy's Marcellus-Utica Midstream Conference & Exhibition in Pittsburgh. (Source: Joseph Markman/HartEnergy.com)

PITTSBURGH—Natural gas prices are down, demand is weak and renewable energy sources are deepening their penetration in the residential and commercial energy sector, but Ryan Savage, vice president at The Williams Cos. Inc., said natural gas supply must rise to meet demand in the next decade.

Admittedly, “that is difficult to talk about right now,” Savage said Dec. 4.

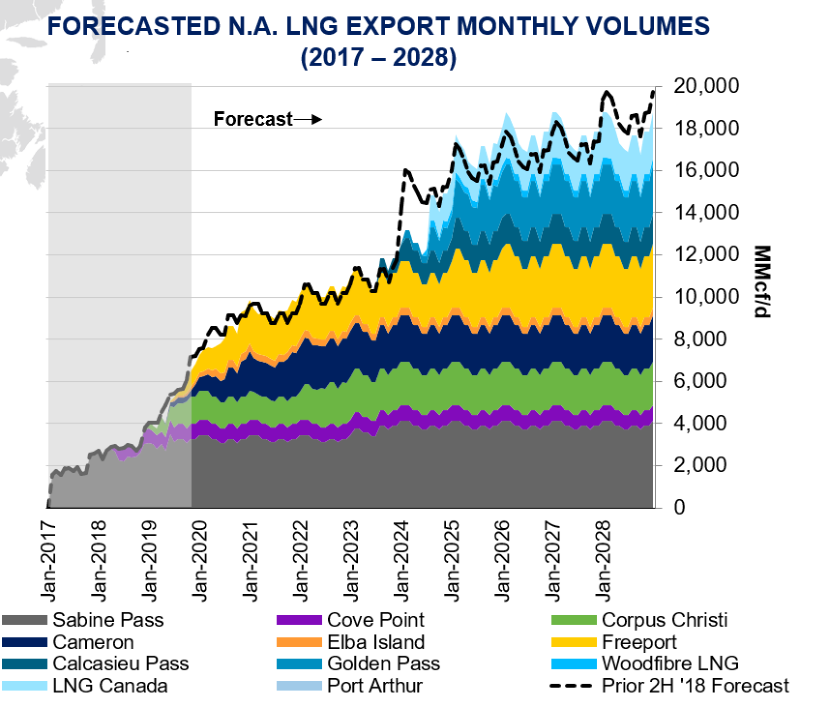

However, the projected demand of U.S. natural gas commitments to Mexico and LNG exports worldwide will match North American residential and consumer natural gas use by 2025, he said. Exports will eventually have to rise to more than 25 billion cubic feet per day (Bcf/d) from roughly 10 Bcf/d in 2019.

“If you’ve got demand growth like that, then we’ve got to increase supply,” he said.

With more than 20 years in the industry, Savage said he’s seen the ups and downs of prices before, in part because of the exuberance of producers. But the longstanding paradox of the industry is that the “cure” for low commodity prices—oil or gas—is low prices themselves.

“We’ve been through this before where we find something that’s a good thing and maybe produce a little too much of it and move a little too much of it and we get a little bit of an overhang,” he said.

LNG export projects under construction, permitted by the Federal Energy Regulatory Agency (FERC) or awaiting a final investment decision (FID) would give U.S. producers another 10.6 Bcf/d of export capacity.

|

North American LNG Projects Move Forward |

|||

|

Project |

Capacity (Bcf/d) |

In-service Date |

Comments |

|

Sabine Pass Train 6 |

0.7 |

2023-2024 |

under construction |

|

Corpus Christi Stage 3 |

1.7 |

2022-2023 |

company aims to FID in 2020 |

|

Freeport Train 4 |

0.8 |

2025-2026 |

Fully permitted, awaiting FID |

|

Calcasieu Pass |

1.4 |

2023-2025 |

FID August 2019 |

|

Golden Pass |

2.2 |

2024-2026 |

under construction |

|

Port Arthur |

1.6 |

2025-2026 |

Fully permitted, awaiting FID |

|

LNG Canada |

1.9 |

2024-2026 |

FID in Fall 2018 |

|

Woodfibre LNG |

0.3 |

2024-2025 |

|

|

Source: Williams Cos., Wood Mackenzie |

|||

Savage said patience is required while demand catches up, though supply will also have to increase. The Permian Basin is expected to increase gas production by 9.7 Bcf/d from 2018 to 2023, according to Wood Mackenzie. But in the Northeast, the Marcellus and other shale plays are also forecast to grow production by 6.5 Bcf/d. The Haynesville Shale and Cotton Valley areas will also increase production by 5.9 Bcf/d.

“It’s clear to me that natural gas is going to have to grow to meet that demand and it’s going to come from the most advantaged space,” he said. “And, sure, some of those are going to be oil-based spaces, but here in the Northeast in the Marcellus we have a tremendous resource that’s been proven. We’ve had producers that have done pretty amazing work in a low-cost environment of driving costs down.”

In the near-term, however, pricing remains an ugly reality.

“It’s always the elephant in the room right now,” he said. “It’s not good. It’s very bad. But you’ve got to get comfortable with the demand story internationally and in the export market. I think when you get comfortable with that, you can see the light at the end of the tunnel.”

Recommended Reading

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.