(Source: Mavrick/Shutterstock.com)

[Editor's note: This story originally appeared in the April 2020 edition of E&P. Subscribe to the magazine here.]

Limited takeaway capacity, industry concerns over regulatory restrictions and low commodity prices are combining to suppress production growth and operator enthusiasm in the Rockies and Bakken region.

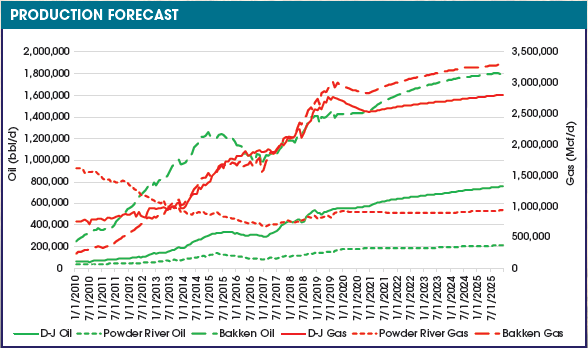

According to the U.S. Energy Information Administration’s (EIA) monthly “Drilling Productivity Report,” oil production in the Bakken remained mostly flat in 2019, while the gassier Niobrara saw only modest gains in natural gas production. The EIA’s report revealed oil production in the Bakken hovering around 1.4 MMbbl/d, while gas production in the Niobrara held steady at about 12.5 Tcf/d.

Although natural gas breakevens in the Rockies and Bakken are higher than commodity prices, Enverus expects any production gains operators might see will likely come from their oil plays.

In its recent “FundamentalEdge Report: Rockies & Bakken in Focus,” Enverus reported that the low-growth outlook will likely remain throughout 2020, but better days could be on the horizon as planned pipeline expansions come online sometime next year.

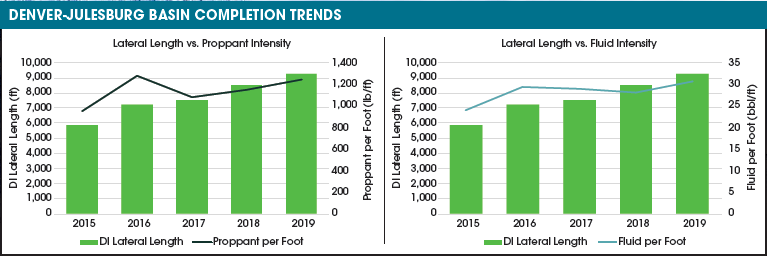

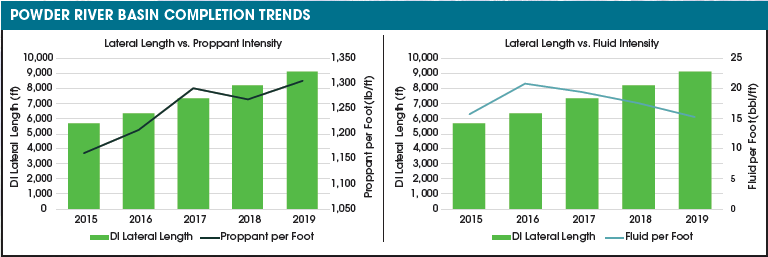

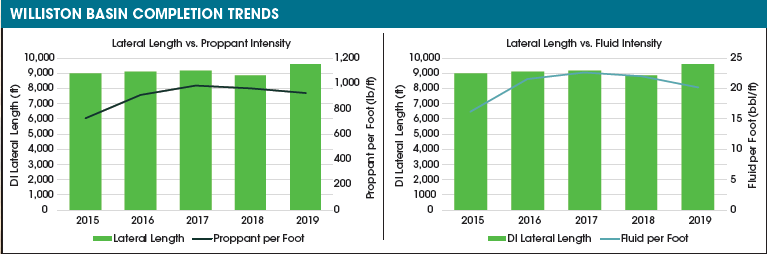

“Like all U.S. basins, the Rockies and Bakken are expected to slow down due to lower prices and pipeline takeaway constraints, but that doesn’t mean there aren’t some glimmers of hope,” said Jesse Mercer, senior director of crude market analytics at Enverus. “Operators that continue to scrutinize cost savings, efficiencies and prioritization of crude oil over gas will fare better than others.”

While most companies are reporting plans to maintain fl at production in the Rockies and Bakken, some are planning growth, such as Devon Energy, EOG Resources, Marathon Oil and Hess. According to its third-quarter 2019 investor report, Devon is planning to potentially double its Niobrara activity this year.

Recommended Reading

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.

High Interest Rates a Headwind for the Energy Transition

2024-04-18 - Persistent high interest rates will make transitioning to a net zero global economy much harder and more costly, according to Wood Mackenzie Head of Economics Peter Martin.

Scotland Ditches 2030 Climate Target to Cut Emissions by 75%

2024-04-18 - Scotland was constrained by cuts to the capital funding it receives from the British government and an overall weakening of climate ambition by British Prime Minister Rishi Sunak, said Mairi McAllan, the net zero secretary for Scotland's devolved government.

Exclusive: Mitsubishi Power Plans Hydrogen for the Long Haul

2024-04-17 - Mitsubishi Power is looking at a "realistic timeline" as the company scales projects centered around the "versatile molecule," Kai Guo, the vice president of hydrogen infrastructure development for Mitsubishi Power, told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

Google Exec: More Collaboration Needed for Clean Power

2024-04-17 - Tech giant Google has partnered with its peers and several renewable energy companies, including startups, to ramp up the presence of renewables on the grid.