(Source: Mavrick/Shutterstock.com)

[Editor's note: This story originally appeared in the April 2020 edition of E&P. Subscribe to the magazine here.]

Limited takeaway capacity, industry concerns over regulatory restrictions and low commodity prices are combining to suppress production growth and operator enthusiasm in the Rockies and Bakken region.

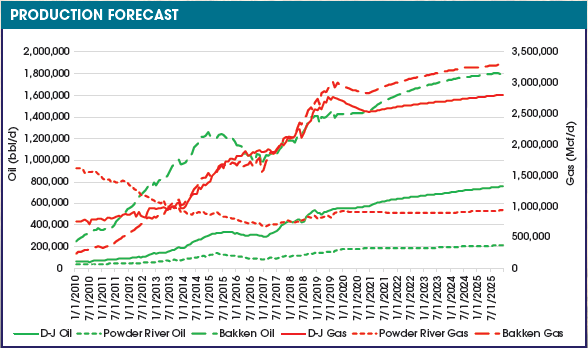

According to the U.S. Energy Information Administration’s (EIA) monthly “Drilling Productivity Report,” oil production in the Bakken remained mostly flat in 2019, while the gassier Niobrara saw only modest gains in natural gas production. The EIA’s report revealed oil production in the Bakken hovering around 1.4 MMbbl/d, while gas production in the Niobrara held steady at about 12.5 Tcf/d.

Although natural gas breakevens in the Rockies and Bakken are higher than commodity prices, Enverus expects any production gains operators might see will likely come from their oil plays.

In its recent “FundamentalEdge Report: Rockies & Bakken in Focus,” Enverus reported that the low-growth outlook will likely remain throughout 2020, but better days could be on the horizon as planned pipeline expansions come online sometime next year.

“Like all U.S. basins, the Rockies and Bakken are expected to slow down due to lower prices and pipeline takeaway constraints, but that doesn’t mean there aren’t some glimmers of hope,” said Jesse Mercer, senior director of crude market analytics at Enverus. “Operators that continue to scrutinize cost savings, efficiencies and prioritization of crude oil over gas will fare better than others.”

While most companies are reporting plans to maintain fl at production in the Rockies and Bakken, some are planning growth, such as Devon Energy, EOG Resources, Marathon Oil and Hess. According to its third-quarter 2019 investor report, Devon is planning to potentially double its Niobrara activity this year.

Recommended Reading

Turning Down the Volumes: EQT Latest E&P to Retreat from Painful NatGas Prices

2024-03-05 - Despite moves by EQT, Chesapeake and other gassy E&Ps, natural gas prices will likely remain in a funk for at least the next quarter, analysts said.

EIA: Oil Prices Could Move Up as Global Tensions Threaten Crude Supply

2024-02-07 - Geopolitical tensions in the Middle East and ongoing risks that threaten global supply have experts questioning where oil prices will move next.

Commentary: Fact-checking an LNG Denier

2024-03-10 - Tampa, Florida, U.S. Rep. Kathy Castor blamed domestic natural gas producers for her constituents’ higher electricity bills in 2023. Here’s the truth, according to Hart Energy's Nissa Darbonne.

Plus 16 Bcf/d: Power Hungry AI Chips to Amp US NatGas Draw

2024-04-09 - Top U.S. natural gas producers, including Chesapeake Energy and EQT Corp., anticipate up to 16 Bcf/d more U.S. demand for powering AI-chipped data centers in the coming half-dozen years.

Antero Poised to Benefit from Second Wave of LNG

2024-02-20 - Despite the U.S. Department of Energy’s recent pause on LNG export permits, Antero foresees LNG market growth for the rest of the decade—and plans to deliver.