Presented by:

[Editor's note: A version of this story appears in the April 2021 issue of Midstream Business magazine. Subscribe to the magazine here.]

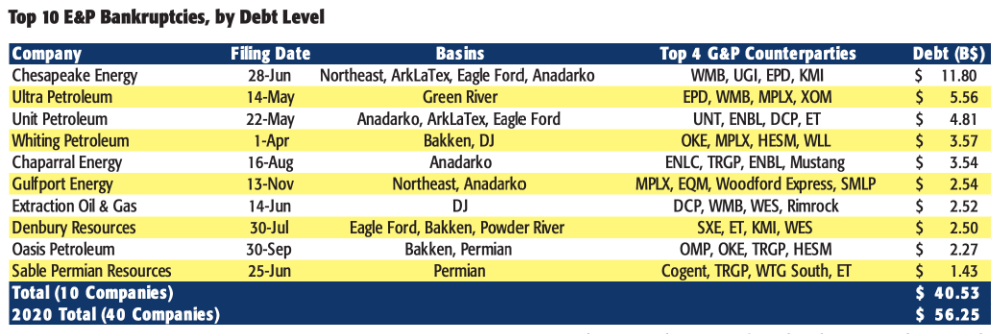

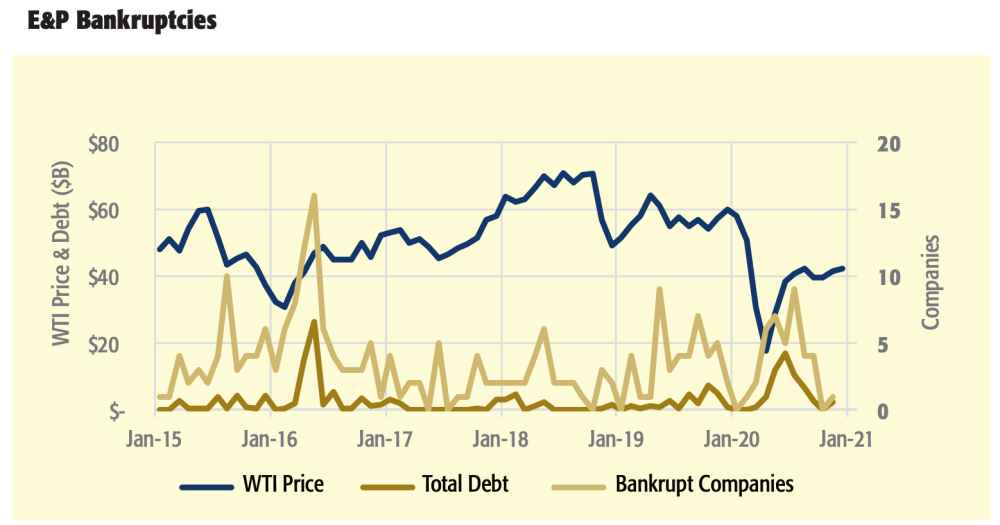

The 2020 market downturn has precipitated the third, and in some respects the worst, bankruptcy event to rock the oil and gas sector in the past five years. A total of 41 energy companies with $56.3 billion in combined debt entered Chapter 11 in 2020, according to data from law firm Haynes and Boone LLP and East Daley Capital’s research.

East Daley’s accounting of the year’s bankruptcies is comprised entirely of E&P companies. COVID-19-related market disruptions in the March-to-June period caused unprecedented volatility, including negative oil prices in April, and sparked the latest industry bankruptcy wave.

Boom-and-bust cycles also are shorter than ever, reflecting both high leverage in the upstream space and the potential for rapid supply growth and oversupply from shale development.

The midstream sector will exit 2020 with no bankrupt names but far from unscathed, contending with the collateral uncertainty of counterparty and rate risks owing to the many upstream bankruptcies in Chapter 11 litigation.

Midstream providers lose out when contracts with producers are not honored or rates are negotiated down in settlements. Owners of gathering and processing (G&P) assets are particularly exposed if financially moribund E&Ps slow future drilling and their volume contributions decline.

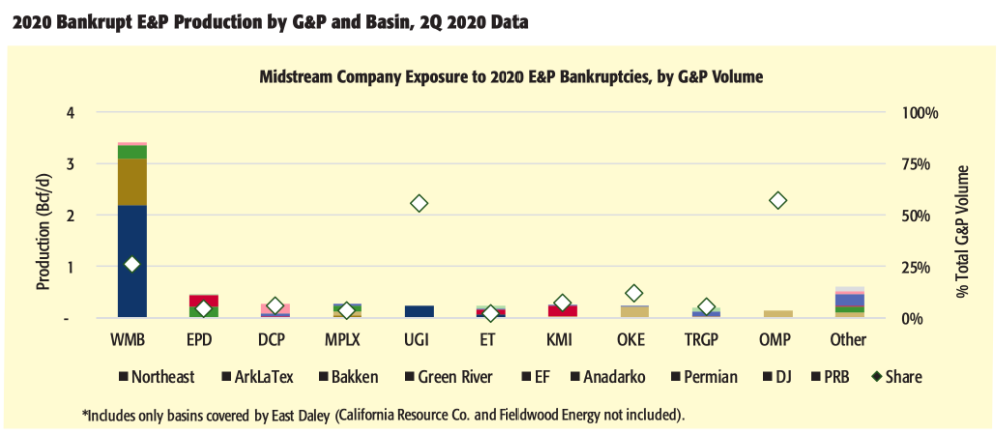

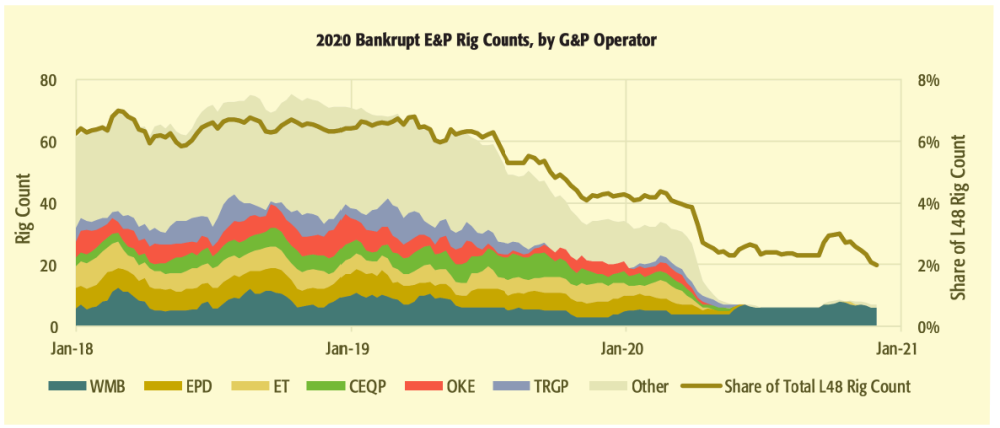

East Daley identified Williams Cos. Inc. (WMB) by quite a distance as the midstream name with the most throughput on its G&P systems from bankrupt E&Ps. WMB gathered and processed 3.4 Bcf/d in second-quarter 2020 from producers that declared bankruptcy this year, or about 26% of company-wide G&P volumes. Enterprise Products Partners LP (EPD), the company with the next-largest volume exposure, gathered 0.5 Bcf/d, or 4% of company volumes from bankrupt E&Ps. WMB’s extensive business with Chesapeake Energy Corp. (CHK) is the primary reason for its high counterparty exposure. UGI Corp. and Oasis Midstream Partners LP (OMP) own small systems with over 50% exposure to bankrupt E&Ps. UGI gathers for CHK in the Northeast, and OMP gathers for bankrupt parent Oasis Petroleum Inc. (OAS) in the Bakken Shale. Other midstream companies with notable G&P system exposure to bankruptcies include DCP Midstream Partners LP (DCP), MPLX and Energy Transfer (ET).

In this report, East Daley identified which midstream names have been most exposed to counterparty bankruptcy risks. The firm also investigated prior oil and gas industry bankruptcy waves to better understand the long-term performance effects to drilling activity once E&Ps exit the Chapter 11 process. While midstream operators have gone through cycles before, the latest pandemic-fueled crash creates different challenges caused by the size and scale of several large drillers that entered Chapter 11.

COVID-19-related market disruptions in the March-to-June period caused unprecedented volatility, including negative oil prices in April, and sparked the latest industry bankruptcy wave.

This time is different–less volume, but more debt

The three bankruptcy waves in the past half-decade had different sources and impacts on the oil and gas sector. WTI in 2015 to 2016 fell from over $60/bbl to $32/bbl on oversupply, marking the end of the growth-at-all-cost era for shale. The second wave, in late 2018, was short-lived following a $20 swing lower in oil prices, spurred by an unexpectedly lenient stance from President Donald Trump on Iran sanctions. The latest wave has been driven by lower demand, a result of pandemic shut-ins in response to COVID-19 that forced economies to shut down and has curtailed transportation demand. Each of these crashes led to spikes in the number of bankruptcy declarations in the oil and gas sector.

The crash of 2015 to 2016 was historic due to the number of companies entering Chapter 11 reorganization and the amount of debt defaulted on. Producers large and small took advantage of low interest rates to lever up and grow production as fast as possible, in the process outrunning cash flows.

Many companies were unable to adjust and bring their breakeven costs down when WTI fell below $40/ bbl, caught in basins that were only economical when oil was priced at $80/bbl. The 2018 to 2019 crash saw another spike in bankruptcies, but the dollar value of the debt was minimal, indicating it wiped out mostly small industry players.

The latest crash of 2020 is different, driven by lower demand rather than excess supply. The types of companies that filed for bankruptcy are also different. While the number of companies declaring bankruptcy is about 50% fewer than in the 2015 to 2016 cycle, the total value of defaulted debt is almost the same. The 2015 to 2016 crash forced many smaller producers into default, but the largest producers were able to navigate that downturn by selling assets and/or restructuring debt.

CHK is the most prominent of these highly leveraged E&Ps, as well as California Resources Corp. (CRC), Whiting Petroleum Corp. (WLL) and OAS. These companies could not escape the 2020 crash, which saw WTI crude turn negative for the first time ever. With no demand recovery in sight until a COVID19 vaccine is widely available, the damage is not likely done.

In addition to these bigger names, 2020 saw two “Chapter 22” repeats, Ultra Petroleum Corp. and Chaparral Energy Inc., which declared bankruptcy between 2015 to 2016 and entered Chapter 11 again in 2020. The resulting effect is larger bankruptcies, as most of the smaller E&Ps had already been wiped out or previously consolidated.

The hangover effect of E&P bankruptcies

East Daley examined pre- and postbankruptcy drilling activity for the 42 largest E&P bankruptcies since 2015 by the amount of debt in default. These 42 bankruptcies comprise about 80% of the total debt restructured through Chapter 11.

Eleven E&P reorganizations were excluded that were either repeat bankruptcies, involved significant international operations, or resulted in transformative acquisitions or dispositions to the company. East Daley’s sample of E&P bankruptcies have operations across the Lower 48, representing samples in all major producing areas. By reviewing each E&P, we determined the total number of wells drilled by the company as a function of time. We normalized each company’s well count vs. time relationship by setting time 0 at the date of the bankruptcy filing. We also normalized each company’s portfolio, setting the well count at the time of its bankruptcy filing (t=0) as the baseline.

East Daley found that most E&Ps add very few wells to their portfolios once exiting bankruptcy. Well counts on average are only 1% higher for producers in the three years following a bankruptcy filing. One outlier, Penn Virginia Corp., stood out for rapidly expanding its drilling program 1.5 years after entering bankruptcy filing, but post-bankruptcy activity otherwise was moribund in the sample. This is ominous for future growth expectations for midstream companies that serve now-bankrupt counterparties.

With no demand recovery in sight until a COVID-19 vaccine is widely available, the damage is not likely done.

E&Ps that declared bankruptcy in 2020 accounted for about 6% of 2018 rig activity, but their share dropped to 2% currently. Except for WMB (buoyed by CHK’s rigs), nearly every other G&P operator has lost rigs. The report concluded that unless assets are sold off or consolidated, midstream operators will see little to no recovery from these bankrupt E&Ps.

The impact

In conclusion, the 2020 crash has been marked by a significant number of E&Ps filing for bankruptcy. While the number of companies in bankruptcy is lower, this year is on par with 2016 for the most distressed debt in default because of the large size of several bankrupt companies. The analysis shows that with few exceptions, E&Ps do not recover and restart drilling even three years after filing for Chapter 11. Bankruptcy may solve for E&Ps’ solvency problems, but it is not an elixir to jumpstart capital investing.

Given that about 6% of 2018 rigs were operated by producers that eventually went bankrupt in 2020, midstream companies should not expect a rebound in drilling and development from these counterparties. E&P bankruptcies impact nearly the whole midstream sector, especially those with significant G&P assets. While WMB has lowered its exposure to CHK since 2016, it still collects most of CHK’s gas production, and individual systems and assets remain highly exposed to the company. Other midstream companies also face risks akin to WMB and its CHK exposure.

The overall EBITDA impact should be manageable for midstream companies with diverse portfolios, but impacts will vary by system and company.

Recommended Reading

Matador Stock Offering to Pay for New Permian A&D—Analyst

2024-03-26 - Matador Resources is offering more than 5 million shares of stock for proceeds of $347 million to pay for newly disclosed transactions in Texas and New Mexico.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.